Executive Summary

The global space economy is poised to nearly triple to US$1.8 trillion by 2035, making the value derived from orbital assets equivalent to that of some G20 economies.

Canada has an opportunity to grow its space economy to $21 billion by 2035 — a four-fold increase.

An estimated $12 billion in public and private capital is needed to spur this growth. Much of that can be leveraged through new procurement strategies.

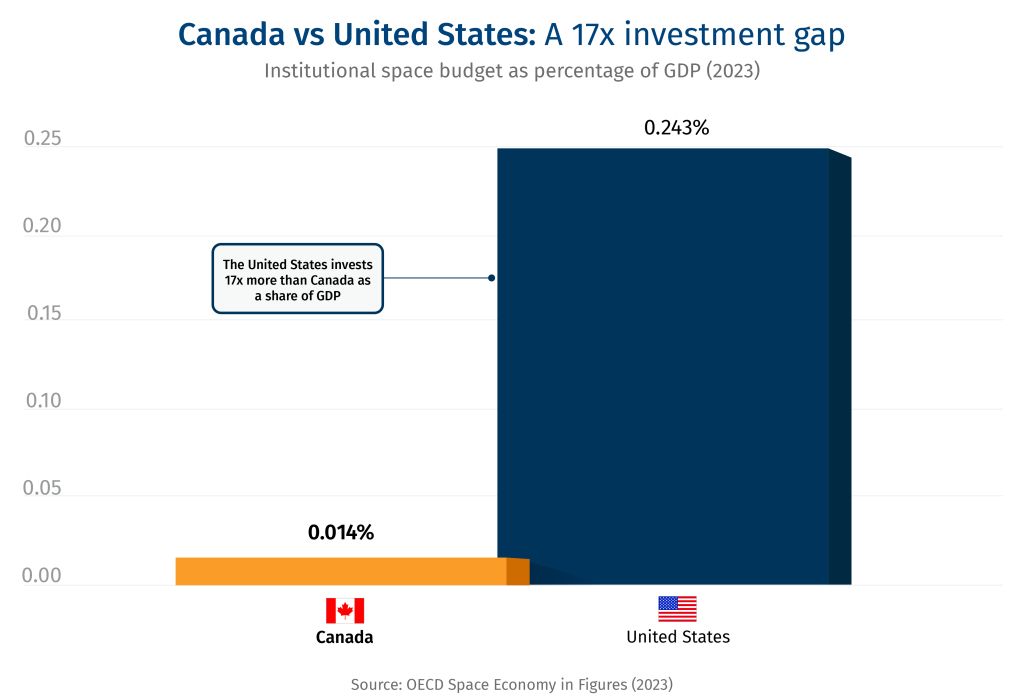

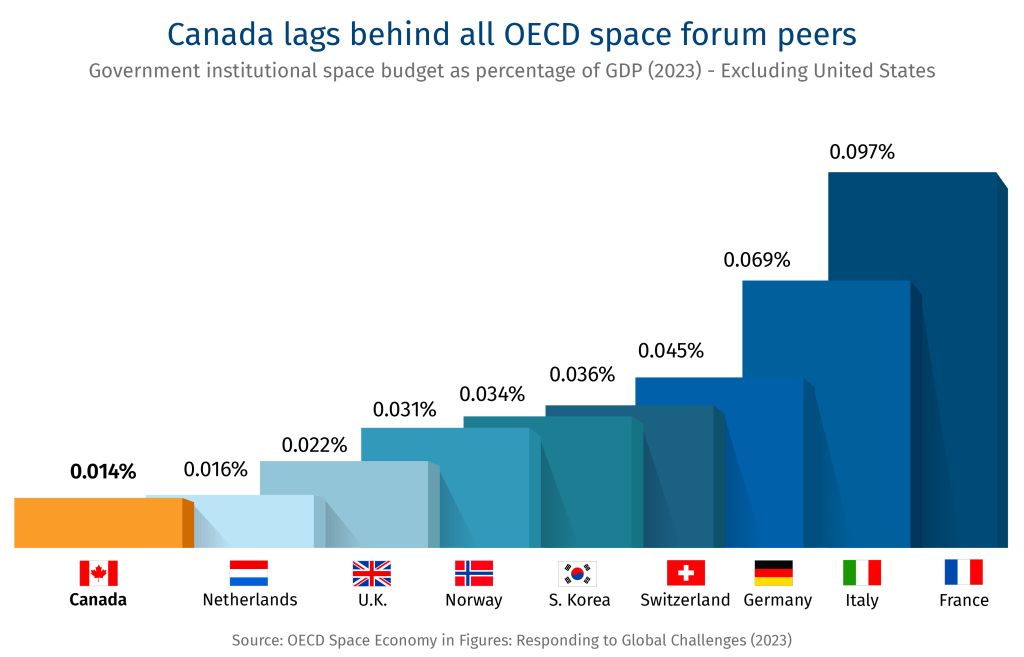

Canada currently ranks last in public spending among 10 OECD Space Forum members as a percentage of GDP. At the same time, the Canadian space industry generates $5 billion in sales revenue, which is 25% less than it did in 2014.

Canada’s total space budget is projected to increase 56% over the next decade. That includes a federal budget commitment of $180 million for launch capabilities, with two sites already under development in Atlantic Canada.

Canada can seize this moment by building a new space strategy around five key pillars: sovereignty, defence, technology, commercialization and climate.

The U.S., China, Japan, and Germany provide critical lessons for Canada — especially through strategic procurement, state scale and finance, as well as technical excellence.

Success depends on a more unified approach within government, procurement modernization, capital market activation, export market development and talent mobilization. These are interdependent levers but success requires simultaneous progress across all of them.

Overview

We’ve entered an ambitious new space age—and Canada needs an ambitious new space strategy.

What’s at stake? Our sovereignty in a more divided world. Our prosperity in a new tech universe. And our relevance to allies when the “final frontier” is suddenly the next economic and strategic frontier.

The global space economy is poised to nearly triple from US$630 billion in 2023 to US$1.8 trillion by 20351, making the value derived from orbital assets equivalent to that of some G20 economies. This transformation is not merely an economic opportunity. There’s a fundamental shift underway in how nations are mapping out their sovereignty and competitiveness, and it’s increasingly through space.

Canada has much of what’s needed to be a leader in this new age. When Jeremy Hansen heads to the moon next year, he’ll be the first non-American to leave Earth’s orbit. Our space researchers are widely seen as among the world’s best (and for a lot more than the Canadarm). And our strong capabilities in the AI economy, and perhaps soon the quantum economy, puts us where the planetary puck is going.

Unfortunately, too much of Canada’s space ambition rests on past achievements and not enough on future commitments. And we’re at risk of losing altitude just as the global space industry is taking off. As of 2025, Canada is one of the only space-faring nations that can’t launch itself from its own soil even to low orbit. meanwhile, our digital lives increasingly flow through tiny satellites sent from Earth on American and European rockets.

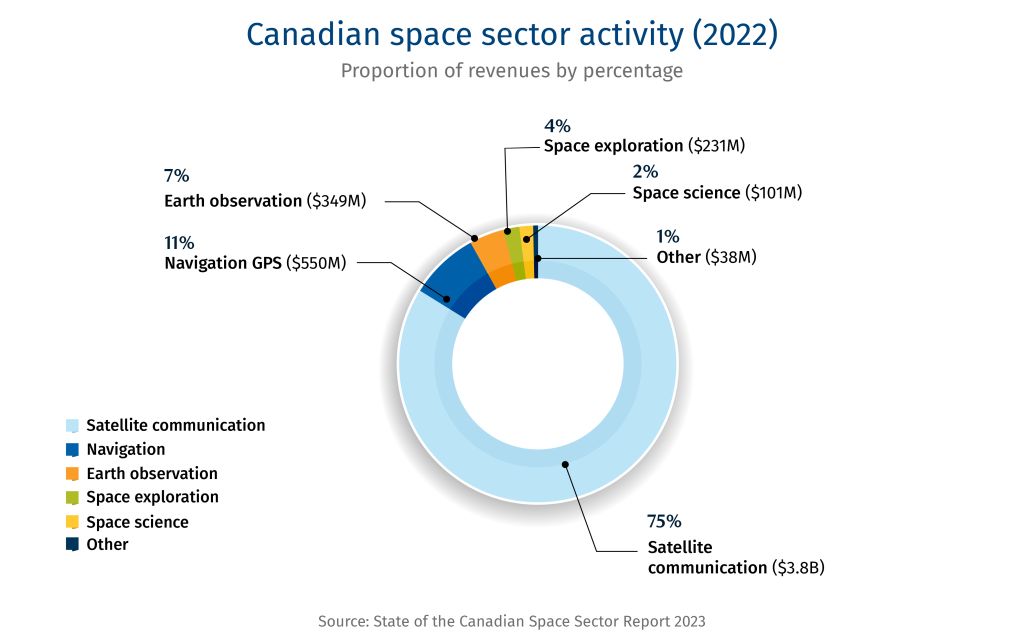

Our private space sector is also nowhere near what Canada could support. The Canadian space industry generates $5 billion in sales revenue2–25% lower than 2014.3 And our space GDP is down 13%, with productivity running about one-third lower than the U.S. space sector. If trends continue, we project negative annual sales growth of just 1% a year over the coming decade, with industry revenue falling to $4.5 billon by 2035.

