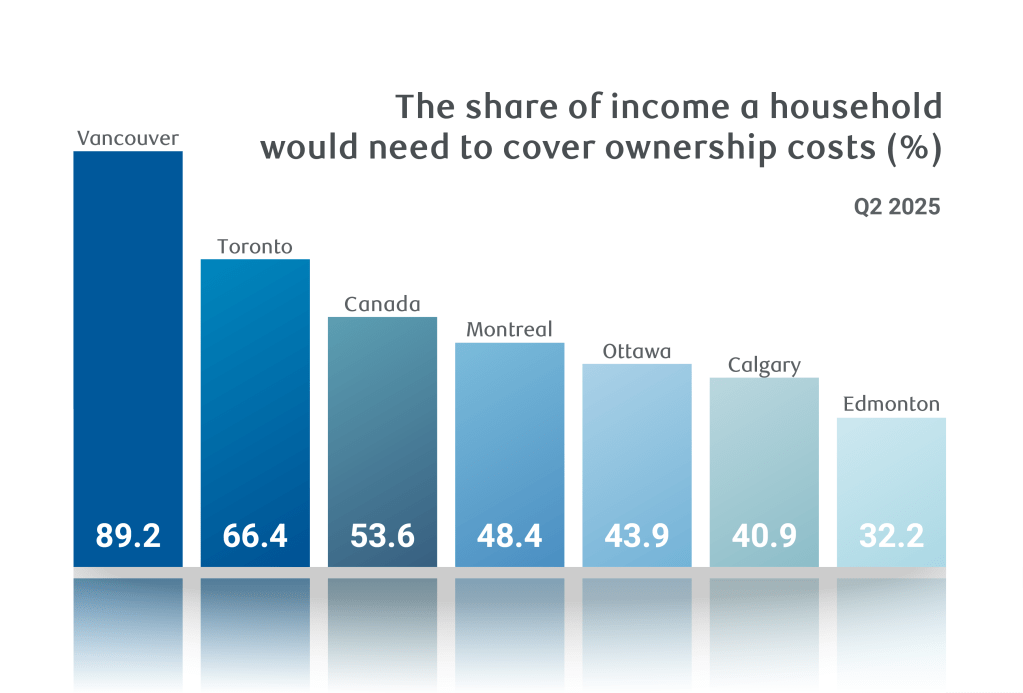

Affordability improved for six consecutive quarters. Lower interest rates, flat prices and sustained household income gains contributed to lowering RBC’s aggregate affordability measure for Canada to 53.6% in Q2 2025 from an all-time high of 63.5% at the end of 2023.

Ownership costs fell in all but one market. Vancouver, Toronto and Victoria recorded the largest decreases, but they remain Canada’s least affordable markets. Regina saw costs rise slightly.

Affordability measures are back to historical norms in the Prairies. However, they’re still a long way from more attainable pre-pandemic levels in the rest of the country with some exceptions.

The speed of improvement is likely to slow. We expect further easing in ownership costs, but see the effect of earlier interest rate cuts fading. Decelerating income growth will also dampen buyers’ purchasing power.

Capacity to own is facing headwinds

Increasing slack in the labour market is now weighing on wage growth, creating fresh challenges for prospective homebuyers. This shift threatens to negatively impact buyers’ purchasing power just as housing markets show signs of stabilization across several regions.

Robust household income growth has contributed to more than a third of the decline in RBC’s national aggregate affordability measure over the past year and a half. (A decline in the measure represents a gain in affordability).

This income component has been crucial in offsetting elevated borrowing costs and stubborn prices in many markets. However, the tailwind is beginning to weaken as employment conditions deteriorate.

Ontario markets could be especially affected by this emerging trend. The unemployment rate in the province has risen significantly above pre-pandemic levels, and is now among the highest in the country.

The ongoing trade war is taking a toll on the province’s manufacturing sector with ripple effects spreading through related industries and supporting services.

Bulk of affordability gains now in rearview mirror

We anticipate interest rate reductions, more price corrections in select markets, and continuing (albeit slowing) income growth will offset roughly half of the pandemic-era increase in RBC’s composite affordability measure for Canada by year-end. About one third has been achieved so far.

