Also in this edition: What the future could hold for Canada’s auto industry

Locked out of the Vault

Agreements from Washington’s inaugural Critical Minerals Ministerial are still being digested, which saw bilateral frameworks with over a dozen trade partners and the unveiling of Project Vault.

Notably, Canada wasn’t among the signatories. So as America rewires the global minerals order, does Canada stand to gain or be left behind?

Why It Matters

Project Vault is America’s attempt to build a Strategic Petroleum Reserve for critical minerals. The problem: the SPR analogy breaks down in a way that matters enormously for Canada.

The original SPR worked because the U.S. had vast domestic refining capacity—stored crude to be converted into refined fuels along the Gulf Coast. Today, North America has almost none of the processing infrastructure needed to convert raw critical minerals into the refined compounds that defense, semiconductors, and EVs ultimately require.

So Project Vault faces a fundamental paradox: stockpile raw ore with no capacity to process it; stockpile refined material almost certainly bought from China—the very dependency the U.S. is trying to hedge.

By the Numbers

-

US$15 billion—EXIM Bank financing already mobilized across allied minerals projects globally, before Project Vault

-

US$12 billion—Project Vault financing (US$10 billion from the U.S. Export-Import Bank and US$2 billion in private capital)

-

60-day supply target buffer for strategic minerals

-

15 bilateral frameworks signed this week alone—including the EU, Japan, UAE.

-

China’s refining grip—98% gallium, 91% rare earth magnets, 96% battery-grade graphite, 79% cobalt

-

Canada’s position—71% of U.S. unwrought aluminum imports; Quebec’s Vaudreuil refinery is one of only two alumina refineries left in North America.

-

Project Vault covers all 60 critical minerals on the USGS list, many of which are core economic exports for Canada

The Bigger Picture

The U.S. isn’t building a multilateral framework—the word chosen deliberately at the ministerial was plurilateral. A smaller, aligned coalition setting its own rules, coordinating price floors, and directing investment collectively. Through EXIM and Project Vault, this architecture is being built in real-time.

Energy-intensive refining and smelting, the very processes needed to turn minerals reserve into usable industrial inputs, on paper at least, is a good set up for Canada. Our clean and cost competitive power (hydro, nuclear) complements existing mineral deposits, which, with integrated rail networks, allow for better full-cycle economics than stand-alone processing and refining operations.

Bottom Line

Canada’s critical minerals endowment is arguably its most important bilateral tool heading into the CUSMA renegotiation. Its broader integration into U.S. supply chains—across aluminum, copper, nickel, zinc and manganese— limits being phased-out to a large extent. If Canada can secure explicit recognition of Canadian content in U.S. value chains, via CUSMA assisted by Project Vault’s predictive offtake and access to U.S. capital, it is a clear win.

That said, our minerals chip depreciates with each passing day. Every bilateral framework Washington signs with another partner narrows Canada’s relative leverage, especially if CUSMA negotiations extend into 2027. And at a time when investment decisions at times are less about economics and more a price of admission to the U.S. market (read: Korea Zinc JV)

Threading that needle will be the challenge.

– Shaz Merwat

Car trouble ahead?

RBC economist Farhad Pananov was at The Globe and Mail’s Future of Automotive event this week. Here’s some of what he heard:

-

Strategic investments in the auto sector have fallen off compared to just to a few years ago when manufacturers were setting long-term pivots.

-

While panelists heaped plenty of praise on Canada’s highly skilled and educated labour force and diversified local economies, it was clear what the country’s greatest advantage is access to the second largest auto market in the world. For now, at least.

-

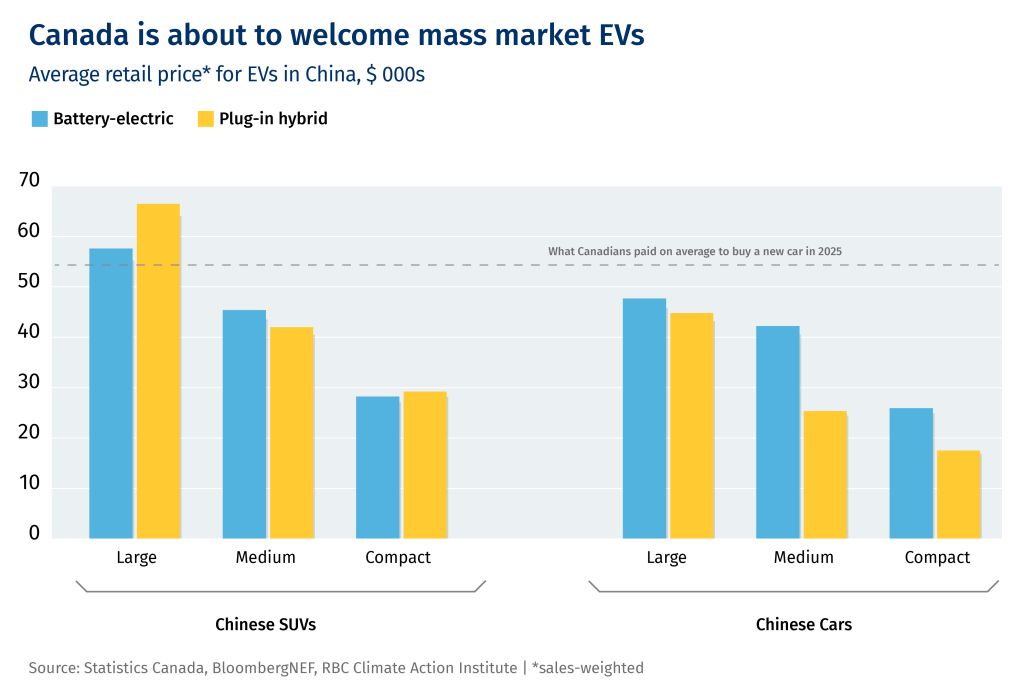

The Canada-China EV deal, which will facilitate the import of 49,000 Chinese EVs a year at low tariff rates, was met with skepticism in the room: Which brands will come to Canada? Will Canadians actually buy them?

The answer to that last question could all come down to the price…

Trade Posts

U.S. lawmakers rebuke Trump’s Canada tariffs

-

The U.S. House of Representatives voted to rescind tariffs on Canadian goods, the same week President Trump threatened to block the opening of the Gordie Howe International Bridge because of trade disputes.

-

While the President will likely veto the motion, Wednesday’s vote was backed by six Republicans, indicating growing discontent with Trump’s trade policies and threats.

U.S. agriculture industry lobbies for CUSMA continuation

-

Over 40 U.S. agricultural groups have formed a coalition to support the Canada-U.S.-Mexico trade agreement, emphasizing the economic benefits it brings to rural communities and American farmlands.

-

The advocacy campaign is targeting members of Congress, the White House, and the President, with economic analysis that shows Canada and Mexico account for approximately one-third of the value of U.S. agricultural exports.

U.K. government signals closer alignment with Europe

-

Chancellor Rachel Reeves announced the U.K. is prepared to unilaterally align with the EU’s single market rules in sectors like financial services to reduce trade barriers, describing closer integration with the EU as the “biggest prize” for U.K. growth, pivoting away from prioritizing non-European trade deals.

-

The Labour government has been reticent to reopen Brexit as a political issue but are beginning to look more fondly at closer integration with the EU as they search for ways to boost economic growth.

— Thomas Ashcroft

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.