Canada’s new automotive strategy is a signal that Ottawa is keen to persist with a central pillar of the country’s manufacturing sector, despite tariff pressures and suggestions from the U.S. President that “we don’t need cars made in Canada.” The new strategy aims to carve out a new path for the industry, led by electric vehicles that have blossomed into a US$750-billion market worldwide in 2025.1

Key 2026 themes we are watching:

Incentives are back, but unlikely to trigger a major uptick in sales. Provincial subsides are phasing out, and the eligible cars pool is limited

Offering up to $5,000 to consumers buying an EV under $50,000, the $2.3 billion subsidy will add 840,000 EVs to Canadian roads by 2030, the government projects.

Total impact on adoption, however, might be subdued. At least 7 in 10 of all purchases under the previous federal program received a subsidy, largely stacked on top of provincial rebates. But provincial support is also dwindling. The once $7,000 stackable support in Quebec now stands at $2,000, while the $4,000 EV subsidy in British Columbia has ended. Most of the other provinces have also pulled back incentives—Prince Edward Island lowered its rebate amount, New Brunswick and Nova Scotia are ending theirs, while rebates in Manitoba and Newfoundland expiring in March.

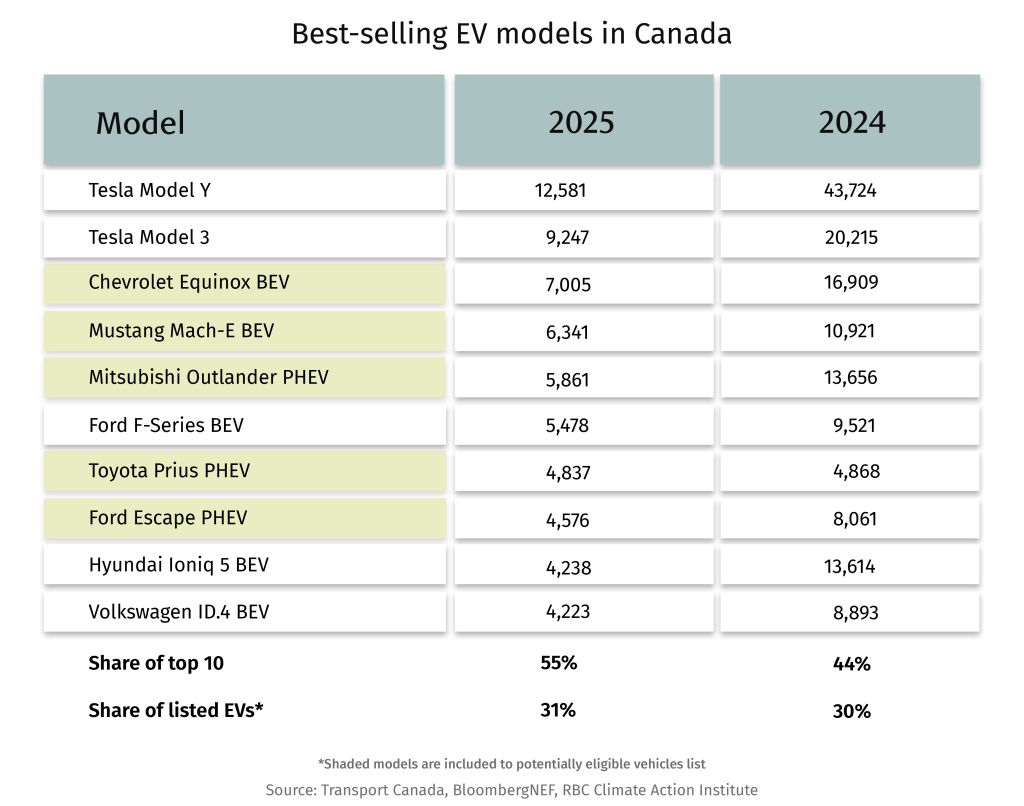

Transaction value threshold of $50,000 targeted for the mass-market segment is also likely to limit adoption. There are only 18 models included in the list of potentially eligible vehicles for a subsidy, 2 which made up only 30% of EV sales in both 2024 and 2025.3

EV prices are still high, and Chinese cars might not deliver the expected relief

The average price of a new EV in Canada was about $70,000 last year,4 so the 49,000 cars under the new China deal could prove to be an attractive bargain. However, final costs for a Chinee EV are likely to creep up as Chinese imports still carry a 6.1% tariff, plus the costs of shipping vehicles to Canada. Chinese carmakers are also likely to seek higher profit margins compared to their competitive domestic market, which is awash with more than 50 brands.

