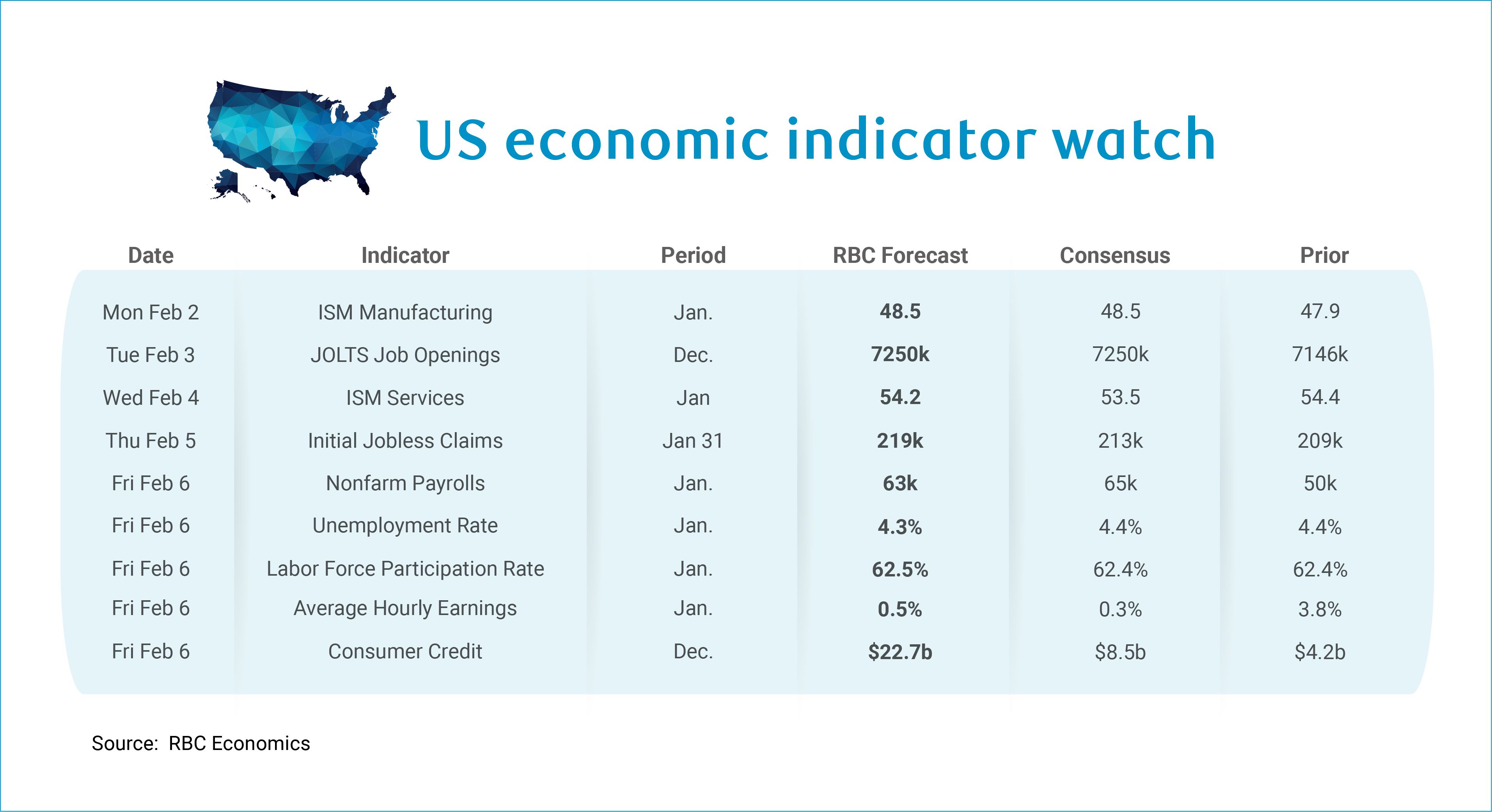

Next week, we are slated to get more labor market data that we expect will signal continued steadying. We forecast the January employment report will show that 63k jobs were added to payrolls – this would mark the third consecutive month that payroll growth comes in above our estimate of breakeven employment of 40k. Pairing this relatively healthy clip of employment growth with initial jobless claims data that points to unseasonably low layoffs and rebound in job posting activity, the evidence suggest that the labor market continued to stabilize in January. In this vein, we expect to see that the unemployment rate likely ticked down to 4.3% following the decline in December. As has consistently been the case in recent months, the bulk of hiring in January is likely to be structural – we expect to see health care hiring account for around half of the monthly gain. Meanwhile, trade-exposed sectors continue to experience weaker growth – the manufacturing sector has shed -72k jobs since Liberation Day. Still, leisure and hospitality has continued to be a bright spot as discretionary services consumption is supported by high-income consumers who continue to spend at a healthy clip.

Perhaps more interesting than the employment report itself will be the QCEW benchmark revisions, which are also set to be released next Friday. The preliminary benchmark revisions in September suggest that average monthly job gains were running ~76K lower than initially reported. The final benchmark revisions are expected to be similarly large in magnitude and have been cited by Chair Powell in prior meetings. The revisions are likely to result in an even lower estimate of breakeven employment than we previously estimated (it’s important to point out that the unemployment rate will not be revised as it is calculated using a different data set). But we will be less focused on the number itself and more focused on which sectors post the most sizeable revisions. We do not expect to see meaningful changes in health care but could see significant revisions in trade-exposed sectors resulting from the shift in hiring activity following the Liberation Day announcements. This will also have meaningful implications for US productivity. Because GDP growth is not impacted by these revisions, if we see sizable downward revisions to employment in the manufacturing sector, this will mechanically boost productivity (output per worker) in the sector.

We are also watching the progress in DC to address the imminent partial government shutdown. At the time of writing, the Department of Labor (which includes the Bureau of Labor Statistics) has yet to secure funding, and should a partial government shutdown occur, we risk not getting JOLTS data, initial jobless claims, the employment report, or QCEW benchmark revisions next week.

Here’s what else we’re watching next week:

