Heading into the Fed’s December meeting next week, the economic backdrop remains foggy. The data that the Fed has on-hand heading into the meeting is stale – and we do not have clarity on the current state of either side of the Fed’s mandate. Our base case forecast one month ago did not assume a December cut from the Fed, given inflation above the Fed’s 2% target and Chair Powell’s comments at the October meeting about proceeding cautiously in a foggy environment. Still, the FOMC will vote based on the data that is available to them at the time of the meeting, and recent data has leaned sufficiently dovish to sway markets and consensus decisively towards a cut. Commentary from the extremely divided Fed has also leaned in this direction. As such, we expect that the Fed will opt not to surprise the market and will opt for the path of least resistance – with a 25-basis point cut – lowering the Fed Funds rate to 3.50-3.75%.

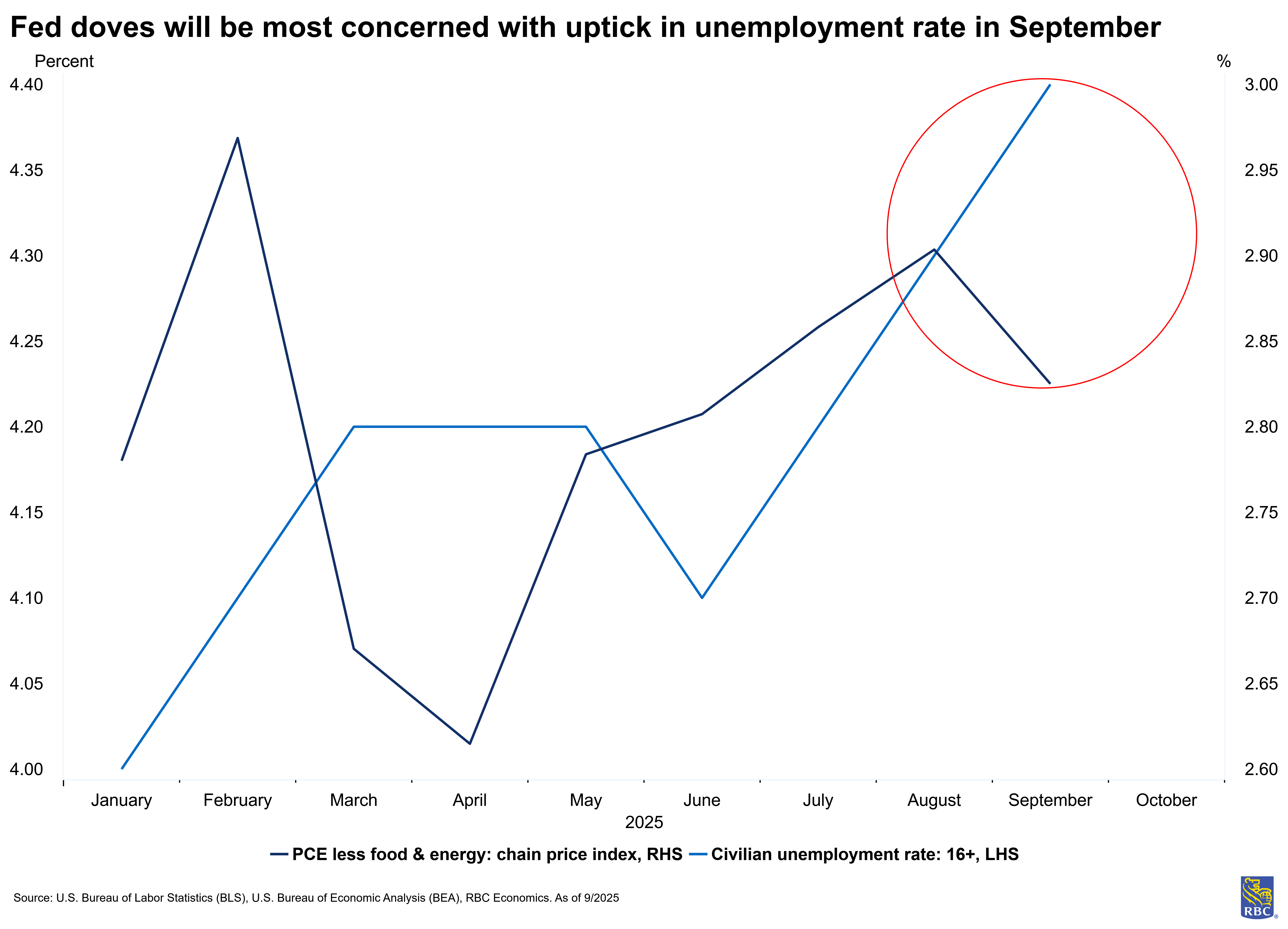

Powell has suggested that rates are moderately restrictive but has also stressed that two-sided risks mean there is no risk-free path. September’s core PCE– at 2.8% y/y – is still above target but is not accelerating to a point that would handcuff the Fed. On the other side of the mandate, the September employment report gave a mixed picture. Despite a upside surprise to nonfarm payrolls, concerns surrounding an uptick in the unemployment rate to 4.4% reflects further weakening in the labor market.

