Highlights:

-

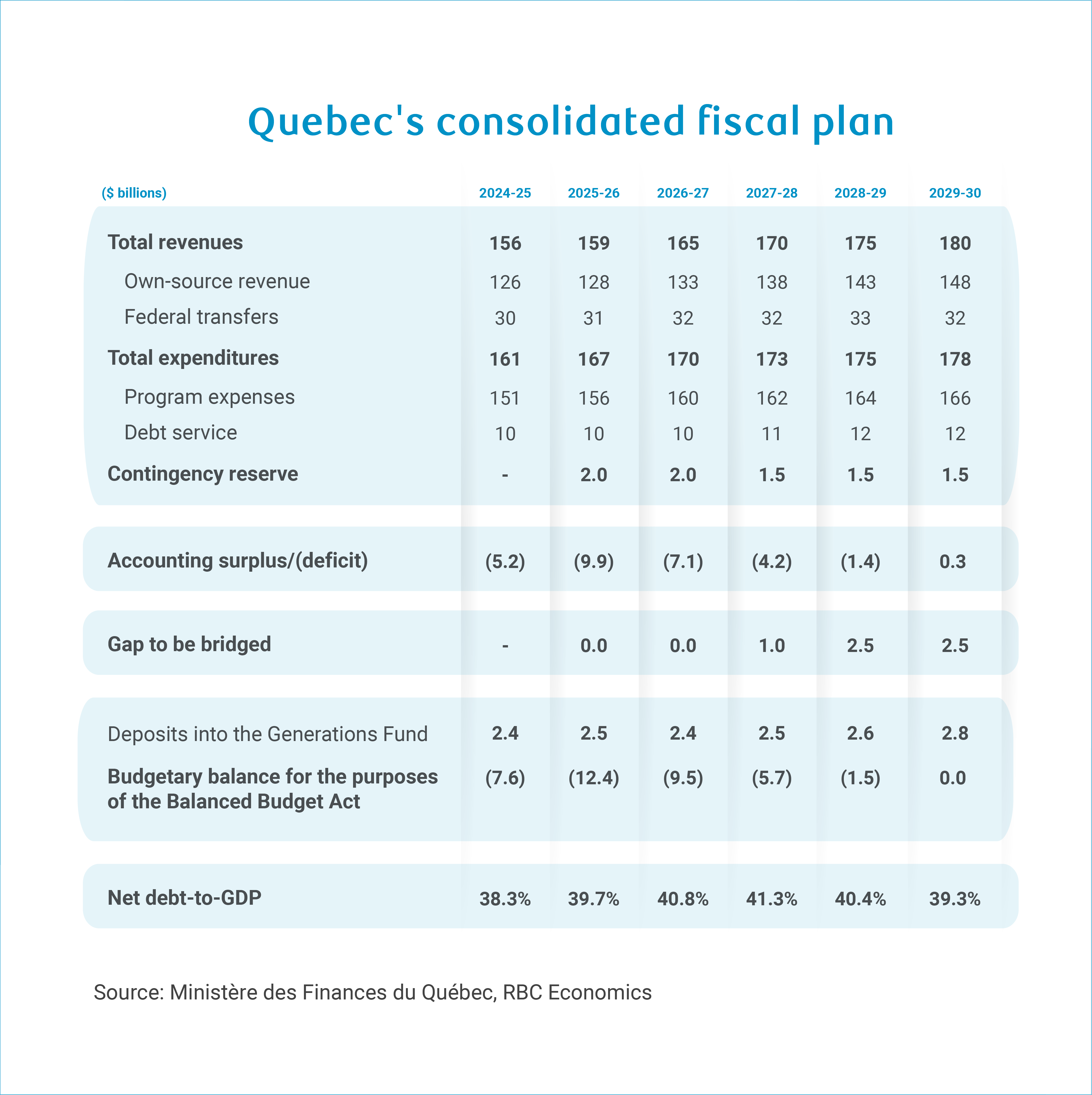

The 2025-26 budgetary shortfall is $1.5B smaller at $12 billion (after deposits to the Generations Fund) than Budget 2025’s projection, but is still more than one and a half times larger than $7.6 billion recorded in 2024-25.

