Key Findings

-

Gas is critical in our best—and worst—case scenarios for global energy systems. Gas will be vital as a transition fuel in a ‘Decarbonizing World’ before declining by the late-2030s; and as an energy security cushion in our worst-case scenario, that we call ‘Dystopian World’.

-

Gas can anchor G7+’s energy security—but needs work. For G7+ consumers, it can reduce dependence on Russia in the near-term and avoid boom-bust cycles. In the longer term, it opens up promising new markets for G7+ producers. But the commodity is geopolitically problematic, too expensive in certain regions like Asia, and deemed too carbon-intensive. The G7+ can help overcome those hurdles.

-

Gas can help address, but also worsen, climate change. Achieving net-zero before the 2060s is challenged. But the G7+ can advance policies and technologies that catalyze carbon capture, accelerate methane intensity reductions, and encourage the development of low-carbon alternatives such as ammonia and hydrogen. That would help limit global temperature rise to around 1.7-1.8 Celsius compared to pre-industrial levels.

-

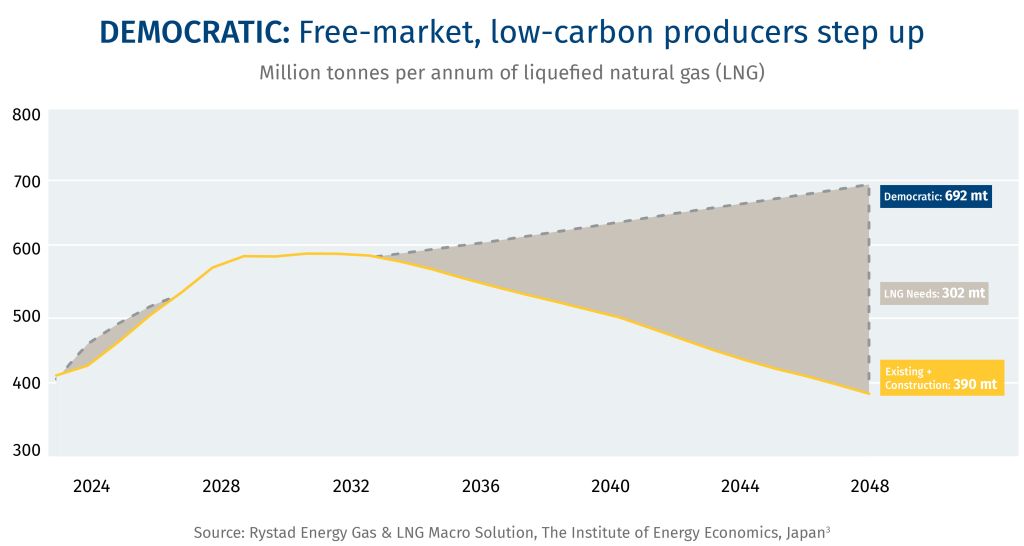

The G7+ could emerge as the most influential LNG player. By 2040, LNG exports from the U.S., Canada and Australia can power G7+ economies and also ship gas to emerging Asia, as we outline in our ‘Democratic World’ scenario. It’s an opportunity for G7+ to expand its geopolitical influence and forge stronger ties with emerging markets.

-

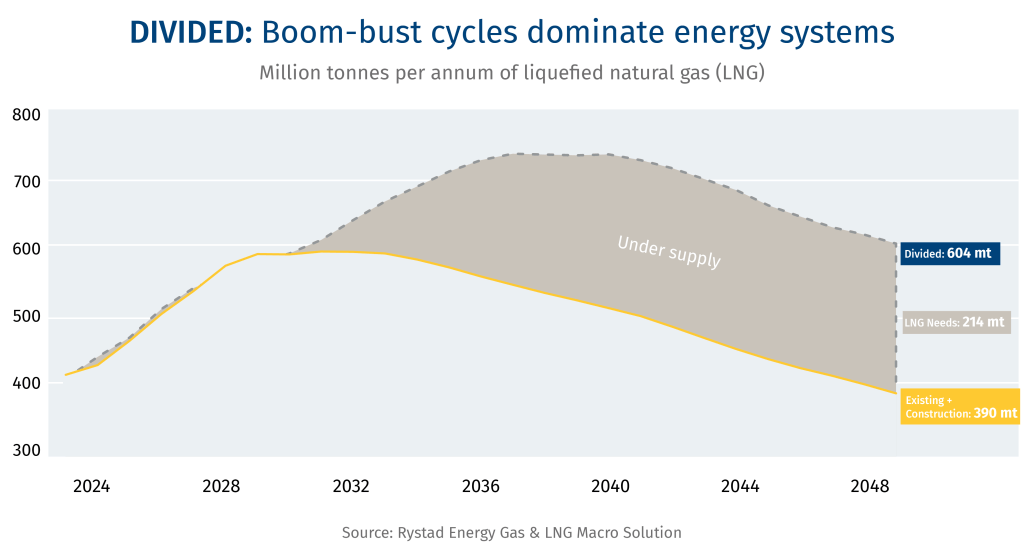

Global LNG export capacity may need to rise by nearly 50% by 2040. Current export capacity and supply under construction is insufficient to meet the needs and aspirations of a rising global population and a world economy that will expand 42%, according to our ‘Divided World’ scenario.

-

G7+ compact can help unlock financing for LNG projects. It could facilitate funding from a range of financial institutions, including multilateral development banks and national export credit agencies, that have excluded natural gas investment for fear of “locking in” emissions.

-

Exporting gas would require US$1.2-trillion in investments in North America alone. A build-out of the continent’s gas infrastructure would likely require around US$1.2 trillion over the next 15 years. But it would require supportive policies and clear frameworks for communities and corporations.

The Long Game for LNG

Welcome to the 2040s.

In the decade that will take us to the mid-century, our world will be very different, and so will our energy needs.

The planet will be home to at least a billion more people, with a population well over nine billion. The world’s economic output, if it follows recent decades, will add the equivalent of another U.S. economy, spread largely across Asia and the global south, with all the energy demands that go with it. Add to that something entirely new—the world of artificial intelligence at mass scale, with computing needs that, for now, seem incomputable. By one estimate, we will need 4,000 more terawatt hours of power to run this emerging data centre economy; that’s equivalent to 15% of the world’s electricity generation today.1

