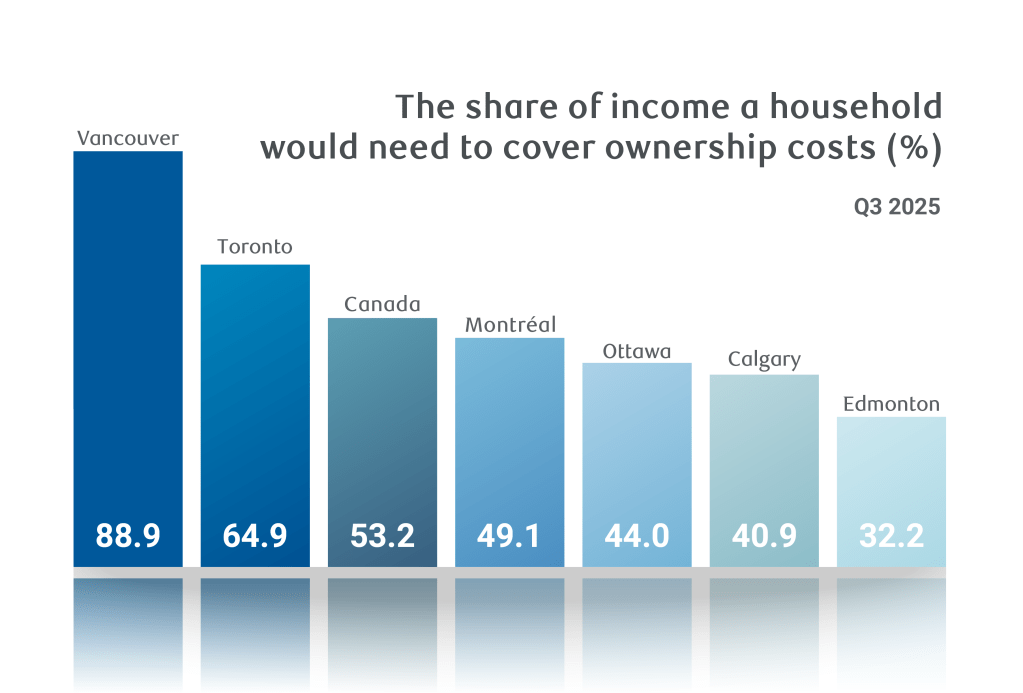

Ownership costs eased for the seventh straight quarter. RBC’s national aggregate affordability measure improved to 53.2% in Q3 2025 from an all-time high of 63.5% in 2023.

The latest gain, however, is the slimmest this cycle. Steady mortgage rates held the decline in the RBC measure to just 0.4 percentage points, or less than a quarter of the average 1.7 ppt drop in the prior six quarters. A dip in the measure represents an increase in affordability.

Improvement is concentrated in a few markets. Vancouver and Toronto—where prices have been falling this year—account for most of the national measure’s decline. Victoria, Halifax and Saint John also recorded better conditions in Q3. All other markets we track saw little or slightly unfavourable changes.

Further gains are poised to be incremental. We see improvement slowing with the Bank of Canada likely on hold through 2026. This would leave only easing prices in certain markets, and sustained household income growth to lighten the ownership cost load.

Progress so far is material but still comes short

Series of interest rate cuts since mid-2024 and falling prices in parts of the country have significantly lowered ownership costs in the past seven quarters.

But, they’ve only partly reversed the historic spike from soaring prices during the pandemic, and the central bank’s aggressive rate hike campaign to fight inflation.

This is true coast to coast. Buyers in every corner of the country still find it less affordable to own a home today than before the pandemic.

Vancouver and Victoria have deteriorated most. Respective mortgage carrying costs continue to be 24 percentage points and 19 percentage points higher than Q4 2019 as a share of household income despite declining significantly from peak levels in 2023.

Windsor, Halifax, Trois-Rivières and Montreal follow with shares still up 13 to 15 percentage points.

Toronto has seen a two-thirds reversal of its pandemic surge—biggest turnaround of any market—though the current ratio continues to stand some 8 percentage points above (hefty) Q4 2019 levels.

Saskatoon, Edmonton and St. Johns are closest to where they were before the pandemic, up about 5 percentage points.