Further advancement becomes more challenging once interest rates reach a stable plateau as it depends exclusively on home price movements and household income trends. Substantial price declines or robust increasing income would be necessary to drive more meaningful gains. However, we anticipate broadly stable pricing across Canada over the next two years with some regional variations and moderate wage increases.

Housing costs resurface as central concern

Trade tensions disrupted Canada’s housing market momentum this spring as concerns over potential economic consequences led many prospective buyers to the sidelines. However, the easing of tariff pressures since spring has helped restore some market confidence.

Home resales have shown signs of recovery through the summer months—though property values continued to face downward pressure across Ontario and British Columbia. This price softening supports affordability improvements, but simultaneously signals persistent market fragility and cautious buyer sentiment.

Growing confidence represents a constructive development for housing markets, but it’s insufficient to spark a widespread activity rebound. Housing cost burdens are set to become the primary concern in part of the nation despite improving notably since the end of 2023—representing a significant barrier to market revival. Markets where affordability has returned to historical norms, however, are on a more solid track.

Victoria: Buyers gain market leverage

RBC’s aggregate measure rose 1.6 percentage points to 69% in Q2 for Victoria—the third worst among the markets we track.

More inventory has given buyers increased leverage in negotiating prices, creating a more balanced dynamic than in recent years. Yet, they remain hesitant to pull the trigger on purchases. Home resales have stumbled after rebounding earlier in the summer, suggesting buyer caution persists despite improved conditions. We expect prices to drift lower amid intense affordability pressures, and the continued reluctance of buyers to commit to current prices.

Vancouver area: Gradual rebalancing amid persistent pressure

Market fundamentals continue their slow rebalancing process as pandemic-era ownership cost spikes gradually reverse in the Vancouver area.

Declining home values and reduced mortgage rates propelled RBC’s aggregate affordability measure lower for six straight quarters to Q2, marking the longest period of improvement recently.

Nevertheless, at 89.2%, this is still the nation’s most challenging (worst) level, creating substantial obstacles for local buyers. Property transactions remain suppressed despite modest summer gains, underscoring persistent affordability burdens. More declines in value are expected with elevated inventory and supply and demand conditions favouring buyers.

Calgary: Nearing normalized affordability conditions

Steady ownership cost declines since the start of 2024 have delivered meaningful relief for prospective owners in Calgary.

RBC’s aggregate affordability measure eased once more by 1.3 percentage points in Q2 to 40.9%, moving significantly closer to the 39.1% historical average. More normalized affordability conditions helped stabilize transactions after two years of decline—albeit from record-high pandemic levels. Robust construction has increased market supply, giving more options and decision time to buyers.

Edmonton: On solid foundations

Transactions remain vigorous in Edmonton as purchasers enjoy comparatively attractive affordability.

Property sales persist well above pre-pandemic thresholds, demonstrating continued demand despite broader economic uncertainties. Affordability conditions appear relatively positive versus most major centres. RBC’s aggregate affordability measure reached 32.2% in Q2, aligning with historical norms after consistent decline since spring 2024. Prospects for buyers appear more positive as earlier supply-demand tightness has eased materially, and price appreciation moderates.

Saskatoon: Migration and attainability sustain strong activity

Market strength continues with migration flows and manageable ownership expenses attracting steady buyer interest in Saskatoon.

RBC’s aggregate affordability measure reached 31.4%, effectively returning to long term averages following a third consecutive quarterly improvement in Q2. Sales have been sustained near pandemic-era levels other than a dip this spring. Activity, in fact, is tracking toward exceeding strong prior year totals. Ongoing supply-demand strains, however, are set to keep home values appreciating strongly in the near term.

Regina: Market heat has yet to weigh on buyers

Regina is among the hotter markets in the country with resales approaching record levels and solid home value growth.

The area boasts the best affordability among the markets we track with RBC’s aggregate measure at 26.6%. But, conditions deteriorated slightly in Q2 with a 0.3 percentage point increase—the sole market posting deterioration. Supply is short given demand, which will likely perpetuate rapid price gains, and potentially erode affordability further.

Winnipeg: Constrained supply fuels price increases

Activity in Winnipeg maintained steady momentum throughout the year, cooling marginally this summer—possibly affected by extensive wildfires.