Then there’s the challenge of government spending. Canada currently ranks last in public spending among 10 OECD Space Forum members as a percentage of GDP4. In a decade that saw SpaceX transform the space economy, and the U.S., China, India and Japan all land crafts on the moon, the Canadian Space Agency’s budget fell 18% from 20155—and at $414 million6 is a fraction of the OECD average.

That’s starting to change, as Canada’s public space investments are again increasing. The total spending for Canada in space reached $549 million in 20247. The federal budget includes a commitment of roughly $180 million8 for launch capabilities, with two spaceports under development (Atlantic Spaceport Complex and Maritime Launch) and several ambitious rocket projects (Canada Rocket Company, NordSpace, Reaction Dynamics). It was also announced that Canada will ramp up its investment in European Space Agency programs by $528.5 million, which will boost R&D for Canadian-made technology, and Canada is the only non-European country partnered with the European Space Agency.

Canada, the third nation in space after the Soviet Union and the U.S., also has some of the world’s leading satellite and robotics firms, led by Telesat Lightspeed (with nearly 200 satellites planned for orbit over the next two years), Kepler Communications (the first in the world to use lasers to connect Earth and space) and MDA Space (ranked the fifth most innovative globally by Fast Company). Plus, a new generation of innovators, including Mission Control and Canadensys. Our new NATO commitment of dramatically increased spending could spark a generational opportunity to invest in those companies, and many more, including through dual-use space capabilities.

Canada can seize this moment by building a space strategy around five essential pillars:

-

Sovereignty: Building a space industrial base

An elevated sector requires much bigger Canadian companies, as well as a domestic infrastructure that starts with sovereign launch capabilities. It’s as fundamental as building and operating our own shipping ports.

-

Defence: Becoming an essential ally in the Arctic

As NATO allies look to Canada for Arctic defence capabilities, we can be the most trusted non-American ally in space, while also being an integral U.S. partner in the defence of North America through our participation in initiatives like the Golden Dome.

-

Technology: Using satellites to secure a digital leap

The race for AI and quantum will run through new constellations of satellites that Canada can continue to help build and operate. This will be critical to any sovereign tech stack, as is the ability to not only control and secure our data but to leverage it for our own objectives.

-

Commercialization: Breakthrough research and development

Every company, whether they know it or not, is a space company. Space is embedded in our daily lives and fundamental to our economy, particularly in geolocation services and the transmission and storage of data. Canada should continue to be at the forefront of researching, developing and commercializing these essential technologies.

-

Climate: Protecting Earth from the sky

Our ability to manage a changing climate, and reduce the impact of extreme weather, runs through space. That will be especially critical as we look to better manage wildfires and develop new ways to protect our changing coastlines and thawing tundra.

To advance this strategy, Canada can draw on plenty of lessons from recent transformations in the space sector, particularly models that embrace defence-oriented priorities while enabling private-sector leadership. The U.S. is the exemplar of recent space innovation and leadership. Following the 2003 Columbia disaster, in which all seven American astronauts onboard the space shuttle were killed, the U.S. pivoted its space strategy from “build and own” to “buy and use.”

Washington became an anchor customer, purchasing services from private companies. Launch costs have fallen 10-fold in some cases, while innovations like reusable rockets, satellite internet like Starlink, and low-cost in-space mobility have emerged. The results speak for themselves: SpaceX’s valuation reached US$350 billion in 20249, while defence-tech companies like Palantir and Anduril command valuations of US$330 billion10 and US$30.5 billion11, respectively.

Canada could use that public-private dynamic to reach similar heights. The current space sector contributes $3.2 billion to GDP12. Using McKinsey’s forecast of a US$755 billion global market by 2035 for ‘backbone’ applications,13 we forecast that, if it receives major investment. Canadian space industry revenue could grow to $21 billion annually by 2035—a four-fold increase.

A key engine propelling this sector growth needs to be Ottawa’s new commitment to dedicating 5% of our GDP to NATO defence spending and dual-use systems.14 Dedicating 5% (of the 5%) to space defence and dual-use systems could inject up to $7.5 billion annually into the Canadian space sector by 2035.15 But Canada also needs to generate more private capital, which will require strategic government spending coupled with a more market-oriented approach. By our estimates, the Canadian space industry will require nearly $5 billion in capital in the coming decade to maintain existing capital stock. In a more ambitious scenario, where Canada doubles its share in the global space market, the country would need $12 billion in space capital.

That strategy needs to recognize a rapidly changing strategic stratosphere, in which two techno-powers—the U.S. and China—are competing for supremacy. We can further use space as a low-orbit lab in which leading science and technology efforts, from computing to life sciences, are accelerating. And as an outer boundary and one of the first points of potential conflict, space will only become more important to national defence.

In this new sphere of influence, Canada can leverage our unique position as both the strongest American ally in space and the leading non-American space player. The choice before us seems clear: embrace ambitious space leadership or accept managed decline in a domain that will define economic and security outcomes for decades to come.

What Canada can learn from global space leaders

The strategic approaches adopted by the four leading space players—the U.S., China, Japan, and Germany with the context of the European Union—provide critical lessons as Canada looks to accelerate its space sector development.

United States: Strategic procurement, market power

The U.S. has fundamentally restructured its space industrial base through a major shift from traditional cost-plus contracting to commercial services procurement. NASA and the Department of Defense function as anchor customers, offering multi-year, fixed-price contracts that de-risk private investment. This model has enabled SpaceX to capture 52% of global launch market share16 —accomplished through a combination of purchase commitments and direct government funding.

The commercial crew and commercial cargo programs exemplify this approach: they procure services at multi-billion-dollar scales, creating predictable demand that attracts private capital.17 The success of these programs, as well as the ancillary result of Starlink’s billions in revenue, validates the commercial viability of this model, while the Starshield program demonstrates how these capabilities can also be adapted for defence applications.18 With around US$7 billion in annual venture funding19 flowing into the sector and International Traffic in Arms Regulations (ITAR) creating protected market conditions, American companies benefit from rapid iteration cycles and risk tolerance.

Without comparable governmental anchor contracts of between $500 million and $1 billion, Canadian firms remain constrained to tier-two supplier roles within American prime contractor networks—manufacturing components rather than integrated systems.20

China: State scale, regional leverage

China has pursued a contrasting model characterized by centralized planning and state capital deployment, though it has also begun to fund its own commercial players after seeing the success of the U.S. strategy. Between the Guowang and Qiafan constellations, China is planning to launch more than 25,000 satellites.21 These represent more than technical achievements; they constitute sovereign infrastructure investments. Through civil-military fusion doctrine, every capability serves dual-use purposes, while Belt and Road Initiative ground stations from Pakistan to Kenya to Argentina extend China’s space influence globally.22

This approach succeeds through cabinet-level coordination that aligns space development with foreign policy and industrial strategy. Provincial governments compete for space industry clusters, creating internal competition within a unified national framework.

By contrast, Canada’s space activities remain fragmented across the Canadian Space Agency, Innovation, Science and Economic Development Canada, the Department of National Defence, and Global Affairs Canada—each operating with distinct priorities and lacking ways to bundle demand into single orders for demand aggregation. This institutional fragmentation prevents the coordination necessary to focus on strategic priorities and national champions.

Japan: Defence imperative, state finance

Japan, which has increased space funding 10-fold in three years, has evolved from a predominantly civil and science-focused space program to a comprehensive national defence-and-markets focused initiative. This transformation materialized through the expansion of defence space spending for the Space Strategy Fund, from its initial ¥300 billion (US$1.93 billion), to ¥1 trillion (US$6.5 billion) over ten years.23

This transformation resulted from reconceptualizing space as essential to national security. Japan’s keiretsu corporate structures facilitate this approach through crossholdings that provide patient capital insulated from short-term market pressures. Government-backed institutions including the Innovation Network Corporation of Japan (INCJ) and the Development Bank of Japan (DBJ) provide strategic financing where private markets fall short.

Germany: Technical excellence, defence transformation

Germany has been undergoing a major shift through defence prioritization, adding a historic US$40 billion in military space capabilities by 2030—including unprecedented consideration of offensive counter-space systems.24 Germany already had a strong platform, being among the European Space Agency’s largest contributors, at €3.5 billion (US$4 billion) over three years.25 It also ranks third globally in space patents26 and hosts over 120 space start-ups.27 In 2022, German SpaceTech startups generated over €120 million in revenue across 16 deals.28

Germany’s regulatory evolution on space, while delayed, also shows pragmatic progress. As an example, in September 2024 Germany published key points for a future German Space Act. One part is a proposed €50 million liability cap with 10% revenue-based recourse limitations29 that could potentially provide more favorable terms for investment. This measured approach—balancing commercial enablement with public protection—offered a template for nations seeking to stimulate private investment without assuming unlimited liability. Note, it is possible that the EU draft Space Regulation (2025)30 will take priority and does not include a specific liability cap. In either case, Germany’s ability to maintain world-leading capabilities in synthetic aperture radar, optical systems, and small satellite technology, while working through regulatory complexity both internally and in the EU, proves that perfect institutional conditions need not be prerequisites for technical leadership.

