Next week brings a data-heavy calendar before the holidays close in, with most releases hitting Tuesday. While these releases will be less consequential for the Fed after this week’s flurry of employment and inflation data, they’re still worth watching.

This Week’s Recap

As a quick recap, this week we got both a delayed double employment report and November CPI data, both sending mixed signals. The November headline employment gains appeared relatively healthy on the surface – though with some concerning underlying themes. Cyclically-exposed services sectors (which exclude government and health and social assistance) shed jobs for the first time since early summer, and trade-exposed sectors continued to post weakness. Moreover, once we factor in QCEW revisions that are likely pending, we are very likely tracking below our estimate of breakeven employment. October headline data was distorted by DOGE buyout recipients falling off of payrolls, but we saw similar trends with services sector hiring slowing to a crawl. And while Fed Doves would have seen a jump in the unemployment rate (to 4.6%) as an opportunity to defend their case, we were not concerned by this uptick since it was entirely driven by re-entrants into the labor market rather than prime age permanent layoffs.

Fed Doves may also have considered the November CPI report to be an early holiday present – with a massive downside to both core and headline inflation. But we caution against giving this report too much weight. Month-over-month measures were absent since the October data was unable to be collected during the government shutdown and though services sector inflation ticked down meaningfully, OER provided a lot of the help (and we do not expect this will be sustained). While the goods sector did show relief, we expect that this reflects companies’ desires to maintain market share during the holiday season. We expect that the Fed will treat the report as a one-off given disruptions around data collection. We anticipate that the December CPI report ahead of the next Fed meeting will be of more help.