Home values continue to appreciate rapidly, reflecting constrained supply and stable demand fundamentals. This hasn’t prevented a slight affordability improvement in Q2 with RBC’s aggregate measure declining 0.3 percentage points to 31.8%—modestly exceeding the 29.3% long-term average. We see limited buyer options supporting more price appreciation.

Toronto area: Ownership costs still a barrier despite easing

Buyer demand in the Toronto area has rebounded since summer as trade concerns subsided, but transactions remain historically subdued.

Poor affordability and weakening job prospects weigh heavily the market, challenging buyers and sellers. Ownership cost pressures have eased noticeably in the past year, particularly for condominiums, but the progress is not enough to fully unlock pent-up demand. RBC’s aggregate affordability measure at 66.4% creates extremely high barriers for most purchasers. We see this continuing even as declining home values lower ownership costs further.

Ottawa: Moderate price gains aren’t derailing better affordability

The market recovery is back on track in Ottawa with sales advancing through spring and summer.

The trade war had unsettled buyers earlier this year, causing activity to dip this winter. Generally balanced supply and demand are sustaining moderate price increases that are not interfering with the improvement in affordability since early 2024. Still, RBC’s aggregate measure remains elevated at 43.9%—suggesting buyers continue to face more strenuous conditions than they have historically. We expect further improvement as rising inventory slowly dampens home value appreciation.

Montreal area: Supply limitations persist

The affordability picture improved in the Montreal area in Q2.

RBC’s aggregate measure fell 1 percentage point to 48.4%, restoring the favorable trajectory that was briefly interrupted in Q1. Buyers still grapple with challenging ownership costs, however. RBC’s measure sits 10 percentage points above its historical average, indicating the improvement to date only restored a fraction of the affordability lost during the pandemic. Despite these headwinds, purchasers continue bidding aggressively amid persistently tight supply. We see little that will change this dynamic near term as the inventory of homes for sale is set to stay low.

Quebec City: Sellers in command

Quebec City saw the strongest annual price increases among markets we track.

Limited supply compared to demand gave sellers the advantage, enabling sustained price appreciation across housing categories. Contributing to robust demand are relatively modest ownership costs versus Montreal or major Canadian centres. RBC’s aggregate affordability measure stood at 34% in Q2—nearly 20 percentage points below the national average. However, this favourable positioning has eroded with Quebec City’s measure remaining essentially unchanged in the past year amid meaningful improvement in most other cities.

Saint John: Resilience remains

Rapid price increases over the past year have curtailed the benefit from lower borrowing costs in Saint John, restricting affordability gains witnessed in other regions.

Yet, the portion of typical household earnings needed to service homeownership expenses (32%) is still lower than in most markets we monitor—sustaining a positive environment for buyers. Predictably, sales have demonstrated durability amid trade uncertainty this year, tracking roughly 9% ahead of last year.

Halifax: Pandemic impact endures

Market activity remained generally subdued but steady this year in Halifax, showing heightened prudence from participants.

Trade tensions may have undermined buyer sentiment, but we think enduring pandemic-related affordability deterioration is the primary constraining factor. RBC’s Q2 aggregate measure (42.3%) still stands far above the historical average by almost 10 percentage points—signalling substantially more challenging conditions than normal. Property values maintain upward momentum driven by constrained supply and demand, though the rate of appreciation has decelerated. We think further moderation is ahead.

St. John’s: Favourable affordability keeps buyers engaged

As the most affordable market east of Saskatchewan, St. John’s sees strong buyer engagement despite broader economic uncertainties.

Existing residential property sales increased more than 9% annually through the first eight months—and 48% above pre-pandemic levels—demonstrating sustained vigour. Home values remain trending firmly upward, supported by tight supply-demand. RBC’s aggregate affordability measure (28.2%) ranks second lowest among tracked markets, and is the best in Atlantic Canada. We expect limited affordability improvement near term as tight conditions drive prices higher.

Read the full Housing Trends and Affordability report for extensive market-by-market analysis.

Robert Hogue is an Assistant Chief Economist, responsible for providing analysis and forecasts on the Canadian housing market and provincial economies.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.