For Canada, Germany offers one of the most relevant models: a G7 nation with federal complexity, strong technical capabilities, and allied commitments that must balance sovereignty with collaboration.

How others are picking up the pace in space

These brief profiles capture the high-level aspects of the space strategies of the UK, South Korea, New Zealand, Norway, UAE, and Australia.

Goal: Brexit-driven strategic autonomy in critical technologies

Strengths: Public capital unlocks private markets. Defence Space Strategy provides framework. UKSA-DSIT integration recognizes space-digital convergence

Assets: OneWeb stake (now Eutelsat). Harwell Space Cluster. Strong satellite manufacturing base

Budget: US$765M public investment catalyzed a US$2.89B space economy boost (3.8x multiplier)31

Key method: Strategic public investments and long-term strategy unlock private capital. Banking conservatism and ESG requirements can create constraints but this significant multiplier demonstrates good success

Lesson for Canada: Comparable Commonwealth economy demonstrates public investment can achieve significant leverage when tied to strategic imperatives like Arctic sovereignty.

Goal: Achieve launch independence through sustained development.

Strengths: Chaebol structure absorbs early losses. Political commitment survives failures. Methodical capability building over two decades.

Assets: KSLV-II (Nuri) operational launcher.32 Naro Space Center. 425 Project.33 Samsung and Hanwha industrial integration. Korea Aerospace Research Institute (KARI).

Budget: US$670M, with US$560M directed at R&D projects.34 Sustained funding through multiple administrations despite technical setbacks.

Key method: 20-year progression: sounding rockets → military35 and commercial36 satellites → launch vehicle. Each failure treated as learning investment not political liability.

Lesson for Canada: We possess everything South Korea spent 20 years building. Difference lies in sustained commitment and commitment to sovereign launch, now recently rectified.

Goal: Dominate responsive small satellite launch market.

Strengths: Regulatory innovation enables rapid iteration. Geographic isolation becomes launch advantage. Private sector leadership with government support.

Assets: Rocket Lab: 70+ launches, 2nd most frequent U.S. launcher. Mahia Peninsula private range. 120 launch opportunities/year. U.S. corporate structure.

Budget: US$59M in public spending, US$1.52B space sector revenue (2024).37 Minimal government investment, high private return

Key method: Special use airspace, streamlined licensing. <2-month contract-to-launch capability.38 First to use 3D printing and electric turbopumps to reduce costs.39

Lesson for Canada: Small nation can dominate global niche through regulatory agility and geographic advantage, and most importantly backing and building off the success of a single, world-leading space entrepreneur. Focus beats breadth.

Goal: Become Europe’s gateway to polar and SSO orbits.

Strengths: Arctic location optimal for high-value orbits. First operational continental European spaceport. Strong allied integration.

Assets: Andøya Spaceport operational. Isar Aerospace 20-year anchor tenant. U.S. Technology Safeguards Agreement. Arctic Satellite Broadband Mission with U.S. payloads.

Budget: US$208M40. US$36K spaceport investment.41 Additional US$20K for defence allocation.42

Key method: 18-month construction for the spaceport.43 German commercial anchor + U.S. military integration.44 30 launches/year capacity at full operation.45

Lesson for Canada: Arctic geography becomes strategic asset through infrastructure investment and allied partnerships. Execution beats deliberation.

Goal: High-value tech transfer and inspiration through prestige projects.

Strengths: Significant capital compresses development timelines. Every tech transfer includes mandatory training. Global talent acquisition at premium rates.

Assets: Hope Mars probe (2020). Mohammed bin Rashid Space Centre. KhalifaSat Earth observation. Partnerships with NASA, JAXA, Roscosmos.

Budget: US$443M in civil space investment. Silicon Valley salaries for global talent. Backing from the US$820M sovereign wealth fund.46

Key method: Buy proven technology, build local capability. Prestige generates foreign investment and regional leadership.47 Now leveraged into domestic start-ups and space investment holdings.

Lesson for Canada: Rapid influxes of targeted capital on major, visible projects can result in meaningful tech transfer and national inspiration.

Goal: Leverage Southern Hemisphere position for Indo-Pacific leadership.

Strengths: Late entry avoids legacy constraints. AUKUS provides technology access. Geographic advantage for polar orbits and regional coverage.

Assets: Australian Space Agency (2018). Multiple launch site developments. Deep Space Communication Complex. SmartSat CRC.

Budget: US$25M (2024), with US$135M over 5 years (2023-2028).48 US$840M Modern Manufacturing Initiative includes a US$101M Australian Space Manufacturing Network.50 Additional defence space investments.

Key method: Focus on mining, agriculture, maritime applications. Allied integration through AUKUS.

Lesson for Canada: Partnerships with the U.S. and integration into strategic domains provides technology transfer and co-investment opportunities. As in the Indo-Pacific, so it can be in the Arctic.

Canada’s space journey: From Alouette to today

We’re the country that sent a skylark to sing in space, built the arm that assembled humanity’s orbital outpost, and created the radar that sees through Arctic darkness.

| 1962 The skylark takes flight | 1981 The arm that built the future | 1995 The all-seeing eye | 2025 The inheritance test |

|---|---|---|---|

| September 29, Vandenberg Air Force Base: Thor-Agena rocket carries 145kg of Canadian built satellite into orbit | November 13, Space Shuttle Columbia: Canadarm unfurls above Earth, Canada wordmark blazing | RADARSAT-1 launches: Canada’s synthetic aperture radar pierces clouds, darkness, Arctic storms | 60 years of excellence meets venture capital reality |

| Alouette 1 makes Canada the third nation in space | The impossible made routine: Many doubted a 6-degree freedom robotic arm couldn’t work in space | Geography as destiny: Built for a country that’s half winter, all vast, mostly invisible from space | Brain drain accelerates: Our roboticists design for Silicon Valley, our radar experts optimize for Arlington |

| Named for a French-Canadian folk song about a skylark, because even our satellites have culture | 410kg on Earth, but in orbit it juggled 100-tonne payloads with centimeter precision | 72-hour promise: Any corner of Canada mapped within three days, Arctic covered daily | Capital gap becomes critical: Technical excellence without financial fuel |

| The miracle: Built by a DND team when transistors were “just in their infancy” with “no textbooks and virtually nothing” to guide them | The nuclear connection: Born from CANDU reactor robots—Canadian ingenuity repurposed for the cosmos | 17-year marathon: Planned for 5 years, operated for 17. Another Canadian overachiever | Budget commitment to domestic launch – need to rise to meet the moment |

| Designed for 1 year. Sang for 10. The little satellite that could—and did | Perfect record: 90 missions, 5 shuttles, built the ISS, fixed Hubble. Zero failures. | The crossroads question: Sovereign space power or sophisticated supplier |

Canadian space industry: Ready to take flight

The following companies collectively employ more than 10,000 Canadians and generate more than $5 billion in annual revenue, with export rates exceeding 80%. They also demonstrate that Canada possesses the technical capability, manufacturing excellence, and commercial acumen to compete globally. What they lack is the scale of capitalization and anchor contracts their international competitors enjoy. With the proposed $12 billion capital injection by 2025 and defense spending increases tied to Canada’s new NATO commitment, these space firms could grow from successful niche players to global champions—creating the ecosystem that attracts and retains the next generation of space companies.51

-

Member of Canada’s fastest growing companies list, three years running

-

Built Canadarm, Canadarm2, and Dextre and now Canadarm3—establishing Canada’s robotics legacy

-

RADARSAT prime contractor, leading synthetic aperture radar technology

-

Developer of MDA Aurora, the world’s leading commercial Low Earth Orbit (LEO) digital communications satellite

-

Over 3,800 employees

-

Strategic relevance: Largest space company in Canada with a proven ability to execute complex programs and compete globally

-

Founded 2015, raised more than US$300 million in venture funding

-

Launching 10 optical data relay satellites in January 2026, building on the flight heritage of 23 previously deployed satellites, designed for compatibility with the U.S. Space Development Agency’s optical communications standards

-

First commercial company to demonstrate inter-satellite links in LEO

-

More than 175 employees

-

Strategic relevance: Kepler leads optical data relay technology globally and provides real-time connectivity, advanced on-orbit compute, and hosted payload services for mission-critical data

-

Developed Spacefarer™ platform used by NASA, and commercial operators

-

Delivered mission critical hardware and software for lunar rovers to customers on three continents

-

Launched Mission Persistence with SpaceX in June, Canada’s Giant Leap for AI in Space

-

Leaders in deploying AI at the edge, on the spacecraft itself, including for wildfire detection

-

Raised over $22 million in equity and non-dilutive funding

-

35+ employees with deep space operations expertise

-

Strategic relevance: Software and operations expertise critical for managing complex constellation and lunar missions

-

Developing Spaceport Nova Scotia, located near Canso, which is designed as a multi-user, multi-mission launch complex

-

Active partnerships with small- and medium-lift launch providers for suborbital missions and ongoing discussions with Canadian and international orbital launch companies

-

Signed a U.S. Technology Safeguards Agreement, enabling U.S. launch providers and spacecraft partners to operate at the site using controlled American technologies

-

MDA Space made a $10 million strategic investment becoming an operational partner

-

The Company received a $10 million loan from Export Development Canada tosupport site development, launch pad completion, and operational readiness

