Alberta is on track to be among the top-performing economies in Canada this year and next. Oil production bolstered by the Trans Mountain Expansion Project (TMX) continues to reach record levels, while energy-heavy exports benefit from comparatively lower exposure to U.S. tariffs.

Solid consumer demand supporting spending and housing activity also leave Alberta well-positioned compared to most provinces.

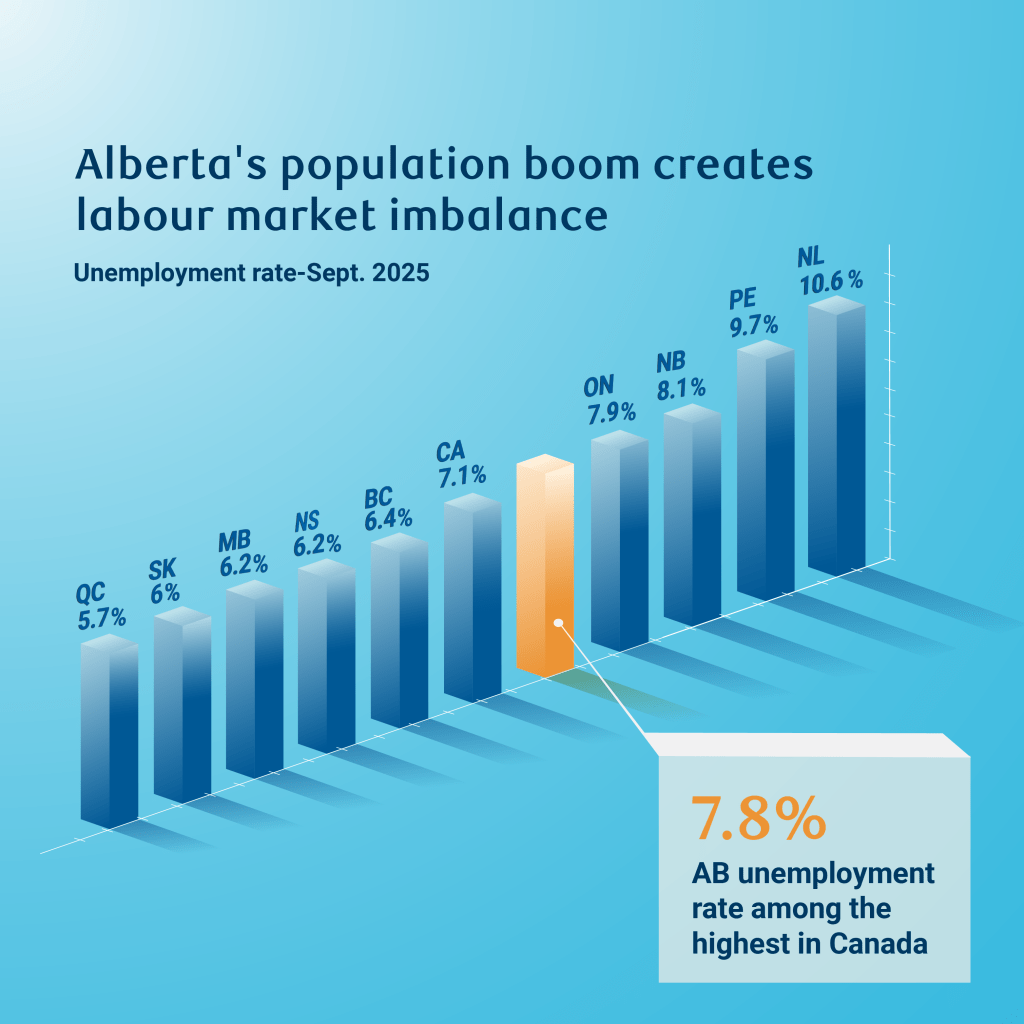

Yet, its unemployment rate has climbed to 7.8%—well above neighboring provinces Saskatchewan (6%) and Manitoba (6.2%), and comparable to the likes of Ontario (7.9%), where there’s greater exposure to U.S. tariffs.

This elevated unemployment rate appears at odds with Alberta’s otherwise resilient economy.

What’s driving the disconnect?

Much of Alberta’s labour market imbalance can be traced to exceptional population growth.

The boom has been a key source of economic momentum, but it has also presented challenges for newcomers looking for work.

Over the past two years, Alberta’s labour force has grown more rapidly than job creation, placing upward pressure on the unemployment rate. This suggests the rising jobless rate could reflect temporary labour market absorption pressures rather than underlying economic weakness.

These pressures are particularly evident among younger workers. The unemployment rate for those aged 15 to 24 has climbed sharply over the past year to 14.7% in September. It’s notable given Alberta has the second-lowest median age in Canada at 38.1 years.

Newcomers—both interprovincial and international—tend to be younger, contributing to elevated unemployment rates within this demographic. This pattern is evident in major cities with Calgary and Edmonton’s unemployment rates at or above 8%. It’s partly driven by sharp increases in youth unemployment rates at 18.3% and 18.5% (seasonally adjusted), respectively.