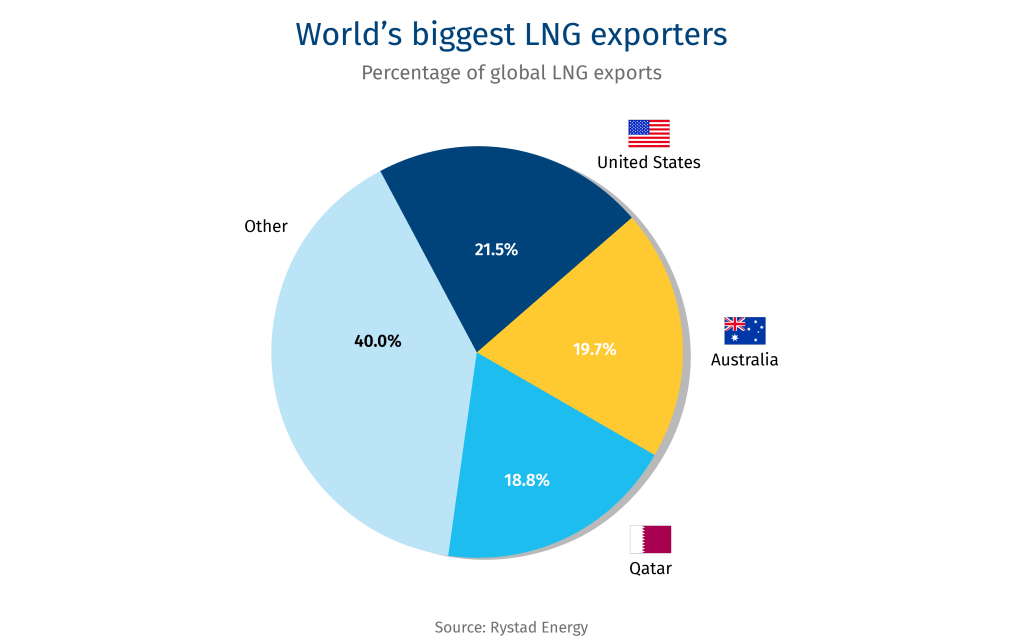

Another step change in energy demand may require more of every practical and affordable energy source, but the greatest expectations may be placed on natural gas. It’s expected to become the world’s dominant energy form, surpassing oil, having already grown in supply by 70% in the first quarter of the 21st century.2 The advent of liquefied natural gas, and supertankers to carry super-chilled LNG across oceans, has transformed the gas outlook even more. In a little over a decade, the United States has transformed itself from amongst the world’s largest gas importers, to the world’s largest LNG exporter.

As oil was to the 20th century, gas may be as critical to the 21st, but not without strategic choices that are already challenging the world. Russa’s invasion of Ukraine, and its weaponization of gas to weaken Europe, is just one indication of how the world’s rapidly growing reliance on gas has put energy security at risk. Rapidly growing and urbanizing countries across much of the world have found their dependence on imported gas to present further risks. The West’s growing ambition to reshore manufacturing, and remilitarize, may require more gas, too, as a reliable and affordable concentrated energy source.

Few bodies may be better suited to address these challenges than the G7, the group of leading liberal democracies (the United States, Canada, the U.K., France, Germany, Italy and Japan) that is meeting June 15-17 in Kananaskis, Alberta. Atop the group’s agenda: energy security.

The G7 was formed 50 years ago, in the mid-1970s, in response to similar disruptions to the global economy caused by an oil shock and ensuing conflicts. Today, the alliance faces new challenges, particularly from China and Russia, and may find opportunities in reasserting itself through an approach to democratic and decarbonized natural gas for a fast-changing world.

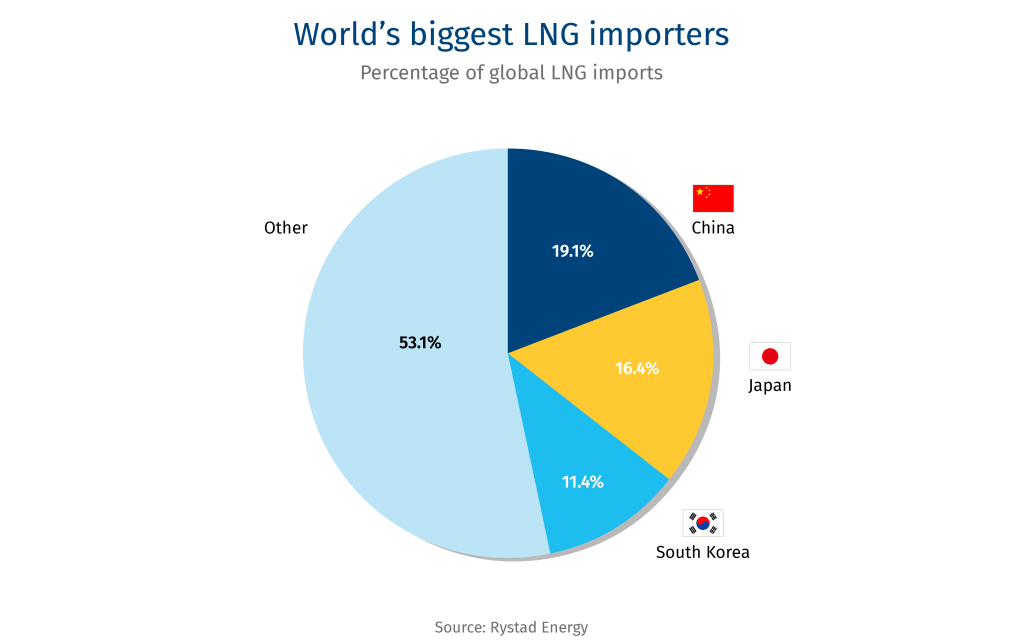

Properly managed, the G7 and key allies such as Australia and South Korea, known as G7+, can create stronger alliances with emerging markets, especially in Asia, stabilize energy prices and strengthen long-term global growth. It could even provide a bridge to lower energy emissions, by displacing coal. Led by the European Union’s 107 million tonnes per annum (mtpa) and Japan’s 64 million mtpa of LNG consumption, the G7+ consumes 227 mtpa, or 51% of global demand. That exceeds the 179 mtpa currently produced by the U.S. and Australia.

By 2040, however, the G7+ gas trade balance could reverse such that its supply far exceeds the demand of its members and allies—by almost 150 mtpa—requiring the Western-led alliance to secure new markets. China is expected to be, by far, the largest purchaser of LNG in 2040 (163 mtpa, from 79 mtpa in 2024, according to Rystad Energy’s base case). But trade frictions with North America could result in Chinese LNG imports diversifying away from American sources.

For the G7, other allies will be critical to ensure a greater balance between supply and demand. India is often seen as a vital long-term prospect for G7+ exports, with projected demand of 63 mtpa. But other emerging Asian markets such as Pakistan, Bangladesh, Thailand and Indonesia will be essential, too, as they’re projected to consume a combined 219 mtpa by 2040. In a potential world where the Chinese market is inaccessible to the U.S., and India follows its own path—prioritizing price above all else, perhaps from Russian supplies—Asian demand will be vital to any G7+ strategy.

With all these forces at play, the world almost certainly will need more gas in 2040—but just how much will be needed?

To map out potential pathways, RBC Thought Leadership and Oslo-based Rystad Energy developed a novel research methodology to outline plausible scenarios for the 2040s, knowing the trajectory of growth will be critical to the mid-century condition of our world. Each was shaped by geopolitical alignments, climate policy ambitions and market dynamics. We then worked with a range of policy experts to assess the risks in each scenario, and develop broader policy options.

