Six charts that analyze Canadian-U.S. oil ties amid new geopolitical developments in oil markets

The U.S. loves heavy oil. The blend is vital for diesel, jet fuel and petrochemicals, and Canada is, by some distance, its biggest foreign supplier. However, a U.S. plan to influence and revive Venezuelan oil has raised concerns that Canada—already facing U.S. pressure on several other domestic industries—could start losing market share to Venezuelan heavy crude in a few years. It could amount to a Washington squeeze on Canada’s most prized resource.

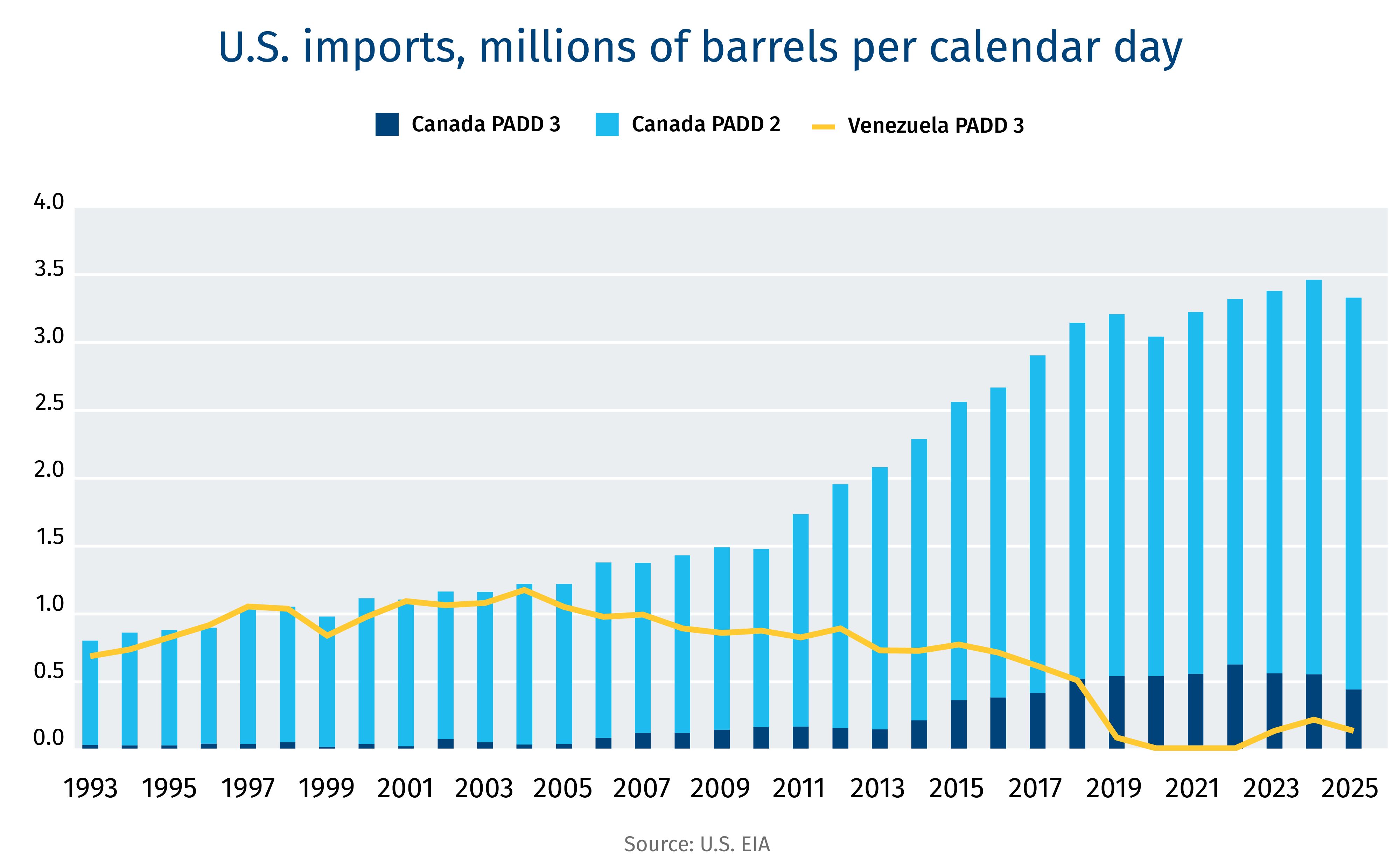

Canadian oil has displaced rivals, including Venezuela and OPEC, in the U.S. market over the past three decades

U.S. crude import patterns reflect a clear structural divergence between Canada and Venezuela. The result is a fundamental reorientation of U.S. import dependence toward Canadian supply, reinforced by reliability, infrastructure, and long-cycle capital investment.