-

Competitive access to polar and sun-synchronous orbits, offering inclinations from 45.1 to 90 degrees and safe downrange corridors over the Atlantic

-

Strategic relevance: Positions Canada to become a launch-enabled nation, capable of deploying and replenishing satellites from its own soil

-

Third-largest landing gear company globally; $800 million in revenue

-

2,000 employees across Canada, U.S., UK, and Spain

-

Supplies Boeing, Lockheed Martin, Airbus, and many more OEMs

-

Export sales represent 90% of revenue

-

Strategic relevance: Precision manufacturing and systems integration capabilities directly applicable to spacecraft programs

-

Specializes in planetary exploration missions and systems, lunar rovers, science instruments, cameras, and lunar greenhouses

-

Developing LRM lunar rover for CSA and multiple lunar utility vehicles for NASA Artemis program and commercial customers

-

Leading the development of lunar greenhouses to produce food for astronauts on the Moon. Working with CSA, DLR, and NASA

-

Produce and sell computers, power systems, and cameras for lunar missions. Over 20 cameras now on lunar surface and another 200 currently in production, 100 of which are already ordered for various international lunar missions

-

Strategic relevance: Next-generation space robotics extending Canada’s legacy into lunar economy

-

Developing Canada’s first end-to-end responsive space launch system with vertically integrated capabilities

-

Tundra rocket (500 kg to LEO by 2028) and scales to Titan rocket (5,000 kg to LEO by 2032), designed as Canada’s first sovereign orbital launch vehicles

-

Building Atlantic Spaceport Complex (ASX) in Newfoundland & Labrador with operations starting in 2025

-

Manufacturing 3D-printed Hadfield & Garneau liquid rocket engines using Jet-A/SAF and LOx propellants

-

Terra-Nova satellite launching 2026 featuring NVIDIA GPU powered edge-AI for wildfire detection and wild field of view (WFOV) space domain awareness (SDA)

-

Strategic relevance: Dual-use SHARP defence program developing hypersonic capabilities and high-altitude missions for Arctic sovereignty using same hardware from Tundra rocket and engines

-

Leader in dedicated orbital launch services, rapid replenishment, and reconstitution of satellite constellations, with patented propulsion technology that simplifies propulsion architecture to ~12 parts compared to ~15K

-

$38M+ in total funding, including a $14M Series A (June 2025) and $10M grant from the Government of Quebec (June 2025)

-

Aiming for maiden suborbital launch in winter 2026; Aurora-8 launch vehicle targets the growing market of small satellites

-

Targeting first orbital launch attempt via pathfinder launch agreement with Maritime Launch Services to launch from Spaceport Nova Scotia in Q3 2028

-

Awarded €300K ($482K CAD) in NATO DIANA Phase II and awarded $776K from CSA SDTP for microthruster demonstration

-

Strategic relevance: Advances Canada’s sovereign launch capability and positions the country in the emerging suborbital and small-satellite launch markets

-

Founded in 1969, now one of the world’s largest satellite operators

-

Telesat Lightspeed LEO constellation: $6.5B investment for 198 satellites

-

Global broadband coverage with focus on enterprise, government, and mobility markets

-

Competing directly with SpaceX Starlink and Amazon Kuiper

-

~750 employees

-

Strategic relevance: Demonstrates Canada’s ability to deploy capital for mega-constellations, critical for digital sovereignt

A new strategy: 5 Pillars to powering Canada’s space ambition

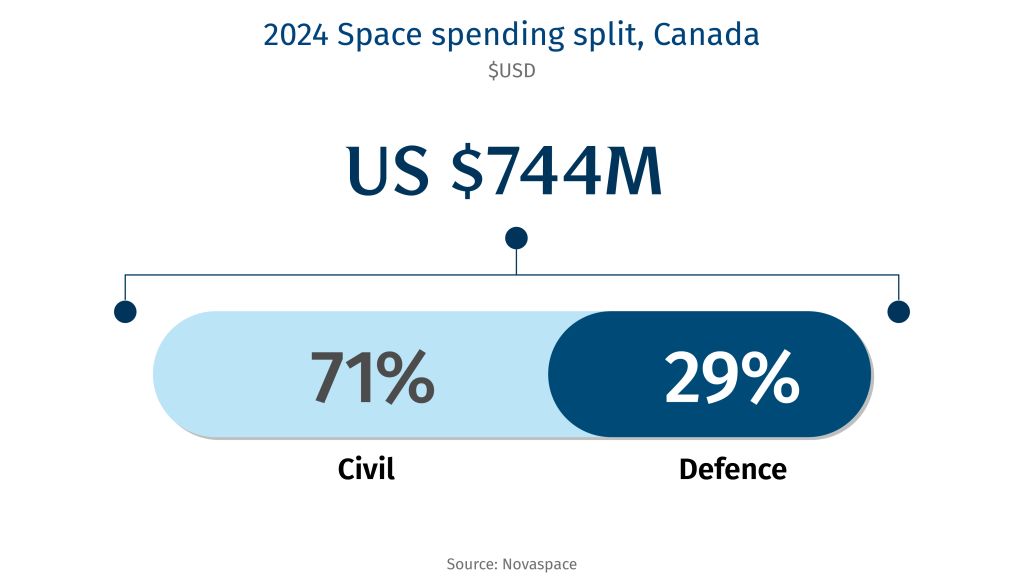

Canada needs to turn its pockets of space excellence into key pillars of a new global strategy. And the renewed focus on defence spending can be the launch pad. Defence spending currently represents 29% of Canada’s space spending and is poised to grow significantly as NATO commitments scale.52 This isn’t just budget reallocation; it’s a fundamental market transformation. Defence-driven procurement can facilitate anchor contracts and multi-year revenue certainty, which can help unlock private capital and enable Canadian space companies to achieve commercial scale.

1. Sovereignty: Building a space industrial base

Target capability by 2035: Strengthen our domestic space industrial base with a focus on sovereign launch capabilities and critical components where Canada has existing strengths.

Private capital, especially in the U.S. and Europe, has created a new generation of space companies. For example, deal flow in the U.S. space industry has more than doubled over the past decade and the value of those deals rose nearly four-fold.53 In the wider space industry, nearly US$50 billion flowed into space companies since 2015,54 growing on average 21% per year,55 with venture capital driving much of the action. The UK has become the second most attractive destination for space capital, as it has received 17% of this inflow.56 The industry is experiencing growth not seen since the Cold War space race, and dual-use and commercial capabilities are driving it.

In this global space race, Canada has many strengths but also some critical gaps. We have strong satellite manufacturing capacity, solid component production, but also fragmented supply chains and no domestic ability to get our own satellites to orbit. Canada is also under-equipped when it comes to testing facilities and national research centres. Decades of underinvestment in national space capabilities relative to our peers is starting to show. This industrial gap fundamentally limits our strategic autonomy and economic potential in a sector growing at 9% annually.57

New federal budget commitments will help, especially with the allocation of $182.6 million over three years for sovereign space launch capability.58 That’s a good start. But industrial competitiveness requires more to build a value chain: new ambitious missions and capabilities, advanced satellite and component manufacturing facilities, testing and validation centres, ground systems infrastructure, and perhaps two operational spaceports in the years ahead—NordSpace’s Atlantic Spaceport Complex and Maritime Launch’s Spaceport Nova Scotia.

The potential for economic transformation is proven. NASA’s shift from “build and own” to “buy and use” didn’t just reduce launch costs; it catalyzed an entire commercial space industry. The U.S. increased objects launched into outer space from 29 in 2011 to more than 2,200 in 202459 by empowering and buying national services from space entrepreneurs, and nurturing domestic manufacturing, supply chains, and service providers.

Modern space economics favour this comprehensive approach. The evolution of satellite technology shows dramatic cost changes. Commercial communications satellites in the 1990s cost $350-950 million (in today’s dollars), and can now be deployed for $150-500 million,60 with new small GEO satellites available for as low as $15 million.61 The transformation in small satellites has been even more remarkable: universities and emerging nations can now build and launch CubeSats as low as $150,000 total, compared to traditional satellites costing hundreds of times more.62 63

A robust industrial base that is increasingly funded through defence space spending could deliver defensive outcomes comparable to more naval destroyers or F-35s—but with far greater domestic economic multipliers through dual-use applications in communications, Earth observation, and climate monitoring.

2. Defence: Becoming an essential ally in the Arctic

Annual capability by 2035: NATO-leading Arctic communications, positioning, surveillance systems; counter-space capabilities for deterrence

Space has fundamentally changed how nations project economic and military power. Advanced militaries now depend on satellites for communications, reconnaissance satellites gather intelligence and identify targets, and PNT constellations (including GPS) guide everything from precision munitions to drones.

Beyond these tactical capabilities, space remains central to strategic security. Early-warning systems that detect nuclear missile launches rely heavily on space-based assets. Starlink’s role in Ukraine grabbed headlines, but that’s just the beginning of how space systems are reshaping national defence.

At the same time, counter-space capabilities are proliferating rapidly. The U.S., Russia, China, and India have all destroyed their own satellites to demonstrate anti-satellite missiles.64 China and the U.S. are building extensive counter-space arsenals, including satellite proximity operations and refueling infrastructure. Russia has shown it can launch nuclear weapons into orbit that could wipe out most low-Earth orbit satellites with an electromagnetic pulse.65 The consensus is clear: any conflict between major powers will likely start with moves in space.