The outcomes suggested by each scenario are profoundly different. The range of our pathways shows that total global gas exports could grow from 411 mtpa in 2024 to as high as 737 mtpa by 2050—or shrink to just 366 mtpa. The net swing of 371 mtpa is nearly equivalent to current LNG exports.

The difference depends on whether the world develops more structured markets for gas, finds ways to connect fast-growing markets with reliable (and democratic) suppliers, and invests in technologies to cut emissions. The environmental attributes of this future gas supply—including the scale of transition to capture carbon and low-carbon derivative fuels like hydrogen and ammonia—will have a major impact on the direction of climate change, as methane emissions from gas are widely considered to be more dangerous to global warming than carbon, even though they’re also easier to contain.

A Role for the G7+

The G7+ nations have an interest in securing long-term supplies of reliable and affordable natural gas, having experienced price shocks from the Western U.S. power crisis of 2000-01, the post-Fukushima disaster LNG price spike in Japan, the recent twin shocks of the Covid pandemic and Russia’s weaponization of gas exports in its war on Ukraine. A coordinated G7+ approach can stabilize markets through more cohesive policy alignment and joint investments around infrastructure.

Leveraging democratic, rules-based gas markets can ensure environmental standards across the supply chain, and further add to economic growth through industrial decarbonization, including investments in carbon capture, utilization and storage (CCUS), low-carbon fuels for industrial heat and heavy transportation, and a coordinated action plan on zero flaring and mitigation of fugitive methane emissions.

In a potential world where the Chinese market is inaccessible to the U.S., and India follows its own path—prioritizing price above all else, perhaps from Russian supplies—Asian demand will be vital to any G7+ strategy.

As such, emerging Asian markets including Pakistan, Bangladesh, Thailand and Indonesia, will be essential for the G7+ as they’re projected to consume a combined 219 mtpa by 2040, especially as they accelerate the switch from coal to natural gas.

To do all this, a G7 gas compact may be needed to lay the foundation for a robust and secure natural gas infrastructure that aligns with the needs of producers and consumers, delivering price stability, affordability, reliability, and lower greenhouse gas emissions. Such a compact could address the needs of a rapidly growing global gas world to develop more sophisticated markets and financial tools; to resolve infrastructure bottlenecks and coordinate national investment plans; and work collectively to ensure rapidly growing countries across Asia, Africa and Latin America have access to G7+ supplies, not only for economic growth but for geopolitical stability.

But the G7 and its core allies need to recognize the risks of some very divergent paths if a coordinated approach is not taken. Our modelling lays out four such outcomes.

Behind the scenes—our research approach

The research and methodology behind this paper is unique for three main reasons:

The research paired quantitative modelling with qualitative interviews and roundtable forums, including with senior officials in Canada’s federal and provincial governments, the private sector, Indigenous groups, international research institutions and multilateral development banks. The team engaged these experts individually and as part of convenings in Washington D.C., Vancouver, Ottawa, London, Beijing, New York, Calgary and Toronto.

RBC Thought Leadership spoke to more than 100 experts in Canada, the U.S., Japan and Europe to explore practical energy security solutions. These included representatives from the Asian Development Bank (ADB), the Bloomberg New Energy Finance (BNEF), Mokwateh, the First Nations Climate Initiative, Dr. Robert J. Johnston, Senior Director of Research, at the Center on Global Energy Policy, Columbia University, and Dr. Ken Koyama, Senior Managing Director, Chief Economist at the Institute of Energy Economics, Japan (IEEJ). RBC Thought Leadership partnered with Rystad Energy to collaborate on the data and modelling for this research.

The four scenarios were modelled for the purposes of developing robust recommendations for the G7+ heading into the Kananaskis meeting in June. We know that traditional forecasting methodologies fall short of capturing the complex drivers of change in our geopolitical landscape and energy systems. We mapped these drivers of change and developed a range of four distinct yet plausible futures against which to stress-test what a coordinated G7+ natural gas strategy could look like.

The World of 2040: Four Very Different Scenarios

The scenarios are built on different variations of key drivers in the G7+ environment, including geopolitical stability, population and economic growth in emerging markets, digitization and data centre deployment, climate and energy policies, the role of international institutions and multilateral forums, fossil fuel production, manufacturing and supply chain distribution, the role of civil society, social cohesion and global gas demand.

Among our assumptions that span all four scenarios:

-

The world’s population will be approximately 9.2 billion, with significant regional variation depending on GDP, education and healthcare trends;

-

coal consumption will continue to decline in OECD countries;

-

continued growth of coal in Asia will offer significant potential for coal-to-gas switching;

-

oil will remain a dominant fuel for the transportation sector, particularly in emerging Asia;

-

nuclear generation will continue to have a strategic but overall minor role to play into the 2030s, with new builds expected in Asian markets such as China and in the U.S., particularly to meet growing demand from data centres;

-

renewables will enjoy exponential growth, particularly in solar and wind, as costs continue to decline;

-

global temperatures are expected to be anywhere from 1.8-2.2 degrees Celsius above pre-industrial levels.

The following scenarios are by no means a prediction of what the future will look like in 2040, rather, they represent a range of plausible futures.

Four Scenarios

-

Headline of the year: “Japan and China resilient to global gas price shocks”

-

Fragmented, protectionist world order, with a further erosion of international institutions and growing influence of Russia and China as global powers.

-

Australia, Russia, Qatar and the U.S. dominate global gas production; concentrated gas supply subjects the G7+ to significant market risks and volatility as a supply gap emerges.

-

Technology growth is regionalized with China and the Gulf nations leading in AI and digital infrastructure that matches North America, driving gas flows to non-G7 markets.

Context

Divided 2040 is characterized by protectionism and regionalism, as the superpowers continue to recede from global alliances, opening the door to a world dominated by Russia for energy and resources, and China for technology and manufacturing. Concerns about energy security in the mid-2020s and early 2030s are now exacerbated by supply and affordability challenges. Multilateral institutions and alliances such as the G7 have limited influence over state actors. The U.S., China and other major global players have receded from international institutions and alliances, further embedding realpolitik and an increasing focus on national policy and borders. Energy security is one of the world’s primary concerns and has had a deep impact on emerging markets’ ability to industrialize and develop economically. A current boom-bust cycle leaves consumers exposed to volatile prices, while major producers such as the U.S., Qatar, Russia and Australia are vulnerable as customers avoid signing long-term contracts. As countries focus on addressing immediate energy security challenges, climate activism has given way to more extreme and violent civic action.

The Global Energy Story

Total power demand is up 66% in 2040 compared to 2025, driven by the industrialization of emerging markets, electrification of transportation, heating and industrial processes. Countries prioritize the deployment of energy systems based on renewables and clean energy sources such as nuclear and hydro, and while natural gas remains an important transition fuel, reliance on fossil fuels declines globally.

