The Bottom Line

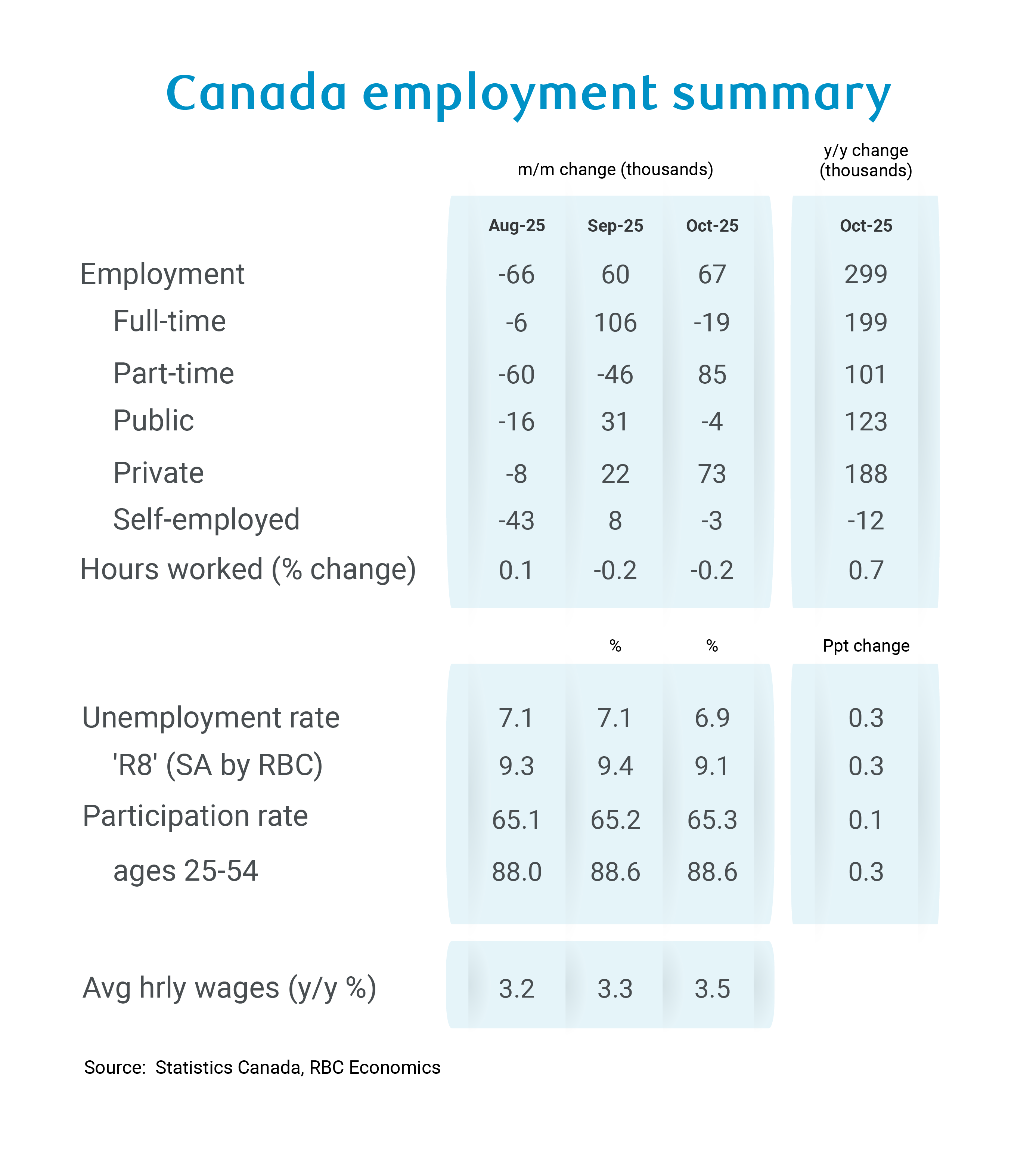

Canadian labour markets were expected to show signs of stabilization in October after deteriorating since the spring, but the data reported this morning (67k employment gain, decline in the unemployment rate to 6.9%) erred more towards outright improvement.

The data is notoriously volatile, arguing against reading too much into any one report, but details were also broadly positive with job growth concentrated in the private sector, improvement in the most trade-exposed manufacturing and transportation sectors, wage growth accelerating, and the labour force participation rate rising.

U.S. tariff policy remains a significant risk, and labour markets are still softer than they were—the unemployment rate is still up 0.3 percentage points from a year ago in October.

But the Bank of Canada was relatively forceful after cutting the overnight rate to the low end of the neutral range in October that additional reductions were unlikely unless economic growth and/or inflation data were to surprise significantly on the downside.

The labour market data for October checks neither of those boxes with employment surprising on the upside and wage growth accelerating. The data is consistent with our own base case projections that the BoC will not cut interest rates further.

The October details

-

The 67k jump in the (notoriously volatile) employment count added to a 60k gain in September.

-

The latest two-month increase has now retraced the cumulative 106k drop over July and August when tariffs imposed by the U.S. administration in the spring appeared to be having a larger negative impact on hiring in trade exposed manufacturing and transportation sectors.

-

Details underlying the October headline employment growth numbers were broadly positive.

-

The unemployment rate fell 0.2 percentage points, to 6.9%— still up 0.3 percentage points from a year ago, but back down to June/July levels. The year-over-year increase was actually the smallest annual rise since August 2023.

-

Regionally the decline in the October unemployment rate was broadly-based—B.C. and Nova Scotia’s rates edged higher, and Alberta’s held steady, but all other provinces posted declines.

-

The employment increase was driven by a 73k rise in private sector jobs with notable growth in the trade-exposed manufacturing (+9k) and transportation and warehousing (+30k) sectors, as well as a 41k jump in retail/wholesale employment.

-

Gains were concentrated in part-time work, but a 19k drop in full-time jobs followed a 106k surge in September. Overall, Canadian employment was up 299k from a year ago in October, and two-thirds of that increase (199k) is in full-time jobs.

-

Actual hours worked did decline for a second consecutive month in October, but due to temporary labour disputes, including a teacher’s strike/lock-out in Alberta.

-

Wage growth unexpectedly accelerated, to 4.0% year-over-year for permanent employees (from 3.6% in September) and to 3.5% for all employees (from 3.3% in September).

-

The labour force participation rate edged higher. The layoff rate remains low (most of the rise in the unemployment rate from a year ago is still concentrated in longer search times for new labour market entrants, particularly youth. And the job finding rate (the share of unemployed people in September that found work in October) reportedly rose to 19.8% in October — up from 16.5% a year ago.

-

Strong employment growth was despite sharply lower population growth that is limiting labour supply. The labour force grew by just 17k in October despite a tick higher in the labour force participation rate. Slower population growth broadly means that less employment gains are needed to push the unemployment rate lower.

About the Author

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.