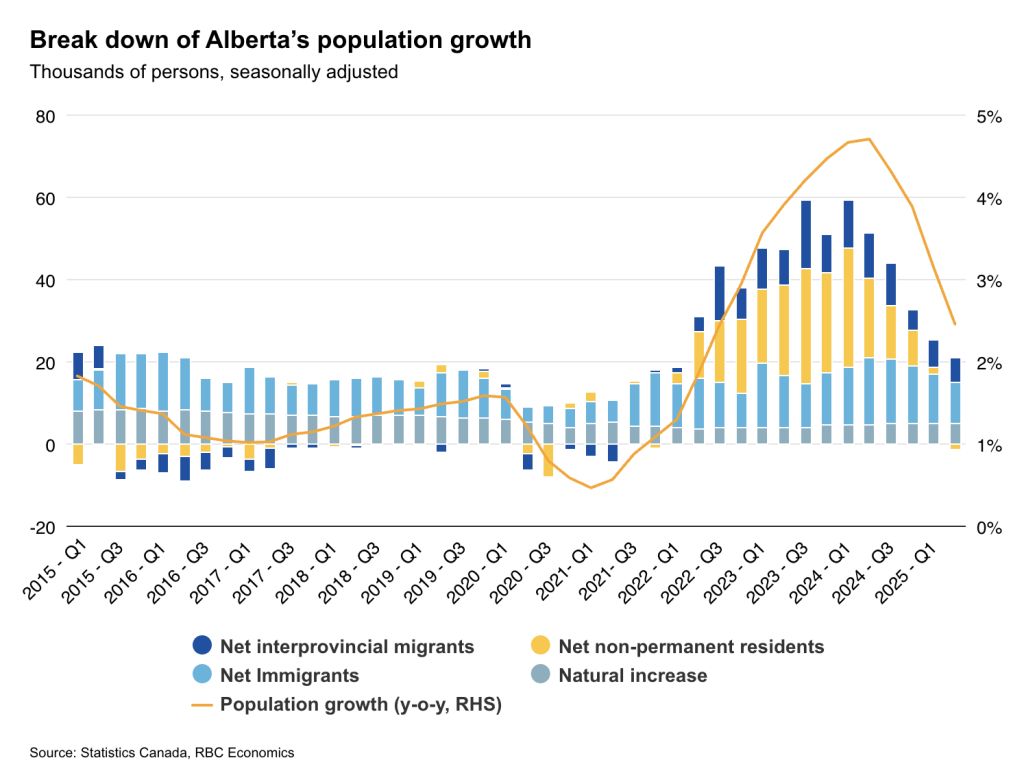

Strong migration flows underpin demographic expansion

The large and rapid influx of mainly young newcomers has also contributed to substantial labour market absorption challenges in Alberta.

The demographic growth reflects a unique combination of factors including major contributions from both international and interprovincial migration.

Net immigration surged to record levels with gains of 54,000 in 2023, and 52,000 in 2024—well above the 39,000 annual average during the five years before the pandemic. The pace has moderated in recent quarters, but it remains significantly above historical norms.

As in other provinces, growth has also been supported by a large influx of net non-permanent residents (NPRs). New federal immigration policies have begun to slow these inflows, but Alberta still added about 22,000 NPRs year-over-year in July, following nearly 174,000 over the two previous years. The province is home to 292,000 NPRs, accounting for roughly 5.8% of its population.

Interprovincial migration has also played a key role. Alberta’s relative affordability advantage continues to attract residents from higher-cost provinces like Ontario and British Columbia. Over the past year, about 28,000 net interprovincial migrants settled in Alberta, building on roughly 88,000 in the preceding two years. Q2 2025 marked Alberta’s 12th consecutive quarter leading the country in interprovincial migration.

Demographic momentum set to moderate amid policy shifts

Alberta continues to outpace its peers in population expansion, but it has slowed to nearly half of the more than 4% pace recorded last year.

The province saw its first net decline in non-permanent residents (seasonally adjusted) in Q2, marking a pivotal shift. Looking ahead, we anticipate further deceleration of in-migrants as new federal immigration targets gradually take effect—particularly among younger cohorts.

Slower population growth should give the labour market more room to adjust. As hiring continues to strengthen with a growing economy, improved absorption will likely ease unemployment pressures.

However, we expect Alberta’s in-migration to remain relatively strong, supported, in part, by sustained interprovincial arrivals, which won’t entirely eliminate absorption challenges for job seekers.

Overall, these trends point to a gradual normalization rather than a reversal of the dynamics supporting Alberta’s population growth. We expect the unemployment rate to decline to 7.1% in 2026, remaining above the national 6.6% average, reflecting ongoing labour market absorption pressures against an otherwise resilient economy.

About the Author

Salim Zanzana is an economist at RBC. He focuses on emerging macroeconomic issues, ranging from trends in the labour market to shifts in the longer-term structural growth of Canada and other global economies.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.