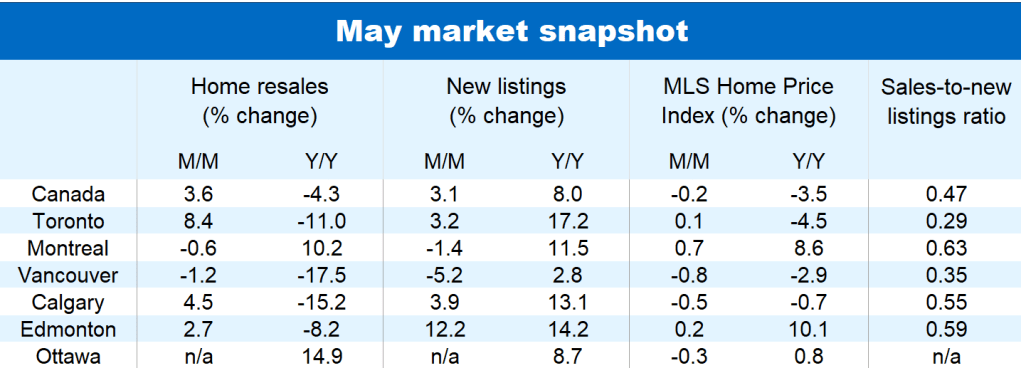

More homebuyers made their way back to the housing market in May, while price corrections eased in several cities. The developments could be early signs that Canada’s housing market is turning a corner after trade war-induced anxiety sent it declining this year.

Home resales are up sequentially for two months nationwide, rising 0.8% and 3.6% in April and May, respectively. The stronger advance last month coincided with the U.S. administration broadly de-escalating tariffs, which may have comforted homebuyers who had retreated to the sidelines on recession fears.

Still, activity remains soft in many local markets—especially in Southern Ontario and British Columbia where resales are barely off cyclical lows—restrained by affordability issues and deteriorating job prospects. May resales were down 4.3% from a year ago in Canada.

Supply trends remain sturdy

The number of properties put up for sale rose again in May—growing another 3.1% from April—bringing the increase over the past 12 months to 8%. Total inventory of homes for sale climbed to a six-year high, sustaining intense competition between sellers.

This has led to outright price drops this year—mostly concentrated in Southern Ontario and B.C. But, the decline slowed materially in May. The national composite MLS Home Price Index fell 0.2% from April, a fraction of the average 0.9% drop in the prior three months. The decline from a year ago remained effectively unchanged at 3.5%.

Price declines moderate in Ontario

Ontario accounted for much of the deceleration last month, though the picture varied considerably within the province and across housing types.

The Greater Toronto Area recorded its first monthly gain in the composite index in six months (0.1%) with the Niagara region (1.6%), London (1.3%), Kitchener-Waterloo (1.6%) and Cambridge (0.6%) seeing larger increases. Single-family homes were the main driver in most cases as condo apartment prices weakened further under the weight of rising inventories.

Aggregate prices, however, fell further in Hamilton (-2.3%), Windsor (-1.2%) Kingston (-0.9%) and Ottawa (-0.2%).

Price trends little changed elsewhere

The MLS HPI continued to fall in B.C. led by month-over-month declines in Fraser Valley (-1.1%), Vancouver (-0.9%) and Victoria (-0.7%). The divergence between Calgary (down 0.5% from April) and Edmonton (up 0.2%) persisted in Alberta. An upward trajectory was maintained in Saskatchewan, Quebec and most of the Atlantic provinces. Quebec City (up 2.3% from April), Halifax (2.2%), St. John’s (1.6%) and Saskatoon (1.5%) recorded strong monthly gains and were among the markets where prices appreciated the most in the past year.

Back to a gradual recovery ahead

We expect housing market confidence to gradually rebuild as tariff de-escalation lifts some of the uncertainty that hindered activity earlier this year. We see this broadly boosting demand, but a weak job market is likely to temper the pace of any recovery in the near term.

This is poised to keep buyers in the driver’s seat for a while longer in Ontario and B.C. as supply-demand imbalances persist. We think it will lead to further price depreciation in these markets, especially in the condo segment where supply is abundant.

Other markets where supply-demand conditions remain tight and price trends positive this year—including Edmonton, Regina, Saskatoon, Winnipeg, Montreal, Quebec City, Halifax and St. John’s—could see firmer appreciation.

Download the Report

Robert Hogue is the Assistant Chief Economist responsible for providing analysis and forecasts on the Canadian housing market and provincial economies.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.