Highlights:

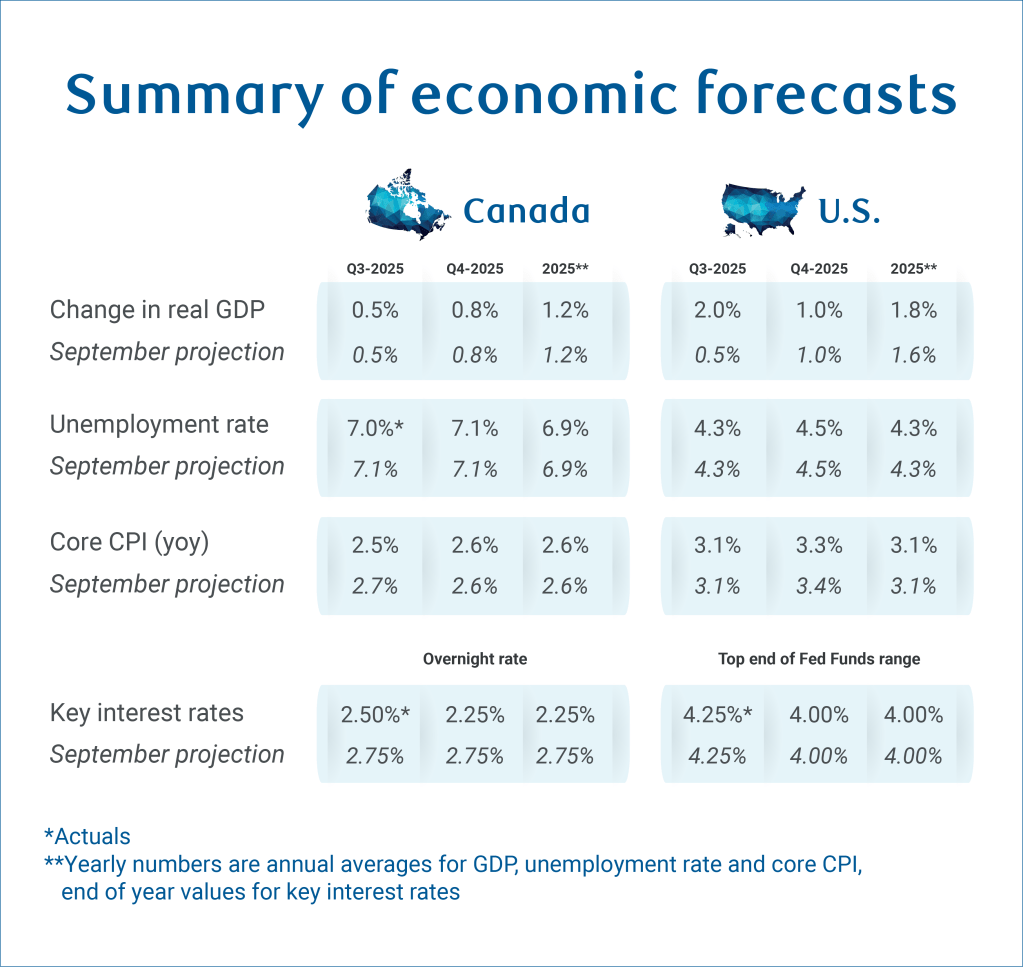

We continue to expect slow growth in Canada. U.S. Section 232 tariffs are expanding, but most Canadian exports to the United States remain duty free under the CUSMA exemption.

Tracking the U.S. economy has become more difficult with the government shutdown curtailing data releases. Available data shows U.S. gross domestic product growth to be more resilient than we expected in Q3, but labour market data remains consistent with a gradual rise in the unemployment rate.

We look for the U.S. Federal Reserve to keep gradually reducing the fed funds target range (including a cut in October), but with 50 basis points fewer reductions in 2026 than previously expected.

For the Bank of Canada, we expect one more 25 bps interest rate cut this year while fiscal policy takes the lead in supporting sectors impacted by trade disruptions.

Issue in focus:

U.S. duties on Canadian softwood lumber and kitchen cabinets will be in effect from Oct. 14, de minimis imports are suspended, and additional threats loom over pharmaceutical products and medium- and heavy-duty trucks. We examine the sector-by-sector impact of these new and pending U.S. tariffs.

Forecast changes:

U.S. tariff announcements have continued to pile up, including new Section 232 measures on softwood lumber, furniture, and kitchen cabinets. The impact will be substantial for related producers and exporters, but is not significant enough to alter our base-case forecasts for the U.S. and Canada.

New tariff measures on lumber and furniture apply to about 1.5% of Canadian exports, adding 0.2% to the total U.S. average effective tariff rate on imports from Canada. That rate should now be converging closer to 6%, but U.S. tariff revenues collected so far have run well below calculated levels for these reasons.

