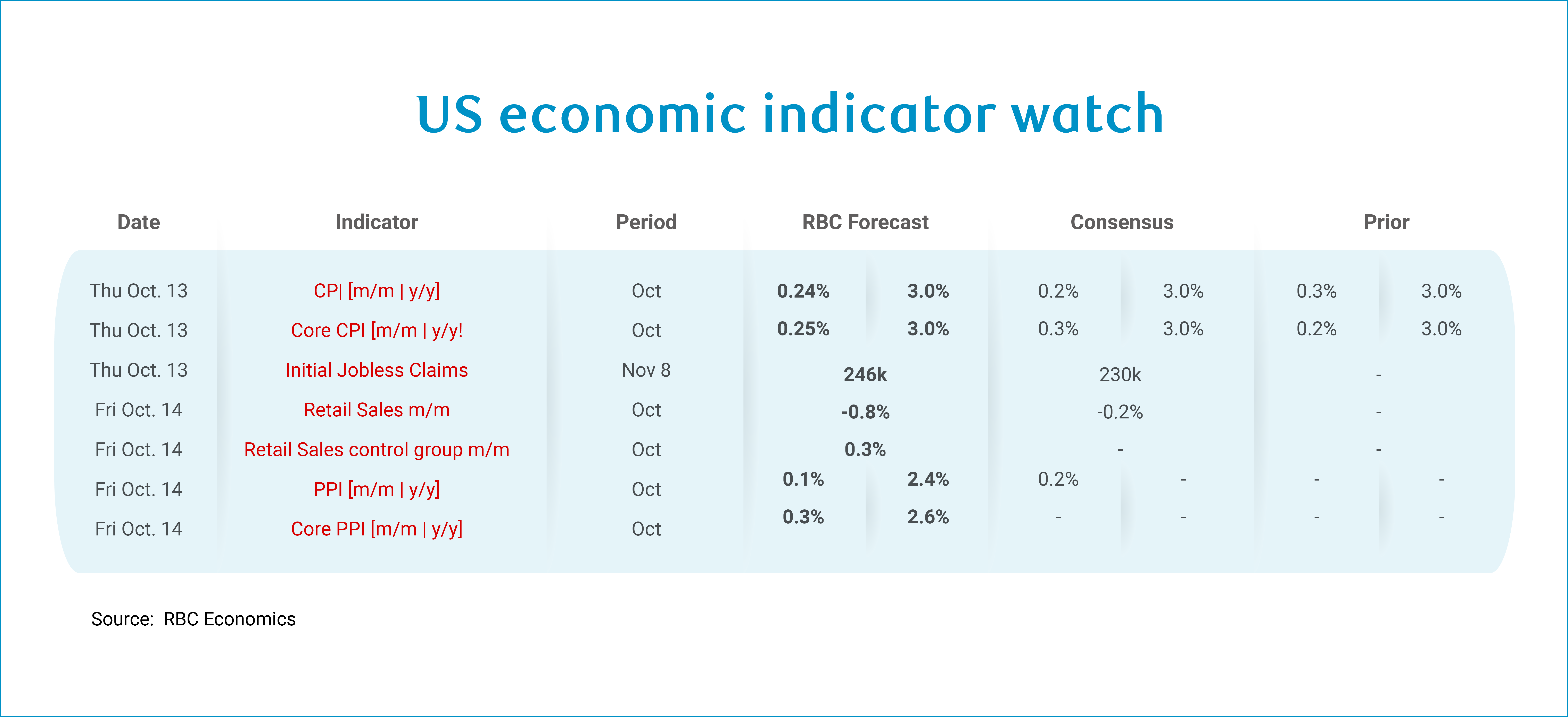

We are now officially experiencing the longest US government shutdown in history as of Wednesday, November 5th when the shutdown entered its 36th day. As the shutdown continues, we will not be getting any new government data next week. We have still opted to publish forecasts for the releases that we will be missing (highlighted below in red), but as we begin to miss consecutive months of data (as is the case for PPI and retail sales), these are lower conviction forecasts based on our assumptions for prior months (for which we did not get data).

The Fed would have been most closely watching CPI data this coming week and this is an indicator where visibility will most certainly be foggy in the months to come. Once the government shutdown is over, data releases will be published with a lag. Since roughly two-thirds of price data feeding into the CPI measure is collected by personal visits by data collectors to bricks and mortar stores (and since we know that these workers are furloughed and in-person data collection did not happen in October), there is a chance that the October release is either canceled altogether or that the majority of October data is imputed – which jeopardizes the quality of the report. As the shutdown stretches into November, we are becoming increasingly concerned that we could see this for a second consecutive month. There is a real possibility that the Fed goes into the December 10th meeting with limited visibility on two months of inflation data – which we expect increases the likelihood of a December pause. Chair Powell himself has acknowledged that a December pause is not off the table, stating, “What do you do if you are driving in the fog? You slow down!”