-

Quebec’s legal obligation to balance the budget by 2029-30 hinges on finding a cumulative $6 billion in new revenue and cost savings over the next five years.

-

The fiscal update introduces $8.3 billion in affordability and competitiveness measures over five years, including pension and insurance premium cuts, tax indexation, and $401 million in support for tariff-exposed sectors.

-

Net debt-to-gross domestic product is still on track to peak more than 41% in 2027-28 despite modest near-term improvement arising, in part, from upside surprise to nominal GDP in 2024.

Quebec’s fiscal trajectory is little changed from Budget 2025 despite a better-than-expected handoff from 2024-25. Public accounts in September showed a smaller deficit of $7.6 billion (after deposits to the Generations Fund) last fiscal year than projected in Budget 2025—mainly due to stronger than projected tax revenues.

The government upgraded its 2025 nominal GDP figure as well, supporting a modest $1.5 billion improvement to the deficit for 2025-26. Some of this, however, will be tempered by reduced capital gains revenue. Quebec is following the federal government’s cancelling of the capital gains inclusion rate increase.

The near-term improvement in the province’s bottom line also won’t speed up the planned return to balance. As in Budget 2025, Quebec’s 2025 fall economic update keeps the five-year fiscal plan in deficit until it’s legally obligated to balance the budget in 2029-30. Budgetary balance, however, continues to rely on finding $6 billion in cumulative savings to bridge the gap—adding upside risk to the longer-term deficit profile.

