This week, the headlines from the World Economic Forum in Davos and subsequent market turmoil garnered more attention than macroeconomic data. Now that the dust has settled and market participants are breathing a sigh of relief – for now – Wednesday’s FOMC meeting will be the focus next week. We anticipate, however, that the meeting will be largely uneventful, at least from a policy standpoint. We expect the Fed will move to the sidelines as data on both sides of the Fed’s mandate have moved in a more favorable direction.

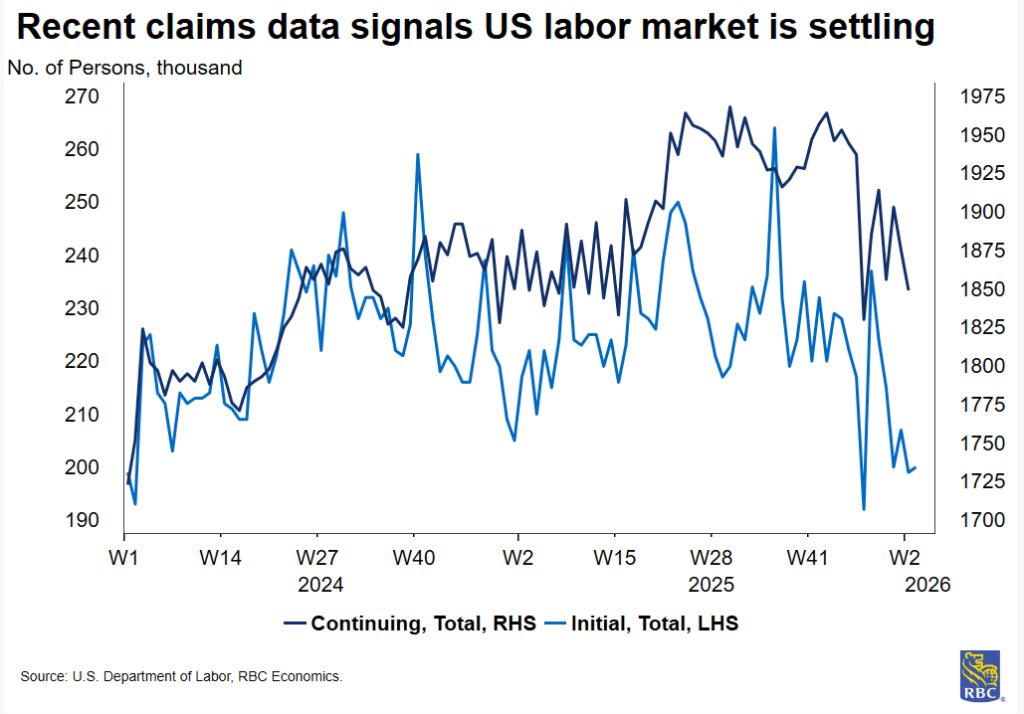

On the labor market front, the unemployment rate surprisingly fell to 4.4% in December after ticking up to (a now revised) 4.5% in November. And so far in January, initial jobless claims have been surprisingly low with the 4-week moving average falling near the 200k mark. It is typical to start the year off with a decline in claims because seasonal layoffs tend to slow by mid-January. However, the current trend is particularly unique because we did not see a post-holiday spike earlier in the month. This suggests that the labor market may well be tighter than previously appreciated amid the flurry of recent layoff announcements. We continue to expect the unemployment rate to move sideways through the year, and a stable UER will alleviate pressure for the Fed to continue to lower rates, especially as inflation remains above target. Additionally, recent spending data from November reflects a consumer base that continues to spend at a healthy clip. Goods spending accelerated during the holiday shopping period and services have remained strong through the year.

The most recent PCE inflation data we got is stale, but November’s print showed core PCE stuck at 2.8%, still well-above the Fed’s target. Part of that stickiness stems from the labor market tightness – wage growth remains robust and puts a floor under how low service pries can fall. And while the more recent CPI readings may suggest continued downside, we think it would be a mistake to place too much weight on that trend. For one, CPI places a greater weight on housing, which has been doing most of the deflationary work for the CPI basket. Secondly, the Fed’s preferred measure is PCE, which is not subject to methodological swings at the start of the year – CPI will see its weights adjusted for the January reading, and we expect housing will GAIN more weight in the CPI basket and skew the trend. This means CPI could present a false hope of lower inflation compared to PCE. In fact, since 1960, core CPI reported a lower reading of y/y inflation vs. core PCE only 20% of the time (160 out of 791 monthly readings).

