-

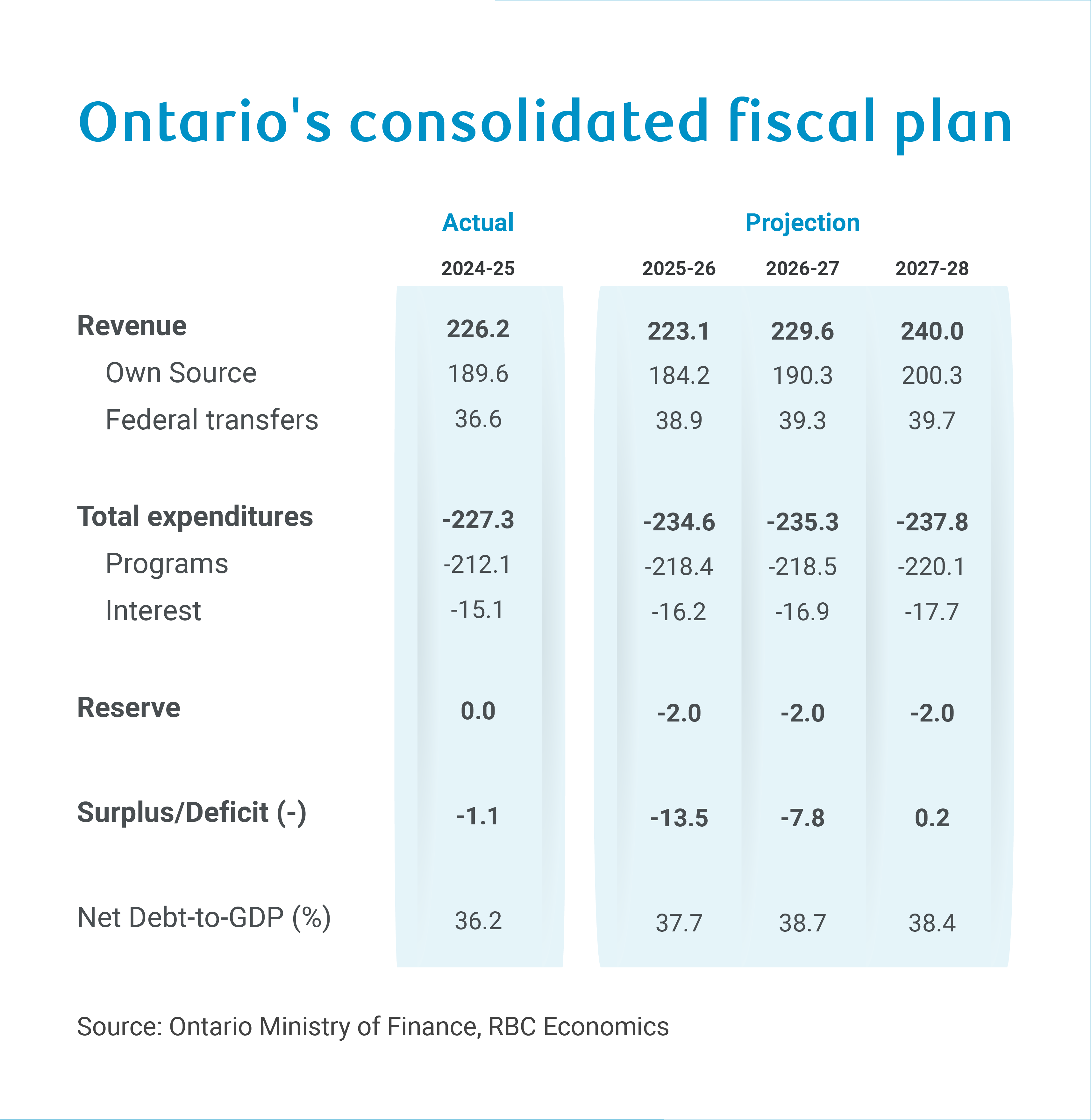

The provincial government now projects a slightly smaller budget deficit of $13.5 billion this fiscal year but leaves future projections unchanged thus maintaining a return to balance by 2027-28.

-

Ontario posted a stronger-than-expected finish to 2024-25 –with a $1.1 billion deficit versus the $6 billion expected in Budget 2025.

-

It is a conservative deficit profile relative to its baseline economic assumptions, with several contingencies baked into the fiscal framework, echoing risks in the outlook.

