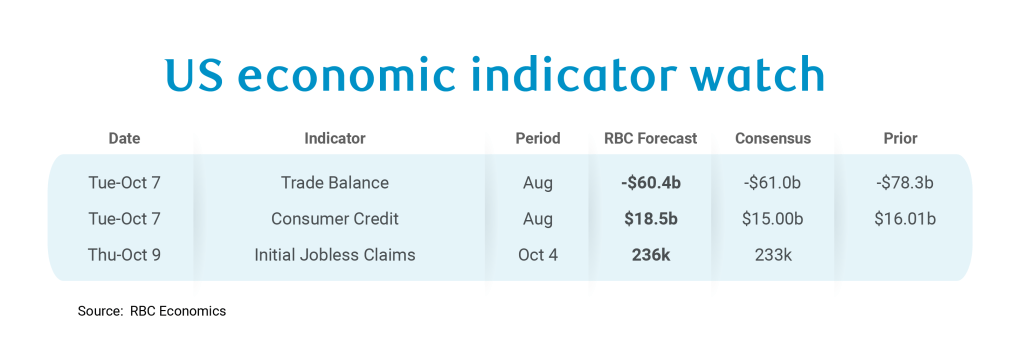

Next week is a quiet week for data, even quieter now with the ongoing government shutdown. We assume that we will not be receiving any government data next week but have still opted to publish our usual forecast table (government data that is unlikely to be published is highlighted in red). Once government services resume, it is expected that government data will be published with a lag as it must first be prepared for release by agency workers who are currently furloughed.

As we wrote in a note earlier this week, ~750,000 workers are currently on furlough but these furloughed workers will not be captured in the initial or continuing claims data once that data is released. After the 2019 shutdown, Congress passed the Government Employee Fair Treatment Act of 2019. This legislation guarantees immediate retroactive backpay to federal employees after a shutdown ends, therefore, workers on furlough are not eligible for unemployment insurance. With this in mind, we would expect to see initial jobless claims reach 236k for the week ending October 4th. If we were to see a spike in federal jobless claims, these would be more likely reflective of DOGE layoffs rather than the government shutdown, since federal employees who accepted the buyout option by were guaranteed six months of pay, which ends in September. It is worth noting that should the government shutdown drag on, this could translate to private sector furloughs for businesses in close proximity to government – and employees working for government contractors are not guaranteed backpay like federal workers, and they are not guaranteed to be rehired either, a risk that increases the longer the shutdown lasts.

We are also including an estimate for the trade balance in our table, even though we are unlikely to receive it on Tuesday. The US trade deficit likely narrowed slightly to -$60.4 billion as the advance trade data that we received last week pointed to a sizable reversal of the July uptick in imports.

Additionally, we will see some private sector data releases next week that will carry greater weight during this data void:

-

We expect to see an $18.5b uptick in consumer credit in August after seeing revolving and non-revolving consumer credit rise in July. This can be used as barometer for consumer spending – notably the revolving credit change which largely reflects credit card spending.

-

We do not typically give as much attention to the soft data, including the NY Fed 1-Year Inflation Expectations survey (landing on Monday) and the University of Michigan Sentiment (landing on Friday), but we anticipate markets will likely give these releases more attention given the void created by the government shutdown.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.