The Bottom Line:

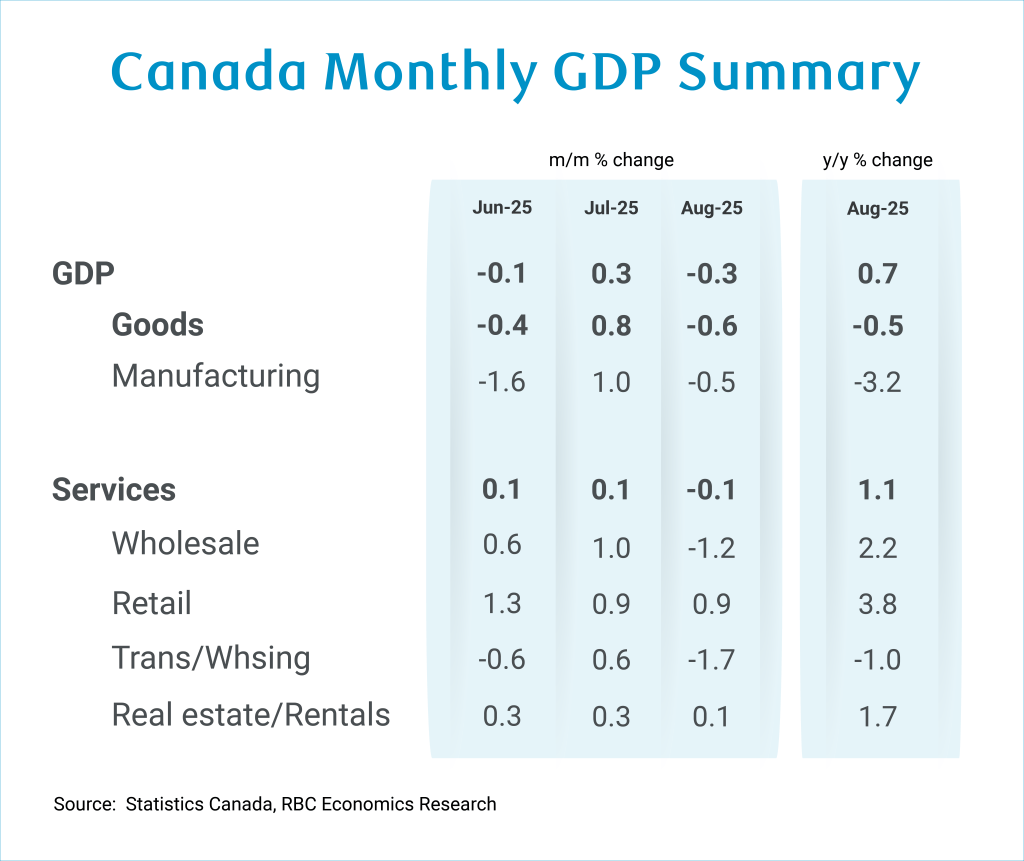

Canadian GDP contracted by 0.3% in August, falling short of both our expectations and Statistics Canada’s advance estimate of a flat reading. But an upward revision to July’s GDP estimate (now +0.3% vs. +0.2% previously) and the preliminary estimate that output rose 0.1% in September left the preliminary estimate of Q3 GDP growth at an annualized +0.4%, just slightly below our (and the Bank of Canada’s) +0.5% base case assumption.

While that represents a modest rebound from the 1.6% (annualized) GDP decline in Q2, much of the downside surprise in August output reflected temporary factors not related to ongoing tariff disruptions. Manufacturing output edged lower to partially retrace a 1% increase in July, but a sharp pullback in air transportation was tied to a strike by airline staff in August, and electricity output fell sharply as drought conditions weighed on hydroelectric power generation.

We continue to expect that broader growth in overall GDP will remain slow but positive in the near-term. Most Canadian exports to the U.S. remain duty free under the exemption for CUSMA compliant trade, but tariffs in targeted sectors of the economy are still high and persistent uncertainty continues to restrain business investment and hiring. We expect growth to improve in 2026 in part supported by increased government deficit spending.

The Details:

-

Canadian GDP growth declined by 0.3% in August, lower than both Statistics Canada’s advance estimate and our own expectation. The decline was broad-based in the monthly report, observed in both goods-producing and services-providing sectors. However, on a quarterly basis, Q3 GDP is still tracking for a small 0.4% (annualized rate) rebound following a 1.6% contraction in Q2.

-

In the goods-producing industries, much of the weakness was driven by contractions in the utility industry (-2.3%). Statistics Canada attributed this to worsening drought conditions weighing on hydroelectricity generation. Mining excluding oil and gas, as well as supporting activities for mining, also posted declines in August.

-

Trade-exposed sectors, such as manufacturing, showed a 0.5% dip in output growth, following the 1% rise in the prior month. Transportation and warehousing industries contracted by 1.7%, but that was mainly due to temporary disruptions from the flight attendants’ strike, which did not extend into September.

-

Meanwhile, other service-producing industries were mixed in August. Wholesale activity was quite weak during that month, but early indicators for September showed flat wholesale sales, which means the notable decline in August likely will not repeat.

-

The retail sector posted a solid rebound in August, up by 1% and erasing the loss from the prior month. However, preliminary estimates for September point to a 0.7% decline in retail sales, suggesting the strength in August might be short-lived.

-

Statistics Canada’s early estimate for September indicates GDP growth of 0.1%, driven by increases in finance and insurance, mining, quarrying, and oil and gas extraction, and manufacturing that were partially offset by decreases in wholesale trade and retail trade. These early estimates are highly revision-prone, but advance manufacturing sales posted a sizable 2.8% increase in September and employment rose in the monthly labour force survey data.

About the Author

Abbey Xu is an economist at RBC. She is a member of the macroeconomic analysis group, focusing on macroeconomic forecasting models and providing timely analysis and updates on economic trends.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.