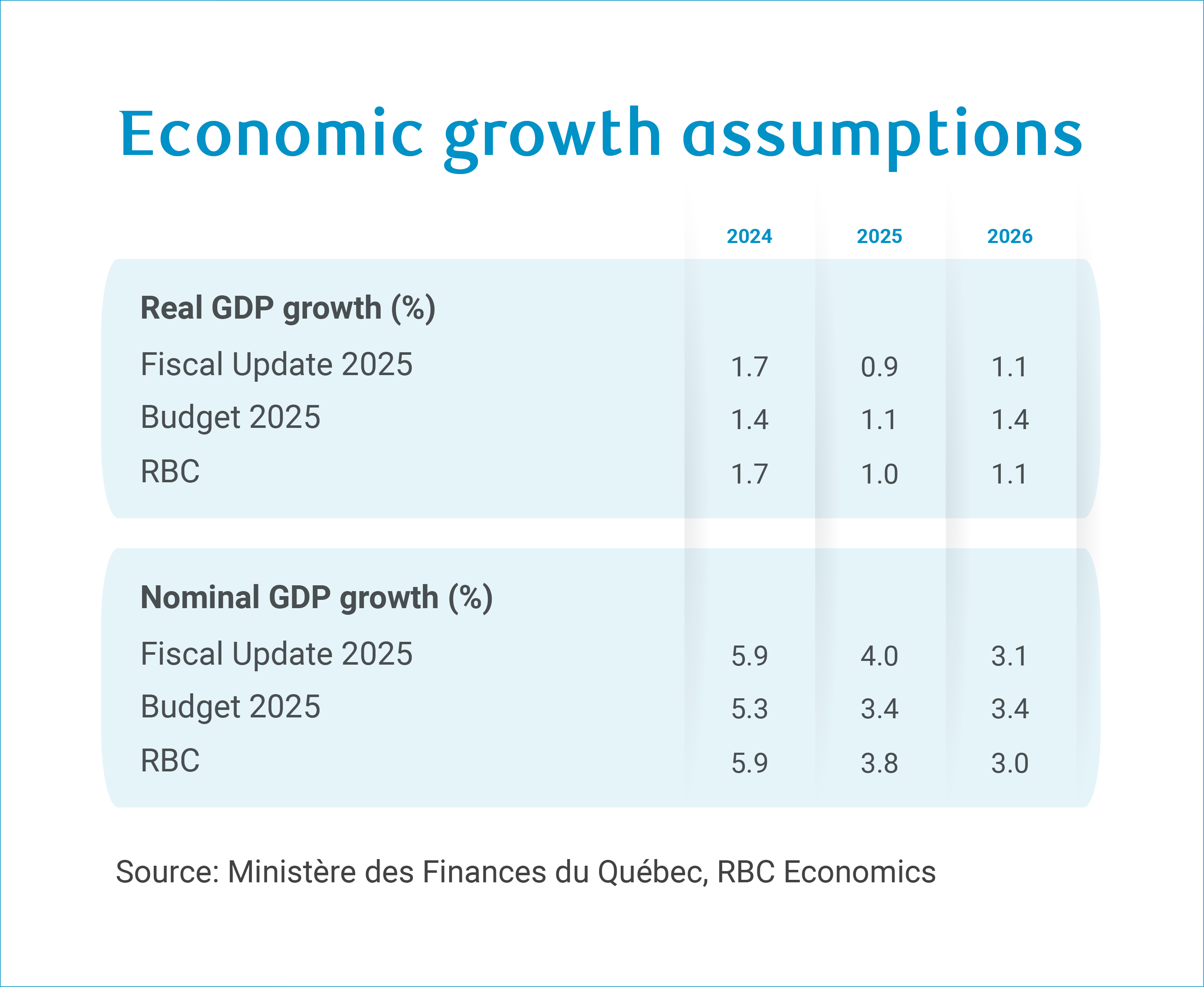

Upward revision to nominal GDP growth supports near-term improvement

Quebec’s nominal GDP growth was revised higher to 4.0% in 2025 – up from the previous 3.4% forecast, reflecting stronger-than-anticipated 2024 performance and resilient wage dynamics to date.

This provides support to the near-term fiscal outlook, though considerable risks loom. The impact of U.S. tariffs thus far has fallen more heavily on Quebec than most other provinces, which if sustained could trigger higher government spending or bring in lower-than-expected revenues.

Targeted affordability and competitiveness measures

The fiscal update introduces $8.3 billion in policy measures over five years aimed at easing financial pressures on households and businesses while bolstering resilience amid trade headwinds.

Nearly $5.9 billion is directed toward affordability measures. This includes a 0.2 percentage point cut to QPP contribution rates, split evenly between employers and employees, and a 13% reduction in Quebec Parental Insurance Plan (QPIP) premiums across both groups, yielding $1.8 billion in support over five years. Indexation of the tax system and social assistance benefits are expected to deliver $4.1 billion over five years, while $59 million targets vulnerable populations through expanded homelessness and social assistance programs.

A further $2.5 billion over five years supports competitiveness through reduced business tax burdens and enhanced capital investment incentives. The government will extend rapid depreciation provisions, enabling businesses to layer provincial benefits with federal measures, and broaden accelerated depreciation eligibility to new investments in buildings used for manufacturing and processing activities ($130 million over five years). Cancellation of the proposed corporate capital gains inclusion rate increase will trim business tax liabilities by nearly $1.1 billion through 2029-30. Reductions to employer social security contributions for QPP and QPIP are also expected to lower business payroll costs ($1.9 billion over five years).

Tariff-exposed sectors receive $401 million in targeted support over five years with particular focus on agriculture, forestry, and fishing industries. Measures include a two-year temporary Health Service Fund payroll tax holiday, and extended tax deferrals for some affected sectors.

Modest improvement to debt burden

Quebec’s stronger-than-expected economic performance has improved its fiscal position. Debt metrics against the size of the economy look slightly better than previously expected, offering a more favourable entry point for the fiscal plan.

Still, the debt burden is on a deteriorating trajectory over the medium-term. The net debt-to-GDP ratio sits at 38.3% in 2024-25—near a two-decade low—but is projected to rise, peaking above 41% in 2027-28 before returning downward, ending at 39.3% in 2029-30.

Quebec’s high debt burden leaves a minimal buffer for downside risks at a time of heightened economic uncertainty across Canada—and especially in Quebec, which shoulders a disproportionate burden of the impact from changing U.S. trade policy.

About the Authors

Rachel Battaglia is an economist at RBC, providing analysis and forecasts for consumer spending trends and provincial economies.

Salim Zanzana is an economist at RBC. He focuses on emerging macroeconomic issues, ranging from trends in the labour market to shifts in the longer-term structural growth of Canada and other global economies.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.