Canada needs advanced space capabilities for battlefield communications, intelligence gathering, target detection, and space control—including counter-space systems—if it wants to maintain sovereignty and deter adversaries. Our NATO and Five Eyes partners naturally expect us to take the lead on Arctic defence, where space systems are particularly critical given the massive territory and sparse population. Emerging Canadian firms like Dominion Dynamics are beginning to develop these critical capabilities domestically for Arctic sensing. Geography gives Canada a unique advantage: positioned far from potential conflict zones in Europe and the Indo-Pacific, we can contribute space assets to allied operations more effectively than ground, naval, or air forces.

With our small population and vast territory, staying tight with our “Five Eyes” – an alliance between Australia, Canada, New Zealand, the United Kingdom and U.S. – to share intelligence remains our best security strategy. Joining initiatives like the Golden Dome proposed by the US could strengthen these ties. The U.S.-led space-based missile defence architecture would integrate allied capabilities into a unified shield against hypersonic and ballistic threats. For Canada, participation could mean more than simply enhanced protection—it positions us as an essential partner in continental defence, potentially securing industrial participation and technology transfer for Canadian firms and ensuring our voice shapes the future of North American security architecture and supports broader Five Eyes capabilities.

Defence investments that fund new technology development consistently boost R&D spending and drive economic growth, as defence innovations built can often find commercial applications. But this economic spillover only works when we develop capabilities domestically rather than buying foreign systems. Canada needs to source from and co-develop with Canadian companies, structuring deals so these firms can scale domestically then globally. The U.S. has built massive companies this way—SpaceX ($350B+), Palantir ($330B), and Anduril ($30B)—through strategic national security contracts.

3. Technology: Using satellites to secure a digital leap

Annual capability by 2035: Quantum-secured satellite communications networks; sovereign positioning, navigation, and timing systems

Over the next decade, nations will secure economic and strategic advantage through technology. And three converging megatrends will reshape global power dynamics: the exponential growth of data as a strategic asset, the vulnerability of current encryption to quantum computing, and the critical dependence of commerce on satellite infrastructure. Nations that control secure satellite communications will hold the keys to digital sovereignty—those without independent capabilities will face strategic constraints.

Consider the scale of satellite dependence today. Maritime shipping, which moves more than $14 trillion in goods annually,66 depends entirely on satellite positioning and timing.67 Financial markets rely on GPS timing for transaction synchronization—an outage costs approximately $1 billion per day to the U.S. economy.68 The positioning, navigation, and timing services sector generated around US$280 billion in downstream revenues globally in 2023 from devices and services.69

The technological landscape of 2030 will be unrecognizable from 2020. As AI models become commoditized and universally available, competitive advantage will shift from algorithms to proprietary datasets. The companies and nations that can securely collect, transmit, and process unique data streams will dominate. Satellite constellations provide these unique vantage points—monitoring global supply chains, tracking economic activity, enabling autonomous systems—but only if that data can be secured.

Quantum computing presents both an existential threat and transformative opportunity. Current encryption methods protecting satellite communications, financial transactions, and military data will be vulnerable to quantum decryption within this decade. China has already demonstrated quantum satellite communications with their Micius satellite.70 The nation that deploys quantum-secured satellite networks first won’t just protect their own communications—they’ll become the trusted provider for allies seeking protection.

Meanwhile, the AI revolution demands unprecedented data transmission capacity and security. Training next-generation AI models requires massive datasets often collected from satellite imagery, IoT networks, and global sensors. The Smart Cities market encompassing these technologies is projected to reach US$1.4 to US$4 trillion by 2030,71 72 much of it dependent on secure satellite connectivity for IoT infrastructure. Control of secure satellite infrastructure is also likely essential for what many are calling sovereign AI.

Every Canadian AI company training models on proprietary data faces choices about data routing and storage. Our innovation ecosystem’s competitiveness depends partly on secure infrastructure that enables protection of intellectual property while maintaining global connectivity.

Canada’s position presents both opportunities and vulnerabilities. Our reliance on allied satellite infrastructure—while beneficial for interoperability and cost-sharing—creates potential single points of failure. It is wise to ensure resilience through diversification.

In scenarios of system degradation—whether from solar events, cyber attacks, or infrastructure failures—Canada needs assured access to positioning, navigation, and timing services. Our banks, power grids, and transportation networks all depend on precise timing signals. The economic risk compounds as Canadian companies in resource extraction, financial services, and advanced manufacturing transmit sensitive data through satellite infrastructure without sovereign alternatives. Additionally, a three-year study conducted by researchers at UC San Diego and the University of Maryland found that roughly half of geostationary satellite signals are transmitting sensitive data completely unencrypted, making them vulnerable to interception with basic equipment.73

Canada possesses unique advantages to become a global leader in secure satellite communications. Our quantum research leadership—through institutions like the Quantum Valley ecosystem in Waterloo, the $360 million National Quantum Strategy, and the additional $334.3 million announced in Budget 202574 75 combined with leading quantum companies like Xanadu, Photonic, and NordQuantique, position us to develop quantum-secured satellite networks ahead of most nations. Combined with our intentions on Arctic sovereignty, NATO obligations, and trusted middle power status, Canada has both capability and market opportunity.

The economic case is compelling. Telesat’s $6 billion Lightspeed constellation76 demonstrates private sector confidence in Canada’s ability to compete globally in satellite communications. Adding quantum security creates differentiation for nations seeking trusted alternatives—not to replace existing partnerships but to ensure resilience through diversity. With focused investment, Canada could build quantum-secured satellite infrastructure serving both domestic needs and allied nations seeking additional secure communications options.

4. Commercialization: Breakthrough research and development

Annual capability by 2035: World-leading research programs in strategic domains; 100+ annual student projects; 2-3 breakthrough technology demonstrations annually

When it comes to space research, nations are no longer competing for scientific prestige but for control of technologies that will define economic and strategic power. China is targeting a space-based solar power demonstration by 2035.77 The U.S. is pursuing nuclear propulsion for Mars missions.78 Japan is developing a lunar RV while offering quarterly ISS deployment opportunities that have enabled over 200 satellite deployments since 2012.79 These aren’t science projects—they’re strategic investments in future market dominance.

Canada’s research strengths uniquely position us for space technology leadership, but only if deployed strategically. Three Canadian quantum companies—Nord Quantique, Xanadu, and Photonic—advanced to DARPA’s Quantum Benchmarking Initiative finals, competing for US$316 million.80 The federal budget’s $334 million quantum investment provides capital to secure these headquarters in Canada.81 Our materials science and robotics expertise, hardened through Arctic operations, directly translates to lunar environments. Our mining sector is well-poised to extract critical minerals, and it is one of the strongest in the world. Our nuclear industry has CANDU reactor experience that could be applicable to space power systems.

Success requires fundamental shifts in how Canada approaches space R&D. Japan’s model of regular deployment opportunities reduces the gap between prototype and product. When investors know technologies can be validated within months rather than years, capital flows to innovative companies. Canada could establish similar quarterly launch opportunities, transforming research projects from academic exercises into commercial pipelines.

The implementation pathway is clear: commercial partnerships from day one, with industry co-investment in research programs. Mechanisms ensuring breakthrough IP remains in Canada. Structured programs that connect student projects to space missions could be a great start. Most critically, acceptance that moonshots require multiple attempts and a commitment to preparing both the public and politicians to accept some failures as part of the process of innovation and growth.

The economic case is compelling. When NASA commits to purchasing orbital and lunar delivery services, companies raise billions in private capital. When DoD funds quantum communications, startups achieve unicorn valuations. Canada can replicate this model with government as first customer, not final customer, creating markets that attract private investment.

The opportunity window may be narrowing. As space commercialization accelerates and the owners of platform technologies emerge, first movers will establish dominant positions. Canada has proven it can produce world-leading research. The next decade will determine whether we capture the value of our innovations or continue subsidizing competitors’ success.

5. Climate: Protecting Earth from the sky

Annual capability by 2035: AI-integrated Earth observation systems; operational climate monitoring for Canadian territory

Canada’s unprecedented 2023 wildfire season—burning 16.5 million hectares, seven times the historical average—demonstrates why climate monitoring has become economic infrastructure. The fires cost over $1 billion in suppression efforts across four provinces, contributing to $945 million in total insured weather losses.83 This crisis creates market opportunity: the global Earth observation sector will grow from $5 billion today to $8 billion by 2033,84 driven by nations requiring the same wildfire prediction, flood monitoring, and agricultural intelligence that Canada must develop for survival.

Space-based monitoring is an operational necessity. Twenty-six of 54 essential climate variables can only be measured from space.85 86 Canada’s unique geography—vast boreal forests, Arctic territories, prairie agricultural systems—creates monitoring challenges that, once solved, become exportable products for nations facing similar environmental pressures.

Canada’s Earth observation heritage provides a strong foundation. Earth observation represents 20-per-cent of Canada’s space expenditures (the second largest driver after satellite communications). RADARSAT’s synthetic aperture radar heritage made Canada a world leader in Earth observation—an advantage that evolved from defence requirements but found commercial markets in resource management, disaster response, and environmental monitoring. Start-ups like SkyWatch and GHGSat are also finding ways to derive and create value from earth observation products, as well as international customers.

