After multiple data surprises landed over the past few weeks – first massive NFP revisions and then a significant upside surprise to PPI – the Fed has a lot of data points to ponder ahead of the September meeting. Still, the news over the past few weeks is consistent with our base case – as we wrote in a note published this week, we are continuing to see evidence that our ‘stagflation lite’ scenario is taking hold. As we have witnessed, inflation will materialize first in producer prices and then flow through to consumer prices with a lag – and this week’s data has unraveled some of the expectation of a September cut, despite the weakness in the labor market, contributing to our view that the Fed will have to wait until December to lower interest rates. The Fed will have some reprieve this upcoming week, as we will be largely focused on housing data – indicators which reflect downstream effects of Fed policy rather than endogenous variables weighing on FOMC decision-makers’ minds.

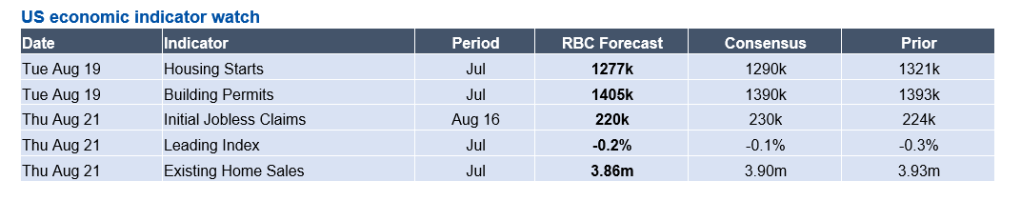

The US housing backdrop has been largely stagnant this year, as housing remains collateral damage of a higher rate environment with limited movement at the long-end of the curve. We continue to expect limited upside in the sector – we forecast another weak housing starts print – as single-family permit issuance was exceptionally weak in June and multifamily unit permits bottomed out in May (multifamily permits flow through to housing starts with a longer lag). This month, however, we expect to see a slight uptick in building permits – still to exceptionally low levels – as mortgage loan volumes have ticked up on a year-over-year basis. On Thursday, existing home sales will likely also disappoint on the back of weaker pending sales volumes in June and soaring home cancellations (home cancellation data from Redfin indicated the highest cancellation rate in June since at least 2017). Outside of housing, we will be keeping an eye on jobless claims for any indications of further weakness showing up ahead of the nonfarm payrolls print landing at the beginning of September. We expect initial jobless claims will likely hold at similar levels as one-month ago (our forecast calls for 220k initial claims for the week of August 16th). While we will watch closely for an upward trend in continued claims, that number did fall this week, providing some relief. If we do see a deterioration, we expect it will be in trade-exposed sectors impacted by tariffs, as these sectors accounted for most of the revisions (outside of local education services) in the updated May and June data.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.