The Bottom Line:

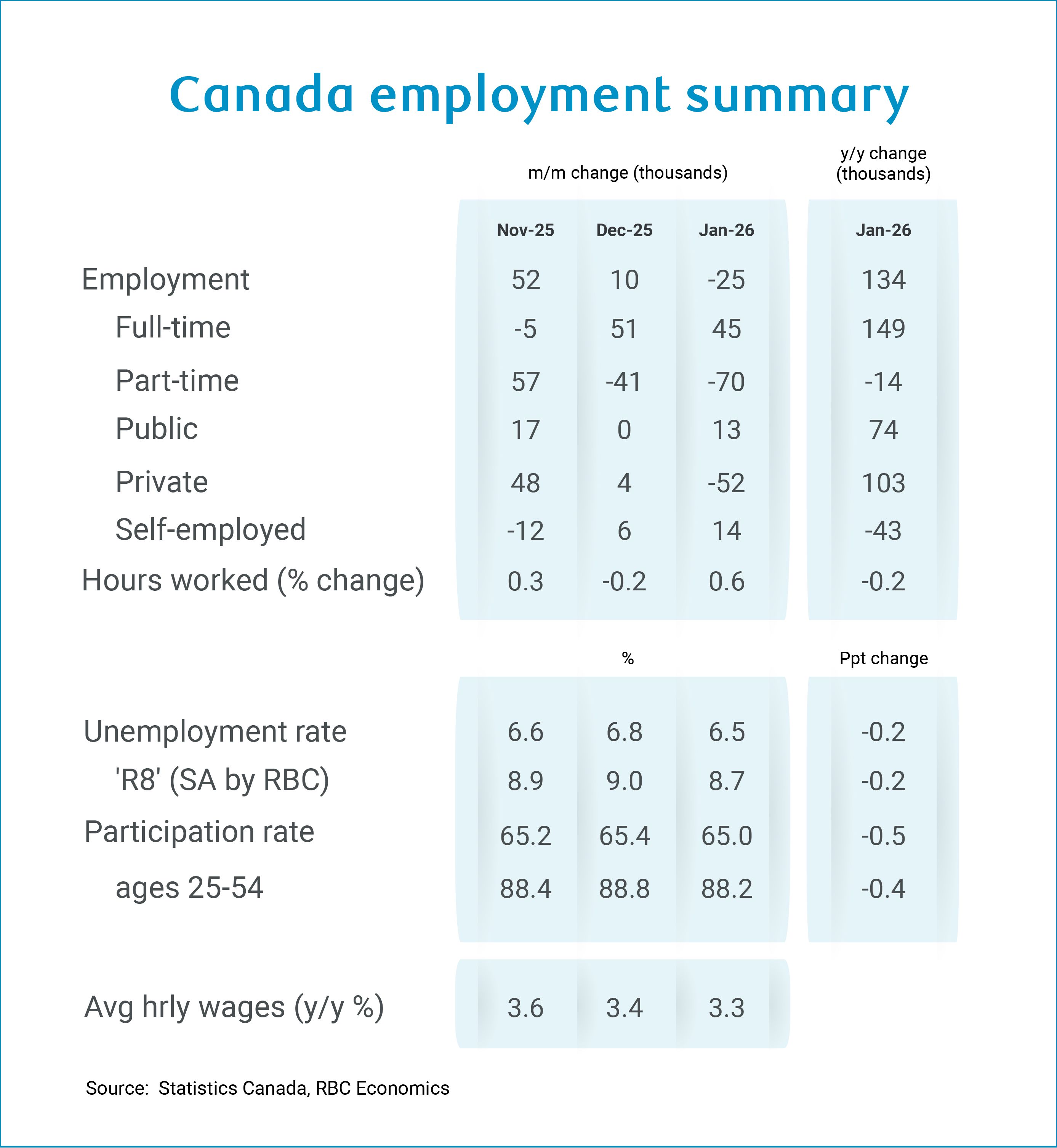

The details of the first Canadian employment report for 2026 were mixed, but broadly point to further signs of improvement in (per-worker) labour market conditions.

A 25k pull-back in employment was the first decline since August, and concentrated in a pull-back in the heavily trade exposed manufacturing sector. But full-time employment and total hours worked rose and a larger drop in the labour force pushed the unemployment rate down to 6.5% — well-below market expectations for a 6.8% reading.

The Canadian labour market data is notoriously volatile and the large drop in the January labour force participation rate is unlikely to be sustained, raising the odds that the unemployment rate will reverse some of this improvement in coming months.

However, there was also little indication that the decline in labour force participation was driven by worker discouragement — Statistics Canada noted that just 0.3% of labour force nonparticipants reported discouragement as a reason for not looking for work, and the alternative R8 unemployment rate (which controls for marginally attached workers as well as those working par-time when they would prefer full-time work) also declined.

We also continue to expect a significant shift in the underlying structural drivers of labour force growth — unprecedented pause in population growth and the continued aging of the population — mean that the combination of softer looking employment growth driving larger-than-usual declines in the unemployment rate will be a persistent feature in 2026 labour market data (read more here)

We remain cautiously optimistic that an improving per-person GDP growth backdrop in the year ahead will be enough to push the unemployment rate broadly lower in 2026. We do not expect further interest rate reductions from the Bank of Canada will be necessary, but also do not expect a pivot to rate hikes until 2027.

The January details:

-

The 25k drop in employment was the first decline since August following a 10k increase in December and 52k rise in November.

-

Details behind the employment drop were mixed – full-time employment rose by 45k with part-time jobs down 70k. Total hours worked rose 0.6%

-

Heavily trade exposed sectors continue to underperform – manufacturing employment plunged by 28k, and were down 51k (-2.7%) from a year ago.

-

The unemployment rate, though, fell to 6.5%, the lowest rate since September 2024 and more than retracing a 0.2 ppt increase to 6.8% in December as the labour force plunged by a whopping 119k to retrace a 78k jump in December.

-

Population growth posted its smallest increase on record (+5k) in January, and is likely to shift to outright declines in coming months, but the labour force participation rate also fell by 0.4 ppts.

-

The drop in labour force itself is not good news, but there was little evidence that a surge in discouraged workers giving up their job search was behind the decline.

-

Statistics Canada noted that just 0.3% of those not participating in labour markets were discouraged job seekers, and the alternative R8 unemployment rate (which accounts for workers who are not searching due to discouragement, and also those working part-time when they would prefer full-time work) also declined in January.

-

The decline in the unemployment rate was reflected across most provinces in January. In Ontario, the decline reflected employment losses in manufacturing that were more than offset by a decline in the number of individuals looking for work (particularly among youth aged 15-24), contributing to a drop in the labour participation rate to 64.4%-the lowest since January 2021.

-

Wage growth continued to edge lower, ticking down to 3.3% in January from 3.4% in December. Most business surveys suggest wage growth will continue to edge lower — the unemployment rate has begun to edge lower, but remains elevated at levels consistent with slowing wage growth.

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.