Next Week’s Events

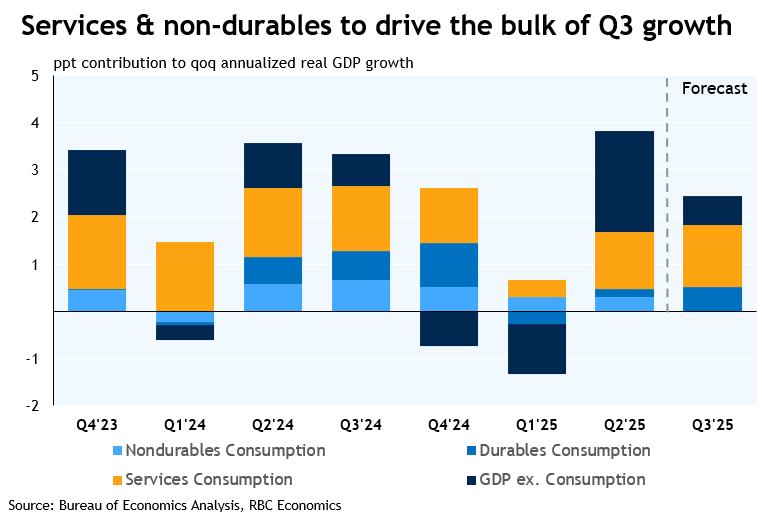

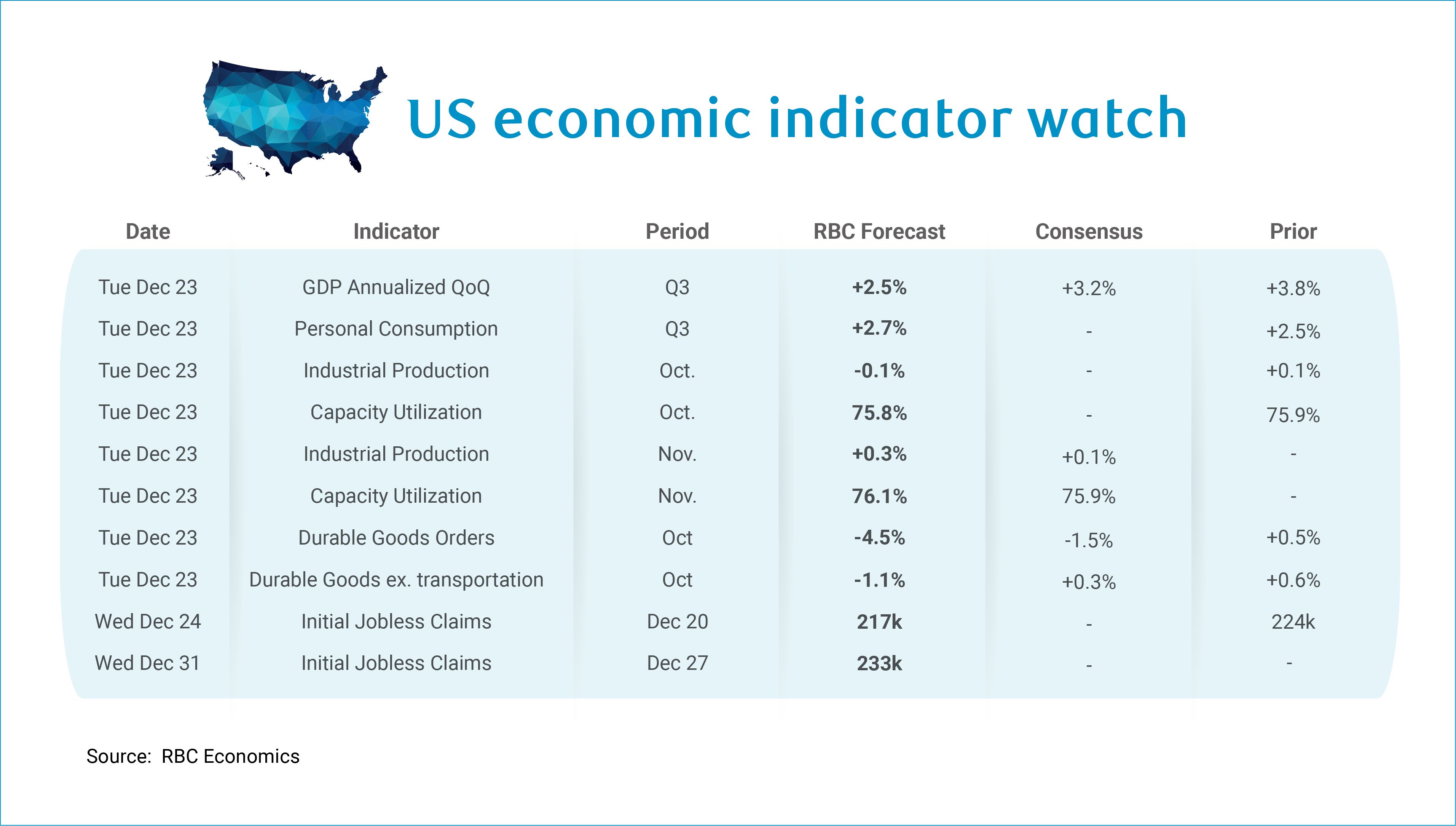

Heading into the next week, GDP data will be front and center. Our forecast calls for real GDP growth to come in +2.5% at a quarter-over-quarter annualized pace in Q3, with a bit of upside risk given uncertainty around inventory levels. We know that consumer spending eclipsed Q2 by a slight margin, as services spending continued to be supported by high income earners and spending on nondurables ramped up meaningfully. Durables spending, on the other hand, was entirely flat, after a Q2 pull forward in spending (accompanied by a downshift in savings rates) in the face of tariffs. September trade data pointed to slightly weaker imports in Q3, again, a product of an earlier pull forward, alongside a ramp up in exports. Adjusting for nonmonetary gold imports could nudge Q3 GDP higher. Inventories will be another wildcard and could move the needle meaningfully, after we saw distortions in earlier quarters.

Outside of real GDP, we have a few other releases ahead of the holidays:

-

We have a double industrial production report on Tuesday. For October, we expect to see industrial production ticking slightly lower -0.1% m/m due to a pullback in manufacturing hours worked and a weaker ISM manufacturing print. In November, industrial production likely ticked up by +0.3% m/m, bringing the capacity utilization rate to 76.1%.

-

We anticipate that the durable goods report will show a pullback in orders in October (-4.5%), largely due to fewer Boeing orders. But even excluding transportation equipment, we expect to see a slight pullback (-1.1%) as we expect weaker activity in most categories.

-

We expect to see initial jobless claims tick slightly lower to 217k in the week ending December 20th after we saw a moderation in claims this week following Thanksgiving holiday distortions. For the week ending December 27th, we will likely see claims move slightly higher to 233k.

The US Week Ahead returns Monday, January 5th.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

Imri Haggin is an economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.