Global climate action from the late 2010s and early 2020s has slowed considerably, with only a handful of European countries strongly dedicated to the cause. While this world remains divided, climate progressivism still endures. Global companies and capital remain directionally committed to a net-zero target. Emissions, on a gradual decline for the remainder of the century, are due to hit net-zero by 2096 as temperatures are limited to 2.0C, an outcome marginally out of bounds of the Paris Agreement.

South Korea and China continue to lead as technology innovators and providers, while other nations are falling behind in the AI revolution and remain mere buyers of those technologies. Global data centre energy demand is about six times what it was in 2025. Technological development is increasingly influenced by regional powers, leading to divergent standards and ecosystems. This fragmentation hampers global interoperability and exacerbates geopolitical tensions. Efforts by Gulf nations to fast-track AI infrastructure deployment as set out in the mid-2020s have come to fruition. The UAE continues to have the highest public cloud spend per employee in the region and is now firmly established as a global AI leader, with Saudi Arabia and Singapore also in the forefront. Given China’s diversification of gas supply and acceleration of domestic production efforts in the mid-2030s, the Gulf and China are strong rivals to the G7 nations when it comes to clean technology innovation and digital infrastructure.

The LNG Story

The world needs to find 207 million more tonnes of LNG by 2040, relative to current capacity and supply under construction. Industrialization of emerging markets like Indonesia and India has been constrained due to the lack of affordable energy supplies. The rise of technological infrastructure in South Korea, China and the Gulf, however, provides a strong demand signal for consistent, growing natural gas demand that peaks in 2038. A supply gap emerges, and gas consumers are subject to market volatility with pricing predominantly influenced by incumbent suppliers—the U.S., Russia, Qatar and Australia—that hold a concentration of supply. The U.S. remains the world leader, bringing on more LNG than Russia and Australia through the 2030s. Other members of the G7+ are subject to market volatility as prices fluctuate, controlled by leading producers and subject to regional market disruptions.

Technology leaders such as South Korea, India and China remain dependent on non-democratic sources such as Russia for the majority of their energy supply to power data centres and digital infrastructure. The global landscape of AI data centres and digital infrastructure, ownership and operation are led by technology leaders. And while developing nations still gain access to AI tool sets, they have little say in setting standards and experience increasing bias and unfair terms from technology providers.

-

Headline of the year: “Indonesia’s new robot factory stalled by global gas shortage”

-

Rise of regional conflicts and a global economic downturn in the late 2030s has led to a highly fragmented world.

-

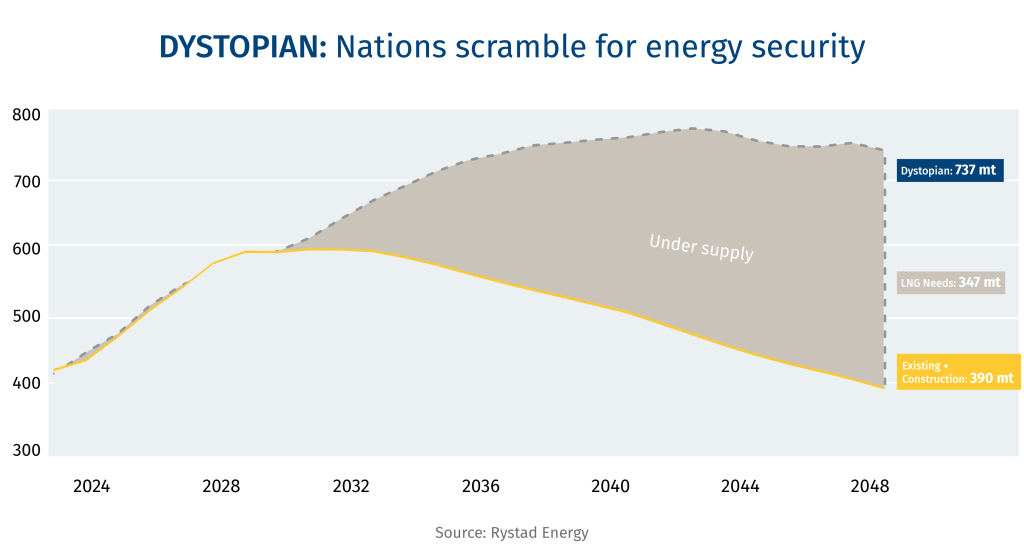

Fossil fuel dependence continues to rise alongside rising demand for LNG.

-

With a significant energy supply gap emerging, Gulf states experience major growth.

-

Energy security dominates policy agendas, distracting from climate action, while national agendas prioritize trade weaponization and geopolitical leverage in the interest of security.

Context

In Dystopian 2040, regional conflicts and a protracted global economic downturn experienced in the late 2030s have led to an erosion of international institutions and the post-WWII global order. International protocols around the rule of law and global security are unenforceable and stuck in a quagmire of indecision and veto power. A failure of any country or international institution to meaningfully act in the face of growing aggression out of occupied Ukraine and the Middle East has resulted in violent and authoritarian regimes redefining the world stage. In economies like the U.S., fearmongering, protectionism and hardline authoritarian rhetoric has led to a declining global presence. The EU is dominated by protectionist policies, focusing on local economies and a handful of key trading relationships to buffer the impacts of regional conflicts. Security dominates national policies and agendas, with nationalist policies creating a bifurcated trade and investment climate. China’s imposition of export restrictions on rare earth elements in the mid-2020s set the stage for a growing trend of supply chain control, particularly in technology and defence sectors. As a result of closed borders and bloc-style co-operation, international trade is limited to small clubs of countries, who limit market access, building on the techno-nationalist policies of the late 2020s to bolster independence from foreign supply chains and competitiveness on semiconductor production. Rising unemployment due to a global economic downturn and a growing technological divide means that there is a rift among those who have access to digital infrastructure and those who do not. In a world where civil society and institutions are characterized by high levels of mistrust and a lack of coordination, the G7 struggles to build energy resiliency and withstand periodic energy supply and demand shocks.

The Global Energy Story

Climate change, alongside regional and protracted conflicts, creates fresh waves of humanitarian crises. The phrase “energy transition” has almost been forgotten, while national security agendas dominate the narrative around energy systems. Global sentiment is heavily tied to energy security, driving demand for low-cost fossil fuels such as oil and coal, at the expense of managing emissions. Fossil-fuel rich Gulf nations experience significant growth as they support Asian economies, and unlock a wealth of state capital increasingly oriented towards a data economy. Globally, increased nationalism and national security concerns lead to a decline in multilateralism. Coalitions like the Paris Agreement fade in significance as the pursuit of cheap energy and economic recovery dominate priorities. The weaponization of trade becomes a common occurrence—even an expected phenomenon as the competition between nations spreads into new spheres. Expect increased militarism and protectionism.

The LNG Story

Natural gas demand is up 16% from 2025 levels. These numbers are tempered by demand for other cost-effective fossil fuels like coal, which remains a core part of energy systems (22% of total primary energy). Global fossil fuel demand continues to rise beyond the original 2030 projections with no sign of slowing into the 2040s. As climate goals take a back seat to national security, coal-to-gas switching in Asia does not play out as predicted in the late 2020s. Energy and national security challenges lie ahead, with projected supply shortages limiting global economic growth. By 2040, an incremental 225 million tonnes of LNG—equal to over half what the world produced in 2024—is required on top of current and in-construction supply.

