➔ The worried, the hopeless and the climate-conscious

➔ King Coal’s long rein continues

➔ A global gridlock’s holding back renewables

Hot takes

➔ Climate literacy for the worried and the hopeless. Ottawa plans to invest14.4 million in 17 projects to boost environmental literacy among young people. It ranges from $1.8 million for BC Parks Foundation to inform students about biodiversity loss and several programs that combine climate science with traditional Indigenous knowledge. We are going to need all of it: A recent study shows Canadian youth are wallowing in “worry and hopelessness” in response to climate change.

➔ Carbon Upcycling is a step closer to cracking the cement emissions challenge. The Calgary-based startup recently broke ground on Canada’s first commercial-scale carbon capture and utilization facility at partner Ash Grove’s Mississauga cement plant. Opening in 2026, the $10-millionproject will capture kiln CO₂ and convert it, along with other industrial byproducts, into up to 30,000 tonnes a year of low-carbon cement materials. Funded by federal programs and venture firm CRH Ventures, the initiative aims to embed circular economy solutions into heavy industry. Also read our 2024 case study on Carbon Upcycling.

➔ UN plastics treaty talks are on the brink. There was limited consensus among delegates of 179 nations after a 10-day marathon on global plastic pollution that ends today. The scale of the problem is massive, with straws, cups and stirrers, carrier bags and microbeads among the single-use products clogging up oceans and threatening marine life. The 2,000-plus delegates are poring over 32 clauses in a draft text, but, some say, countries can’t even agree on the definition of “plastic pollution.”

AI deepfakes’ power problems

Saskatchewan Premier Scott Moe was the latest target of an AI deepfake video that falsely showed him promoting cryptocurrencies. It’s not just a public menace—it has implications for the climate.

Some AI models gobble up 20.4 million joules to generate a 30-second video, according to data extrapolated from an MIT study —that’s enough to power an electric vehicle for 18 kilometres. Eight million AI deepfakes could be shared online this year—doubling every six months, according to Open Fox, a law-enforcement consultancy. Add to it millions of meaningless, misleading and near-malicious AI-concocted videos that litter the Internet (countries as mythical monsters , anyone?). It’s not nothing: One 30-second video per day, for a month, would be the equivalent of adding 40% to a typical one-bedroom apartment’s utility bill, according to energy policy lead Shaz Merwat who wrote about AI’s power needs last year.

AI’s demand on power grids is already formidable:

➔ Datacentres will account for 20% of electricity demand growth to 2030 in advanced economies, the International Energy Agency estimates.

➔ Emissions from data centres could rise from 180 million tonnes today to 300 metric tonnes (Mt) by 2035 in IEA’s base case, with 500 Mt as a higher estimate—roughly 2.5x the emissions of Canada’s oil and gas sector.

➔ The United States now has the largest pipeline of gas-fired power plants in development globally, surpassing China—with a fifth to power data centres.

➔ Given the exponential use originating from image and video queries, most likely over time, we could see tiered pricing for heavy data users to match users’ data use for heavier AI tasks, Merwat said.

Felippa Amanta, who published a study on the AI deepfake challenge for Oxford University, goes a step further: “The deepfake’s effect on climate information and emotion will be much more significant than the direct energy to produce the deepfake.”

King Coal’s enduring rein

Spot the resilient fossil fuel in the chart below. Old King Coal set a new demand record last year, with coal-for-power generation also hitting its highest level ever. Trade in the carbon-intensive commodity also broke records in 2024. Coal is the world’s most carbon-intensive fossil fuel, with emissions on average 50% higher than natural gas.

Here are some coal trends that suggests it will endure for some time:

-

China accounts for 56% of global demand, but India and the U.S. is expected to see production rise.

-

The U.S. is considering several regulations that were poised to limit coal use in power generation. A Trump executive order also lifted “unattainable emissions controls” for coal plants to ensure energy security.

-

The IEA expects global coal consumption to plateau in 2026, but rise 5% in the fast-growing ASEAN region.

-

Despite coal’s resurgence, the IEA expects renewables-based electricity generation to overtake coal-fired generation in 2025.

