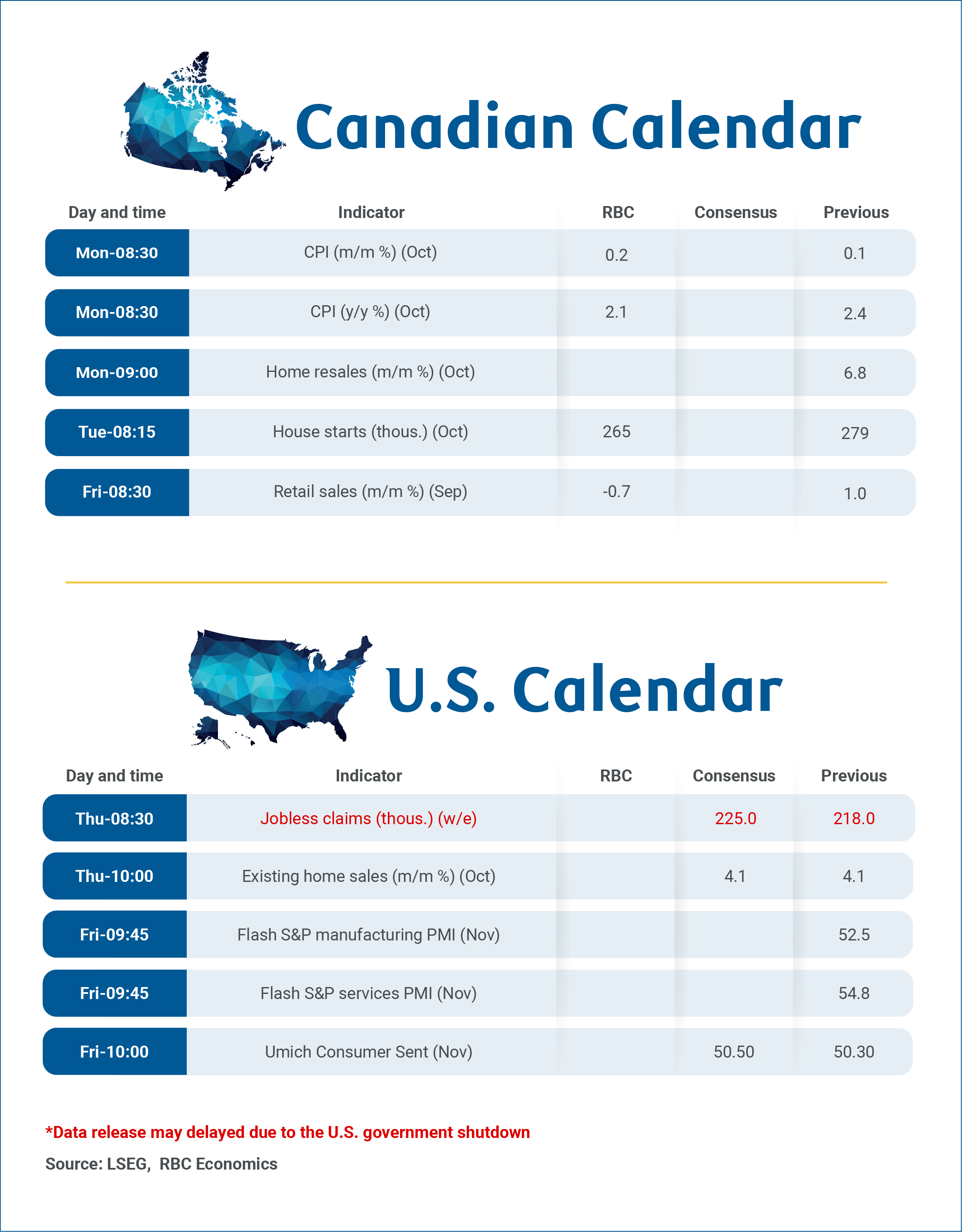

For the week of November 17th, 2025

Canadian consumer prices and spending in focus in the week ahead

Delayed U.S. data releases due to the record long government shutdown could begin to trickle out in the week ahead – including potentially the September nonfarm payroll data that was just days away from release before the government shut down in early October.

Next week’s Canadian economic calendar includes important releases on Canada’s household spending and inflation backdrop. October CPI data will likely be the primary focus, with housing starts and resales also set for release on Monday and September retail sales (and the advance estimate for October) to follow on Friday.

We forecast headline inflation to edge down to a 2.1% year-over-year rate, following last month’s upside surprise. This moderation is expected to be primarily driven by lower gasoline prices, which fell 5% from September. We expect food price growth to hold close to September’s 3.8% annual rate in October. The October data will include the annual update on property tax prices in the CPI data. Significant property tax increases again took effect in some major population centers, but nationally we expect a smaller increase (4%) than the 6% increase in October a year ago.

Headline CPI growth continues to be distorted on the downside by the removal of the cabon tax from energy products in most provinces in April. Broader measures of ‘core’ inflation are expected to remain above the Bank of Canada’s 2% target rate in October. We look for the price growth excluding food and energy products to hold at a 2.4% year-over-year rate. CPI-trim and CPI-median measures should hold around a 3% year-over-year rate.

Statistics Canada’s advance estimate indicates retail sales declined 0.7% month-over-month in September, reversing most of a 1% increase in August. On a quarterly annualized basis, retail sales volume growth likely maintained positive momentum in Q3, albeit at a slower pace than Q2. This also aligns with our own cardholder spending analysis for Q3, which indicates consumer resilience despite ongoing moderation in spending patterns.

Week ahead data watch:

-

We anticipate housing starts will retreat in October following September’s surge. Our forecast stands at 265,000 units, representing a 5% monthly decline that partially reverses September’s 14% increase.

-

Canada’s October home resales report on Monday should show a mixed housing market backdrop across the country, with early market reports pointing to elevated inventories to sales remaining in less affordable markets in B.C. and Ontario but resale increases in other regions.

This report was authored by Assistant Chief Economist Nathan Janzen and Economist Abbey Xu.

Explore the latest from RBC Economics:

Podcast: The 10-Minute Take. Canadian Budget 2025: How should we be thinking about bigger deficits?

The US government shutdown ends, but we still need data

Canada maintains tight immigration policy despite permanent resident exemptions

Share these insights with your network:

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.