-

Headline of the year: “G7 Methane Club Declares Victory at 15th Anniversary of Kananaskis”

-

Climate security dominates global policymaking, with aggressive emissions reduction targets.

-

Global power demand more than doubles, driven by industrialization and digital infrastructure. Renewables and clean-tech solutions take the lead to meet demand.

-

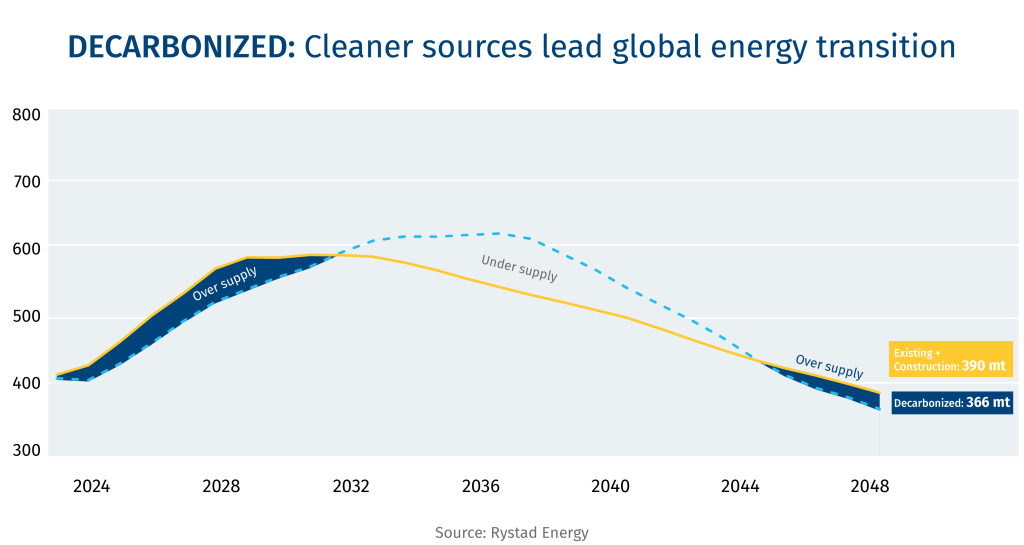

LNG demand declines, presenting the risk of stranded assets.

-

Remaining gas supplies are governed by the emergence of a clean gas market, with methane performance tracking to meet demand for abated natural gas.

Context

In Decarbonized 2040, aggressive climate policies and targets dominate the international landscape, as the world’s leading economies race to cut emissions and secure a more cost-competitive energy supply. Climate security is the pre-eminent focus shaping energy policies as destructive climate events became increasingly difficult to ignore by the 2030s, shaping voter preferences and civic action, and leading governments to re-invigorate global cooperation and international institutions. There is a meaningful return to global climate targets and the creation of new market mechanisms to unlock value from decarbonization. This includes the emergence of a clean fuels and certified natural gas market, underpinned by the measurement and tracking of methane emissions. Carbon capture is on track to reach three billion tonnes sequestered by 2050, equivalent to four times Canada’s total emissions in 2025. Millennials and GenZ, now in critical leadership roles in organizations, are driving the decarbonization agenda across governments and institutions. Civil society, too, is characterized by strong, diverse voices who are active in holding institutions accountable to their climate commitments.

The Global Energy Story

Total power demand is up 66% in 2040 compared to 2025, driven by the industrialization of emerging markets, electrification of transportation, heating and industrial processes. Countries prioritize the deployment of energy systems based on renewables and clean energy sources such as nuclear and hydro, and while natural gas remains an important transition fuel, reliance on fossil fuels declines globally.

While China has maintained its position as a clean technology manufacturer and intellectual property leader, the West’s investments in clean technologies through the 2030s begins to pay off, with a more distributed global supply chain that leads to greater resiliency and lower costs.

Countries that developed small modular reactors (SMRs) in the 2030s—Canada, the U.S., Argentina, Poland, Romania and China—are exporting that expertise around the world to countries seeking clean and reliable energy. Electrification is a clear winner, too, allowing for the displacement of direct-use emissions and an increase in energy efficiency. Oil demand falls almost 60% from current levels to 43 million barrels per day by 2050—a level not seen since 1969. Natural gas demand, while falling, remains more resilient, down 33% from current levels.

The LNG Story

The maturity of carbon markets, border adjustment mechanisms and a “methane club” across G7+ buyers and sellers drives a robust certified natural gas market. Throughout the 2030s, governments and industry leaders worked to develop clear and transparent market regulations, as companies were incentivized to reduce methane emissions and sought to differentiate themselves based on performance. National regulations in G7+ countries are grounded in a multilateral G7+ natural gas strategy, which enables global trade and methane measurement. Significant innovation around satellite technologies has enabled more effective methane tracking and robust data sets, enabling greater consistency of methane tracking than the world saw in the 2020s. There is a risk that existing LNG infrastructure becomes stranded, as the world’s leading economies shift to alternative energy sources and LNG demand declines. Global LNG demand declines rapidly by 2040 such that the world does not require any net new LNG by 2050 relative to existing and in-construction supply. Existing natural gas supplies from G7+ sources have a competitive advantage among climate-minded buyers looking for hydrogen/ammonia and abated gas. Multilateral development banks like the Asian Development Bank have supported energy efficiency improvements in gas distribution and gas power plants as well as coal-to-gas switching projects in Asia.

Net-zero likely occurs in the mid 2070s, with a projected temperature rise of 1.8C. However, further efforts such as requiring a 30% decrease in carbon intensity of natural gas production post-2030 could result in a further 40-45 billion tonnes of incremental CO2e avoided in this scenario by 2100.

LNG: An opportunity for reconciliation

Canada’s LNG opportunity cannot be capitalized without Indigenous partnerships and participation. Most of the land connecting the country’s major gas fields to the Pacific Coast are unceded territory, claimed by, or ratified through, treaty to First Nations in British Columbia. This is a huge opportunity for reconciliation—one that’s already being slowly realized. Cedar LNG and Ksi Lisims, two West Coast projects that will add 15 mtpa to Canada’s export capacity, have significant Indigenous ownership through the Haisla and Nisga’a Nations, respectively. By cultivating meaningful Indigenous partnerships and developing models for Indigenous capital, capacity and consent, LNG can be an opportunity for shared prosperity, while allowing Canada to meet the moment and expedite major projects quickly.—Varun Srivatsan

-

Headline of the year: “G7+ agreement to connect Earth with low-orbit data centres”

-

The world is dominated by coalitions of like-minded nations, and multilateral institutions are reinvigorated.

-

A dual-energy trajectory emerges as renewables scale rapidly with global climate funds while LNG demand continues, driven by Asian industrialization and coal-to-gas switching.

