➔ Why Canada’s critical to G7+’s metal security

➔ Peak IEA vs OPEC fight

➔ A geothermal breakthrough

Hot takes

➔ Canadians slammed the brakes on zero-emission car purchases in Q1. Sales were down 19.5% compared to the same period last year, while total light-duty vehicles, that includes hybrids and plug-ins, fell 3.2% during the period. New vehicle registrations accounted for 9.5% of total car sales in Q1, down from an impressive 18.9% in Q4, S&P Global data shows. A confluence of factors tripped up sales, including the end of the $5,000 federal rebate, a drop in Quebec’s rebate program, and tariff uncertainty. Tesla is also losing its brand appeal in Canada, securing less than 10% market share in April, down from 50% a few years ago.

➔ G7 leaders were not the only luminaries in Alberta this month. Haitham al-Ghais, secretary-general of the Organization of Petroleum Exporting Countries, showed up in Calgary for the Global Energy Show with the bold claim that “there is no peak in oil demand on the horizon.” Over the past few years, OPEC and the International Energy Agency have bickered over the peak dates of oil, which the Paris watchdog believes could come before 2030. OPEC also recently called out the IEA for cutting its electric vehicle forecast as proof it was backtracking on its peak-demand theory. But the IEA remains firm, noting in its June forecast that a “peak in global oil demand is still on the horizon.”.

➔ The Arctic is hot territory. Three new books this year show how the top of the world is now top of mind, as it warms up for—and to—more commerce. In The North Pole, Norwegian explorer Erling Kagge charts how explorers were traversing the region as early as the 1600s to find shortcuts from Europe to Asia. In End of the Earth, fossil hunter Neil Shubin explores what the latest science tells us about the riches beneath. And in Arctic Passages, journalist Keiran Mulvaney explores how thawing ice could cut trips from, say, Korea to the Netherlands, circumnavigating geopolitical flashpoints Suez and Panama canals.

Critical Canada

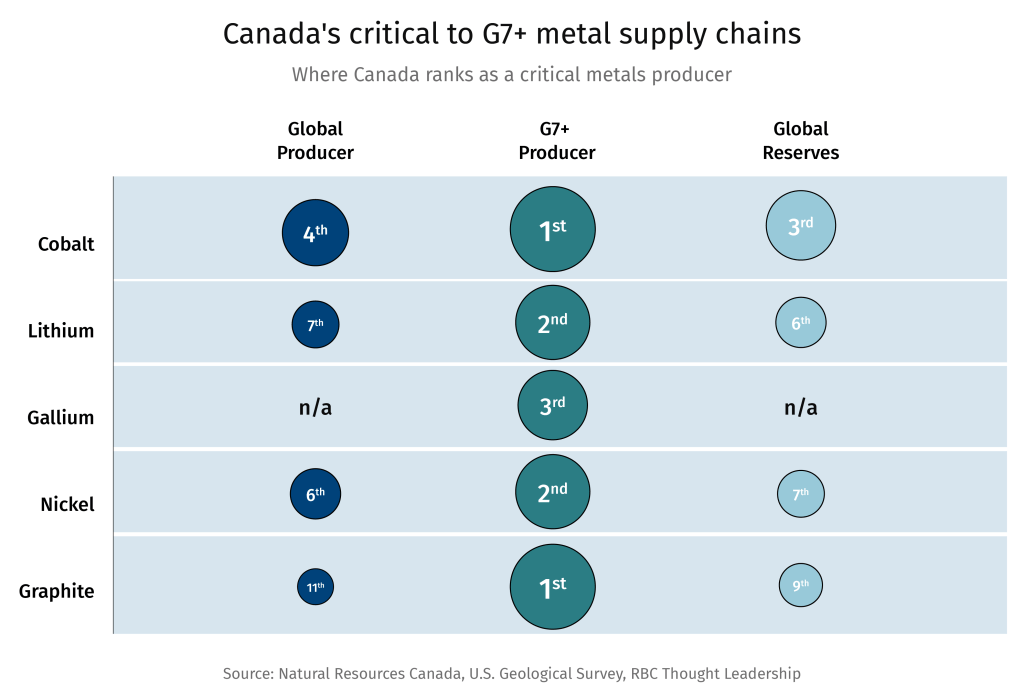

From Nice to Kananaskis, critical minerals are on everyone’s lips. But it was awkward in the coastal French city where delegates at the UN Ocean Conference criticized the U.S.’s interest in deep-sea mining, suggesting that the White House’s plans for offshore critical minerals set “a dangerous precedent that could destabilize the entire system of global ocean governance,” according to the International Seabed Authority (ISA). It seems that the business of developing clean energy inputs is not always, well, clean.

