The Federal Reserve kept rates unchanged today, as expected, and upgraded its assessment of the economy and job market while continuing to highlight that inflation remains elevated. It was largely what markets already knew to be true and thus more of a mark-to-market event than a provision of more information. And yet, while the meeting may have appeared to be a nonevent on the surface, there are three key stories associated with their decision that deserve focus. Indeed, it bolsters our view that in 2026, the Federal Reserve is likely to remain on the sidelines.

Uncertainty is still significant – for markets and policymakers

While markets may be growing accustomed to uncertainty, this persistent fog over both the current state of the economy as well as its outlook renders policymaking increasingly more challenging. Driving the uncertainty: absent or partial data for Q4 following the government shutdown, a lack of clarity over tariff policy (from both new tariffs and pending court rulings), and the upcoming transition of Fed leadership. The rising odds of another government shutdown beginning Feb 1st certainly won’t help.

In our view, while a pause is justified by the underlying data, it’s also consistent with Chair Powell’s own October comments: “What do you do if you are driving in a fog? You slow down.” Slow down the Fed has.

In particular, the true pace of US inflation (one side of the Fed’s dual mandate) in Q4 is a particular question market. Recall that:

-

The November CPI report seemed like a gift for doves. It was primarily driven by a reprieve in housing pressures but could be sending a muddied signal given the necessary tweak in methodology in the absence of October data. That’s not just a now issue – it will impact CPI until the April report.

-

Complicating the inflation picture: core PCE is running hotter than core CPI – an atypical occurrence. This represents a significant shift because the housing sector is less important to the core PCE basket and is therefore providing less disinflationary help there. This suggests other sectors are not slowing as meaningfully in that core PCE basket.

-

We have yet to observe a clean month-over-month read on CPI post-shutdown. The data continues to be impacted by these distortions from a government shutdown hangover, i.e. even short-term inflation momentum visibility is fuzzy.

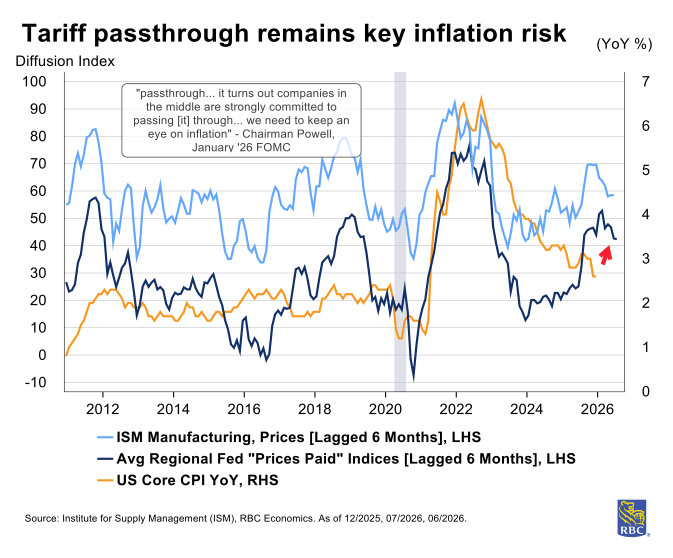

How’s the Fed handling this inflation uncertainty? Powell acknowledged inflationary risks will persist in 2026 due to tariff pressure:

“The other thing is, pass-through, we didn’t know how fast that would be to consumers, how much exporters would take, how much companies in the middle would take and consumers would take and it turns out companies in the middle are strongly committed to passing the rest of it through, which is one of the reasons we need to keep an eye on inflation, and not declare victory, prematurely.”

The green light for rate cuts from the labor market switched off – and we don’t expect it will turn back on in 2026

While inflation is murky, the Fed has clearly revealed a bias towards the “full employment” side of its mandate and has leaned on softening in the job market as justification for its most recent 75bps of rate cuts. But with jobless claims flagging unseasonably low layoffs, a decline in the unemployment rate to 4.4%, and strong wage growth – average weekly earnings accelerated to 3.8% y/y in December – additional rate cuts to stabilize the labor market were a much harder sell in this meeting.

It’s true that a good deal of the labor market strength is coming from structural forces in the economy – a decline in labor force participation rates coupled with substantial health care hiring [adding 146k new jobs in Q4] reflects the massive wave of Baby Boomer retirements and their shifting needs (i.e., medical care).

“We saw data coming in which suggests some signs of stabilization. I wouldn’t go too far with that, but some signs of stabilization… economic activity outlook has clearly improved since the last meeting, and that should matter for labor demand and employment over time.”

Still, there is evidence of cyclical weakness, particularly in tariff-exposed goods sectors like manufacturing, transportation and warehouses. But problematically for central banks across the world that are fighting trade wars, lower rates aren’t going to help revive or offset job growth in sectors impacted by trade disruptions. Effectively, rate cuts would be the wrong medicine for this problem – what ails this part of the economy is not interest rates that are 25bps too high. At the same time, Powell acknowledged that many view current rates as being very close to neutral:

“It is hard to look at the incoming data and say that policy is significantly restrictive at this time. It may be loosely neutral or somewhat restrictive. It is in the eye of the beholder and, of course, no one knows with any precision.”

The Fed remains in the backseat, not the driver’s seat, of the US economy

Markets are accustomed to central banks that drive the business cycle, but Powell’s current Fed is facing an economy at the whim of Court rulings, geopolitical events and increasingly relevant moves in the US dollar and the long-end of the curve.

“Technically, higher long-term rates means less accommodative financial conditions but remember, many, many things move long-term rates. It is not necessarily what happen on the short end-to-end. There can be effects from moving our policy around, but it is much more assessments of the fiscal path, and fiscal policies and risks and things like that that move the 10-year around.”

The reduced sensitivity of the economy to the front-end of the curve, combined with the structural forces that are reducing the cyclicality of the economy itself mean the Fed’s ability to save it from its challenges is increasingly muted. The solution: to sideline until a larger shock, in either direction, arrives.

“We will continue to make our decisions meeting by meeting, based on the incoming data and the implications and outlook of balances and risks. Haven’t made any decisions about future meetings but the economy is growing at a solid pace, the unemployment rate is broadly stable, and inflation remains somewhat elevated, so we will be…letting the data light the way for us.”

Mike Reid is Head of U.S. Economics at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is a Senior Economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

Imri Haggin is an Economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.