But Canadian oil is not just a Gulf Coast (PADD3) play. It’s also a strategic and critical player in the U.S. Midwest refinery complex (PADD2)

Venezuelan crude once dominated Gulf Coast imports, but its collapse created space that has only partially been filled by Canadian barrels. The Gulf Coast is seen as a battleground, but only 10% of total Canadian imports flow into the region known as PADD 3. Most Canadian crude growth has occurred within the Midwest refinery region, known as PADD 2, which accounts for 69% of total Canadian export growth into the U.S. over the past three decades.

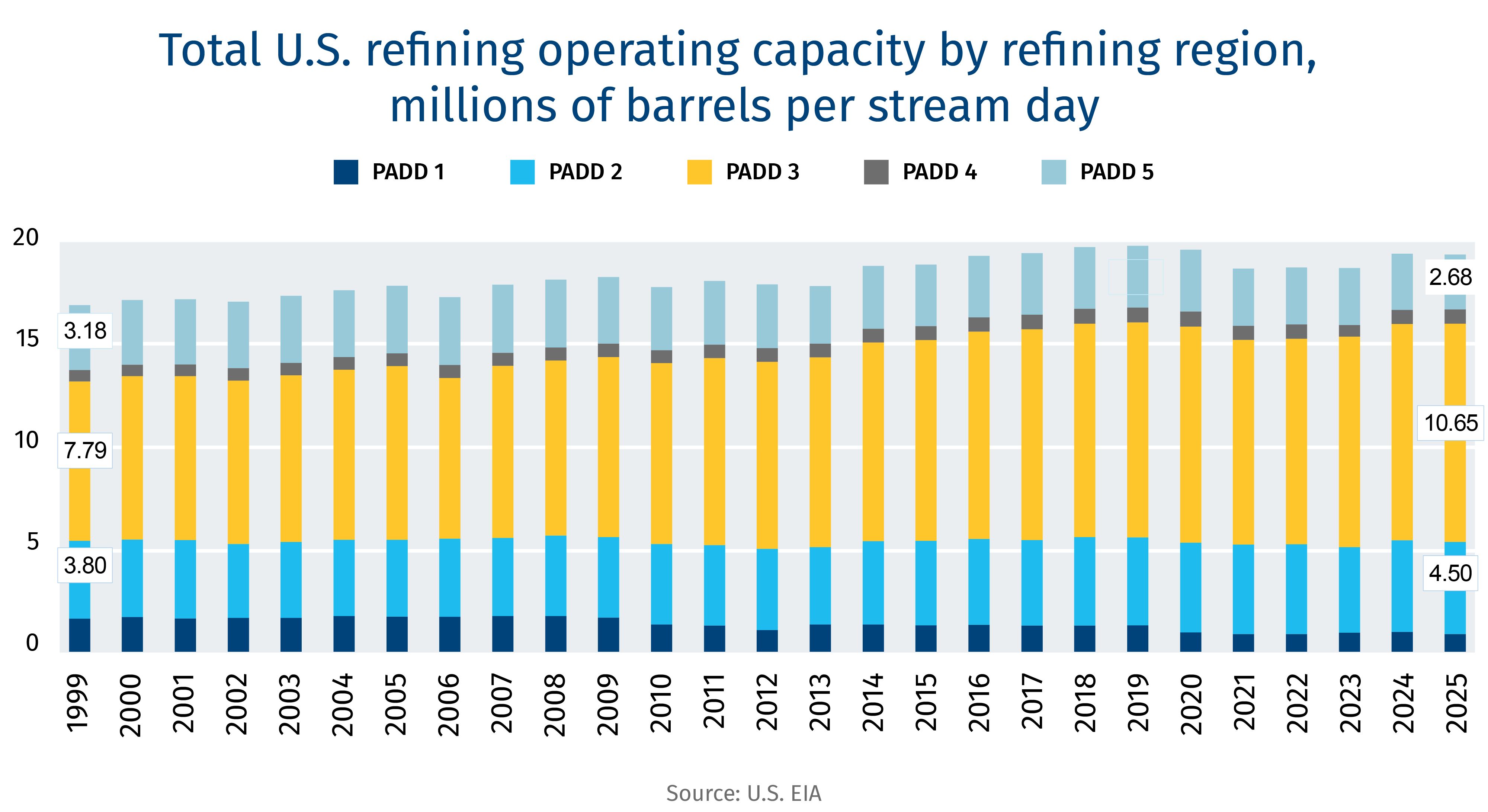

U.S. refineries are engineered for the oilsands and other heavy oil: the co-dependence with Canada will be hard to break

U.S. refining capacity growth has been concentrated in PADD 3 and PADD 2, reinforcing the system’s orientation toward large-scale, complex refining hubs. The Gulf Coast’s dominance reflects decades of investment designed to process heavier and more diverse crude slates, positioning it as both a domestic refining centre and a globally relevant supply hub.