-

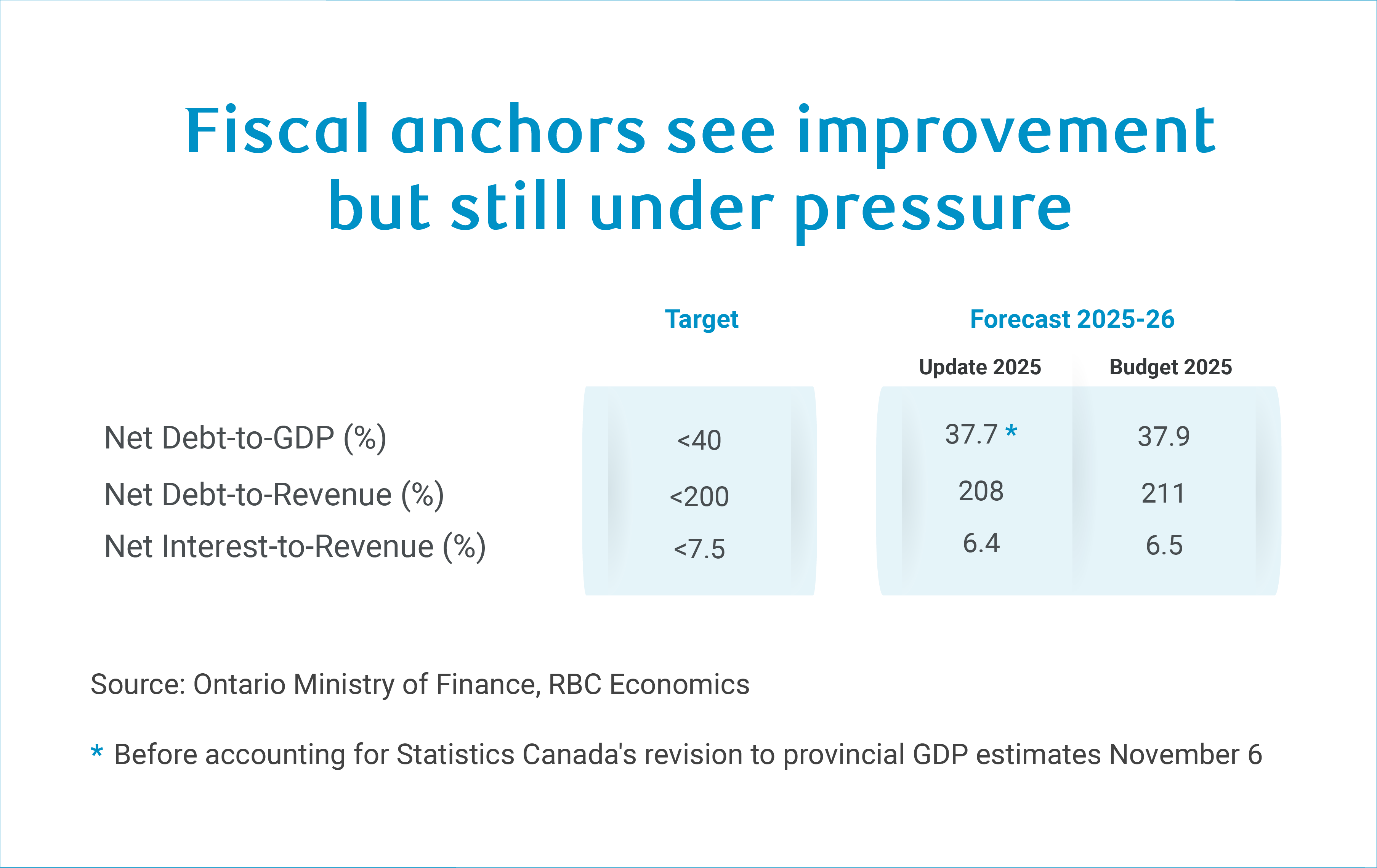

The 2025-26 net debt-to-GDP ratio improves modestly to 37.7% in the document (-0.2 percentage points versus the budget). However, officials estimate that the upward revisions in Statistics Canada’s provincial GDP for 2022 to 2024, released earlier in the day, would further reduce it to 37.1%.

-

Ontario continues to operate within two of its three fiscal anchors with improvements above affording larger buffers.

-

The statement maintains the same profile for the capital plan and a smattering of new and reannounced measures at modest fiscal cost.

Deficit projection improves for 2025-26

Revenue and expense profiles have shifted up modestly for the projection period.

Some of the higher-than-expected 2024-25 revenues carry through the projection period with strong equity markets expected to drive further increases in personal income taxes. Meanwhile, budget 2025’s sizeable upside surprise on program expenses was not repeated with only a moderate mark-up in the projection.

With interest expenses and the reserve mostly unchanged, the deficit projection improved by $1.1 billion in 2025-26 with no changes after.

Sizeable contingencies amid elevated risks

The statement maintains a reserve of $2 billion, and marks down the private sector forecast by 0.1 percentage points. There is also a net $1.5 billion added to the contingency fund in 2025-26.

Some of this has been maintained from the budget, but does represent an implicit upside to deficit projections.

