Key takeaways

-

Canadian agriculture has immense potential but an innovation drain is slowing it down. Canada is home to some of the world’s most productive soils and innovative farmers. But agriculture’s annual growth in productivity has declined to about 1% over the past decade from 2% the previous decade, suggesting that few breakthrough innovations are making it to farms.

-

The sector is not attracting enough talent. Job vacancy rates are 1.5% above the national average. Less than 1% of STEM and business graduates, who play increasingly important roles on the modern farm, are choosing occupations in agriculture.

-

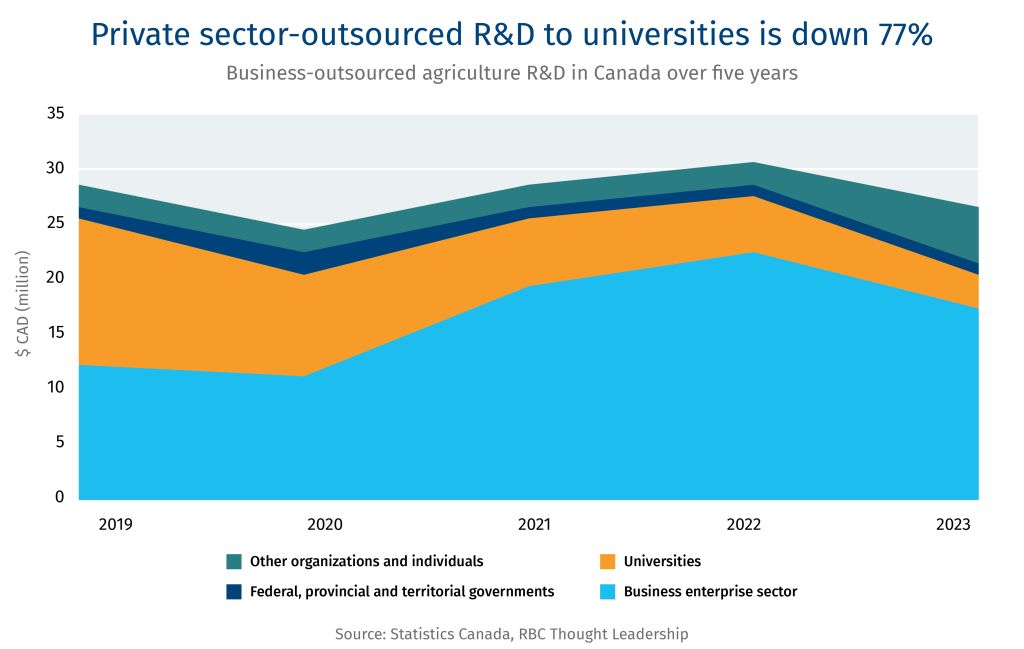

The research and development system is becoming less diverse. Public investment in agriculture knowledge generation, which includes R&D, has declined by 15% since 2010. Private sector outsourced R&D to universities is down 77% over the past five years. And the number of enterprises conducting R&D in the past decade has shrunk by 29%.

-

Other countries are pulling ahead. Canada has fallen behind Australia, the U.S., Japan, and Brazil in public investment in agriculture knowledge generation. Home-grown agriculture commercialization is in a slump as the country’s trade balances grow in innovation areas including agriculture chemicals, fertilizers, and services.

