In this week’s edition: A critical minerals action plan, why trade diversification may not be a silver bullet and how tariffs are making food insecurity even worse

Noteworthy

By John Stackhouse

Mark Carney got out of the G7 alive. The Kananaskis summit could have been a trade wreck, but Donald Trump clearly had other things on his mind. That doesn’t mean Canada, or any of the other summiteers, can claim victory. Here’s why, and some of what we’re hearing:

-

There was never going to be a Canada-U.S. agreement at the G7, for one simple reason: DJT was not going to announce something so important to his domestic agenda on foreign soil (unless, of course, he planted the Stars and Stripes with it.)

-

The ensuing suggestion of a 30-day window for a deal is aspirational. Anyone who has dealt with Trump knows he doesn’t stick to deadlines, and he uses time as a negotiating tool. That means don’t settle if you don’t have to. And now, the Carney team’s biggest concern is playing out, as POTUS gets distracted by events. A Middle East war, for instance.

-

Some on the Canadian side don’t mind that, thinking that a “rag the puck” strategy allows Canada to get to a fuller USMCA conversation in the fall.

-

But still other Canadians fear the worsening impact of countervailing tariffs. “Elbows up” sounds fine, until you elbow someone on your own team. Plain + simple: Canada is suffering more from the tariff war than the U.S. right now.

-

And the longer the uncertainty goes on, the more challenging it will be for Canada to attract investment.

-

Longer term, Canada remains in the crosshairs of Trump’s sectoral studies, which will only make it harder for our exports in his Core 5 categories: autos, steel/aluminum, lumber, pharmaceuticals and semiconductors.

-

As someone put it to Trade Zone: “When your negotiating partner is willing to be far more ruthless, you’re not in a good negotiating position.”

The week that was

-

The U.S. and Canada are looking to secure a deal within 30 days. If they can’t, Carney said, Canada will impose counter-tariffs.

-

Canada is cracking down on the dumping of cheap foreign steel to support domestic steel producers getting hammered by Trump’s 50% tariffs.

-

The volume of commercial trucks crossing into the U.S. from Canada is down more than 10% in each of the past two months compared to 2024. Meanwhile, trucks from Mexico to the U.S. were only down 2.8% in May (and 6.4% lower in April).

-

The U.K.’s Business Secretary said that efforts to get relief for steel exports to the U.S. will be wrapped into broader tariff negotiations, indicating that there is still a ways to go on the recently announced trade deal between the U.S. and U.K.

-

The U.S. Fed held rates steady and said it will watch the impact of tariffs closely this summer.

-

Housing starts in the U.S. hit a five-year low in May as tariffs hit imported construction materials.

-

Despite tariffs effectively shutting the U.S. out as a destination for its goods, China increased its overall trade surplus to US$500 billion so far this year—that’s up 40% YoY.

Minerals on the G7’s mind

G7 leaders unveiled a Critical Minerals Action Plan this week to counter non-market distortions, increase supply chain transparency, and reduce strategic dependency on Beijing. While light on specifics, some key items aligned with our report, The New Great Game:

-

Limit price distortions: G7 members committed to coordinated responses to supply disruptions and pledged improved market transparency and traceability. No explicit mention of a “China premium” or minimum price floor, as we noted, but positive developments, nonetheless.

-

Unlock financing: Encourage development banks, export credit agencies, and private capital to accelerate upstream investment in G7 countries and emerging market allies.

-

Supply-chain traceability, standard-setting and sustainability: A G7 roadmap due by year-end to create benchmarks to ensure responsible mining, environmental safeguards and labour standards.

Canada remains positioned as a central actor in mineral resources, with the potential to serve the growing needs of European and U.S. defence and new energy mineral needs—a natural advantage in trade talks with the U.S. and partners. Further efforts to strengthen the remainder of the value chain—building out refining capacity, for example—will complement Canada’s resource advantage.