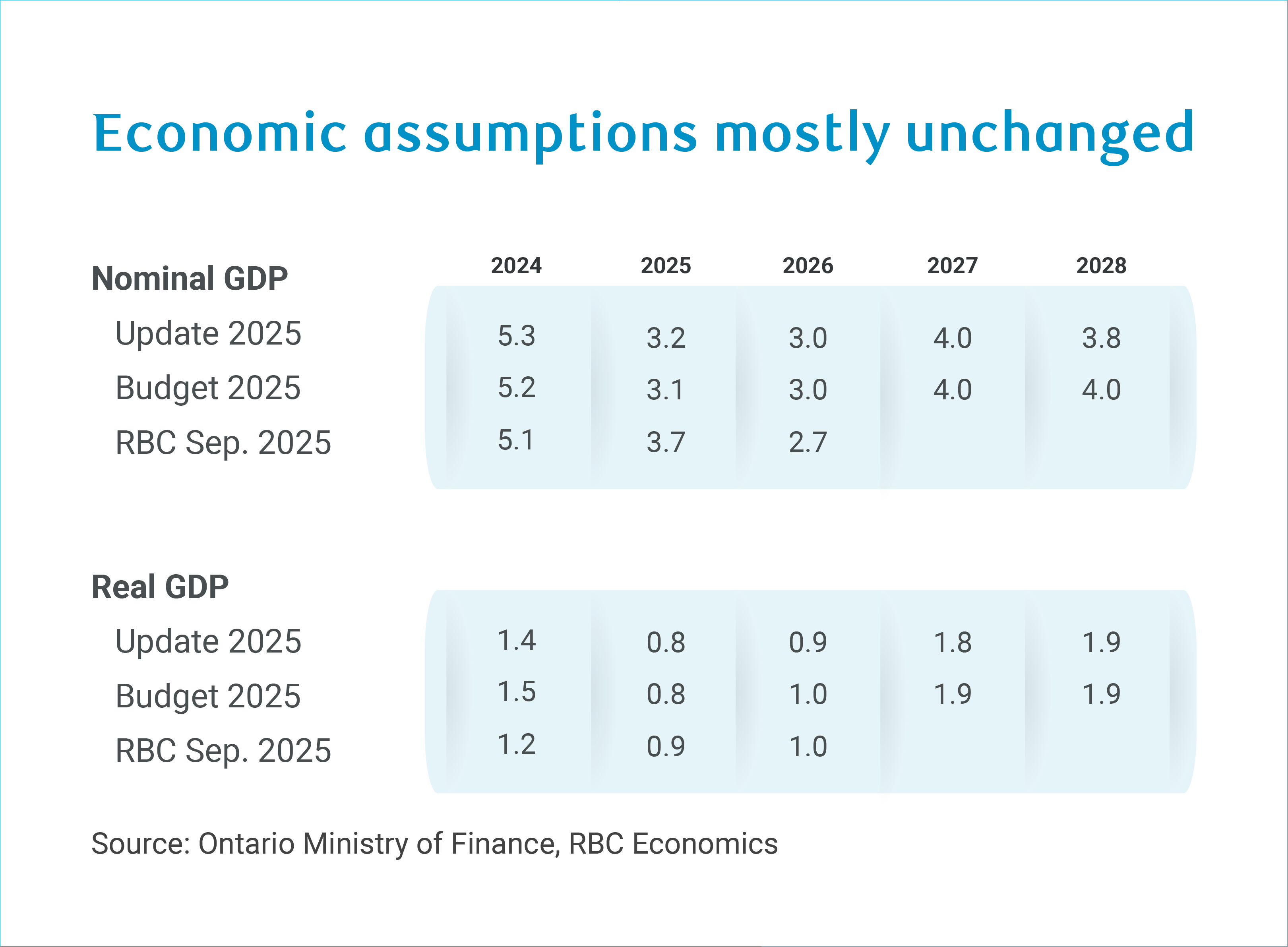

The real and nominal GDP planning assumptions are similar to the budget with slightly stronger nominal growth this year and slightly weaker in 2028.

The statement also provides moderate upside and downside economic scenarios. The downside scenario would see the level of nominal GDP 2.6% lower by 2027-28, and marks down the deficit by a cumulative $17.5 billion over the forecast horizon.

Two of three fiscal anchors met with higher buffers

The government plans continue to operate within two of its three fiscal anchors, although all three see improvement throughout the projection period given the lower-than-expected deficit in 2024-25.

In Budget 2025, we observed moderate buffers against the two compliant anchors—net debt-to-GDP and net interest-to-revenue.

The benefit from the 2024-25 result is marginal, but the net debt burden will also benefit from Statistics Canada provincial GDP estimates released earlier in the day, which significantly revised up the level of Ontario GDP for 2022 to 2024. Ontario officials estimate this would lead to an additional 0.6 percentage point improvement in 2025-26. This would put the ratio at 37.1%—representing a more significant buffer.

Capital plan levels the same plus smattering of new and re-announced measures

Strong infrastructure spending continues to be a fixture of the Ontario plan. But, total capital spending is largely unchanged from the budget, and is estimated to stand at $201 billion over 10 years.

The statement includes $1.8 billion in new tax measures over three years, including $1.3 billion to expand and enhance the Ontario Made Manufacturing Investment Tax Credit announced in budget 2025, as well as $0.5 billion for HST relief for first-time homebuyers. On the expenses side, support for home care makes up the majority of $0.6 billion in new 2025-26 expenses.

The update introduced or reannounced a range of other measures intended to provide relief for tariff-affected businesses and workers, as well as efforts to boost Ontario’s economic competitiveness and growth.

About the Author

Cynthia Leach is the Assistant Chief Economist at RBC covering the team’s structural economic and policy analysis. She joined in 2020.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/community-social-impact/reporting-performance/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.