-

Global supply chains and trade are more evenly distributed and resilient, with the G7+ coalition solidifying its influence in LNG and manufacturing in an effort to counter China’s dominance over supply chains.

Context

In Democracy 2040, the world features strong coalitions among like-minded nations, with a growing effort to counter the fragmentation seen in the late 2020s and early 2030s. Multilateral institutions are experiencing a renaissance, undergoing a shift in their governance and structures to address frequent and critical global challenges. There are a few dissenting and regionally-focussed nations, as we saw during a decade-long retrenchment of international institutions that continued through the late 2020s and early 2030s. The international landscape is now dominated by coalitions of democratic countries in the G7+ to counter China and Russia, and ensure resilience in critical sectors of the economy such as advanced manufacturing, defence and energy. The most recent G7+ Agreement enables G7 gas importers and allies such as South Korea to secure gas supply for power data centres and digital infrastructure needed to power the next generation of AI technologies. As renewables continue to scale, gas has a critical role to play to serve demand peaks in big cities and support resiliency of electricity grids. The G7+ cooperation on natural gas has reduced gas market volatility, compared to the 2020s. Without a robust clean gas market, however, tensions remain between EU countries and the rest of the G7 members, who have compromised on meeting emissions targets in favour of affordability and resiliency. The global public square is robust in democratic countries, with civil society organizations advocating for greater collaboration and cooperation between countries with shared values and renewed commitments to bold climate goals. However, system-level oppression of civil society actors and voices in non-democratic states creates a global divide between liberal democracies and the rest of the world.

The Global Energy Story

Progress on climate is slow to start in the 2030s, but the Green Climate Fund is beginning to have real impact on climate mitigation and climate action. Contributions from both the global south and the G7+ mean that in 2040, the Fund has reached $800 billion worth of leveraged investments with a total of 25 billion tonnes of avoided emissions. The Green Climate Fund is only one example of a general sentiment that shifting away from fossil fuels is inevitable and renewables’ share of the global energy mix continues to increase exponentially. The rapid adoption of cost-competitive renewable energy sources and the G7+’s coordinated strategy on natural gas helped the West secure energy supplies for rapidly growing economies like Indonesia and India.

Global trade and supply chains are diversifying in 2040 through international and regional trade agreement. Mutually beneficial friendshoring and reshoring in a systematic, orderly fashion provides policy certainty and unlocks capital for critical infrastructure. For the G7+, diplomacy among its members helps develop common ground for climate-minded economic growth, which in turn secures its geopolitical presence in South and Southeast Asia, countering growing Chinese influence.

Technology leadership is spread across a range of competitive states, including continued leadership from China, the U.S. and the United Arab Emirates, as in the mid-2020s. But a renewed commitment to multilateral institutions has resulted in robust global pacts such as a Global Digital Compact that seeks to democratize access to AI and the energy sources needed to power a new data economy.

The LNG Story

Access to resilient natural gas supply through the G7+ coalition unlocks greater adoption of AI and energy needs for greater industrialization across Asia. Japan, Thailand, Korea, and India are major demand centres as an Asian renaissance dominates global LNG demand through 2050. LNG demand reaches 692 million tonnes by 2050—and is still rising as global economic growth drives demand. The climate impact of this reality is mitigated by the maturity of methane capture technologies and demand for abated gas by ethical buyers like Japan. However, a global clean gas market hasn’t emerged in the way experts predicted in the late 2020s. Clean gas market mechanisms are adopted by smaller coalitions of states and in bilateral or multilateral trading relationships. Growing carbon markets among the G7+ ultimately enables both energy transition and greater gas supply, which allows for growing natural gas demand rooted in significant coal-to-gas switching in Asia. While the G7+ coordination on a natural gas strategy enables access to resilient supply and demand within these countries, China continues to play a significant and growing leadership role in clean technologies and manufacturing, posing a major risk to the G7+ who actively seek these technologies to meet their climate commitments.

The Kananaskis Agenda: An Action Plan for Natural Gas

As the G7 host and the world’s fifth-largest natural gas producer, Canada is uniquely positioned to shape the future of natural gas by advancing its own economic and climate goals and supporting global energy security.

But there are several roadblocks that’s holding back natural gas. First, G7+ member nations — the core group plus allies like Australia and South Korea — are not aligned on gas’s role in the future of energy markets. Major producers like Canada and the U.S. need contract security to build up infrastructure and strategic supply. But consumers such as France, Japan and Britain want contract flexibility and diversified supply sources to hedge their risks and meet climate targets. Another layer of complexity comes with Canada, Germany, Italy, Japan and the U.S. favouring natural gas, while France and Britain support greater use of hydrogen, nuclear and abated gas to achieve climate goals. Moreover, climate-minded governments in Australia, Canada, France and the EU also don’t see eye-to-eye with the U.S., which sees fossil fuels driving its energy dominance.

A coordinated and cooperative policy framework adopted by G7 members can facilitate the creation of a more resilient natural gas and LNG market that reduces price volatility, unlocks capital, increases diversified supply and de-risks demand, and enables the eventual transition to a decarbonized gas market.

Here are some action-oriented approaches that could help the G7, through its energy ministers, move toward a democratic and decarbonized future for gas:

1. Declare a G7 compact to support decarbonized natural gas

A G7 policy compact that defines the role of natural gas and related fuels across a range of energy demand scenarios can help break the boom-and-bust cycle of prices and investment. It can also signal investment and financing of gas infrastructure sufficient to meet the expected supply gap identified in three of the four scenarios outlined in this paper.

G7 governments should also work to end the debate over whether natural gas is a solution or contributor to climate change. It’s both. In the short to medium term, coal-to-gas fuel switching, methane intensity reduction, and deployment of gas as an intermittency solution for renewables make a significant contribution to climate action. Over the longer term, governments need to work with industry to secure a commitment to new pathways to develop abated natural gas pathways, which may be required across all scenarios.

2. Develop a stable, well-functioning global gas market

The LNG market has evolved dramatically over the past decade, from a series of regional markets anchored mostly by long-term, oil-indexed contracts to something more dynamic and global.

In these ways, the LNG market is starting to resemble the global oil market which has become deep, resilient and highly liquid since the 1980s, offering a wide range of contracts, price benchmarks, and risk management tools for both physical and financial markets. These features mean that oil prices, while volatile, have a greater capacity to absorb shocks and rebalance.

Despite progress, the LNG market still has a ways to go to become sufficiently global and liquid to attract price-sensitive importers and risk-averse capital providers. Price spikes in 2022, in the midst of the Russia-Ukraine conflict, were dramatic and damaging for consumers, leading to a rebound in coal demand in Asia and shut-ins of gas-intensive industrial production in the EU.

A key feature of a G7 gas compact should be to further develop a tradeable market with both financial and physical participants, which in turn derisks capital, reduces capital costs and incentivizes further investment. More financial, or non-commercial participants, can help expand liquidity and bring in new pools of capital.