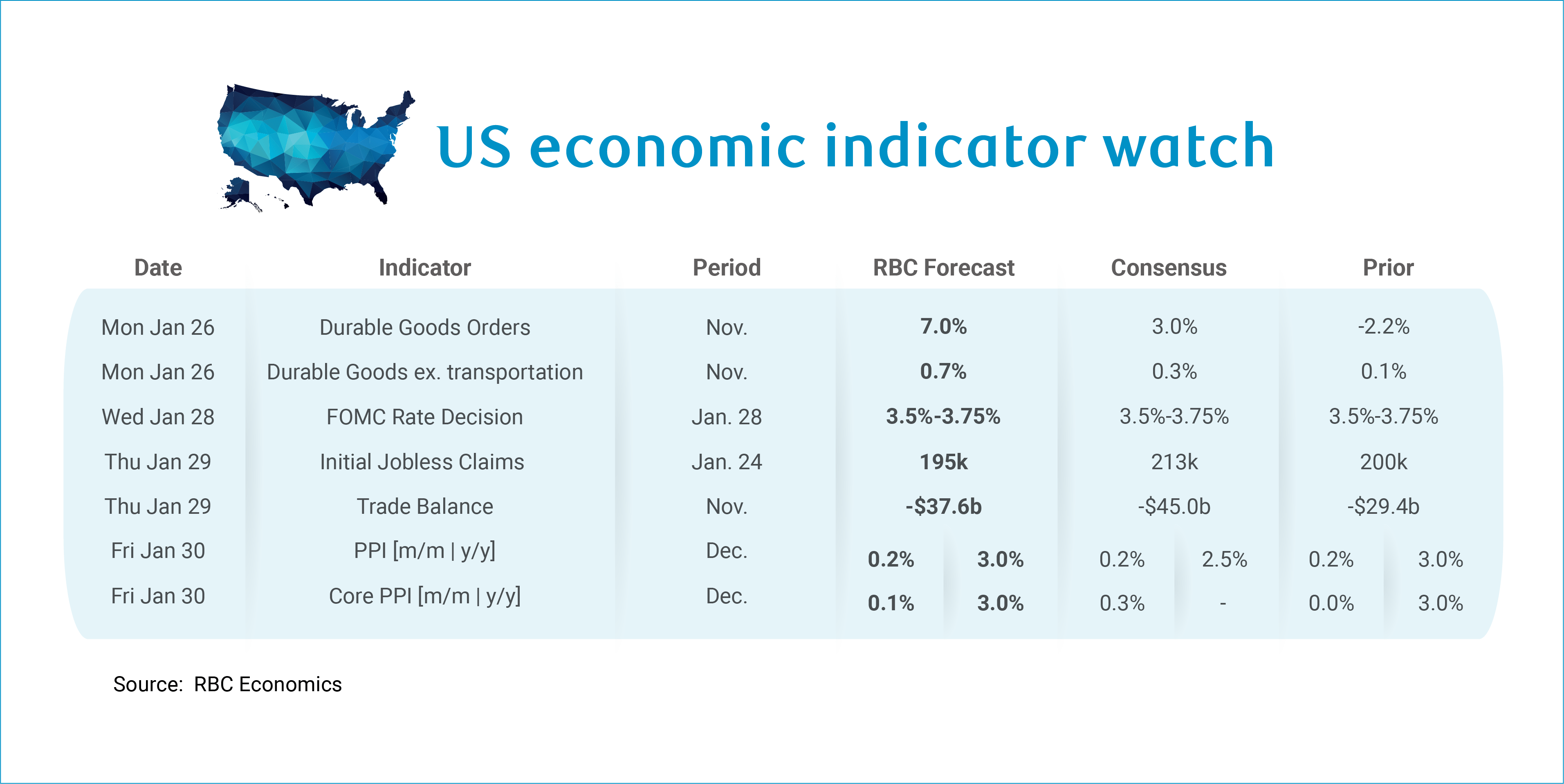

If anything, PPI data matters more in the coming months, however, as it will serve as a precursor to tariff pressures observed in the CPI basket. In fact, while we anticipate core PPI will post a modest +0.1% m/m uptick in December, should the metric come in hotter than expected, this could be more of a market mover than the Fed meeting. We will be paying close attention to wholesale and retail trade margins for signs of tariff passthrough. Another focus will be on medical care services, which bears relatively more weight in the Fed’s preferred PCE measure of inflation. Medical services also represent an increasingly a critical sectors for an aging US population, and a cohort that has increasingly been driving consumption growth.

Aside from the FOMC and PPI data, here is what else we will be watching next week:

-

We expect initial jobless claims will come in slightly lower for the week ending January 24th, at 195k. This is consistent with the labor market stabilization that we are seeing take hold along with seasonal trends, as claims tend to trend lower towards the end of January.

-

Durable goods orders will likely look exceptionally strong, as a massive uptick in Boeing orders in November (after Boeing saw minimal orders in October) will skew the headline figure. Excluding transportation, durable goods orders are still expected to trend meaningfully higher, +0.7% m/m.

-

We have the US trade deficit widening in November to -$37.6 billion. Interestingly, this gap it notably smaller than what we have seen in prior years for the month of November. This is reflective of the massive pull forward of trade activity in H1, as firms rushed to avoid tariffs. Most notably, imports of finished metal shapes (used to manufacture both autos and appliances), pharmaceuticals, and computers and computer parts surged in the first half of 2025 relative to the same time the year prior.

About the Authors

Mike Reid is Director, Head of U.S. Economic Research at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is a Senior Economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

Imri Haggin is an Economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.