RBC Climate Action Institute’s latest annual survey of 150 executives shows 136 (91%) Canadian executives said their organization had a greenhouse gas (GHG) emissions reduction strategy—a sizable jump from 73% in last year’s survey.1

The survey, part of the RBC Climate Action Institute’s soon-to-be released Climate Action 2026 report, finds businesses in review-and-reset mode.

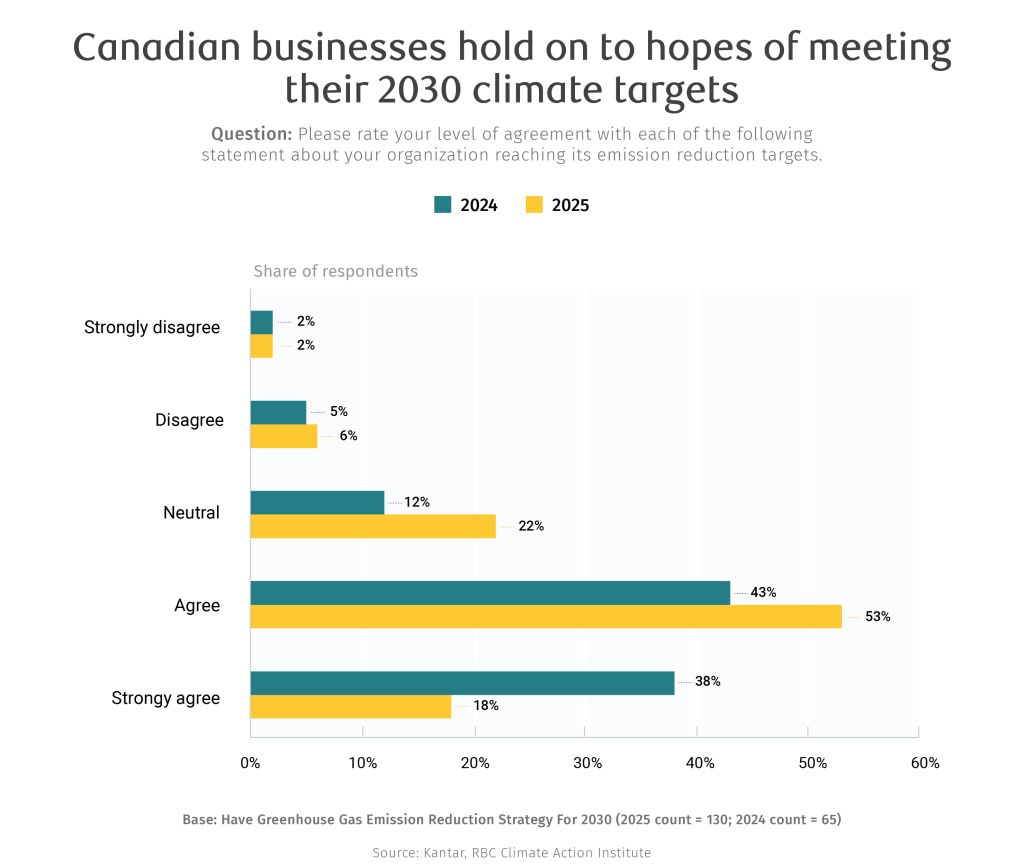

While a strong majority had a strategy, they were scaling back their targets in the interim: the percentage of executives “agreeing” or “strongly agreeing” when asked whether their organizations will reach its 2030 climate targets stood at 71% this year, compared to 81% last year.

That seems understandable as tectonic shifts are shaking up several planks of the Canadian and global economy this year, including trade, investments and energy security. Nearly three out of five senior leaders said their companies are planning to scale, or have already scaled back, their climate commitments or targets. More than a quarter cited the risk of political blowback in the U.S. as a key factor in their company’s decision, while just over 20% pointed to shifting sentiment at home for their decision.

A few other highlights from our survey:

-

Executives believe they should be driving climate progress. Corporate priority (63%) was the biggest driver of their emissions reduction strategy, followed by government regulation (60%). With several federal and provincial government climate policies in retreat in Canada, it will be interesting to see whether GHG emission reduction strategies wane in future surveys.