In Kananaskis, Canada corralled G7 nations to at least agree on a critical minerals “action plan .” While a united and sweeping G7 statement was being avoided on several matters to avoid the ire of the Oval Office, leaders agreed on developing a framework to finance new mines and downstream processing facilities, and reduce reliance on China for key metals such as lithium, cobalt and rare earth elements.

As a major producer of several commodities vital for the production of electric vehicles, defence, smart phones and wind turbines, Canada wants to play a key role, as part of its overarching “energy superpower” ambition.

There’s some awkwardness here, too as the federal government is starting to get some pushback: Chiefs of Ontario believe Bill C-5, proposed by the government to fast-track mining and other projects, will override environmental laws and “sidestep constitutional obligations.”

The private sector , which overwhelmingly wants all levels of governments to build an energy-agnostic utility corridor, also has a laundry list of concerns including cost overruns and delays of mega-projects, scope creep, stakeholder consultations, environmental assessments, and regulatory delays, according to a KPMG survey of Canadian executives.

Our report, The New Great Game, outlines how Canada can overcome challenges to scale its critical minerals sector. Further reading: Resourceful: How Canada can strike a new commodity deal with the U.S. and others

The Canada-Japan gas nexus

Japan is the Canadian energy sector’s new market—with a climate twist. B.C. Premier David Eby was in Japan as recently as this month, showcasing his province’s commodity resources, including energy. Meanwhile, Mitsubishi Corp.—an anchor investor in LNG Canada, will start receiving shipments from the facility starting in July.

Our new report on G7+ Strategy for Natural Gas , examines how member countries can leverage natural gas to ensure energy security. Canadian LNG can find a greater Asian foothold if it can align with Japan’s Green Transformation Emissions Trading System (GX-ETS), which is central to the Asian country’s carbon neutrality by 2050.

Here’s how:

-

Japan’s GX policy accepts low-carbon LNG—particularly if paired with methane abatement, carbon capture and storage (CCS), or certified emissions standards—as transition-aligned. Canadian LNG could qualify for long-term GX-aligned supply contracts, if emissions reductions are verifiable.

-

Japanese investment via GX Transition Bonds, especially in infrastructure such as liquefaction and CCS-enabled transport. Japan is collaborating with Australia and other countries on clean ammonia. Canada’s low-carbon certified energy products can tap several opportunities including financing through GX Transition Bonds and Japan’s Joint Crediting Mechanism (JCM).

-

Canada can also tap Japan’s plan to scale blue hydrogen imports, by developing natural gas with CCS.

-

Japan’s economy also needs power to maintain its edge in computation and digital infrastructure. Data centres, AI and digital infrastructure are going to depend on natural gas, offering another opening for Canada.

Read the full report here. Also watch John Stackhouse and lead author Shaz Merwat discuss the report.

Trends, tech & science

➔ The World Bank is entering the nuclear energy space. In a boost to nuclear, the World Bank is collaborating with the International Atomic Energy Agency, the UN nuclear watchdog, to support existing reactors and support “grid upgrades,” including SMRs, amid a push from the U.S. and Germany. Natural gas power plants, that do not “constrain renewables,” could also tap its funding. However, the World Bank’s board has not yet agreed on funding upstream natural gas development.

➔ Carbon capture projects are ramping up. Between 2020 and 2030, carbon management project deployment is expected to be dominated by capture-only initiatives, which will account for approximately 45% of all operational and planned projects, according to a new report by the International Energy Forum . The U.S., the U.K. and Canada—in that order—have the highest number of proposed CCUS projects by 2030. That will take proposed global CCUS capacity to 1 gigatonne of CO2 by 2030 (equivalent of taking 306.3 million cars off the road for a year), with most initiatives financed through public funding.

➔ A Bill Gates-backed geothermal firm reported an industry-shaking breakthrough. The industry is abuzz after Houston-based Fervo Energy drilled 15,765 feet in 16 days—a 79% cut in average drilling times. With drilling the costliest line item for geothermal companies, the feat is a giant step in making geothermal economically competitive with other energy sources. Second, its technology—borrowed heavily from fracking techniques—, allows the industry to look beyond geological sweet spots for geothermal, like Iceland. Gates’ Breakthrough Energy immediately rewarded the company with an additional US$100-million injection, part of a US$206-million investment round for the company.

Curated by Yadullah Hussain, Managing Editor, RBC Climate Action Institute.

Climate Crunch would not be possible without John Stackhouse, Sarah Pendrith, Jordan Brennan, John Intini, Farhad Panahov, Lisa Ashton, Shaz Merwat, Vivan Sorab, Caprice Biasoni and Lavanya Kaleeswaran.

Have a comment, commendation, or umm, criticism? Write to me here (yadullahhussain@rbc.com)

Climate Crunch Newsletter

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.