Canada’s current Earth observation strategy explicitly recommends developing a dedicated program to “source commercial and international data”87 to complement sovereign capabilities. However, this recommendation was notably absent from the RADARSAT+ funding package announced in 2023.88 Canada could develop and fund a new initiative, analogous to NASA’s Commercial SmallSat Data Acquisition program, that focuses specifically on acquiring, evaluating, and integrating commercial and international Earth Observation data. Canada could also build off of NASA’s Earth Information Center initiative and work towards a national Climate Resilience Design Centre, enabled by space-data and AI.

AI could transform Earth observation from static imagery to predictive intelligence. Canada could build a world-leading Earth digital twin. It could enable algorithms to identify patterns that are harder for human analysts to discern. That could include early indicators of crop failure, illegal resource extraction, maritime trafficking, or military movements. This AI-driven Earth observation creates commercial export opportunities—data products and analytics services that allied governments, resource companies, and agricultural operations will pay for. Dual-use optimization is powerful. The same satellites that monitor wildfires and agricultural conditions can also provide military intelligence, border surveillance, and maritime domain awareness.

Strategic unlocks to secure Canada’s place in space

Canada could capture an estimated $21 billion of the global space market annually by 2035, creating new jobs and transforming our economy. Or we could watch from the ground as others claim the high frontier. The difference comes down to approximately $12 billion in capital investment and the political will to deploy it–and soon.

The are several strategic unlocks that Canada’s leaders could consider:

-

Canada’s space governance remains fragmented across multiple departments with no single point of accountability, deterring the private investment needed to scale the sector. One option is to have the National Space Council report directly to a senior minister or Clerk of the Privy Council, granting them authority to coordinate all federal space spending. This creates the focused leadership that capital markets require—mirroring how Japan’s Prime Minister provides oversight over the country’s national space agency.

-

NovaSpace, a global consultancy firm, diagnosed our core failure: we create “technology orphans”—innovations that win small government grants, then die without major customers.89 The Department of National Defence could break this cycle by committing to become a significant customer of Canadian space innovations and services and providing world-leading space defence capabilities for ourselves and for our allies in the process.

-

It is hard for companies to raise capital against one-time contracts, which is what Canada often offers. The Canadian Space Agency could address this by shifting from buying hardware to purchasing services, replicating NASA’s success, as outlined above. At the early stages, this could be similar to the US SBIR program (which Budget 2025 may create a version of, through ISED).90 Phased contracts would take companies from $200,000 feasibility studies through $1.5-million development contracts, on a pathway to commercialization towards $50-million deals, creating a proven pathway from innovation to market.

-

Canadian space companies also face challenges in “de-banking” for defence-related work and the country has venture funds that are often too small to scale champions. To navigate this, Export Development Canada (EDC) could consider establishing a dedicated Space Finance Division with expanded lending capacity, while Finance Canada could classify space as “strategic infrastructure” to unlock pension fund investment. EDC could also consider guaranteeing 80% of commercial loans, like how it did through BCAP during the pandemic. This could mobilize the billions needed to build Canadian champions.

-

Canada’s space exports grew 13% from 2020 to 2023, proving international appetite exists. Fast-tracking agreements with Five Eyes and NATO partners, combined with a dedicated Space Export Division within Global Affairs, could help position Canada as a trusted non-American option for nations seeking alternatives to U.S.-China dependency. An “Allied Space Preferred Partner” designation could also expedite approvals.

-

More than 40 universities and research centres participate in the Canadian space sector, and this is a strength that can be built on.91 At the same time, in the context of talent, Canada is facing significant challenges. The major reduction of international students may reduce our talent pipeline, and many of our traditional sectors including automotive are struggling amidst the trade war. Opportunities to unlock talent could include industrial retraining programs into the space and defence sectors, especially from hard hit areas of our economy. One opportunity is a U15-led, business-academia approach to space-driven technologies for earth science and climate resilience, including wildfire detection and management—something that can exported to NATO allies for dual use purposes. Further, national regulatory sandboxes and multi-year federally funded university space research institutes partnered with the CSA and DND that link space and defence procurement with post-secondary institutions and industry partners could create pre-qualified talent pipelines and accelerate security clearances.

These unlocks—unified leadership, procurement modernization, capital market activation, export market development, and talent mobilization—are interdependent. Success requires simultaneous progress across all dimensions. International precedents, particularly NASA’s commercial programs and the UK’s space investment strategy, demonstrate that government market-making can catalyze private sector growth.

But the window is narrowing. First-mover advantages in quantum communications, Arctic surveillance, and other emerging space technologies have expiration dates measured in months and years, not decades. Furthur delay risks permanent relegation to consumer and tier-two status rather than being a producer and leader in the global space economy.

The path forward requires coordinated action across government, industry, and capital markets. Without executive-level leadership and the structural reforms outlined, Canada risks missing a generational opportunity.

At a time when we’re aiming east, west and north, instead of south, Canada also needs to look up—and aim higher, quite literally, with an ambitious space strategy.

Download the Report

Authors

Alexander MacDonald, Former Chief Economist, NASA

Jaxson Khan, CEO, Aperture AI | Senior Fellow at University of Toronto

John Stackhouse, Senior Vice President, Office of the CEO, RBC

Editorial and production

John Intini, Senior Director, Editorial, RBC Thought Leadership

Sydney Wisener, Intern, RBC Thought Leadership

Caprice Biasoni, Design Lead, RBC Thought Leadership

Lavanya Kaleeswaran, Director, Digital & Production, RBC Thought Leadership

Methodology

Data on the Canadian space economy is limited. The Canadian Space Agency (CSA) publishes an annual State of the Canadian Space Sector Report, including revenue, gross domestic product, employment and exports. Company-level data is available for publicly traded firms. Our method blended data from both sources to model sales revenue, GDP and capital expenditure across ‘baseline’ and ‘ambition’ growth scenarios. The calculations were made through a series of steps.

-

To forecast sales revenue and GDP to 2035 in the ‘baseline’ scenario, we derived the longest possible compound annual historical growth rate using CSA data (2014-2022), which we assume will govern the future growth of sales revenue (-0.8%) and GDP (1%) going forward.

-

To forecast sales revenue under the ‘ambition’ scenario, we assume Canada doubles its global market share by 2035, rising from ~1.1% of the global market in 2022 to 2% by 2035. In partnership with McKinsey & Company, the World Economic Forum projects the global space market ‘backbone’ applications (such as satellite, launchers, broadcast television, and GPS) will grow to US$755 billion by 2035,92 putting Canada’s share at $21 billion. This ambition scenario thus sees the space market grow 4x in 10 years.

-

To infer the capital required under a baseline and an ambitious scenario, we used data for publicly traded space firms. From 2020-2024, Canada’s publicly traded space firms had a capex-to-revenue ratio of 36% (on a weighted average basis). That figure was skewed by heavy investments from a few key firms that are unlikely to be repeated in the future, even under the ambition growth scenario. To better anchor the capex-to-revenue ratio, we included a few mature aerospace companies, which have much lower capital requirements. On a weighted-average basis, this brought the capex-to-revenue ratio down to ~10%.

-

Across the baseline and ambition scenarios, we multiplied annual sales revenue by 10% to determine the annual capex, aggregating the figures over 2025-2035 to determine the total capital required.

World Economic Forum and McKinsey & Company, “Space: The $1.8 Trillion Opportunity for Global Economic Growth, World Economic Forum”, April 8 2024, https://www3.weforum.org/docs/WEF_Space_2024.pdf .

Canadian Space Agency, A thriving Canadian space sector: $3.2 B towards Canada’s GDP for 2022, Government of Canada, September 24, 2024, https://www.canada.ca/en/space-agency/news/2024/09/a-thriving-canadian-space-sector-32b-towards-canadas-gdp-for-2022.html

Canada Space Agency, ”State of the Canadian Space Sector 2014“, Government of Canada, 2014, https://publications.gc.ca/collections/collection_2017/asc-csa/ST96-8-2014-eng.pdf

STIP Compass, ”Space Profiles”, OECD, 2025, https://stip.oecd.org/stip/space-portal

Canadian Space Agency, “2015-2016 Quarterly Financial Report for the Quarter Ended December 31, 2015”, Government of Canada, December 31, 2015, https://www.asc-csa.gc.ca/eng/publications/qfr-2015-2016-03.asp

Canadian Space Agency, 2024-25 Departmental Plan, Government of Canada, https://www.asc-csa.gc.ca/eng/publications/drr-2024-2025.asp

Canadian Space Agency, 2024-25 Departmental Results Report, Government of Canada, https://www.asc-csa.gc.ca/eng/publications/drr-2024-2025.asp

Department of Finance Canada, Budget 2025, Chapter 4: Protecting Canada’s sovereignty and security, Government of Canada, https://budget.canada.ca/2025/report-rapport/chap4-en.html

Aria Alamalhodaei, ”SpaceX in talks to raise new funding at $400B valuation”, Tech Crunch, July 8, 2025, https://techcrunch.com/2025/07/08/spacex-in-talks-to-raise-new-funding-at-400b-valuation/

Keithen Drury, “Prediction: 3 Stocks That Will Be Worth More Than Palantir 3 Years From Now”. Nasdaq, June 24, 2025, https://www.nasdaq.com/articles/prediction-3-stocks-will-be-worth-more-palantir-3-years-now