-

Energy efficiency was a popular way (82%) to lower emissions. When asked “what’s the primary focus of your organization’s climate strategy?” 62% picked waste reduction, and 41% identified the purchase of carbon credits—similar to last year. There was, however, a drop in switching away from fossil fuels (46% in 2025, versus 52% in 2024), and electrification (48% in 2025, versus 59% in 2024).

-

Customers are seeking sustainable products and services. Customer/client demand (54%) was the next big driver of their strategic decision-making—little changed from last year despite new economic and affordability pressures on customers. However, only 30% of executives cited investor demand as a key factor.

-

Sustainability policies are viewed as expensive… 60% of executives said implementing sustainability policies led to a moderate cost increase of between 5 to 15% to their business costs, while another 13% reported cost inflation exceeding 15%. In our survey, we did not define what sustainability policies companies were pursuing.

-

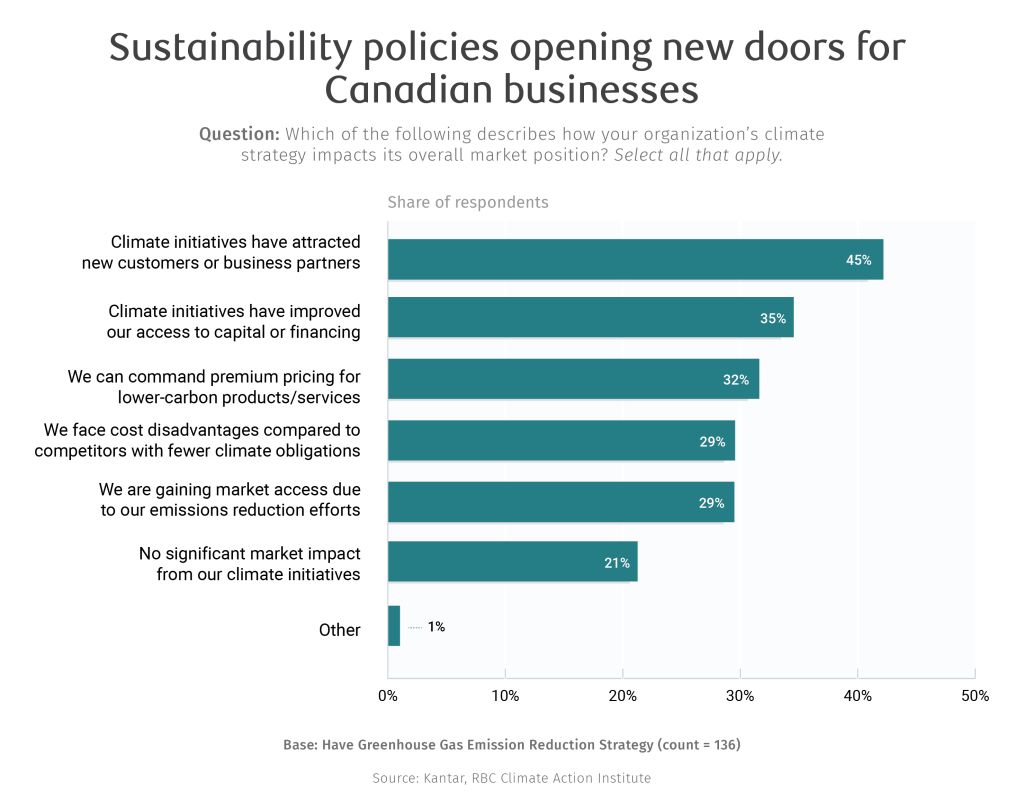

… But deploying climate policies had upside, according to the executives. Around a third of executives (32%) reported commanding premium pricing for their lower-carbon products and services, with 29% reporting securing new market access; 45% said their climate initiatives attracted new customers and business partners. However, nearly a third suggested they faced cost disadvantages compared to competitors with fewer climate considerations. A fifth reported noting no difference from their climate action.

-

Lack of access to capital tops the barriers list. In addition, the challenge of qualifying for government incentives and regulatory uncertainty, along with macro-economic conditions, were most frequently ranked as the top three barriers facing executives in their effort to lower their corporations’ GHG emissions.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.