The global LNG market also needs effective and transparent reference prices. The emergence of such benchmarks with variance in duration and indexation can anchor a well-functioning market. This includes the ability to structure contracts to trade LNG cargoes using a range of markers across varying periods of time to avoid exposure to a single formula based on Henry Hub or Brent benchmarks. G7 countries should look to build on existing efforts such as the Japanese-led Producer-Consumer Dialogue.

Methane-tech: Reining in a potent gas

Natural gas is predominantly made up of methane, a powerful greenhouse gas. Lowering methane emissions in the LNG value chain—from wellheads to carriers to regasification terminals—is seen as a key driver of environmental performance for companies. This is especially critical as methane is 28 to 36 times more potent than CO2 over a 100-year timespan.

Several technologies can help plug leaks from LNG infrastructure: this includes tech that can detect (through satellites, airborne and on-ground sensors), contain (through vapour recovery units, low-bleed pneumatic devices), or combust (high-efficiency flare stacks) methane. Emissions can also be reduced by replacing gas-powered devices such as compressors with electricity driven equivalents, freeing up the gas for shipment.

Several technologies and policies are already making a difference. In the U.S., methane emission intensities dropped across natural gas processing (30%) and transmission and compression (33%) facilities between 2014-23, according to Environmental Protection Agency (EPA) data. Norway, meanwhile, has the world’s lowest emissions intensity driven by policies such as a ban on non-emergency flaring as far back as 1971, and a venting and flaring emission tax imposed in 2015.

However, precise measurement of methane emissions remains a challenge, with estimates subject to widespread uncertainty and underreporting. As methane measurement advances (for example, through satellite-based monitoring, of which more than a dozen satellites are in orbit today), operators and regulators can further constrain emissions, lower measurement uncertainty, and take appropriate mitigating action.

Some methane mitigation technologies can also allow oil and gas producers to capture methane and feed it back into the gas chain to lower emissions. In North America, for example, leak detection and repair (LDAR) technologies and improved equipment maintenance practices can conservatively avoid up to 55 million metric tons of carbon dioxide equivalent (MTCO2e) in methane emissions annually—the equivalent of taking 13 million gas-powered cars off the road.-Vivan Sorab

3. Invest in decarbonization to cut emissions with new technologies

A G7+ gas compact should not be an endorsement of business-as-usual practices. Action on methane mitigation is critical alongside pathways to carbon-neutral fuels derived from natural gas.

The elimination of fugitive emissions and routine flaring/venting from the natural gas value chain is embedded in the Global Methane Pledge, which is central to the natural gas industry’s hopes to be aligned with a low-carbon future. It can be business-friendly, too, as mitigation costs are generally low and even net-positive in cases where fugitive gas can be captured, processed, and sold.

The G7 can play a critical role in supporting the deployment of measurement, monitoring, reporting, and verification (MMRV) protocols for methane emissions. The EU is leading such efforts through the rollout of its Methane Regulation, which requires the energy sector to document the methane intensity of fossil fuel imports, as a precursor to implementing a shift to lower methane-intensity fuels. This can be a differentiator for LNG sources, and involve major consumers such as Japan and South Korea to adopt regulations similar to the EU, while producers like Canada, the U.S., and Australia align on timelines and technology/policy pathways for rapid reductions in methane intensity.

The pathway to carbon neutral fuels should include the application of carbon capture and storage (CCS) technology to the production of ammonia, methanol, and hydrogen products. CCS technology will also be integral to preserving long-term demand security for natural gas in power generation as industrial production decarbonizes.

Energy security generally depends on the diversification of energy sources by fuel, technology, and geography. Clean electricity is essential to achieving a low-carbon economy, but maintaining a diverse, resilient system will require other sources including nuclear, bioenergy, offsets, and carbon capture. Low and zero carbon fuels can also support the decarbonization of industrial production processes such as steel and cement production that require higher temperatures. Canada and the U.S. can also partner with G7+ countries to decarbonize bunker fuel markets by switching to ammonia or methanol. Recent data from China shows a pathway to displace diesel in trucking with LNG, a pathway that could further evolve to clean hydrogen.

4. Promote new financing tools for developing economies to invest in clean growth

LNG’s status as a fossil fuel and its inherent price volatility as a commodity, along with its capital-intensive nature, presents project financing challenges. Developing countries tend to require large-scale infrastructure to import and store LNG and convert it from liquid to gas, to be shipped to internal markets. Most require concessional financing. A clear G7+ policy signal, providing greater acceptance of natural gas can unlock financing across a range of institutions, including multilateral development banks like the International Finance Corporation (IFC) and European Bank for Reconstruction and Development (EBRD), national export credit agencies such as Export Development Canada and private sector banks and asset managers that have excluded natural gas investment for fear of “locking in” emissions or being misaligned with Paris Agreement objectives. Supportive policies should stress the above-mentioned compact among G7 member states and commit to derisking and decarbonization the natural gas sector.

The continued evolution and progression of Article 6 of the Paris Agreement and the use of Internationally Transferred Mitigation Outcomes (ITMOs) such as Japan’s Joint Crediting Mechanism (JCM) also provide avenues for new financing methods based around the transfer of carbon credits generated from investments in methane reduction, coal-to-gas switching, or bunker fuel to clean ammonia.

However, the current Article 6/ITMO framework is not fit for purpose for natural gas or for trade between developed countries. Nonetheless, the spirit of “carbon clubs”—and creating shared incentives for natural gas-linked carbon reduction projects among G7 members—could be used to create financeable revenue streams for projects. These measures could be further complemented by programs such as Japan’s GX bonds, and South Korea’s climate funds could also co-finance LNG aligned with energy security and emissions transitions.

The use of certified natural gas can further demonstrate a clear pathway to decarbonization and alignment on values within G7+, in turn reducing project finance risks and improving project economics through enhanced pricing and offtake, and enabling access to transition finance.

Japan’s Emissions Trading Opportunity

Launched in 2023, the GX-ETS is a central component of Japan’s strategy to achieve carbon neutrality by 2050 and support industry decarbonization through a phased approach. Auctioned carbon credits support the repayment of Climate Transition Bonds (GX Bonds) which support transition-focused spending in areas such as hydrogen, ammonia, carbon capture, and EV infrastructure. These sovereign bonds aim to raise approximately ¥20 trillion (US$150 billion) by the early 2030s, catalyzing greater capital mobilization of approximately ¥150 trillion (US$1 trillion) in public and private investments.

While its focus is on domestic decarbonization, Japan has expressed interest in securing clean energy and low-carbon supply chains abroad and in funding the development costs of clean technologies.

Canada can benefit significantly by aligning its clean fuel exports—especially LNG and hydrogen—with Japan’s GX goals, provided projects meet Japan’s standards on carbon intensity, transparency, and reliability.

Here’s how:

-

Japan’s GX policy accepts low-carbon LNG—particularly if paired with methane abatement, CCS, or certified emissions standards—as transition-aligned. Canadian LNG could qualify for long-term GX-aligned supply contracts, if emissions reductions are verifiable.