Trends, tech and science

Ballard is powering through a global hydrogen reckoning. The Vancouver-based company that’s been plugging away at hydrogen tech since 1979, launched its second major shake-up in less than a year. It underscores the pressure hydrogen fuel cell companies face after years of hype. Under new CEO Marty Neese, Ballard is pivoting to a narrower set of applications where its technology has proven traction, like transit buses and stationary backup power. The 30% operating cost cut target for 2026 suggests that the pace of hydrogen buildout has been slower than the market—or Ballard’s earlier strategies—anticipated.

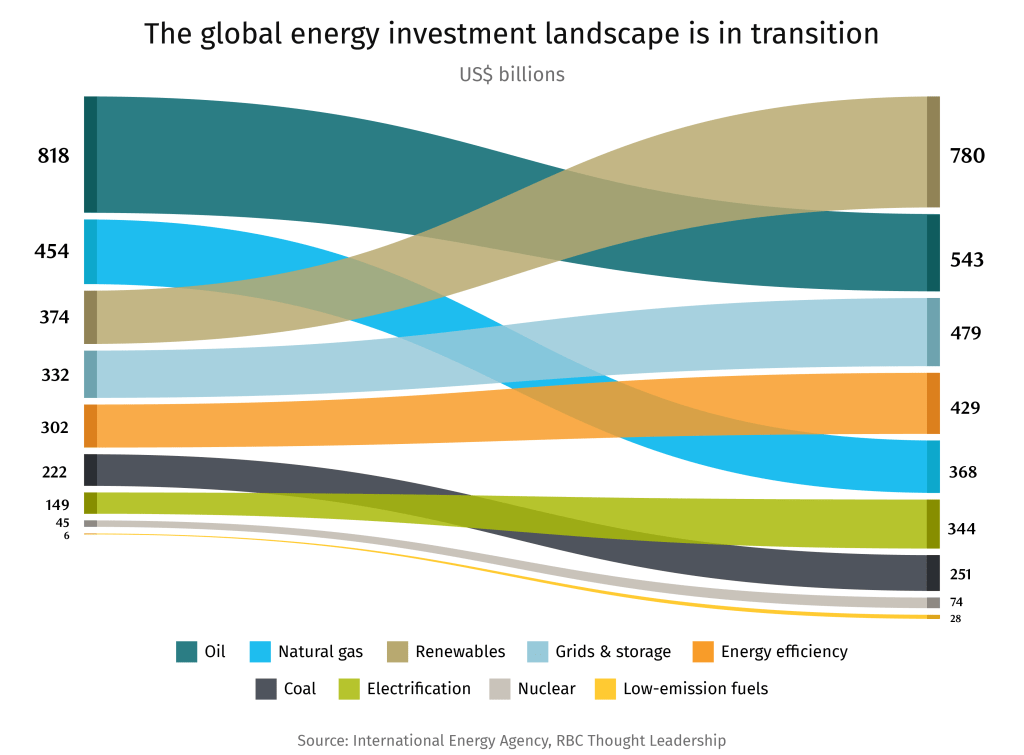

A global gridlock is stifling renewable energy. Nearly 40% of Scotland’s wind power capacity was curtailed due to grid constraints over the past six months. That’s the latest setback in a long list of renewable and affordable power being held back by a gridlock. For every dollar invested in renewable power, just 60 cents go to grids and storage—the ratio should be one-to-one, the UN estimates, noting that there’s three times more renewable energy waiting to be plugged into grids than was added last year.

Solar and wind are getting eclipsed. The White House’s war on renewables has seen projects valued at US$22-bilion scrapped in the first six months of 2025, according to E2 data . That’s 16,500 in jobs lost during the period. On the heels of the Big Beautiful Bill that would see low-carbon energy credits phased out faster, a new federal order subjects wind and solar projects to greater scrutiny as it “denigrates the beauty of our Nation’s natural landscape.” It echoes Alberta’s no-go zone directive last year.

Curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute.

Climate Crunch would not be possible without John Stackhouse, Sarah Pendrith, Jordan Brennan, John Intini, Farhad Panahov, Lisa Ashton, Shaz Merwat, Vivan Sorab, Caprice Biasoni and Lavanya Kaleeswaran.

Have a comment, commendation, or umm, criticism? Write to me here (yadullahhussain@rbc.com)

Climate Crunch Newsletter

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.