It’s no surprise many prospective buyers remain hesitant. They have yet to see a full reversal of the earlier massive loss of purchasing power.

End of recuperation phase is near

Good news is we anticipate more progress ahead. Ongoing price corrections in select markets, and sustained (albeit slowing) income growth will continue to restore purchasing power.

That said, we’re likely approaching the end of the recuperation phase. In fact, it may have already been reached in parts of the country. Steady expected interest rates will mute a significant source of ownership cost reduction.

Further meaningful advancement would require steeper price declines or more robust income increases—neither of which seem likely under our base case forecasts, and housing scenarios for 2026 and 2027.

Victoria – Prices ease but affordability still third worst

Cost of owning a home continues to ease in Victoria, but remains very steep for an average buyer.

RBC’s aggregate affordability measure fell 1.1 percentage points to 67.9% in Q3—still third worst among the markets we track.

More inventory has given buyers increased leverage in negotiating prices. And, home values have softened as a result.

However, it has yet to boost activity in a significant way. Home resales increased only 1.6% so far this year with little momentum since summer.

We expect prices will continue drifting lower amid intense affordability pressures.

Vancouver – Most improved among tracked markets

Falling prices are helping to turn around Vancouver’s strained affordability picture. They’ve contributed to it achieving the biggest improvement in the past year among tracked markets.

Still, ownership costs represent nearly 68% of an average household’s income, remaining extremely challenging for buyers.

Trade war-related uncertainty has added further complications. End result has been a bumpy recovery in transactions this year.

We see little that would spur buyers into brisker action. More abundant inventory is giving them more choice, and a longer time to make decisions.

Sellers will be compelled to lower prices further to get deals done.

Calgary – Affordability close to long-run average

Calgary has been in a holding pattern by some key measures. Resales have barely budged since spring, and RBC’s gauge of affordability remained unchanged between Q2 and Q3.

But, other signs point to growing supply as homebuilders complete new units, and there’s weakening home values.

Earlier declines have largely normalized affordability. The share of a household’s income needed to cover the cost of owning a home at today’s price, at 40.9%, is just a touch higher than the long-run average (39.2%).

Further improvement could arise, while robust construction continues to boost supply and drive prices lower.

Edmonton – Ownership costs declining since spring 2024

Edmonton has lost the solid momentum it had last year. Resales are down 5.4% so far this year with the monthly trajectory remaining largely flat since spring.

This isn’t to say activity is soft, though. Transactions this fall were still running close to 60% above pre-pandemic levels.

A favourable affordability picture keeps buyers engaged. RBC’s aggregate affordability measure stood at 32.3% in Q3, aligning with historical norms after consistent declines since spring 2024.

Prospects for buyers appear more positive as earlier supply-demand tightness has eased materially, and price appreciation moderates.

Saskatoon – Strong migration flows sustain market

Saskatoon buyers and sellers have taken trade war uncertainty in stride, and forged ahead with making deals this year. The number of homes changing hands has grown 2% to date, standing out for its vigour in Western Canada.

Still-strong migration flows and manageable ownership expenses sustain steady buyer interest.

RBC’s aggregate affordability measure inched slightly higher to 32.1% in Q3, though it remains very close to the long-term average.

Ongoing supply-demand tightness, however, is poised to keep home values appreciating firmly in the near term.

Regina – Best affordability among all markets

Regina isn’t letting up and remains among the hotter ones in the country. Resales hover near record levels and home values are on a solid upward trajectory.

Buyers benefit from the best affordability among the markets we track with RBC’s aggregate measure at 26.4%. Conditions even improved marginally in Q3 with a 0.2 percentage point decrease.

Supply is short, given strong demand, likely supporting further price gains, while potentially eroding affordability.

Winnipeg – Stable demand and steady momentum

Activity in Winnipeg maintains steady momentum amid strong in-migration (until recently), and affordability that compares well to most other major markets.

Resales this year are on pace to be the strongest since 2021.

Home values continue to appreciate rapidly, reflecting constrained supply and stable demand fundamentals.

RBC’s aggregate affordability measure (32.1%) is significantly better than the national average (53.2%), and only slightly worse than the long-term average (29.4%).