Nevertheless, targeted sectors will be adversely affected (see more in Issue in Focus below). The U.S. administration’s expanding use of Section 232 is also incrementally driving more Canadian goods outside of the CUSMA exemption that’s shielding the bulk of trade with the U.S.

More specifically:

-

We still look for the Canadian economy to return to modest growth in Q3. GDP is expected to grow an annualized 0.5% as the trade balance stabilizes, household consumption stays strong while residential investment bounces back, offsetting persistently soft business investment.

-

Our Canadian labour market outlook is little changed. Job losses remain largely confined to heavily trade exposed areas. The unemployment rate held at 7.1% in September, in line with our expectations that labour market conditions may be nearing bottom.

-

The BoC is expected to cut rates again in October after clearly signaling its intent to support the economy at September’s meeting. A single 25 bps cut is unlikely to be viewed as sufficient, and economic developments since the last meeting have not improved enough to warrant a hold.

-

The Canadian federal budget update on Nov. 4 is expected to include significantly larger budget deficits (2%- 3% of GDP.) We continue to see upside risks to growth from increased government spending relative to our base case, helping offset still significant downside risks from potential trade disruptions.

-

Preserving the Canada’s CUSMA tariff exemption remains critical for the near-term outlook. While recent rhetoric from both U.S. and Canadian officials turned more constructive, tariff uncertainty still poses significant downside risk.

U.S. government shutdown that began October 1 continues. While the direct economic impact may be modest, the closure prevents key data releases, reducing visibility into the effect of tariff passthrough on the economy and consumer prices at this critical juncture.

GDP growth for Q3 is tracking to the upside of our prior expectations, thanks to resilient consumer spending. Private-sector labour market data released since Oct. 1 has largely reaffirmed the “low hiring, low firing” dynamic seen in the official payroll stats released prior to the shutdown.

Hiring demand as measured by Indeed job openings have continued to decline into early October, but initial jobless claims (not published during the shutdown by the U.S. Department of Labor, but still available from state governments) have averaged ~229k1 over the two weeks since September 20 by our count—little changed from the average 225,000 in the first half of September.

Overall, we continue to expect the impact from trade shocks will keep flowing through the economy as pre-built business inventories slowly deplete, narrowing business margins while inflating consumer prices.

More specifically:

-

We have revised U.S. GDP growth in Q3 higher to 2%. In Q4 and into 2026, we left the slower GDP growth profile unchanged as tariff impact filters through the economy with a lag.

-

The U.S. unemployment rate is still expected to rise to 4.5% by the end of 2025 (from 4.3% latest reported for August), and peak at 4.6% in early 2026.

-

Core inflation in the U.S. is expected to creep up from 3.1% in August to 3.5% in early 2026, while headline stays close to 3% over the same period.

-

We now think the Fed will follow up with an October cut before pausing in December. The lack of data and the lack of surprise in private alternative data mean the Fed’s assessment of the economy is unlikely to have improved drastically since the September meeting.

-

This doesn’t mean policymakers are not worried about inflation. We think the combination of sticky core inflation into 2026 and a (gradual) drift higher in the unemployment rate means further, but limited, interest rate cuts with 50 bps less of a reduction in the fed funds target range by mid next year in our current outlook from a month ago. We see a new Fed fund terminal of 3.25%-3.5%.

2.50%

-25 bps in Sep/25

-25 bps

Oct/25

The BoC restarted its cutting cycle in September after pausing since March. Softening in the labour market, GDP and slowing core inflation were key drivers behind the move, but it also expressed concerns about aggregate demand as unemployment rises and population growth slows. Without a significant pick-up in either labour or inflation data, we expect the BoC will follow with another 25 bps cut in October.

4.00-4.25%

-25 bps in Sep/25

-25 bps

Oct/25

Softer-than-expected employment trends this year prompted the Fed to restart its cutting cycle in September, alongside a broad dovish shift in the dot plot. Meeting minutes revealed still significant concerns about inflation that we expect will ultimately limit the extent of additional rate cuts in 2026. For this year, however, we expect the Fed will follow up with one more cut in October before pausing in December.

4.00%

0 bps in Sep/25

-25 bps

Nov/25

The Bank of England Monetary Policy Committee voted 7-2 in favour of holding the Bank Rate in September. The MPC retained an easing bias as well as ambiguity on the timing and extent of further easing, and voted to reduce the overall QT envelope for the 12-month period starting from October 2025 to £70 billion from £100 billion. We continue to expect one more cut in November and no additional reductions after.

2.00%

0 bps in Sep/25

0 bps

Oct/25

The European Central Bank held its deposit rate at 2% in September. While the Governing Council avoided committing to a future path, President Lagarde highlighted that inflation has reached target with a stable outlook, domestic demand is showing resilience, and growth risks are becoming more balanced. We maintain our forecast for the deposit rate to remain steady at 2%.