Looking ahead, most of the inflation data for October will not be released, implying that we will not have month-over-month data points available for November, except for a handful of series relying on non-survey sources (likely for gasoline, motor vehicles, airfares, and a few others). And these will not be released until after the December meeting, alongside a combined October and November employment report (which will not include the October unemployment rate).

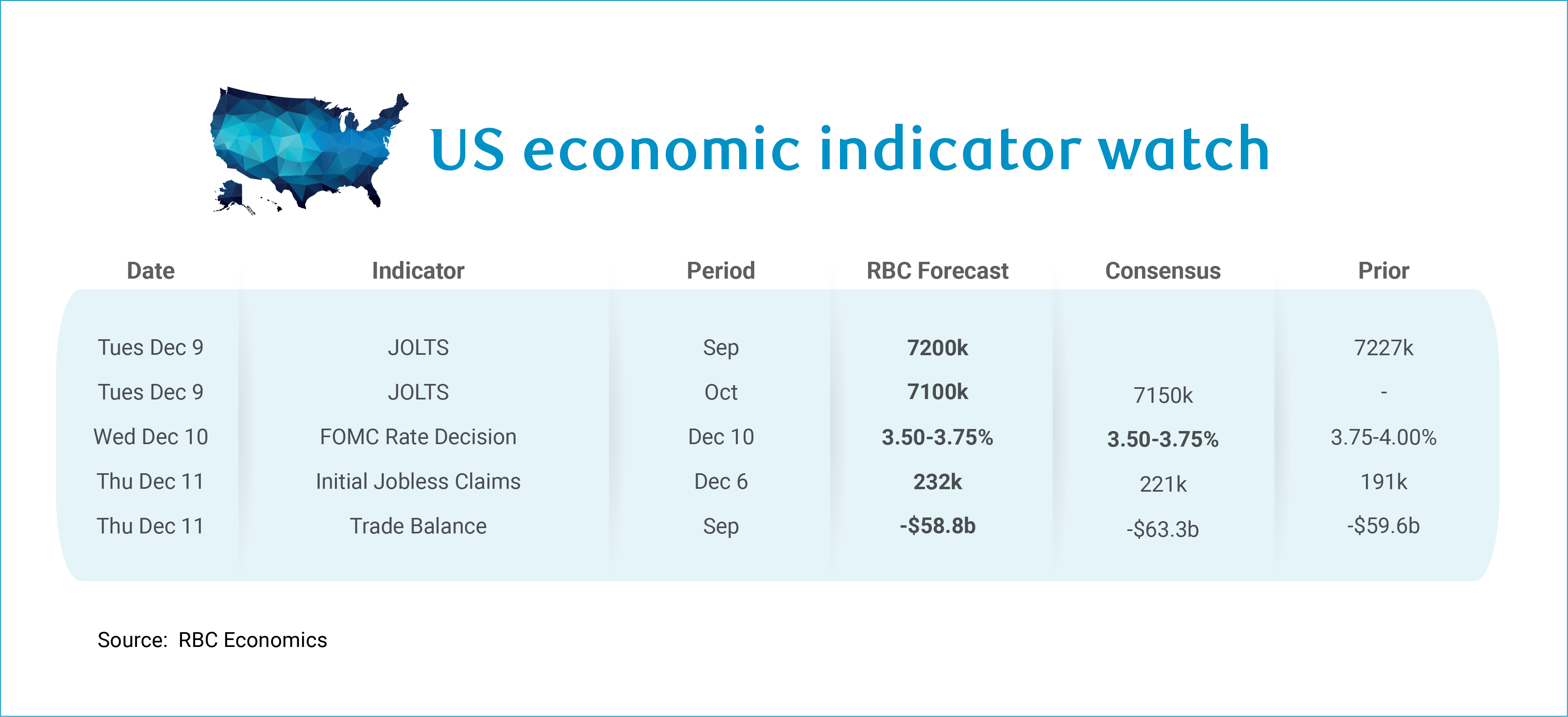

Aside from the Fed meeting, have a few other data releases landing next week:

-

JOLTS data for both September and October will be published on Tuesday. Job postings data from Indeed suggests that job postings likely bottomed out in October and have since turned a corner. Our forecast calls for job openings to tick lower in October (to 7100k from our forecast of 7200k in September).

-

We expect to see initial claims rebound +232k the week ending December 6th. This past week was marked by a sizeable downside to jobless claims (+191k), but this is not all that surprising. The week of the Thanksgiving holiday typically results in large swings as claims are less likely to be filed (and processed) during the holiday shortened week.

-

We also get lagged trade data from the US Census Bureau. We are forecasting a narrowing of the trade balance to -$58.8b because the pull forward of pre-tariff spending earlier this year. We expect less spending on imports in Q3.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

Imri Haggin is an economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.