Why trade diversification may not be a silver bullet

Diversifying trade partners, in the wake of the current trade war with the U.S., has become a hot topic. But while lowering tariff barriers is sound economics, this alone may not lead to higher export volumes.

The Harper conservatives pursued bilateral trade agreements with a range of countries and economic blocs, including Europe (CETA), Asia-Pacific (CPTPP), and a host of Latin American countries. And yet, just 4% of Canadian exports are EU-bound and 6% are shipped to CPTPP countries—ratios that remain unmoved over two decades.

Meanwhile, nearly 80% of Canadian exports are sent to the U.S. Canada’s reliance on a few key industries—energy, automotive and metals—further entrenches this dependence. Canada needs an integrated trade strategy that diversifies trading partners while boosting export competitiveness. And it makes the Carney-Trump 30-day deal deadline all the more important.

A trade war on food security

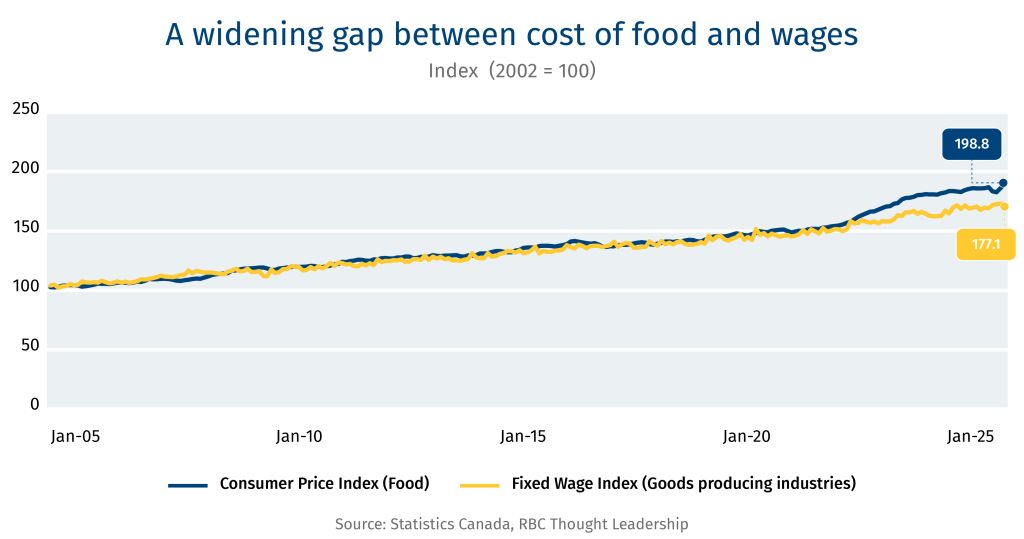

One in four Canadians are experiencing food insecurity—a level never seen before in this country. It’s an issue of affordability, and one that tariffs and the ongoing trade uncertainty, threatens to make worse.

-

Job loss and insecurity is forcing many to make difficult choices: Between January and May, Canada’s manufacturing sector lost 54,000 jobs and the country’s unemployment rate rose to 7%, the highest it’s been since 2016, excluding the pandemic.

-

Rising cost of living threatens to further deepen the food insecurity crisis. But it’s more than about jobs—over 60% of food-insecure households rely on wages or self-employment income to support themselves.

-

Supply chain disruptions impact food consistency and costs: In the U.S., tariffs are estimated to increase food prices by 2.6% in the short run, disproportionately impacting fruit and vegetables, that are expected to rise 5.4%.

In our latest report–Feeding the Crisis: The Tariff Toll on Food Insecurity–we lay out three potential solutions, all linked to Canada’s growth ambitions.

The Final Word

“If the current tariffs and counter-tariffs remain in place, past experience suggests pass through of about 75% of the costs of tariffs over roughly a year and a half.”

–Bank of Canada Governor Tiff Macklem during a speech this week in St. John’s, Newfoundland.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.