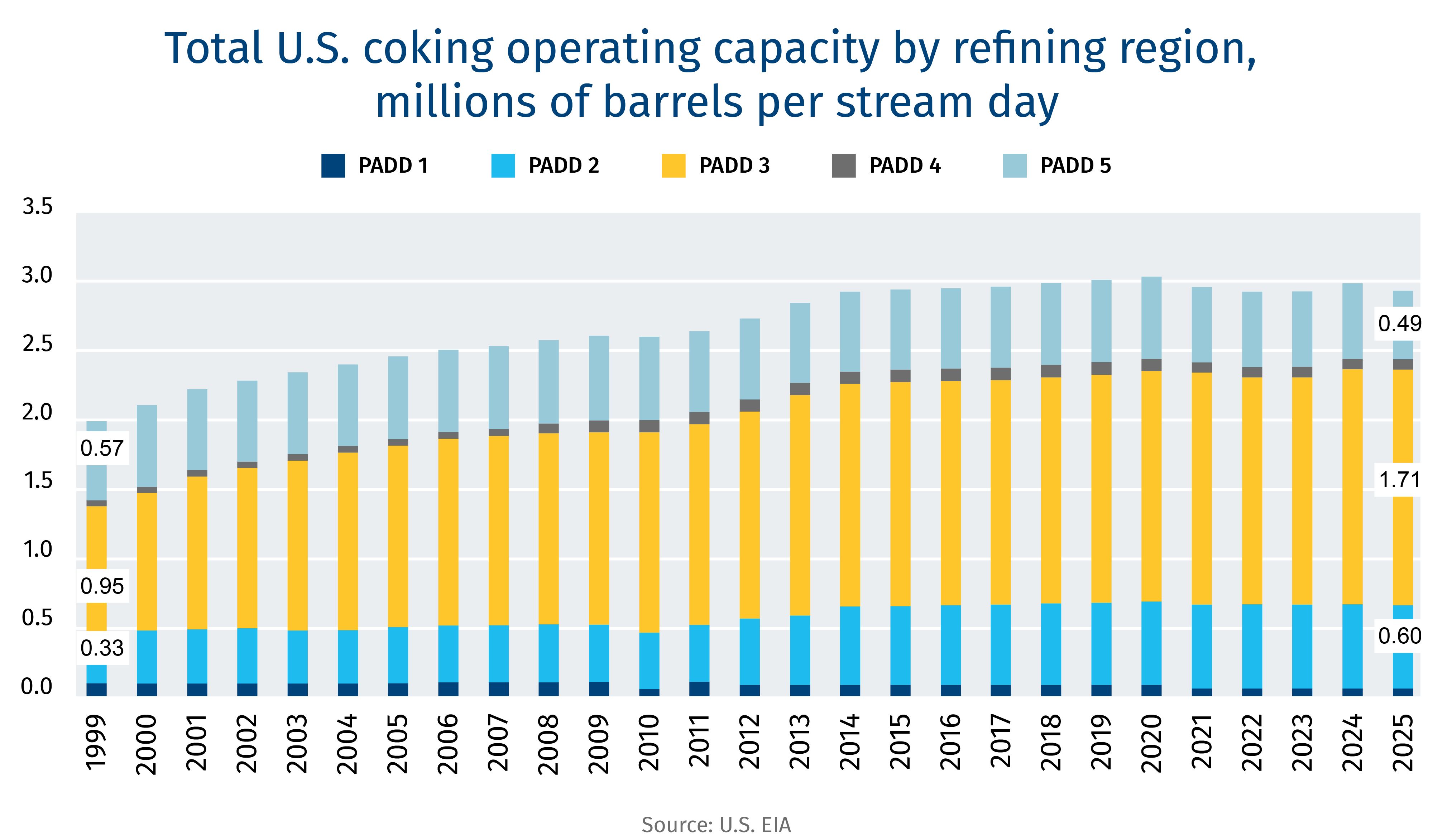

The U.S. and Canada are poised to ride the plastics boom: U.S. refineries spent billions to bolster their heavy-oil dependent petrochemicals sector

Coking capacity remains a defining feature of the U.S. system’s ability to process heavy crude, with the majority of investment concentrated along the Gulf Coast. The steady build-out of coking units over time highlights how refiners structurally adapted assets to heavier barrels, further entrenching supply relationships that favor Canadian crude.

