The Bottom Line:

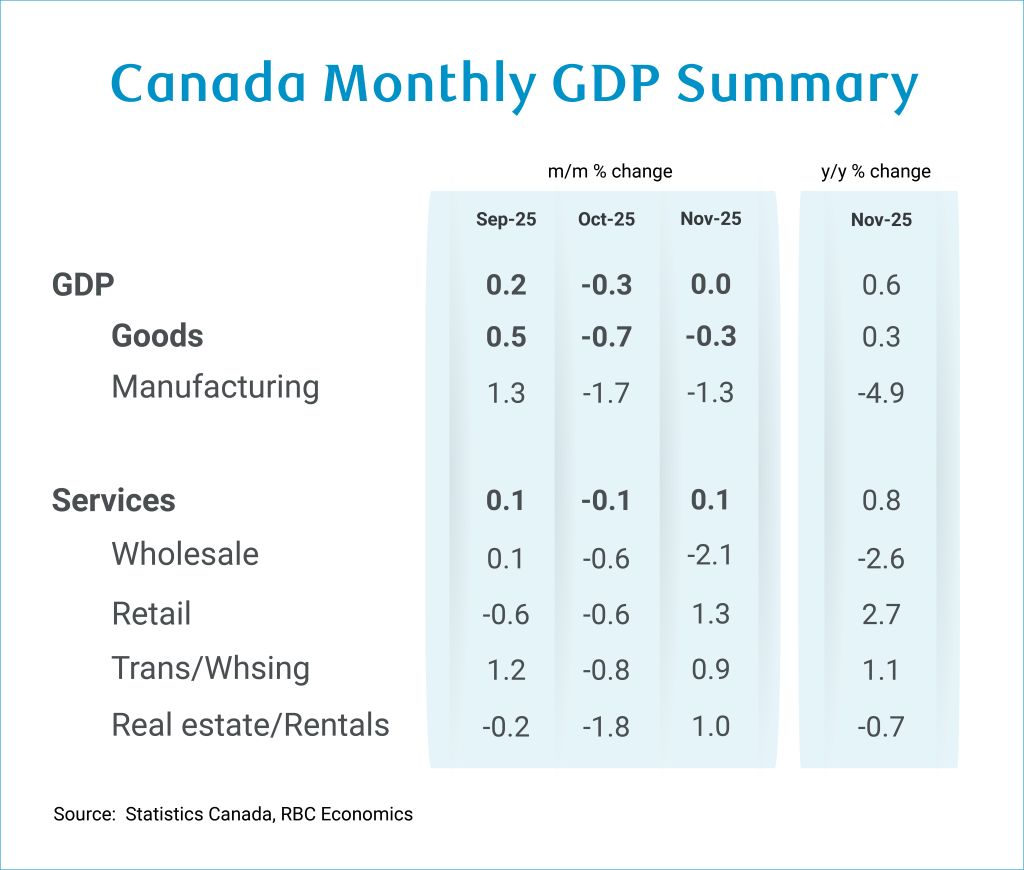

Canada’s economy was muted in November, with real GDP growth coming in flat, slightly lower than both our pre-release expectation and Statistics Canada’s advance estimate for a 0.1% increase.

Output in service producing industries bounced back after a decline tied to labour disruptions in the education and postal service sectors in October. But output in the goods producing sector remained under pressure, tied in part to a large drop in auto production in November reportedly due to temporary chip shortages, but also consistent with sectors heavily trade exposed to trade with the United States continuing to underperform.

The preliminary estimate for December points to a small rebound (+0.1%) with early indicators for December showing strength in manufacturing and wholesale activity partly offset by softer retail spending, weaker home resales, and a partial retracement in hours worked.

Monthly GDP estimates are highly revision prone, but as reported are tracking a -0.5% annualized decline in Q4, below both our current base-case forecast of 0.5% and the Bank of Canada’s flat projection published in the January Monetary Policy Report.

We remain cautiously optimistic that per-person and per-worker economic conditions have begun to improve in Canada, as softer GDP readings are also a function of slowing population growth, and do not expect further interest rate reductions from the Bank of Canada. Softer recent momentum also, though, reinforces that a near-term pivot to interest rate increases won’t be needed. For the Bank of Canada, this subdued growth backdrop supports keeping the policy rate on hold through 2026 as officials balance a fragile output outlook with underlying inflation trends that have still been running slightly above target rates.

The November Details:

-

Real GDP remained little changed (+0%) in November, led by a rebound in services-producing industries (+0.1%), while goods-producing (-0.3%) output continued to contract.

-

Early indicators for December were mixed. Hours worked declined 0.2% month over month, the advance retail sales indicator fell 0.5%, while wholesale and manufacturing sales rose 2.1% and 0.5%, respectively. Taken together, the preliminary monthly GDP estimates are tracking a -0.5% annualized decline in Q4/25 GDP following a 2.6% surge in Q3.

-

Within goods-producing industries, weakness was concentrated in manufacturing (-1.3%) and the agriculture, forestry, fishing and hunting sector (-1.1%). The November Survey of Manufacturing indicated that motor vehicle and parts production recorded some of the largest declines, reflecting ongoing global semiconductor constraints. According to Statistics Canada, the agriculture sector weakness was mainly driven by declining wheat and grain crop production alongside forestry operations hitting record lows due to weak lumber markets and sawmill cutbacks.

-

Other trade-exposed sectors such as transportation and warehousing posted a more than full rebound of 0.9%, as labour disruptions in the postal services sector continued to unwind.

-

Educational services rebounded by 1% following an earlier pullback related to Alberta’s teachers’ strike. Retail trade output rose 1.3% in November, led by holiday shopping and food/beverage retailers recovering from earlier British Columbia work disruptions.

-

Offsetting those gains, wholesale GDP dropped by 2.1%, also impacted by the global semiconductor shortage. The finance and insurance subsector retraced slightly (-0.1%), following five consecutive months of prior growth.

-

Statistics Canada’s advance estimate for December points to GDP growth of 0.1%, driven by gains in manufacturing and wholesale trade, partly offset by declines in mining, quarrying, and oil and gas extraction.

About the Author

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States.

Abbey Xu is an economist at RBC. She is a member of the macroeconomic analysis group, focusing on macroeconomic forecasting models and providing timely analysis and updates on economic trends.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.