-

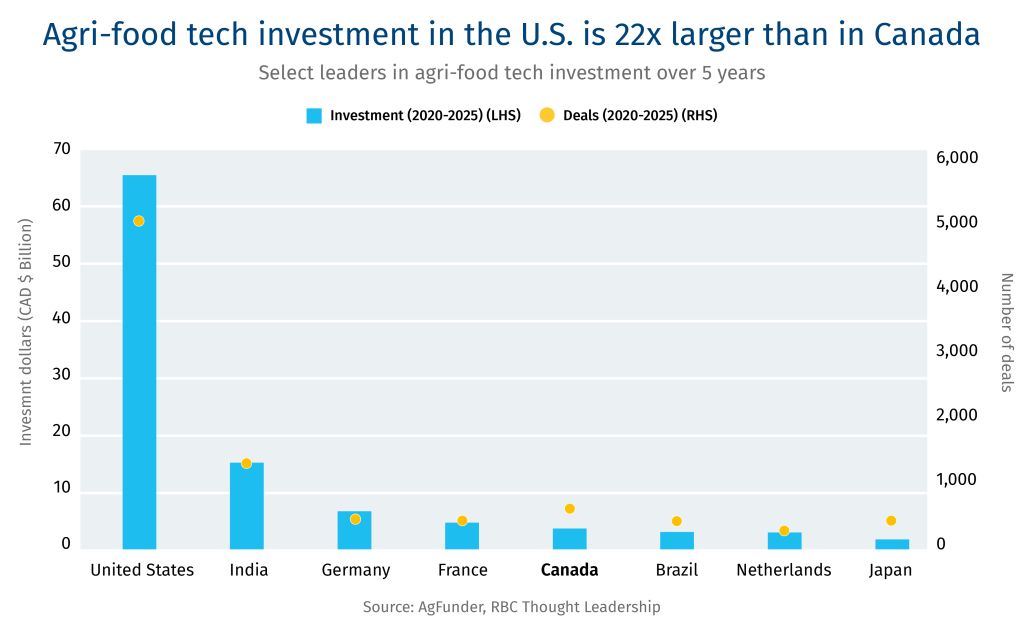

Commercialization of agriculture solutions are headed south. Investment in American agri-food technology startups has been 22 times larger than Canada’s over the past 5 years. The outsized market for investment in the U.S. is pulling Canadian innovation south for capital, mentorship, and market application.

Canada’s agriculture sector has all the ingredients to be the best in the world—productive soils, temperate climate, advanced on-farm mechanization, and a growing agri-food manufacturing sector. The size of the opportunity for Canada really comes into focus when you consider the scale of production as a breadbasket to the world, rapid development of digital tools, which are transforming every aspect of farming, and growing access to expand in high-potential export markets, most notably in Europe, the Middle East, and Asia.

Capitalizing on this moment, however, won’t be easy. Productivity has been steadily declining in recent years.1 And the sector has struggled to attract the right mix of talent and maintain the level of investment in R&D that is required to remain a global leader. Addressing these challenges as the sector undergoes a generational shift is not only essential for strengthening the resilience and competitiveness of Canadian agriculture but also for advancing the country’s broader pro-growth ambitions. It can unlock new economic opportunities, keep innovation within Canada’s borders, and position the country as a global leader in sustainable, high-quality agri-food production. But Canada needs a gameplan. One that starts with a strategy that sets the next generation of agriculture leaders up for success.

Shrinking the talent gap

The Canadian agriculture sector needs more diverse, highly qualified talent to innovate. Job vacancy rates in the sector have been, on average, 1.5% higher than national vacancy rates over the past 10 years.2 And it’s only getting worse. The Canadian Agricultural Human Resource Council estimates that the sector’s domestic labour gap could grow to more than 100,000 by 2030.3 And that’s before 40% of Canadian farmers hit retirement age by 2033.4 Not everyone will call it quits, of course, but there is no doubt that the sector is on the verge of a massive shift.

From a technological standpoint, it already is. Advanced technology—automated tractor steering and animal feeding, robotic milkers, and GIS for soil mapping—is commonplace on today’s Canadian farms. And it’s big business. The number of farmers reporting annual revenues over $1 million has grown year-over-year since 2015, up 67% in 2023.5

Automation demands diversified skills: Farmers remain the cornerstone of the sector, but the industry needs new skills to embrace the technological revolution that’s underway. All kinds of professions—from engineers and data scientists to marketers and business administrators—play crucial roles. The Conference Board of Canada revealed that 1 in 3 jobs in agriculture could be automated in the next decade.6 This suggests an opportunity to mitigate the projected exponential growth in the on-farm labour gaps, but demands more STEM-trained talent applying their expertise to agriculture.

And yet, attracting diverse, highly qualified talent, has proven challenging.

The talent pool is shrinking: In 1931, 1 in 3 Canadians were part of the farm population; in 2021, it was 1 in 61—or 1.6% of the country’s population.7 While a testament to advances in production systems and technology, it is also a barrier to attracting talent. While younger generations in the farm population are more likely drawn to agriculture careers, there’s a need to attract a new talent pool. But many Canadians with engineering, business and computer science degrees are unaware that the sector needs their skills. If Canadians are not exposed to, for example, how engineering, business and computer science is applied to the agriculture sector via robotics, the operating of multi-million-dollar farming businesses or creating soil-health monitoring software, it is unlikely those with that skillset will consider growing their careers in the sector.