Utkarsh Shetti, ”Anduril secures $30.5 billion valuation in latest fund raise”, Reuters, June 5, 2025, https://www.reuters.com/business/anduril-secures-305-billion-valuation-latest-fund-raise-2025-06-05/

Canadian Space Agency, ”2024-25 Departmental Results Report“, Government of Canada, https://www.asc-csa.gc.ca/eng/publications/drr-2024-2025.asp

World Economic Forum and McKinsey & Company, ”Space: The $1.8 Trillion Opportunity for Global Economic Growth”, World Economic Forum, April 8 2024, https://www3.weforum.org/docs/WEF_Space_2024.pdf

Prime Minister of Canada, ”Canada joins new NATO Defence Investment Pledge”. PMO Office, June 25, 2025, https://www.pm.gc.ca/en/news/news-releases/2025/06/25/canada-joins-new-nato-defence-investment-pledg

Alex MacDonald & Chris Hadfield, ”Canada faces a once-in-a-generation opportunity to stake a serious claim in space”, Globe and Mail, September 26, 2025, https://www.theglobeandmail.com/opinion/article-canada-space-claim-national-defence/

Todd Harrison, ”Space Trends in 2024“, American Enterprise Institute, January 13, 2025, https://www.aei.org/op-eds/space-trends-in-2024/

NASA, ”Commercial Crew Program Essentials”, accessed November 17, 2025, https://www.nasa.gov/humans-in-space/commercial-space/commercial-crew-program/commercial-crew-program-essentials/

Spc. Xavier Chavez, ”Army Reserve Soldiers use SpaceX’s Starshield technology for faster, more convenient military communication“, Army Reserve, August 11, 2025, https://www.usar.army.mil/News/News-Display/Article/4271149/army-reserve-soldiers-use-spacexs-starshield-technology-for-faster-more-conveni/

Bryce Tech, Start-Up Space 2025, 2025, https://brycetech.com/reports/report-documents/start_up_space_2025/BryceTech_Start_Up_Space_2025.pdf

Canadian Space Agency, ”Contracts Awarded under the STDP“, Government of Canada, Accessed November 17, 2025, https://www.asc-csa.gc.ca/eng/funding-programs/programs/stdp/contracts-awarded.asp

Andrew Jones, ”China’s Guowang launch raises questions about satellite purpose and transparency”, Space News, January 7, 2025, https://spacenews.com/chinas-guowang-launch-raises-questions-about-satellite-purpose-and-transparency/

Hema Nadarajah, ”China: A Global Power’s Celestial Ambitions”, Asia Pacific Foundation of Canada, May 9, 2024, https://www.asiapacific.ca/publication/china-global-powers-celestial-ambitions

Shoko Tamaki, ”Japan to create a 1-trillion-yen fund to bolster space business”, The Asahi Shimbun, April 21, 2024, https://www.asahi.com/ajw/articles/15240338

Melusine Lebret & James Black, ”Germany’s €35 Billion Bet on Military Space Capability”, RAND, November 13, 2025, https://www.rand.org/pubs/commentary/2025/11/germanys-35-billion-bet-on-military-space-capability.html

Europlanet, ”Agreement at ESA Ministerial Council”, November 24, 2022, https://www.europlanet.org/agreement-at-esa-ministerial-council/

Germany Trade & Invest, ”Markets Germany Magazine 2/25 | Aerospace: Race to Space”, June 21, 2025, https://www.gtai.de/en/invest/service/publications/markets-germany/race-to-space-1915738

Traxn, ”Space Tech Sector in Germany”, November 5, 2025, https://tracxn.com/d/explore/space-tech-startups-in-germany/__qoq2Is1HhSTm7xvAUB2WKVh_XNPWilm4vA0ZvDeC5w4

Lena Stache, ”Ready for Lift-Off: The Booming SpaceTech Industry in Germany and Europe”, DeepTech & Climate Fonds, February 6, 2024, https://dtcf.de/ready-for-lift-off-the-booming-spacetech-industry-in-germany-and-europe/

Timo Stellpflug, ” The EU Space Act – Europe’s Law For Space”, mondaq, August 19, 2025, https://www.mondaq.com/germany/terrorism-homeland-security-defence/1667794/the-eu-space-act-europes-law-for-space

Timo Stellpflug, ” The EU Space Act – Europe’s Law For Space”, mondaq, August 19, 2025, https://www.mondaq.com/germany/terrorism-homeland-security-defence/1667794/the-eu-space-act-europes-law-for-space

UK Space Agency, “UK Space Agency Catalysed £2.2 Billion Investment in 2024/25,” Gov UK, Updated 18 July 2025, https://space.blog.gov.uk/2025/07/18/uk-space-agency-catalysed-2-2-billion-investment-in-2024-25/; UK Space Agency, ” UK Space Agency Annual Report 2024-2025″, Gov UK, Updated 21 July 2025, https://www.gov.uk/government/publications/uk-space-agency-annual-report-and-accounts-2024-2025/uk-space-agency-annual-report-2024-2025

Hong A-reum, “Nuri rocket launches Korea’s next-generation medium satellite and 12 CubeSats for space science and applications”. Chosun Biz, November 16, 2025, https://biz.chosun.com/en/en-science/2025/11/16/Y3XHULOGEZFBTM7YQJVDT25XLE/

Tae Yeon Eom, ”Espionage, Elevated: North and South Korea’s Growing Military Satellite Competition”, Asia Pacific Foundation of Canada, January 13, 2025, https://www.asiapacific.ca/publication/espionage-elevated-north-and-south-koreas-growing-military

Korean Aerospace Administration (KASA), ”KASA’s 2025 Proposed Budget Set at KRW 964.9 Billion”, August 28, 2024, https://www.kasa.go.kr/prog/bbsArticle/BBSMSTR_000000000041/view.do?bbsId=BBSMSTR_000000000041&nttId=B000000000756Ij2hD1

Tae Yeon Eom, ”Espionage, Elevated: North and South Korea’s Growing Military Satellite Competition”, Asia Pacific Foundation of Canada, January 13, 2025, https://www.asiapacific.ca/publication/espionage-elevated-north-and-south-koreas-growing-military

Hyonhee Shin & Soo-Hyang Choi, ”South Korea says homegrown space rocket put satellites into orbit”, Reuters, May 25, 2023, https://www.reuters.com/technology/space/south-korea-launch-homegrown-space-rocket-thursday-2023-05-25/

Deloitte Access Economics and Space Trailblazer, ”Innovation for growth, Charting the Space and Advanced Aviation Sectors”, Deloitte, April 2025, https://www.mbie.govt.nz/assets/innovation-for-growth-charting-the-space-and-advanced-aviation-sectors.pdf

Satnews, ” Rocket Lab changes ‘Changes in Latitudes, Changes in Attitudes’ launch to Tuesday”, November 3, 2024, https://news.satnews.com/2024/11/03/rocket-lab-changes-changes-in-latitudes-changes-in-attitudes-launch-to-tuesday/

Michelle Starr, ”The world’s first 3D-printed, battery powered rocket engine destined for space”, CNET, April 15, 2015, https://www.cnet.com/science/the-worlds-first-3d-printed-battery-powered-rocket-engine-destined-for-space/

Ministry of Trade, Industry and Fisheries, ” International Space Cooperation”, Government.no, Accessed November 17, 2025, https://www.regjeringen.no/en/topics/business-and-industry/research-and-innovation-for-business/romvirksomhet/norway-and-the-european-space-agency/id518461/

Marius Fagerli, ”Norway’s Port to Space”, TechTour, July 16, 2024, https://techtour.com/news-norways-port-to-space/

Business Norway, ”Defence and space”, Accessed November 17, 2025, https://businessnorway.com/invest-in-norway/industries/defence-and-space

Marius Fagerli, ”Norway’s Port to Space”, TechTour, July 16, 2024, https://techtour.com/news-norways-port-to-space/

Birgitte Annie Hansen, ”Norway and the US Strengthens Space Cooperation in the High North”, High North News, January 21, 2025, https://www.highnorthnews.com/en/norway-and-us-strengthens-space-cooperation-high-north

Marius Fagerli, ”Norway’s Port to Space”, TechTour, July 16, 2024, https://techtour.com/news-norways-port-to-space/

UAE Beta, “The National Space Fund”, 2025, https://u.ae/en/about-the-uae/science-and-technology/key-sectors-in-science-and-technology/space-science-and-technology/the-national-space-fund

Gulf Business, ”UAE leads as Middle East space market reaches $18bn, reveals report”, September 19, 2025, https://gulfbusiness.com/uae-leads-as-middleeast-space-market-hits-18bn/

Space & Defence, “Lack of Budget Funding Signals Australian Government’s Ongoing Disinterest in Space”, May 16, 2024, https://spaceanddefense.io/lack-of-budget-funding-signals-australian-government-ongoing-disinterest-in-space/

Australian Government, ”Modern Manufacturing Initiative and National Manufacturing Priorities announced”, October 1, 2020, https://www.industry.gov.au/news/modern-manufacturing-initiative-and-national-manufacturing-priorities-announced

ADM, MMI funding to support Australian space manufacturing, June 16, 2023, https://www.australiandefence.com.au/defence/cyber-space/mmi-funding-to-support-australian-space-manufacturing