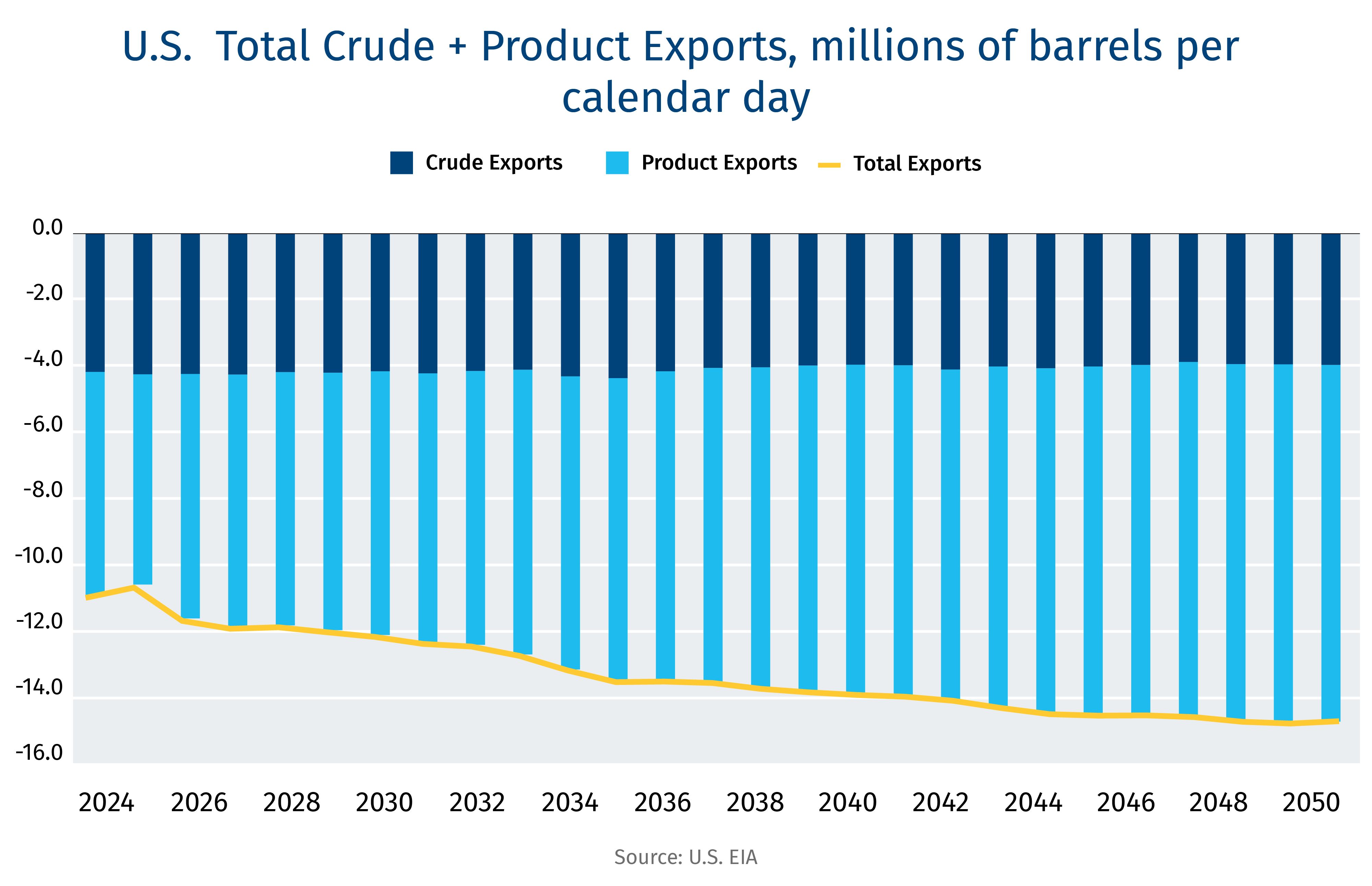

Canada provides oil security to the U.S., while U.S. refineries serve as gateways for Canadian oil to reach global markets

The U.S. energy system is increasingly focused on exports, with petroleum products accounting for majority of outbound volumes over time. This underscores the Gulf Coast’s role not only as a refining hub, but as a critical petrochemical and export platform. For Canada it reinforces the importance of market access, blending, refining, and re-export pathways within an evolving global trade landscape.

