Bottom line:

Inflation readings reported well below expectations in November as headline CPI slowed to 2.7% y/y and core CPI slowed to 2.6% y/y – the slowest pace since March 2021. But the data quirks surrounding this report make it hard to digest. What we do know is that the data showed sustained improvement in core services – the slowing in housing prices continued to provide notable help. But core services ex-housing remained sticky suggesting that wage pressures continue to put a floor under prices there. The core goods sector saw some relief, slowing modestly in November. This likely reflects the desire of companies to maintain market share during the holiday shopping season. The question remains, is this report enough to convince the Fed that inflation will continue to slow? We expect they will treat this as a one off given the disruptions surrounding data collection in both October and November. As Powell noted in the December press conference ” what we get for, for example, CPI… we’re going to look at that really carefully and understand that it may be distorted by very technical factors.”

No spike in trade-exposed sectors ahead of the holidays

-

We did not see a spike in trade-exposed sectors in November. Perhaps this is not so surprising as firms attempt to preserve market share ahead of the holidays. Core goods prices slowed modestly (+1.4% y/y in November vs. +1.5% y/y in September).

-

Within core goods, we saw a deceleration in the year-over-year values across most spending categories. The exception to the rule was medical care commodities (+1.1% y/y from +0.7% y/y in September). This makes sense given the spike in pharmaceutical imports in September – which could suggest a depletion of pre-tariff inventories.

-

Tariff exposed goods including appliances, autos, and electronics all slowed on a y/y basis relative to September (we exclude October due to the shutdown).

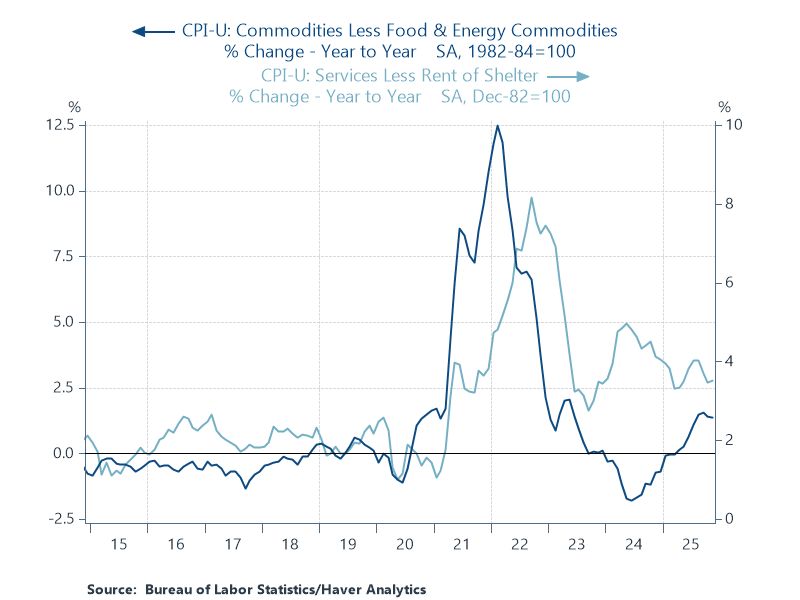

Core services slowed but driven primarily by housing

-

Slowing housing prices provided meaningful help to core services, where year-over-year price growth slowed notably.

-

But taking out rent of shelter, the underlying trend in services decelerated less meaningfully, as services wage growth remains elevated.

The Fed should treat this report as a one-off

-

Absent month-over-month data, this morning’s report was difficult to interpret. We expect that the December CPI report – released mid-January – will be more helpful for understanding fundamental trends. While this morning’s print was an early holiday gift for Fed Doves – we caution against putting too much weight in the report given the data collection challenges that impacted both October and November.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

Imri Haggin is an economist at RBC Capital Markets, where he focuses on thematic research. His prior work has centered on consumer credit dynamics and treasury modeling, with an emphasis on leveraging data to understand behavior.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.