Alex MacDonald & Chris Hadfield, ” Canada faces a once-in-a-generation opportunity to stake a serious claim in space”, The Globe and Mail, September 26, 2025, https://www.theglobeandmail.com/opinion/article-canada-space-claim-national-defence/

Novaspace, ”Enabling Commercialization of Space in Canada”, May 2025, https://nova.space/wp-content/uploads/2025/05/Whitepaper-Final-Space-Canada.pdf

Bryce Tech, ”Start-Up Space 2025: Private Sector Space Investment Activity in 2024”, 2025, 4, https://brycetech.com/reports/report-documents/start_up_space_2025/BryceTech_Start_Up_Space_2025.pdf

Scott Atkins, ”Financing the space economy: Scaling up private investment to transform industries and help solve global challenges”, Norton Rose Fulbright, July 2025, https://www.nortonrosefulbright.com/en-mh/knowledge/publications/b8a10e07/financing-the-space-economy#10

Strategy and PWC, ”Expanding Frontiers”, Accessed November 17, 2025, https://www.strategyand.pwc.com/uk/en/insights/expanding-frontiers-down-to-earth-guide-to-investing-in-space.html

Strategy and PWC, ”Expanding Frontiers”, Accessed November 17, 2025, https://www.strategyand.pwc.com/uk/en/insights/expanding-frontiers-down-to-earth-guide-to-investing-in-space.html

McKinsey & Company, ”Space: The $1.8 trillion opportunity for global economic growth”, April 8, 2024, https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/space-the-1-point-8-trillion-dollar-opportunity-for-global-economic-growth

Government of Canada, ”Budget 2025”, November 2025, 186, https://budget.canada.ca/2025/report-rapport/pdf/budget-2025.pdf

Edouard Mathieu, Pablo Rosado, and Max Roser, “Space Exploration and Satellites”, OurWorldinData.org., Accessed November 17, 2025, https://ourworldindata.org/space-exploration-satellites

Caleb Henry, ”Geostationary satellite orders bouncing back”, Space News, February 21, 2020, http://spacenews.com/geostationary-satellite-orders-bouncing-back/

Douglas Gorman, “K2 Space Nabs $15M from NewSpace Capital”, Payload, September 15, 2025, https://payloadspace.com/k2-space-nabs-15m-from-newspace-capital/

SatCatalog, ”CubeSat Launch Costs”, December 12, 2022, https://www.satcatalog.com/insights/cubesat-launch-costs/

Tensor Tech, ” Cube Satellites: Unlocking Space for Everyone”, September 18, 2025, https://tensortech.co/updates/detail/Cube_Satellites_Unlocking_Space_for_Everyone

Lauren Cho, “Averting ‘Day Zero’: Preventing a Space Arms Race”, Next Generation Nuclear Network, Centre for Strategic and International Studies,

August 6, 2025, https://nuclearnetwork.csis.org/averting-day-zero-preventing-a-space-arms-race/

Euronews, ” NATO raises alarm as Russia finalises nuclear-powered Burevestnik missile”, Yahoo News, November 16, 2025, https://ca.news.yahoo.com/nato-alarmed-putins-petrel-missile-072146137.html

McKinsey & Company, ”McKinsey on the Maritime Industry”, November 2024, https://www.mckinsey.com/~/media/mckinsey/industries/aerospace%20and%20defense/our%20insights/mckinsey%20on%20the%20maritime%20industry%20november%202024/mckinsey-on-the-maritime-industry-november-2024.pdf

Rob Jackson, ”How Satellites are Protecting Maritime Shipping Vessels”, IT Supply Chain, January 9, 2025, https://itsupplychain.com/how-satellites-are-protecting-maritime-shipping-vessels/

Alan O’Connor et al., ”Economic Benefits of the Global Positioning System (GPS)”, RTI International, 2019, ES-4, https://www.rti.org/sites/default/files/gps_finalreport.pdf

European Union Agency for the Space Programme (EUSPA), EUSPA EO and GNSS Market Report, 2024, https://www.euspa.europa.eu/sites/default/files/euspa_market_report_2024.pdf

Matt Swayne, ” China Establishes Quantum-Secure Communication Links With South Africa”, March 14, Quantum Insider, 2025, https://thequantuminsider.com/2025/03/14/china-established-quantum-secure-communication-links-with-south-africa/

GetNews, ” Smart Cities Market Growing Trends, Future Outlook, Advance Technology, Global Size, Share And Forecast – 2030”, Globe and Mail, May 20, 2025, https://www.theglobeandmail.com/investing/markets/markets-news/GetNews/32497300/smart-cities-market-growing-trends-future-outlook-advance-technology-global-size-share-and-forecast-2030/

Mordor Intelligence, ”Smart Cities Market Size – Industry Report On Share, Growth Trends & Forecasts Analysis (2025 – 2030)”, Accessed November 18, 2025, https://www.mordorintelligence.com/industry-reports/smart-cities-market

Andy Greenberg & Matt Burgess, ”Satellites Are Leaking the World’s Secrets: Calls, Texts, Military and Corporate Data”, Wired, October 13, 2025, https://www.wired.com/story/satellites-are-leaking-the-worlds-secrets-calls-texts-military-and-corporate-data/

Department of Finance Canada, Budget 2025: Build, Protect, and Empower Canada (Ottawa: Department of Finance Canada, 2025), https://budget.canada.ca/2025/home-accueil-en.html.

National Quantum Strategy, ” National Quantum Strategy roadmap: Quantum computing”, Government of Canada, February 17, 2025, https://ised-isde.canada.ca/site/national-quantum-strategy/en/national-quantum-strategy-roadmap-quantum-computing

GlobeNewswire, ” Telesat invests US$5 million in Farcast to develop fully integrated User Terminals for Telesat Lightspeed satellite network”, November 4, 2025, https://financialpost.com/globe-newswire/telesat-invests-us5-million-in-farcast-to-develop-fully-integrated-user-terminals-for-telesat-lightspeed-satellite-network

Emma Frederickson, ” China Is Building a Solar Station in Space That Could Generate Practically Endless Power”, Popular Mechanics, March 12, 2025, https://www.popularmechanics.com/science/energy/a64147503/china-solar-station-space/

NASA, ”Nuclear Propulsion Could Help Get Humans to Mars Faster”, February 12, 2001, https://www.nasa.gov/solar-system/nuclear-propulsion-could-help-get-humans-to-mars-faster/

Hiroki Akagi et al., ”Innovative Launch Opportunitunity for Small Satellite by Using One and Only Function on Kibo/ISS”, SpaceOps Conferences, June 1 2018, https://arc.aiaa.org/doi/pdf/10.2514/6.2018-2692

Madison McLauchlan, ”Nord Quantique, Xanadu, Photonic advance to next phase of DARPA quantum race”, Betakit, November 6, 2025, https://betakit.com/nord-quantique-xanadu-photonic-advance-to-next-phase-of-darpa-quantum-race/

Madison McLauchlan, ”Nord Quantique, Xanadu, Photonic advance to next phase of DARPA quantum race”, Betakit, November 6, 2025, https://betakit.com/nord-quantique-xanadu-photonic-advance-to-next-phase-of-darpa-quantum-race/

Canadian Climate Institute, ”FACT SHEET: Climate change and wildfires”, July 23, 2024, https://climateinstitute.ca/news/fact-sheet-wildfires/

https://www.ibc.ca/news-insights/news/severe-weather-in-2023-caused-over-3-1-billion-in-insured-damage

Novaspace, ”Commercial Earth Observation Market Surpasses $8 Billion by 2033”, November 27, 2024, https://nova.space/press-release/commercial-earth-observation-market-surpasses-8-billion-by-2033/

One Ocean Science, “Our Action for Climate Change” (Landing Page), Accessed November 18, 2025, https://oneoceanscience.com/topic/satellite-altimetry-and-sea-level-rise/

CNES, ”Space Climate Observatory”, Accessed November 18, 2025, https://cnes.fr/sites/default/files/2024-08/cnesmag-special-issue-space-climate-observatory-en.pdf

Canadian Space Agency, ”Canada’s Strategy for Satellite Earth Observation”, February 2022, https://www.asc-csa.gc.ca/pdf/eng/publications/canada-strategy-for-satellite-earth-observation-v2.pdf

Canadian Space Agency, ” RADARSAT+: over $1 billion for the future of satellite Earth observation”, Government of Canada, October 18, 2023, https://www.asc-csa.gc.ca/eng/news/articles/2023/2023-10-18-radarsat-plus-over-1-billion-dollars-for-the-future-satellite-earth-observation.asp

Novaspace, ”Enabling Commercialization of Space in Canada”, May 2025, https://nova.space/wp-content/uploads/2025/05/Whitepaper-Final-Space-Canada.pdf

Ibid, Budget 2025.

Canadian Space Agency, ”State of the Canadian Space Sector Report 2023“, 2023, https://www.asc-csa.gc.ca/eng/publications/2023-state-canadian-space-sector.asp

World Economic Forum and McKinsey & Company, ”Space: The $1.8 Trillion Opportunity for Global Economic Growth”, World Economic Forum, April 8 2024, https://www3.weforum.org/docs/WEF_Space_2024.pdf.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.