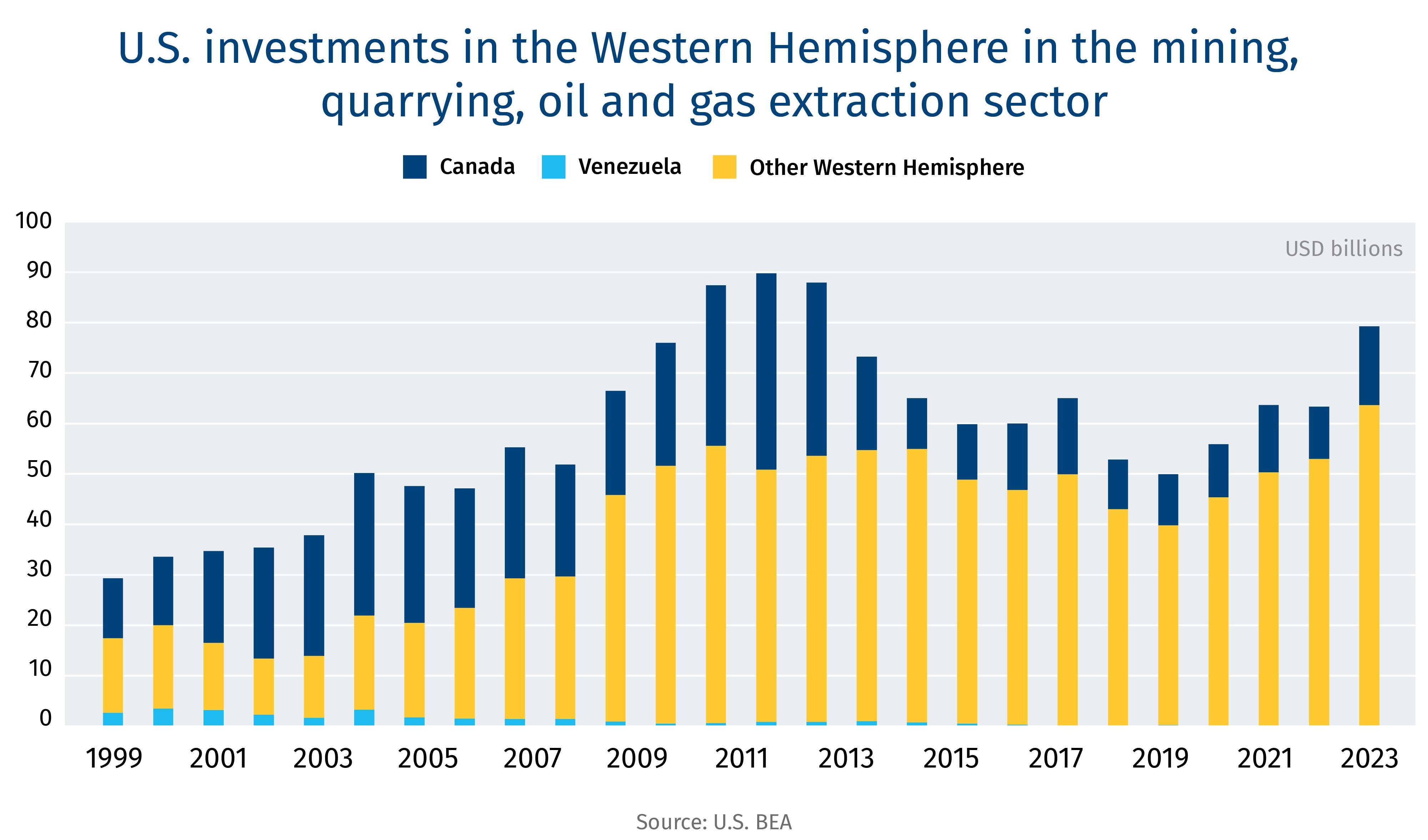

However, U.S. oil investments in Canada have seen a decade of capital flight

For all the cross-border integration, U.S. capital investment in the Canadian resource sector (mining, oil and gas) has fallen by more than half from its US$39.1 billion peak in 2011. Meanwhile, U.S. investments into other Western Hemisphere countries has steadily grown from US$16 billion in 2000 to US$64 billion in 2024, even without Venezuela.

The competition for investment dollars from the U.S. into the Western Hemisphere is growing—Canada will need to lock in American capital to ensure it preserves its pre-eminent position in the U.S. market.

Contributors

Shaz Merwat: Policy Lead, Energy, RBC Thought Leadership

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.