However, it may not improve much ahead as we see limited buyer options driving up prices.

Toronto – Ownership costs fall the most

Toronto is struggling to get back in gear after the trade war derailed a budding recovery earlier this year.

Ownership costs continue to drop—falling the most in Q3 among tracked markets—though this has yet to energize buyers in a material way.

Affordability remains extremely strained despite significant improvement since early-2024. RBC’s aggregate measure (64.9%) still suggests only a small minority of households could afford owning a home—far worse than before the pandemic.

The market’s struggles also partly reflect dimmed job prospects with the region’s unemployment rate reaching a four-year high of 9% this summer, and more abundant inventory gives buyers more time to decide.

We see these factors continuing to pressure home values lower in the near term.

Ottawa – Rising values slightly erode affordability

Ottawa is experiencing a market recovery. However, it’s gradual and uneven with resales increasing in only five of the first 11 months of this year.

Supply and demand are generally balanced and support moderate price increases—in contrast with most other Ontario markets.

Rising home values contributed to a slight erosion of affordability in Q3. RBC’s aggregate measure inched 0.2 percentage points higher to 44%. It indicates buyers are facing more strenuous conditions than historically, given it’s markedly above the long-run average of 36.5%.

We expect growing inventory will dampen home value appreciation ahead.

Montreal – Affordability may be stretching buyers’ limits

Sustained tight supply and demand has kept property prices on a solid upward trajectory in Montreal this year.

The downside is it’s now making it harder to carry costs of owning a home. RBC’s aggregate affordability measure rose 0.5 percentage point to 49.1% in Q3—second increase in the past year.

For now, buyers seem pressed to act quickly amid still low inventory. Missing out on an opportunity could leave them with fewer and more expensive options.

But, the fervour could fade if affordability deteriorates further. RBC’s measure sits more than 10 percentage points above its historical average, suggesting current conditions may already be stretching buyers’ limit.

Quebec City – Ownership costs rise the most

Quebec City stands out this year, outpacing all other tracked markets in price appreciation and inventory reduction.

Demand has stayed strong despite increasing ownership costs. RBC’s aggregate affordability measure rose the most among tracked markets in Q3—by 0.6 percentage points—and is one of only two that show a deterioration from a year ago.

Still, at 34.8%, it compares favourably to Montreal and other major Canadian centres. This position no doubt keeps buyers engaged.

We expect low supply to demand continuing to sustain solid home value gains ahead.

Saint John – Moderating price gains help lower ownership costs

Sales recovery in Saint John has demonstrated durability amid trade uncertainty this year, tracking roughly 9% ahead of last year.

But, earlier rapid price increases have moderated. This has helped lower ownership costs in Q3.

RBC’s aggregate affordability measure eased by 0.3 percentage points in the latest period to 31.5%—still among the best among the markets we monitor.

We see headwinds ahead as migration to the area slows, but tight supply to demand is poised to maintain support for prices near term.

Halifax – Affordability continues to be strained

Buyers in Halifax are staying cautious in uncertain economic times. Resales to date are effectively unchanged from a year ago.

Prudence could also reflect elevated prices butting against the limits prospective buyers can afford. Halifax’s aggregate measure of affordability continues to be historically high at 41.7% despite easing in the past year, including in Q3.

We think strains are likely to persist. Low supply to demand raises odds of further price gains, while a soft economy is poised to contain household income growth.

St. John’s – Market momentum raises ownership costs

St. Johns is very active supported by the lowest ownership costs east of Saskatchewan, solid—albeit easing—population growth, and a relatively robust labour market.

Rapid home value increases have yet to deter buyers. But, those gains made it slightly less affordable to own a home in Q3. RBC’s aggregate measure rose 0.5 percentage point last quarter to 28.8%.

It would likely take a much more sizable deterioration to stall momentum. Existing residential sales are on track to increase more than 8% from last year.

However, we expect affordability to erode only modestly as price appreciation remains contained amid firm, but steady supply-demand conditions.

Read the full Housing Trends and Affordability report for extensive market-by-market analysis.

Robert Hogue is an Assistant Chief Economist, responsible for providing analysis and forecasts on the Canadian housing market and provincial economies.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.