For proof, look no further than postsecondary enrollment. Agriculture and natural resources are the second smallest field of study in Canada, only ahead of personal improvement and leisure.8 And those with agriculture-focused diplomas and degrees in the workforce are concentrated in general agriculture and production (32%), horticulture business and services (19%), veterinary technician, administration, and medicine (18%) and food, plant and animal sciences (18%).9

Agriculture grads are not landing in increasingly influential professions such as policy, data, trades and finance. These occupation fields have an important role in managing risks for agriculture but less than 1.5% in each field have some form of agriculture-focused post-secondary training.10 That’s a missed opportunity for entrepreneurial activity in applying data and computer scientist, finance, and trade technician skills to unlock new ways to approach farm management, automation, and financial capital in agriculture.

A path forward

Creating more experiential and workplace learning opportunities for students is one way to break down silos when it comes to fields of study, attract those from outside of agriculture disciplines, and build up Canada’s agriculture talent pool.

Collaboration across faculties on college and university campuses might be one place to start to offer students more diverse courses and experiences that are not conventionally born from agriculture departments. For example, Olds College, a uniquely agriculture focused institute in Alberta, offers programs in digital agriculture that includes a wide range of courses, including plant science and data management and analytics. Creating cross-disciplinary hubs also provide a centralized place to expose students to new skills and tools like the University of Guelph’s AI for Food, an AI and data hub for agri-food.

But to truly advance student exposure, non-agriculture institutions should consider doing more to connect students to career opportunities in agriculture. This requires fostering academic and industry relationships that could be catalyzed by non-agriculture academics attending existing agriculture conferences that typically only attract delegates from within the sector to learn about the opportunities for their students.

Curating workplace placements in agriculture would give students not enrolled in agriculture degrees a first-hand look at the sector’s career path potential. Greater work placement opportunities require greater engagement from the sector, which is important especially important at a time when disruptive technologies like AI are reducing entry level jobs. Sector engagement could build upon successful programs like the Youth Employment and Skills Program (YESP). Training and youth experience programs like YESP could also consider developing STEM, business or sustainability recruiting streams for youth that directly respond to skills demanded in the sector.

Re-energizing research & development

Canadian agri-food R&D has sparked innovations that have reached billions: the Spartan apple, canola, and Yukon Gold potatoes, to name a few. It’s also made the country a global leader in transformative development such as greenhouse tomato production, animal genetics and welfare, and largescale grain production. But dwindling investment in R&D and roadblocks across the innovation pipeline has diminished the sector’s competitive edge. As a result, startups are leaving Canada, often going to the U.S., for funding and to test their innovations. And multinational agribusinesses are moving their R&D investments aboard.

Agriculture knowledge is in freefall: Investment in R&D is critical to sparking innovation and attracting talent. Canada’s federal, provincial, and territorial governments have boosted investment by $500 million for the current agriculture policy framework, Sustainable Canadian Agriculture Partnership (SCAP) (2023-2028), which is a five-year $3.5 billion funding pack. Still, Canada’s public investment in R&D has been in decline. According to OECD, agriculture knowledge generation has dropped by 15% over 10 yearsa.11 Meanwhile, Australia, Brazil, and the U.S. have seen an uptick in public spending. Canada’s federal investment in agriculture science and innovation is projected to decline even further, down 12% between now and 2027.12 These cuts challenge the government’s ability to participate in networks of R&D institutes and build impactful public-private partnerships.

Government support for commercializing R&D in agriculture is shrinking under its science and innovation portfolio. AgriInnovate, the federal program for targeted agriculture commercialization, has contracted 42% from $165 million (2013–2018) to $95 million (2023–2028).13

Private funding is changing: There is also a growing divide between industry and academia, as businesses have reduced their outsourced R&D funding to universities. And private investment for in-house research is also changing. While Canadian-owned agriculture companies continue to increase in-house R&D investment, up from $101 million in 2018 to $120 million in 2023, international companies investing in in-house agriculture R&D in Canada dropped from $60 million in 2018 to $40 million in 2023.14

Strong innovation hubs are often defined by clusters of universities, colleges, businesses and governments that collaborate along the innovation cycle—from idea generation to growth.15 In Canada, the prospects of building these hubs for agriculture are deteriorating, with the number of enterprises conducting agriculture-focused R&D down 29% over the past 10 years.16

