Hot takes

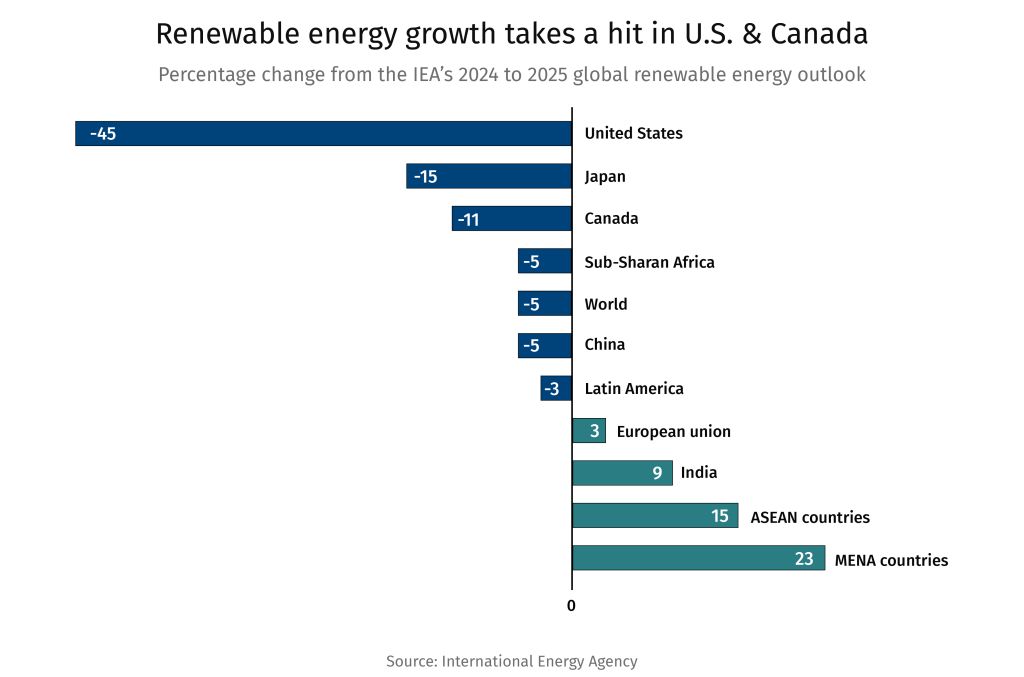

➔ The IEA has tempered Canada’s renewable energy growth forecast. The International Energy Agency’s latest report still expects Canada to add 21 gigawatts of renewable energy capacity by 2030, almost double the growth of the previous six years, mainly in onshore wind and utility-scale solar PV. However, that’s an 11% decline from the IEA forecast from last year. Ongoing grid challenges and policy and regulatory changes in Alberta were among the key reasons for the IEA pulling back its forecast. It’s a major reversal elsewhere too, with the U.S. and China—the world’s two largest renewable energy markets—facing slower growth amid policy shifts, supply chain vulnerabilities and financing pressures.

➔ Can Canada attract H1-B visa types that are no longer welcome in the U.S. For all the talk of Canada capitalizing on U.S.’s visa snarls to attract the world’s brightest and smartest comes a sobering stat: it takes 53 months for Canada to issue a Start-Up Visa (SUV). A new Betakit study shows that the decade-old program has been facing several challenges, while the government has also slowed the process as part of a wider immigration slowdown. Getting some of the world’s smartest climate, cleantech and innovative minds would require some quick thinking—and processing—from policymakers.

➔ David Greybeard made Jane Goodall. The chimpanzee, with the silver facial hair, was the first animal conservationist Goodall saw using tools and eating meat—sparking a lifelong quest by the conservationist in her pursuit of a greener and richly-biodiverse Earth. She anthropomorphized animals (pointedly rejecting the established practice of using numbers to identify animals by naming Greybeard and his family). By making it personal, Goodall—who died last week, aged 91—lifted them up and, through the Goodall Institute saved countless (though not nameless) species. Goodall was ahead of the curve, but her focus on nature is finally gaining traction.

➔ Further reading: Unearthing Value: How nature can play a critical role in pro-growth agendas – RBC

Cultivating the next generation of Ag innovators

Canada’s agriculture sector has all the ingredients to be the best in the world—productive soils, temperate climate, advanced on-farm mechanization, and a growing agri-food manufacturing sector. But capitalizing on the moment, won’t be easy, according to a new RBC Thought Leadership report . The sector has struggled to attract the right mix of talent and maintain the level of investment in R&D that is required to remain a global leader.