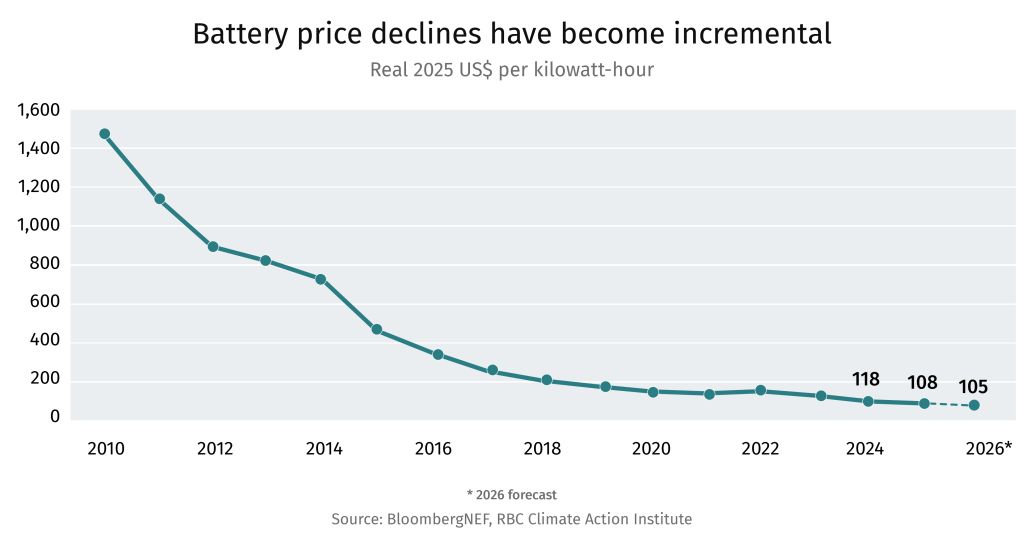

Overall, EV price improvements have lost momentum, especially as battery prices—that make up about a third of EV costs—are also flattening out. The 25-40% difference in costs between Chinese and U.S. carmakers stems from efficiency in battery production.5 The recent scale back of EV roll-out plans by the Detroit Three—Ford, GM and Stellantis—could further slow price improvements in North American EVs.

Check out RBC’s Electric Car Cost Calculator to compare electric vehicle costs to gas models

Emissions would likely to come down, mostly driven by hybrid electric vehicles adoption

Canada’s new emissions standards, however, don’t target EV sales specifically, they only aim to achieve equivalent emission reduction of up to 75% EV sales in 2035, compared to 100% EV sales required under the previous legislation.

Over the past decade, emissions performance improved by 30-50%, however, total emissions continued to rise as more cars entered Canadian roads, from ~20.1 million passenger vehicles in 2011 to 24.5 million in 2024.6 7 BloombergNEF projects that Canada’s car fleet will largely stay flat going into 2035 and decline further in future, in which case improved emissions performance will deliver absolute emissions reduction, though clean fleet eventually hinges on parting with all tailpipe emissions.8

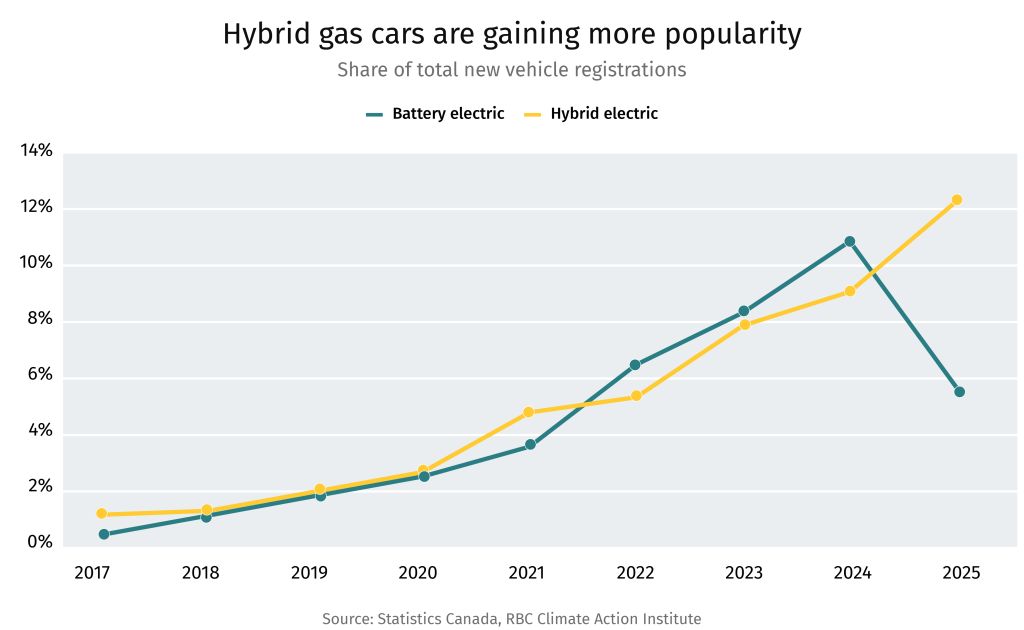

American carmakers now have the flexibility to adjust their technology to ensure compliance, which could delay full electrification in favour of hybrid cars, which are nearly half as less emitting and are more attractively priced. Hybrids are already ascendant, with car sales in the category on the rise in 2025 even as battery-electric vehicles (BEV) sales plummeted.

BloomergNEF, Energy Transition Investment Trends 2026

Transport Canada, EVAP Vehicle List

BloombergNEF, EV Sales Interactive Dataset

Statistics Canada, New motor vehicles sales, Table 20-10-0085-01. Average price derived by ratio of total purchase value to total vehicle sales.

McKinsey Center for Future Mobility, The future of affordable EVs: Breakthroughs in battery pack costs

Environment and Climate Change Canada, Greenhouse Gas Emissions Performance for the 2023 Model Year Light-Duty Vehicle Fleet

Statistics Canada, Vehicle registrations by type of vehicle, Table 23-10-0308-01 and 23-10-0067-01

BloombergNEF, Electric Vehicle Outlook 2025

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.