3.60%

0 bps in Sep/25

0 bps

Oct/25

The Reserve Bank of Australia held the cash rate at 3.6% in September. Communication leaned hawkish, acknowledging consumer strengthening, a resilient labour market and critically higher-than-expected inflation in August. We retain our outlook for two further 25bps cuts from the RBA in November this year and February 2026, though upside surprises in the Q3 inflation report at the end of October could derail this path.

Issue in focus: Expanding U.S. Section 232 tariffs squeezes Canadian manufacturers

The U.S. administration has been relying more on Section 232 tariffs recently to target imports.

The other set of country-specific IEEPA tariffs imposed on Canada since March are currently under review at the U.S. Supreme Court. These tariffs critically exempt products that complied with CUSMA trade, which accounted for 94% of Canadian exports to the U.S. in 2024.

That exemption, however, does not apply to Section 232 tariffs with the sole exception of auto parts where CUSMA exemptions temporarily apply until administrative challenges are resolved. To-date, these Section 232 tariffs have accounted for the bulk of U.S. duties charged on Canadian exports.

For details on the implications of the announced and looming U.S. Section 232 tariffs:

Softwood lumber

-

Softwood lumber products targeted with new 10% tariffs accounted for 1.3% of Canadian exports to the U.S. in 2024.

-

The latest tariffs apply globally, but disproportionately impact Canada as they stack on top of anti-dumping duties already imposed on lumber producers in August.

-

With 75% of softwood lumber imports coming from Canada in 2024, the U.S. is highly reliant on Canada for these products. Sourcing from alternative markets won’t be easy due to geographical and logistical barriers. American buyers will face higher prices as they absorb the additional costs.

Kitchen cabinets

-

Tariffs of 25% on kitchen cabinets are significant for Canadian manufacturers. About a fifth of Canadian kitchen cabinets were exported in the past.

-

U.S. importers may pivot to other sources. Canada’s share of U.S. imports for these products is smaller (about 7% in 2024). Canada faces a higher tariff rate compared to Europe, which accounted for 8% of U.S. imports in 2024 and will see a new 15% tariff.

-

The broader economic impact is limited since the sector as a whole comprises only 0.3% of Canadian exports to the U.S. in 2024.

Pharmaceutical products and heavy vehicles

-

Tariffs on pharmaceutical products and heavy trucks remain unclear, but threats loom.

-

Pharmaceutical exports to the U.S. made up about 1.3% of Canadian exports in 2024, but the final impact would hinge on whether generic drugs are exempted since they take up a substantial 79% of Canadian drug exports to the U.S. Exemptions could sharply limit damage to this sector.

-

Heavy trucks (5 short tons and above) accounted for 0.6% of Canadian goods exports to the U.S. in 2024, and 8% of total motor vehicle exports to the U.S.

-

U.S. tariffs so far have been applied to the non-U.S. content of finished vehicles. Statistics Canada estimates that over 40% of Canadian heavy truck exports to the U.S. in 2024 were U.S. content (intermediate parts imported earlier in the production process), 30% were Canadian content with the rest from other countries.

Suspension of the de minimis treatment

The recent U.S. global suspension of the de minimis treatment (duty free access for low-value imports) following terminations for China and Hong Kong in May is concerning for Canadian retail exporters.

De minimis entries, which include U.S. goods imports valued under US$800 per person per day have ballooned in the last decade as e-commerce expanded. Total entries surged from 123 million in 20142 to 1.4 billion in 2024, according to U.S. Customs and Border Protection (CBP) data.

CBP data suggests the average value of de minimis entries was US$47.50 in 2024 (well below the US$800 value threshold), indicating they are weighted toward lower-value household goods.

How the end of de minimis impact trade statistics and consumer prices:

-

Since de minimis imports were not subject to duties, they are largely absent from U.S. Census Bureau trade data. That means the elimination won’t have a significant impact on the trade balance.

-

Still, they have grown to represent a sizable share of consumer spending. In 2024, de minimis imports accounted for more than 1% of total U.S. household goods consumption, 5.6% of e-commerce sales, and 8.3% of consumer goods imports (excluding food and auto).

-

The end of de minimis will push up U.S. consumer costs as they turn to pricier domestic alternatives instead of absorbing tariffs costs on very low-value imports. Lower-income U.S. households will likely see a bigger impact, having relied more on affordable goods from e-commerce platforms.

-

For Canadian exporters, low-value exports to the U.S. may still qualify for duty-free status if they comply with CUSMA requirements. However, the added administration and brokerage costs will erode already-thin profit margins on low-value items, or worse, force some exporters to exit the U.S. market altogether.

About the Author

Claire Fan is a Senior Economist at RBC. She focuses on macroeconomic analysis and is responsible for projecting key indicators including GDP, employment and inflation for Canada and the US.

- Claims data from Hawaii, Massachusetts and Virgin Islands (combined under 5% of total claims) for week of September 27 are missing at time of writing. We assumed claims in these states grew at the same rate in the same week a year ago. ↩︎

- All years referenced in this section are U.S. fiscal years. ↩︎

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.