Research by Lisa Ashton, Director of Agriculture Policy, highlights the scale of the challenge:

-

Canadian agriculture has immense potential, but the innovation curve may be slowing down. Canada is home to some of the world’s most productive soils and innovative farmers. But agriculture’s annual growth in productivity has declined to about 1% over the past decade from 2% the previous decade, suggesting that few breakthrough innovations are making it to farms.

-

The sector is not attracting enough talent. Job vacancy rates are 1.5% above the national average. Less than 1% of STEM and business graduates, who play increasingly important roles on the modern farm, are choosing occupations in agriculture.

-

The research and development system is becoming less diverse. Public investment in agriculture knowledge generation, which includes R&D, has declined by 15% since 2010. Private sector outsourced R&D to universities is down 77% over the past five years. And the number of enterprises conducting R&D in the past decade has shrunk by 29%.

-

Other countries are pulling ahead. Canada has fallen behind Australia, the U.S., Japan, and Brazil in public investment in agriculture knowledge generation. Home-grown agriculture commercialization is in a slump as the country’s trade balances grow in innovation areas including agriculture chemicals, fertilizers, and services.

-

Commercialization of agriculture solutions are headed south. Investment in American agri-food technology startups has been 22 times larger than Canada’s over the past 5 years. The outsized market for investment in the U.S. is pulling Canadian innovation south for capital, mentorship, and market application.

To address the agriculture skills gap, RBC launched an investment initiative in Winnipeg today to help cultivate the next generation of Canadian farming. Introduced alongside Manitoba Premier Wab Kinew, RBC Generate was launched with a $5 million, five-year investment in agriculture in the Prairies with plans to expand through programming delivered as part of a national movement with farmers, The Canadian Alliance for Net-Zero Agri-food (CANZA) Nature United, Sustainable Food Systems for Canada (SF4C) and Indigenous sustainable farming initiatives.

NUCLEAR

SMRs: Small but mighty

RBC Thought Leadership’s Vivan Sorab moderated a panel on Tripling Nuclear Power by 2050: The Role of SMRs in Achieving Global Energy Goals at the SMR Forum in Edmonton last week.

Joined by Atkins Realis Carl Marcotte, Terrestrial Energy’s William (Bill) Smith, GE Vernova Hitachi Nuclear Energy’s Lisa McBride, and George Christidis from the Canadian Nuclear Association, the panel explored the role of SMRs and Canada’s advantages. Here are some of the key takeaways:

-

Collaboration is Canada’s competitive advantage: Ontario has taken the lead, commencing construction of the G7’s first grid scale SMR, and has brought together government, utilities, the Canadian nuclear supply chain, and academics to build Canada’s first new nuclear plant in 3 decades. As provinces outside of Canada’s existing nuclear provinces consider nuclear for the first time, building on this collaboration will be key to success.

-

Canada must seize the opportunity: With initiatives like Canada’s SMR Roadmap and first-mover advantage on SMR construction, Canada has positioned itself as a leader in next-generation nuclear. But with competition from the U.S. and other countries heating up, Canada must act fast to maintain its lead and ensure that its SMR expertise enables energy security and decarbonization globally. More synergy between the federal and provincial governments will be critical.

-

Investment must grow: Canada’s future nuclear fleet will need new investment to sustain a growing supply chain, a next-generation workforce, and the skilled tradespeople needed to build new reactors.

-

SMRs have a big price tag. The Ontario Power Generation’s four SMRs at Darlington with a capacity of 300-magawatt are expected to cost $20.9 billion. That compares to the 377-megawatt natural gas-fired power station in Saskatchewan carrying a price tag of $825 million. While SMRs can have geostrategic value, they will still need to compete with gas, hydro and bigger nuclear plants to attract capital.

-

Indigenous communities are front and centre: New nuclear projects will not succeed without placing indigenous communities at the forefront. Engagement must be early and projects must enable indigenous participation and equity.

Curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute.

Climate Crunch would not be possible without John Stackhouse, Sarah Pendrith, Jordan Brennan, John Intini, Farhad Panahov, Lisa Ashton, Shaz Merwat, Vivan Sorab, Caprice Biasoni and Lavanya Kaleeswaran.

Have a comment, commendation, or umm, criticism? Write to me here (yadullahhussain@rbc.com)

Climate Crunch Newsletter

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.