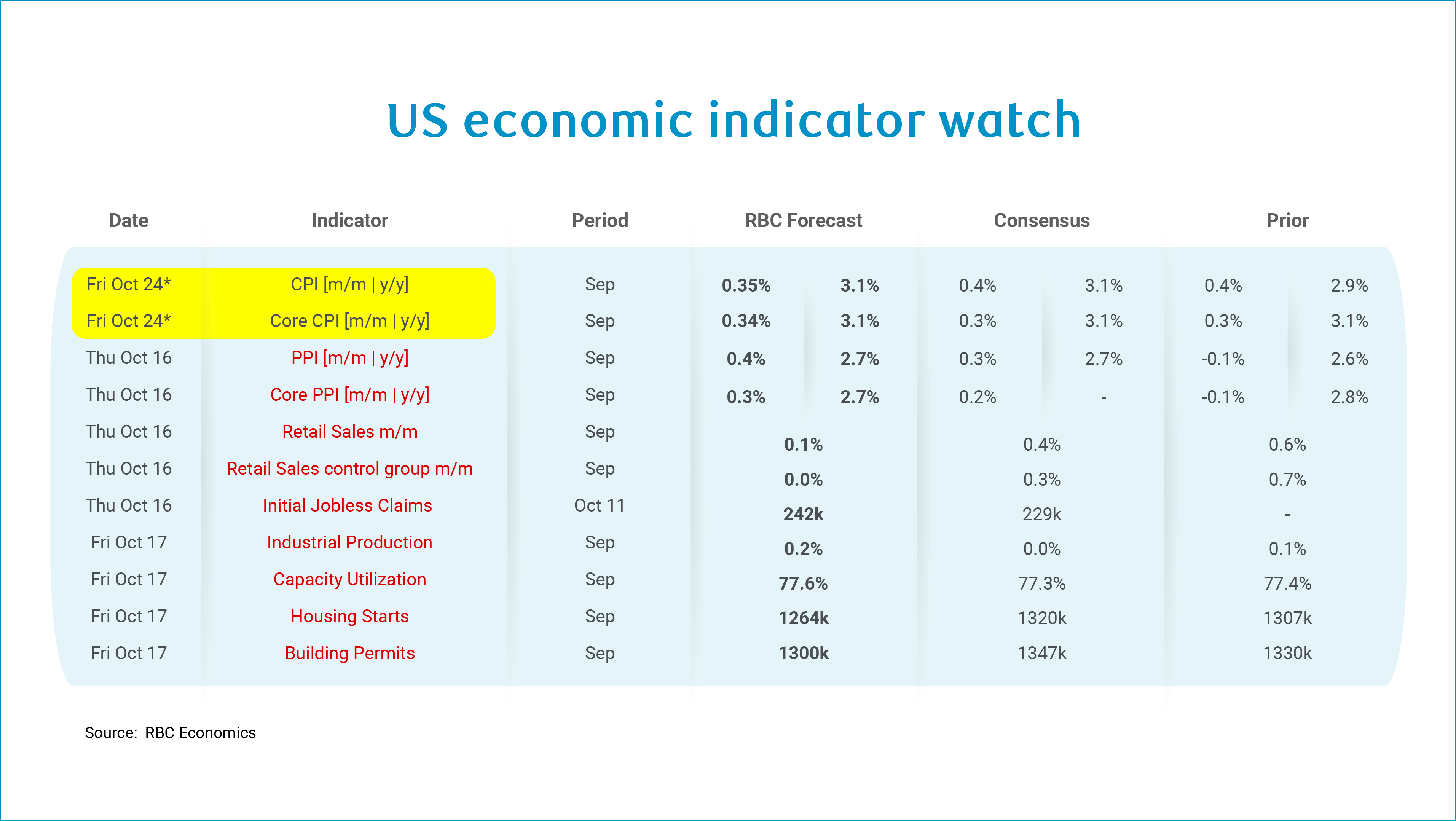

The continuation of the US government shutdown means another week of minimal data in what otherwise would have been a critical week for data releases. We continue to publish our usual forecast table, highlighting in red the government data that is unlikely to be published. However, a press release from BLS indicates that CPI will be released on Friday, Oct 24 at 8:30am ET. But don’t get your hopes up for additional data – the release specifies that this relates to the annual COLA calculation need for social security 2026 payments. No other data reports will be released by BLS.

The government shutdown and delayed data reports come at a critical juncture for the Fed. While the September CPI data will presumably provide an accurate snapshot of inflation, the ongoing shutdown will create ripple effects for future months of data due. The CPI Survey, which is used to collect data for the BLS inflation report, collects 100,000 prices for commodities and services each month. According to the BLS, “Approximately two-thirds of price collection in the CPI is done by personal visits of CPI data collectors to brick-and-mortar stores,” with the remainder of the data collected over the phone and online. We are currently in the collection period for the October data, but with BLS employees unable to work, there is no data being collected. This means that the share of data that is imputed is likely to be much higher – calling into question the reliability of the October CPI data. This comes at a time when the share of BLS prices imputed using different-cell imputation, which is when the BLS cannot estimate a missing price from using price changes for similar items in the same geographic area. Instead, they must use price changes for similar items from another geographic area. In August, 36% of BLS imputations were different-cell, compared to 9% one year ago.

Surely this will call into question the accuracy of inflation metrics for October (scheduled for release in November) that will also impact the relative change for data collected for the November report (scheduled for release in December). This comes at the exact time that we expect tariff pressures to begin to manifest . All of this will make a data-dependent Fed’s job increasingly challenging for the remainder of 2025. It will jeopardize the Fed’s ability to get a clear line of sight into how tariffs are impacting consumer prices at a time when both sides of the Fed’s mandate are increasingly in tension.

For now, we will focus on the September report, where we expect to see core inflation tick up by 0.3% m/m. Core goods pressures have started to heat up, marking the beginning of a delayed tariff passthrough. Concerningly, the breadth of inflationary pressures has widened –45% of CPI basket items are now reporting price growth at or above 3%, compared to roughly two-thirds pre-pandemic.

Outside of CPI, we will monitor announcements for delayed releases of the following prints:

-

PPI likely rose +0.4% m/m in September with continued pressures expected from trade-exposed sectors like transportation and warehousing as well as rising food costs.

-

Growth in retail sales spending was likely on the tepid side in September (+0.1%) after three consecutive months of outperformance. To-date, we have yet to see tariffs erode purchasing power – we expect to see a more meaningful pullback starting later this year.

-

We expect US jobless claims will rise to 242k for the week ending October 11th after state-level filings point to total US claims rising by 235k the week prior.

-

There is some ambiguity surrounding whether the Federal Reserve will release Industrial Production (and concurrently Capacity Utilization) data next week, as crucial government inputs required for the metric are unavailable. Once the data is released, we expect it will show Industrial Production ticked up slightly (+0.2% m/m) in September.

-

Housing data may well be the only data we get next week, landing on Friday. We expect to see Building permits come in slightly weaker in September. Housing Starts will likely come later (and also lower), since this data comes from the Census Bureau which is impacted by the shutdown disruption.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.