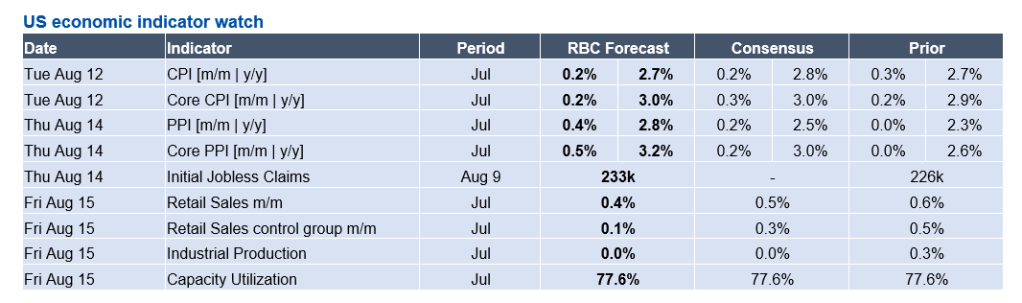

After last week’s substantial NFP revisions , all eyes will be on Tuesday’s CPI print as market participants and economists assess the likelihood of a September rate cut – now back on the table as labor market weakness is more pronounced than previously thought. Still, the Fed remains focused on inflation and should next week’s print come in hotter than expected, it could derail the Fed’s ability to cut interest rates at the September meeting. While we do expect to see an uptick in both core and headline inflation, we do not anticipate that next week’s data will fully capture the impact of tariffs on consumer prices. Our forecast calls for a 0.2% m/m rise in core inflation in July, pushing the y/y pace to 3.0%. We expect to see continued upward pressure from core goods – we are looking for a 0.4% m/m rise. The increase will likely be seen in trade-exposed sectors like motor vehicle parts and equipment, apparel, and recreation commodities (i.e., toys) but July’s data will be far from capturing the full extent of tariff impacts. We do expect to see more pronounced price pressures emerge in PPI before we see material passthrough to consumer prices in the coming months. We forecast next week’s core PPI will post a notable 0.5% uptick, with pressure heating up in finished consumer goods alongside trade services and transportation and warehousing. With a more modest 0.4% m/m rise, we expect headline PPI inflation will be helped by cooling energy prices, but core pressures should be the focus as tariff pressures permeate domestic supply chains.

Retail sales will culminate the week, and we are anticipating an underwhelming print outside of auto sales – we forecast the retail sales control group (which excludes autos, building materials, gasoline, and food services) is expected to post a muted 0.1% month-over-month uptick. Still, the consumer continues to pull forward auto purchases – Autodata sales showed a 7.6% m/m spike, which we view as the last effort of buyers to avoid tariffs. But we expect a broader pullback on spending will continue and will translate to declines in most discretionary categories for July. One sector that continues to surprise to the upside is online shopping, which is seeing growth above 8% y/y. Interestingly, however, that pace is below the median rate seen in online sales over the past 25 years, suggesting the sector is not immune from a pullback.

Next week, we also have industrial production data landing and outside of domestic producers for autos, other industries appear to be lagging. While ISM manufacturing improved this month it remained in contraction territory and that was reflected in the index of manufacturing hours worked, which was flat following 3 months of declines. With this in mind, we have industrial production and capacity utilization holding steady at month-ago levels, as activity continues to be hampered by tariff policy and decision paralysis faced by businesses.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.