The Bottom Line:

Rather than signaling a setback, December’s modest employment gain and rising unemployment rate reinforce our view that Canada’s labour market recovery is underway but will likely prove choppy, with slack absorbed only gradually over time.

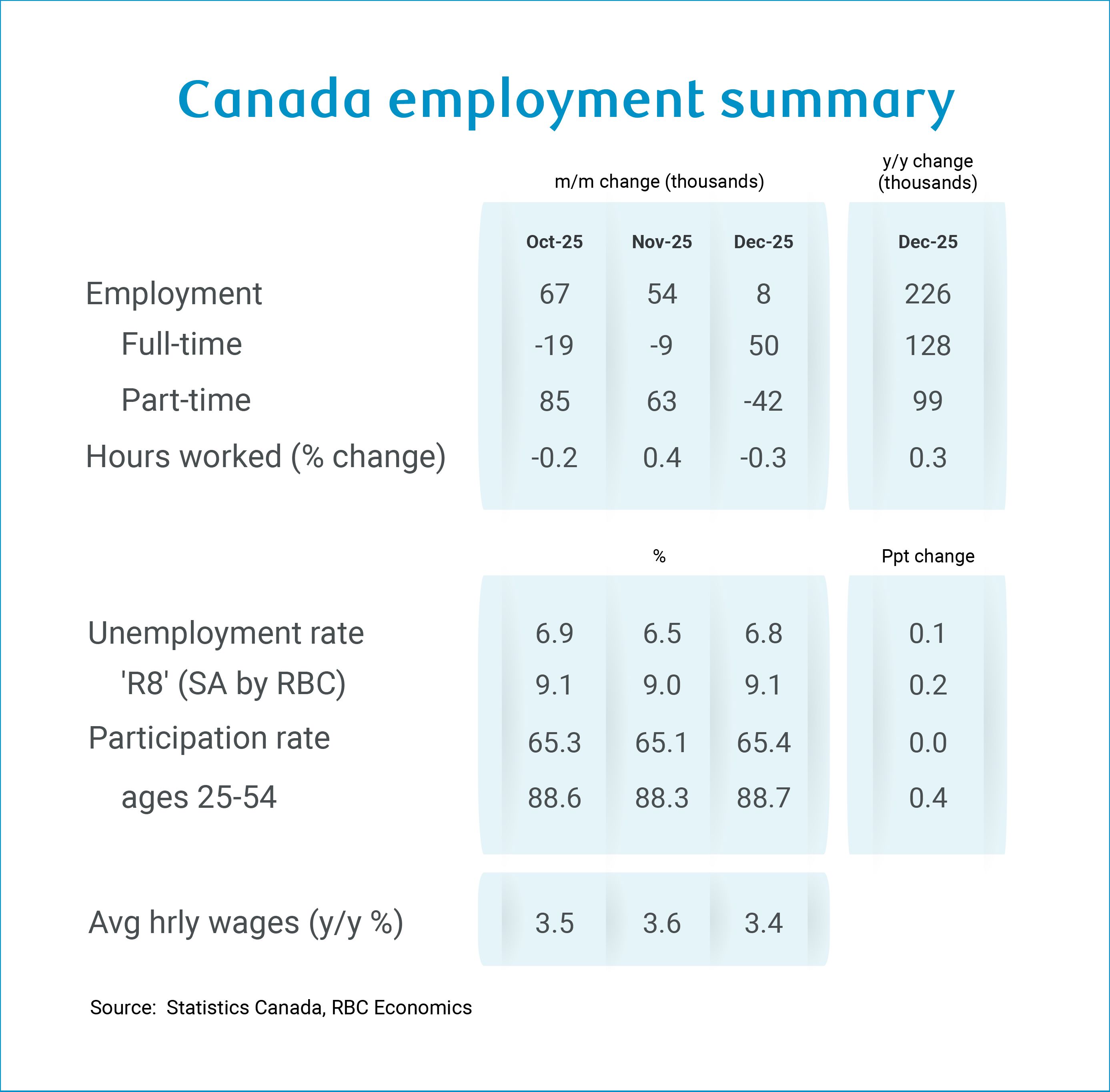

Employment grew by just 8,000 in December, following a robust 181,000 increase over the prior three months. The unemployment rate rose to 6.8% from 6.5%, driven primarily by a jump in the share of the population looking for work rather than an increase in layoffs. Even at 6.8%, the rate remains below October’s 6.9% and September’s recent peak of 7.1%.

Trade-exposed sectors, particularly manufacturing and transport and warehousing, experienced persistent job losses over the summer but showed stabilizing conditions by year-end. In December, combined employment in these two sectors was essentially flat month-over-month and 22,000 above December 2024 levels.

Overall, this report signals gradual improvement in the Canadian labour market backdrop that aligns well with Bank of Canada expectations, and supports their near-term holding bias. We expect the central bank will hold rates steady this year before hiking in 2027.

Data recap/the details:

-

The job gain in December marked the end of a volatile year for Canadian employment marred by uncertainty in international trade policy. Overall, the labour market recorded 226k job growth in 2025, with hiring concentrated towards the end of the year.

-

In December, job growth in public sectors including education services (+11k) and health care (+21k) were offset by losses in other services industries, including finance and insurance (-10k) and professional services (-18k), for example, accounting, legal or engineering services.

-

The unemployment rate ticked higher from 6.5% to 6.8% in December while the labour force participation rate rose sharply from 65.1% to 65.4%. Most of the new entrants into the labour market were not absorbed by new employment, and therefore contributed to rising unemployment rate.

-

Permanent layoffs on a seasonally adjusted basis were little changed in December (-3k), signaling a low-hiring but also low-fire environment in the labour market by end of year 2025.

-

Among different demographics groups, the youth (15–24-year-old) unemployment rate rose by half a percentage point to 13.2% (seasonally adjusted) in December. The less volatile 25–54-year-old, or prime-age unemployment rate rose to 5.9%, below a recent peak of 6.1% in August.

-

Regionally and just like the decline in November, the rise in December’s unemployment rate was fairly broad-based among provinces. Ontario’s unemployment rate rose 0.6 percentage points in December to 7.9%, well above the national average.

-

On a year-over-year basis, all provinces except Nova Scotia posted an increase in their employment levels despite a tumultuous year.

-

Hours worked contracted 0.3% in December. On a quarterly annualized basis, total hours worked fell 0.6% in Q4, below our tracking of GDP growth for a 0.5% increase in the same quarter.

-

Wage growth eased slightly from 3.6% in November to a still elevated 3.4% in December.

-

Population growth in December(+10k) was the smallest increase since December 2020 and the second smallest increase dating back to 1976. In the coming year, we expect the pace will keep slowing as government’s policy pivot limits immigration inflows.

About the Author

Claire Fan is a Senior Economist at RBC. She focuses on macroeconomic analysis and is responsible for projecting key indicators including GDP, employment and inflation for Canada and the US.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.