Canada is not the first place innovators trial solutions: Over the past decade, Canada has fallen from third among all countries in agri-food technology investment value to tenth.17 18 Canada has the tools to fast-track R&D commercialization, but they are being under-utilized. These include mechanisms like the Canadian Intellectual Property Office (CIPO)’s Green Technologies Program, which can be used to position Canada as a strong competitor in agriculture technology. While this program’s utilization remains low, patents have a higher grant rate of 95% relative to 69% for standard patent applications.19 This is a potential competitive advantage for Canada in agriculture technologies that contribute to positive environmental outcomes as the United States Patent and Trademark Office terminates its Climate Change Mitigation Pilot Program. Yet, Canada has a steep hill to climb, as it’s not in the top five countries for filing patents in the top agriculture technology subdomains: Pest and disease management, crop adaptation and genetics, smart farming (e.g., sensors), livestock management, and mapping and imagery.20 Canada’s time to market for agriculture innovations would need to be addressed to attract more investment and Canada-based R&D, as Canada’s trade deficit across pesticides and agriculture chemicals has grown by 159% over the past 10 years.21

R&D incentives are not as lucrative as others in the OECD: Canada has strong tax incentives for R&D investments as a percentage of GDP, ranking 9th in the OECD. But when looking across its suite of R&D incentives, it’s lacking platforms for transformative match funding, ranking 23rd for direct R&D spending as a percentage of GDP among OECD nations.22 Programs that have cost-share funding opportunities for R&D and commercialization exist, including AgriScience and AgriInnovation. But generally, budget cuts, inefficiencies in program delivery, and some mismatch between research priorities and industry demand, risk underdelivering innovation.23

A path forward

Foster an outcome-driven approach to boosting private demand for Canada-made agriculture R&D and commercialization. One option is to prioritize agriculture as a pilot sector under the forthcoming Canada Innovation Corporation (CIC). Prioritizing agriculture, which has a clear problem in innovation characterized by lacking R&D spending and commercialization, could be a business case for the rest of Canada on how to streamline and reorientate a sector’s approach to R&D to focus on delivering applicable results for the industry and the wider economy.

The people that make up Canada’s agriculture sector are champions of it. But the sector needs to raise its profile to emerge as a viable and desirable place to innovate and build careers.

Boosting engagement among young Canadians could give the agriculture sector a jolt of innovation as new blood enters the workforce and positions the sector as a renewed international force in agriculture talent, ideas and production.

Download the report

Authors

Lisa Ashton, Director of Agriculture Policy, RBC Thought Leadership

Tenille Bonoguore, Strategic, Initiatives Lead, Arrell Food Institute at the University of Guelph

Evan Fraser, Professor and Director, Arrell Food Institute at the University of Guelph

Our project partner

USDA. International Agricultural Productivity, 2025.

Statistics Canada. Job vacancies, payroll employees, and job vacancy rate by industry sector, monthly, unadjusted for seasonality, 2025.

Canadian Agricultural Human Resource Council. Sowing seeds inf change: Agriculture labour market forecast 2023 – 2030, 2024.

RBC Thought Leadership. Farmers Wanted, 2023.

Statistics Canada. Farm operating revenues and expenses, annual, 2025.

Conference Board of Canada. The Next Frontier in Canada’s Agri-Food Sector, 2024.

Statistics Canada. The socioeconomic snapshot of Canada’s evolving farm population, 2021.

Statistics Canada, Postsecondary enrolments, by field of study, registration status, program type, credential type and gender, 2024.

Statistics Canada. Occupation by major field of study, 2022.

Statistics Canada. Occupation by major field of study, 2022.

OECD. Agricultural Policy Monitoring and Evaluation – Agriculture knowledge generation, 2024.

Agriculture and Agri-Food Canada. 2024–25 Departmental Plan, 2024.

Agriculture and Agri-Food Canada. Evaluation of the AgriInnovate Program, 2025.

Statistics Canada. Business enterprise in-house research and development expenditures, 2025.

McKinsey and Company. Building innovation ecosystems: Accelerating tech hub growth, 2023.

Statistics Canada. Counts of business enterprise research and development performers by industry group based on the North American Industry Classification System (NAICS), 2025.

AgFunder. Global Agri-Food Tech Investment Report, 2025.

AgFunder. AgTech Investor Report: Year in Review, 2015.

World Intellectual Property Organization. Expedited Examination Programs of IP Offices Canada.

World Intellectual Property Organization. AgriFood: Patent Landscape Report, 2024.

Innovation, Science and Economic Development Canada. Trade Data Online, 2025.

OECD. R&D tax incentives, 2025.

Agriculture and Agri-Food Canada. Evaluation of the AgriInnovate Program, 2025.

Baseline is a three-year average.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.