We continue to forecast mounting core goods pressures alongside core services in the near-term. Still, in October we expect to see a modest uptick in core of +0.25% m/m. We have witnessed early signs of tariff pressures building in trade-exposed sectors including apparel, home furnishings, and motor vehicle parts and equipment to-date. Still, prices for other trade-exposed sectors, new vehicles, for example, have been largely flat so far. When we account for tariffs, we think that the inventory buildup coupled with the desire of companies to maintain market share heading into the holidays will mean that we will not see a material spike in prices until the new year.

While the September data posted a downside to both core and headline inflation, this was predominantly driven by weak growth in the owners’ equivalent of rent (CPI) component of the CPI basket. Home price data from the National Association of Realtors – where median sale prices typically lead OER by 22 months – suggests that this was likely a one-off and is not expected to continue into October. We expect to continue to see pressures mount in core goods and services in tandem. Headline will be helped this month by a pullback in gasoline prices.

Outside of CPI, here are the other indicators that we are missing out on:

-

Core PPI is expected to tick up +0.3% m/m which would lower the headline number to +2.6% y/y. A pullback in energy prices will help this month. We expect transportation and warehousing prices will continue to weigh on the overall index, but seasonal factors will help for this sector in October.

-

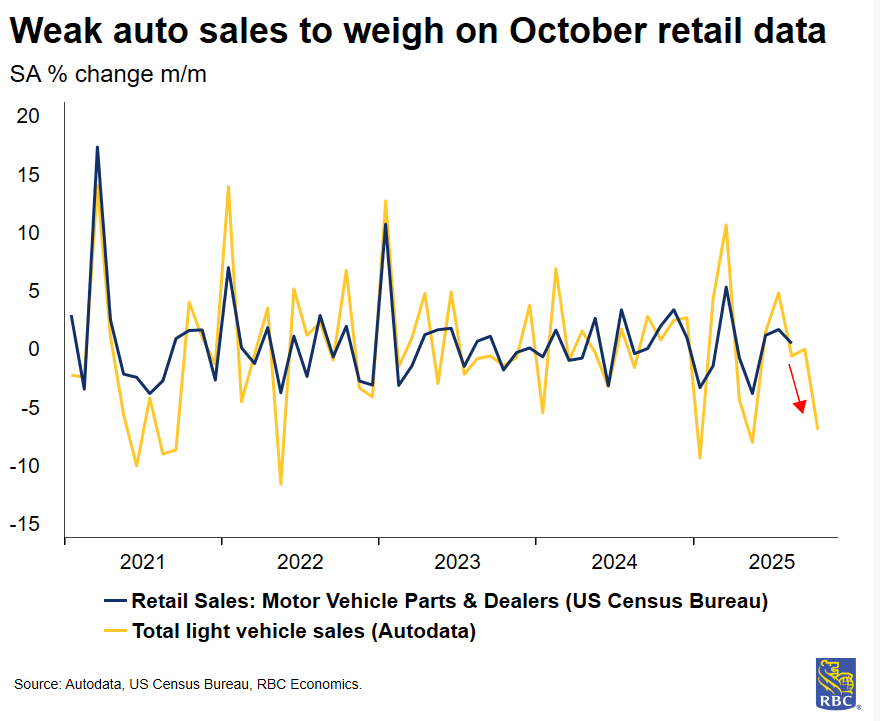

Retail sales activity likely slowed in the month of October – we expect to see a pullback in the overall metric (-0.8% m/m) with a +0.3% uptick in the control group (which excludes autos, gasoline, building materials and restaurants) rendering real retail sales (control group) flat after netting out inflation. Both auto sales (Ward’s auto sales fell -6.5% m/m in October) and gasoline sales are expected to weigh on retail activity this month and the prolonged impact of the government shutdown will not help. Federal employees to-date have lost ~$27 billion in wages that are expected to be back paid at a later date – by our calculation, this will likely shave a few tenths off of real GDP in Q4 but could weight more meaningfully on activity should the shutdown last through the month.

We will be getting state-level jobless claims data next week, and this can be aggregated and seasonally adjusted to arrive at total US initial claims. We expect to see initial jobless claims likely tick up to 246k the week of November 8th. Still, in level terms, jobless claims remain low. State claims data illustrated that private sector jobless claims did not worsen in October. This is aligned with what we observed in this week’s ADP and ISM Manufacturing and Services Employment data – a labor market that has stabilized (but has not yet improved) amidst a low-hiring low-firing dynamic. While the Challenger Report for October spurred dramatic headlines, this print does not change our current assessment of the US labor market. In level terms, 153k layoff announcements is not a drastic number. We exceeded that in both February (172k) and March (275k) of this year. Even if the 153k job cut announcements materialized all at once (which is highly unlikely) – this would only nudge the unemployment rate up by one-tenth to 4.4%. It is more likely that layoffs would be spread out over the coming months. Structural trends (aging demographics) will continue to be a factor, and attrition/retirements may in fact alleviate the need for further layoffs – in fact, some of these layoffs may show up in the data as “early retirements” and may not count in the unemployment data. Outside of the impact of the shutdown, we do expect that payroll growth is hovering around breakeven level. If we do see the unemployment rate drift up to 4.5% by year end, that remains consistent with our forecast – sub-trend growth with above target inflation.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

Imri Haggin is an economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.