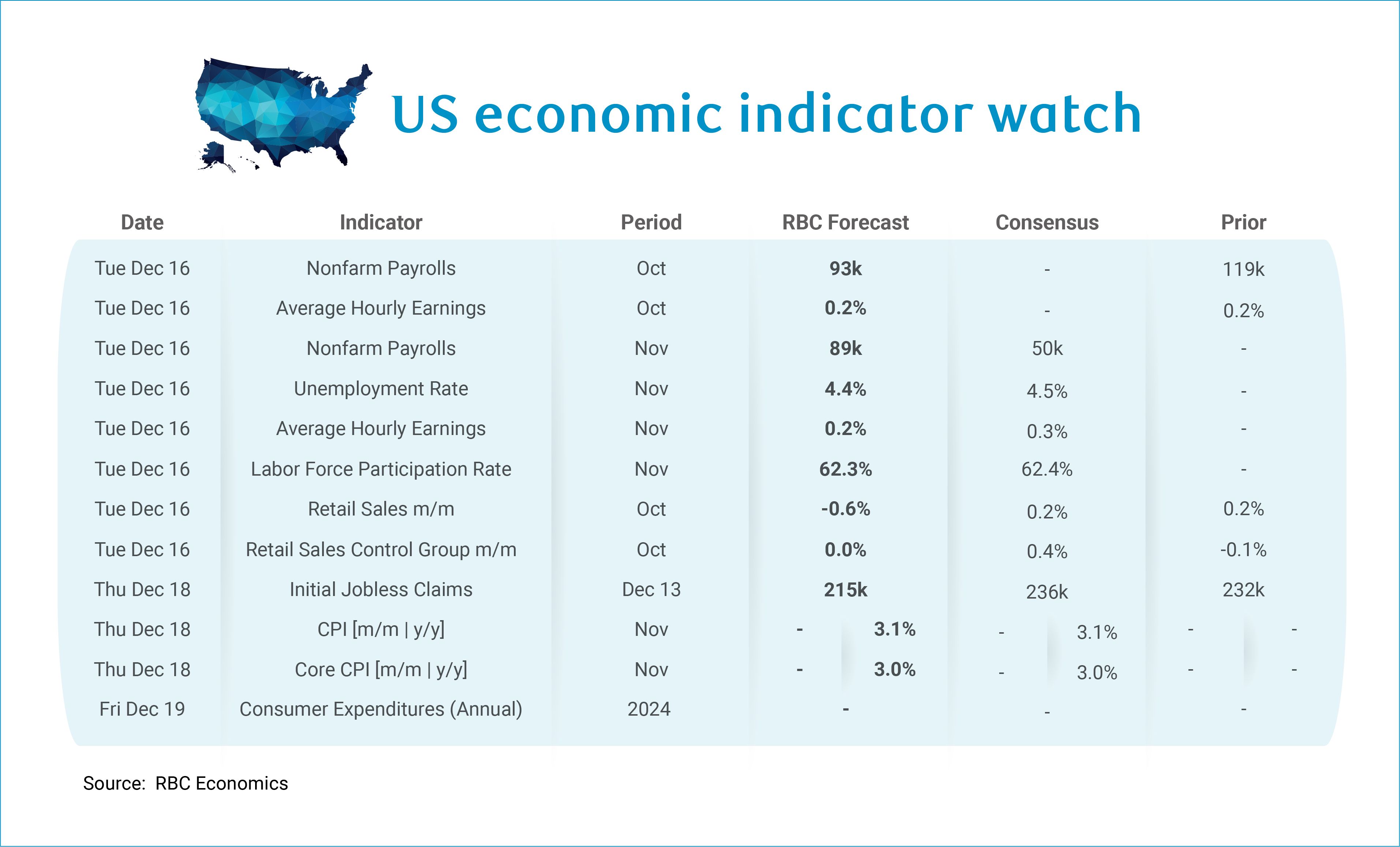

Next week is a loaded on the data front, which should help markets and economists get a better view of the macro backdrop. A double nonfarm payrolls report will be released on Tuesday. We expect that 93k jobs were added to the US economy in October, which is in-line with job gains suggested by October JOLTS data after netting out total separations from new hires (keeping in mind BLS temporarily suspended the alignment process so we could see revisions to JOLTS data). Furloughed federal workers who were not paid during the shutdown will be counted as employed in the NFP report so we will not see a distortion from the government sector in the October data. For November, we expect that an additional 89k jobs were added. We continue to see the bulk of job gains stemming from structural job creation in sectors like health care while trade-exposed sectors, like manufacturing where we expect continued declines. Still, cyclical services sector hiring improved in September (notably in leisure and hospitality), and we expect these improvements will continue. The ISM Services employment index has ticked up 2.5ppts through November since bottoming in July. Despite stabilization to prior months’ weakness, we face a labor market that advances its low-hiring, low-firing backdrop. We will not get an unemployment rate print for October due to shutdown disruptions to the household survey, but we anticipate that the unemployment rate will hold steady at 4.4% in November.