-

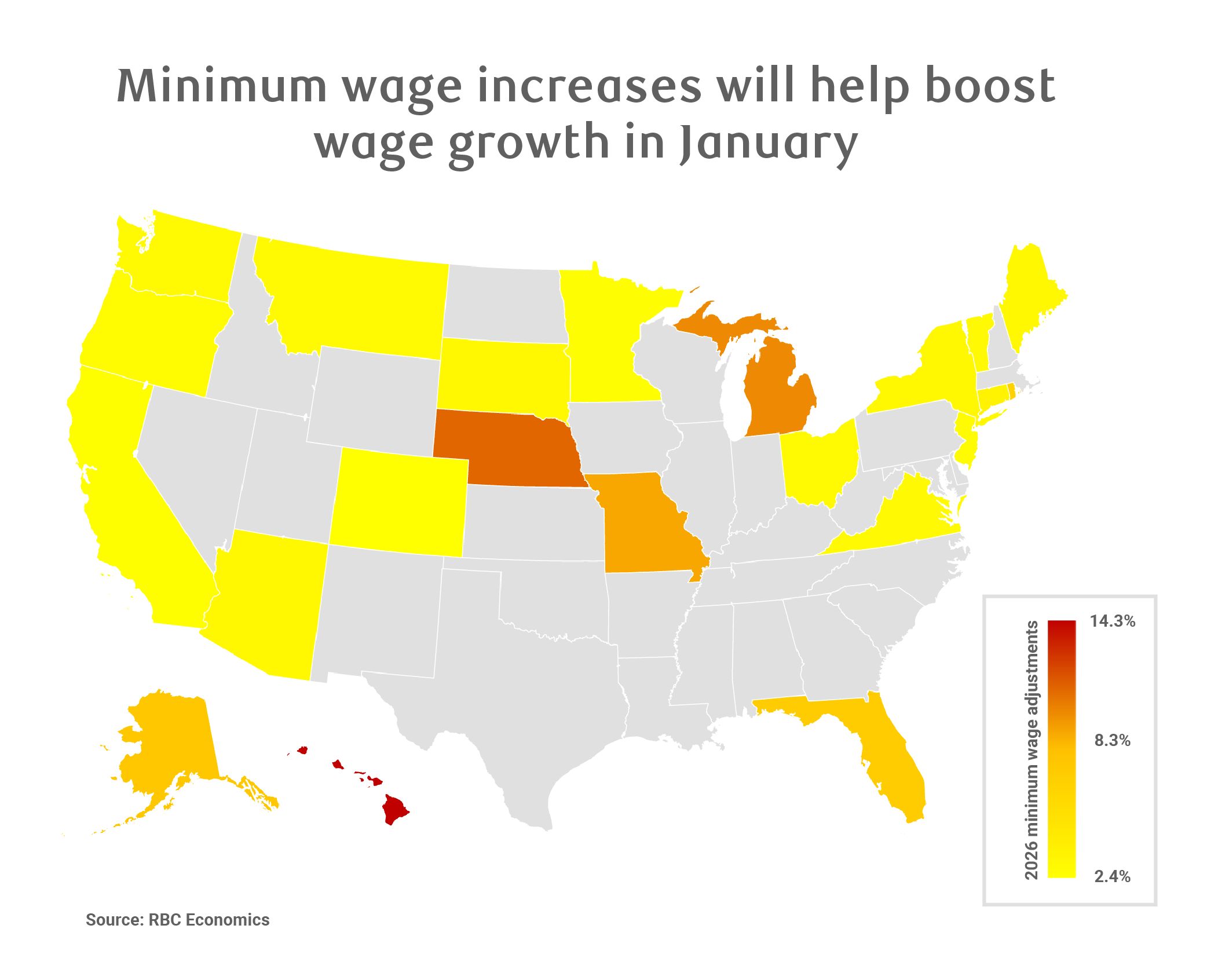

We expect to see a notable uptick in average hourly earnings (+0.5% m/m) as 19 US states hiked their minimum wage in January. An additional 3 states are set to hike the minimum wage later in 2026. End of year pay increases should also help boost wage growth in January.

-

The ISM Manufacturing index likely improved slightly – though we do not expect the reading to emerge from contraction territory. Five regional Fed manufacturing surveys showed improvement but two sizable regions in the South (Richmond and Texas) reported negative prints. More interesting will be the prices paid indices, which we continue to monitor for signs of tariff passthrough.

-

ISM Services is expected to show a modest decline from last month, though we expect it will remain in expansionary territory. Three regional Fed services surveys pointed to a slowdown in activity.

-

JOLTS data for December is stale but we expect it will show up an uptick in job openings to 7250k. The December Indeed Job Postings Index improved by 1.6ppts from the prior month.

-

This week, our model suggests we will see initial jobless claims tick up slightly to a still-low 219k in the week ending Jan 31st. Initial Jobless Claims have continued to trend sideways with, surprisingly, no uptick in the aftermath of the holiday hiring season. Stable continued claims data continues to suggest that the labor market weakness likely came to a head last summer, which is in line with our view that the unemployment rate will stabilize in 2026.

-

We expect to see a $22.7b surge in consumer credit for December. Following a strong retail sales report in November, we did not see a proportionate credit increase in the November credit report. Consumers (specifically lower and middle-income earners) are increasingly reliant on credit utilization to fuel consumption, and we expect that this was especially true over the holiday shopping period.

Mike Reid is Head of U.S. Economics at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is a Senior US Economist at RBC Capital Markets. Carrie is responsible for projecting key US indicators including GDP, employment, consumer spending and inflation for the US. She also contributes to commentary surrounding the US economic backdrop which she delivers to clients through publications, presentations, and the media.

Imri Haggin is an Economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.