-

Japanese investment via GX Transition Bonds, especially in infrastructure such as liquefaction and CCS-enabled transport. The country is already engaging Australia and other countries for clean ammonia. Canada’ low-carbon certified energy products can tap several opportunities including financing through GX Transition Bonds and Japan’s Joint Crediting Mechanism (JCM)—a bilateral initiative launched by the government to facilitate GHG emission reduction in collaboration with partner countries.

-

Canada can also participate in Japan’s plan to scale imports of green and blue hydrogen and ammonia for power and industrial use, given Canada’s potential to produce green hydrogen, and several hydrogen hubs under development in Alberta and Newfoundland and Labrador. Blue hydrogen, through natural gas with CCS potential, could emerge as another opportunity.

-

Japan’s economy also needs power to maintain its edge in computation and digital infrastructure. Data centres, AI and digital infrastructure are going to depend on natural gas. — Robert J. Johnston.

5. Create a Centre of Excellence to share market insights, technologies and best practices

The U.S. and Canada have strong incentives for cooperation on natural gas. The two countries have deeply integrated domestic markets, growing demand for gas-fired electricity to support reindustrialization and data centres, and a shared need to ensure growing exports do not lead to higher prices at home. Increasingly, as LNG exports from North America grow, the incentives for cooperation and coordination across the G7+ loom large.

The G7+ can advance these interests through a new organization to provide follow-on technical and policy action to support the implementation of a decarbonized and derisked natural gas market. Canada would be an excellent location for such a centre, given its role as the host of the 51st G7 leaders’ summit, longstanding commitments to climate action, technical expertise in horizontal drilling, methane capture and electrification, and growing role as a producer.

The Centre could sponsor technical, applied research in areas like methane mitigation, lower cost ammonia and hydrogen fuels. Equally important would be policy research and financial innovation supporting areas such as regulatory project assessment, community benefits sharing, methane MMRV, and sustainable/transition finance to support developing countries. The Centre could further embrace analysis of carbon market development, including markets for certified natural gas.

A G7 Centre of Excellence would be a clear signal from the world’s leading natural gas producers and consumers of their commitment to a derisked and decarbonized global gas market.

Certified gas: The gold standard

Several natural gas certification programs underwritten by independent third parties have emerged in recent years. North American operators Project Canary, Equitable Origin (EO), and MiQ (Methane Intelligence) play a meaningful role in certifying the carbon, environmental and human-rights credentials of natural gas.

In North America, about 30% of natural gas is currently certified to EO and MIQ. A third of production from Canada’s Montney basin is certified, as is two-thirds of contracted supply of the soon-to-launch LNG Canada. Over half the production from the Utica and Marcellus in the northeastern U.S. is certified as well.

For methane, where leaks often go unreported, producers certify natural gas volumes to MiQ as a way of highlighting the low carbon pedigree of their molecules. Additional environmental and social performance aspects that exceed regulatory minimums such as Indigenous equity participation and water use minimization are captured under the EO standard, largely consistent with disclosures that would be required under the EU’s emerging Corporate Sustainability Reporting Directive. The theory is that that these environmental and social attributes would lead to higher prices or, at a minimum, better market access.

The certified market is in the early stages of development, but the outlook for certified natural gas and potential regulatory catalysts could drive a bigger, more liquid market. If enough countries jointly developed and implemented a methane-intensity requirement (or broader certification standard) that exceeded the volume of certified natural gas, then the value of the certifications would increase and further incentivize emissions reduction.

Finally, field-based audit by industry experts following increasingly well-defined assurance processes consistent with ISO and IFRS norms adds rigour and a paper trail to claims of higher commitment and associated performance on the ground. Certifications can also assist in reducing project finance and insurance risk premiums, improving project economics through the potential for enhanced pricing and offtake, and enabling access to transition finance. Dr. Robert J. Johnston

The Big 5: The power sources that fuelled the global economy over the past 25 years

Coal

2000: 24% of global market share

2024: 26% of global market share

Global coal consumption has risen 67% since 2000, with growth in Asia more than offsetting declines in Europe and North America. China alone accounted for 74% of Asian growth. While Chinese consumption is expected to decline, rising consumption in India and Southeast Asia means coal will remain a critical energy source in Asian economies.

Oil

2000: 37% of global market share

2024: 31% of global market share

Global oil consumption is up almost 30% since 2000, with China accounting for over half of global growth. North American and European consumption is largely flat, with growth primarily coming from emerging markets. Transport across road, marine and shipping has represented almost 80% of global oil demand growth since 2000. Still, oil’s dominance within global energy systems continues to fall.

Nuclear

2000: 7% of global market share

2024: 5% of global market share

Energy generation from the technology has remained relatively consistent over the past quarter century, with declines in the developed world offset by new capacity in China. New nuclear power plants proposed and underway in Asia, revival of nuclear power plants in Canada and Europe, and new reactor designs in the U.S., largely driven by the electricity needs of data centres, could offset historical declines in nuclear.

Renewables

2000: 10% of global market share

2024: 13% of global market share

Wind and solar generation has grown exponentially from negligible levels in 2000, boosting total renewables (including hydro and biomass) global primary energy market share to 13%. Growth in other renewable generation sources such as geothermal are also growing moderately.

Natural Gas

2000: 22% of global market share

2024: 25% of global market share

Gas has boosted its market share over the past quarter century on rising demand from several economies. The power sector’s shift from coal to gas has also spurred demand and helped lower emissions for several countries, including Canada. Since 2000, 50% of gas growth has come from the power sector. Another 12% from the energy industry and another 8% from the residential sector. As a critical feedstock for petrochemicals, gas was also at the centre of a plastics boom. The globalization of LNG markets, with several new countries building LNG import terminals, has also driven demand.

All data sourced from BNEF World Energy Outlook

The Growth Project

The report is part of RBC’s Growth Project, an initiative to spark new ideas for the Canadian economy. For more on the Growth Project, click here.

Sign up here to receive RBC Thought Leadership’s newsletter, flagship reports and analysis on the forces shaping Canadian business and the economy.

Authors

Shaz Merwat, Energy Policy Lead

Kathleen Gnocato, LNG Research Initiative Lead, Independent Consultant

Contributor

Dr. Robert J. Johnston, Senior Director of Research, Center on Global Energy Policy, School of International and Public Affairs, Columbia University

Editor

Yadullah Hussain, Managing Editor

Design and production

Shiplu Talukder, Digital Publishing Specialist

Download the Report

All data from Rystad Energy unless otherwise mentioned. Rystad gas and LNG data is sourced from Rystad’s Gas and LNG Macro Solution module. Rystad energy and emissions data is sourced from Rystad’s Energy Scenario Solution module.

Please refer to Behind the scenes-our research approach section for more details on the research collaboration.

1. McKinsey & Co.

2. International Energy Agency

3.The Institute of Energy Economics, Japan, 2025 Outlook

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.