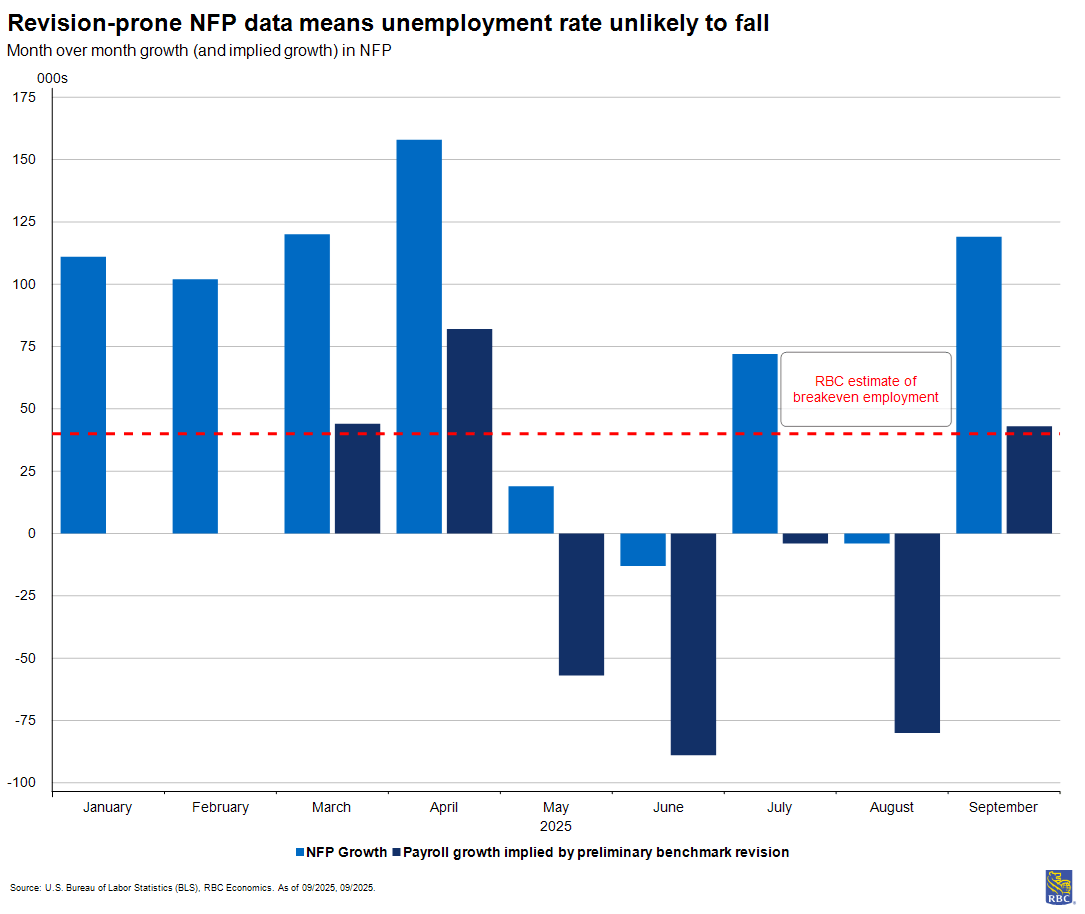

Despite our estimates point to a breakeven employment pace of 40K monthly, we still do not expect the unemployment rate to fall despite consecutive payroll prints at more than double that pace. The reason for this is that the CES (payroll) data will likely be revised lower. The annual QCEW benchmark revisions (911,000 through March 2025) earlier this year pointed to monthly payroll gains that were on average -70k lower than what was previously published. Chair Powell acknowledged this himself at the December FOMC meeting when he stated, “So, there is an overcount in the payroll job numbers we think, continuing, and it will be corrected.” If we continue to see an overestimation of a similar magnitude, we would still likely be witnessing employment growth that is either at or slightly below breakeven levels. Additionally, administrative data from the Social Security Administration suggests retirements are exceeding the pace of labor force exits reported in the household survey. Both revisions will likely show up in the data in Q1 2026.

We also get the CPI data next week, but only for November – October’s report was cancelled due to the government shutdown. Without the October CPI report, we lack the prior month’s data needed to calculate November’s month-over-month change. This will limit our ability to assess tariff passthrough in trade-exposed sectors. Even so, the hurdle for core inflation to tick up on a year-over-year basis is relatively high (+0.3% m/m last November). Since we do not expect core inflation to clear this hurdle, our forecast calls for core inflation to hold steady at 3.0% in November. Headline inflation will likely tick up to 3.1%, thanks to upward pressure from energy and a continued drift higher in food prices. Importantly, next Friday brings the delayed Consumer Expenditure Survey (CEX) release, which is used to re-calculate the CPI basket weights each year. Should we find that consumers have spent relatively more on services in 2024, this would mean that services will gain more weight in the CPI basket relative to goods and mechanically could help “offset” some tariff pressure. Nonetheless, we still expect core inflation will remain stubbornly above 3.0% y/y for most of 2026.

Outside of jobs data and inflation, next week we are also watching:

-

Headline retail sales likely fell -0.6% m/m in October, as weaker motor vehicle sales will weigh on total spending. The retail sales control group (which excludes auto sales, gasoline, building materials and restaurant spending) likely held steady. September retail sales data pointed to consumers losing steam; after a sizeable pull forward in spending in earlier months, we could expect to see more subdued spending heading into the holiday shopping season.

-

Initial jobless claims will likely normalize the week of December 13th – we expect to see claims tick up by 215k. This is after a notable upside for the week ending December 6th. The upside was likely a one-off, reflecting an influx of the prior weeks’ claims being held back and pushed into the following week after the Thanksgiving holiday.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

Imri Haggin is an economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.