The Bottom Line

The tick higher in the headline inflation rate in December largely reflected tax-related distortions. The temporary GST/HST tax holiday a year ago artificially increased measured year-over-year growth in after-tax prices, particularly for after-tax restaurant prices, which jumped to 8.5% above year ago levels in December.

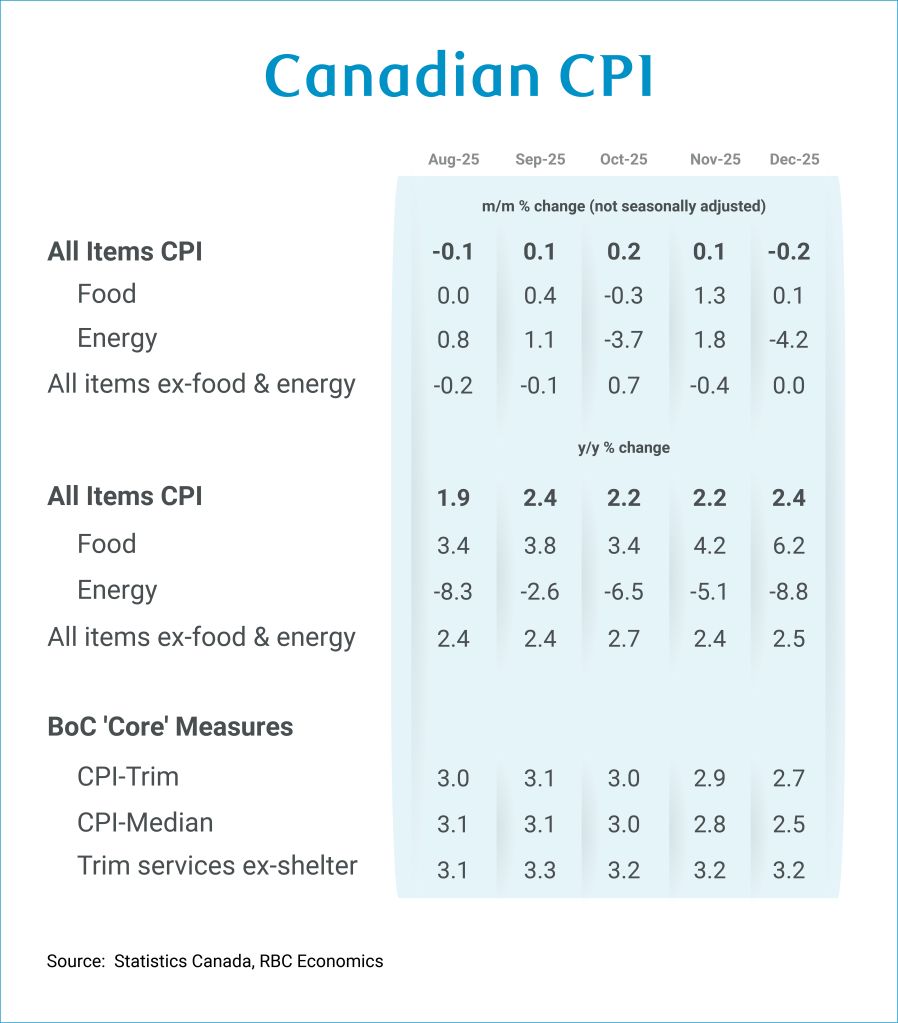

Broader underlying price pressures actually showed signs of easing in December— the BoC’s trim and core CPI measures (which exclude indirect taxes) posted their smallest average month-over-month increase (+0.1%) since February 2024.

Still, current inflation is highly uneven across products.

Energy prices were almost 9% below year-ago levels in December (in part due to the removal of the consumer carbon tax in most provinces in April 2025).

But grocery prices (less impacted by the tax changes a year ago) continued to surge, hitting 5.0% year-over-year in December, led by higher prices for meat (8.5%.)

The rise in food prices will continue to raise concerns about affordability, particularly at the lower end of the income distribution. But there is little the Bank of Canada can do about higher grocery prices, which have been driven by global commodity price trends, and reduced cattle inventories that have been putting upward pressure on meat prices.

The BoC will be encouraged by further signs that inflation is broadly trending back towards the 2 percent target, but the broader economic backdrop has also shown signs of stabilizing with the unemployment rate beginning to edge lower. And interest rates have already been cut to the neutral levels that would not be expected to add to, or subtract from, inflation pressures over time. As long as the economic backdrop shows further signs of improvement, and inflation remains at or above 2% target rates, there is little reason for the BoC to lower interest rates further.

The December details:

-

Headline CPI growth rose to 2.4% in December from 2.2% in November, with the increase largely driven by higher indirect taxes with prior year levels lowered artificially by a temporary GST/HST holiday in place from mid-December 2024 to mid-February 2025.

-

Much of the increase came from a jump in year-over-year restaurant price growth to 8.5% from 3.3% in November—restaurant prices were exempt from GST/HST a year ago during the tax holiday (declined 1.6% year-over-year in December 2024)

-

Still, grocery prices were significantly less impacted by tax distortions and jumped to 5.0% above year-ago levels—the highest rate since October 2023.

-

As in recent months, much of the upward pressure in prices came from higher prices of meat, which have been pushed up in part by reduced North American cattle inventories. Beef price growth actually slowed slightly in December but was still 16.8% on a year-over-year basis.

-

Energy prices continue to provide offset, running below year ago levels, although also in part due to tax distortions (the removal of the consumer carbon tax in most provinces in April 2025.) Energy prices were down 8.8% from a year ago in December.

-

Overall, price growth excluding indirect taxes, price growth slowed from 2.8% in November to 2.5% in December. Excluding food, energy, and indirect taxes, price growth held steady at 2.4% on a year-over-year basis in December.

-

Broader underlying core measures showed further signs of moderation. The BoC’s trim and median measures posted an average 0.1% increase in December—the smallest increase since February 2024. The three-month moving average of the measures fell below a 2% annualized rate for the first time since April 2024, although the 12-month growth rate remained above the BoC’s 2% inflation target.

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.