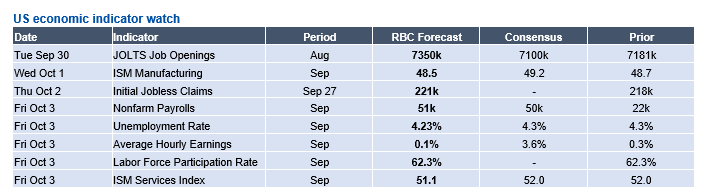

The main question in our minds next week is whether we will get the highly anticipated labor market data next Friday. To be clear – if we have a government shutdown on October 1st, the employment report will not be published. A continuing resolution would mean data is released, for the time being, but could still result in a shutdown at a later date (see below for our FAQ concerning a government shutdown).

If we avoid a shutdown and the data is released as scheduled on Friday, we expect that the nonfarm payrolls report will show that 51K jobs were added to the US economy in September. While in previous cycles, a sub-100K NFP print would point to a rising unemployment rate, we now estimate that 2025 breakeven employment in the US – that is, the number of jobs that need to be added on a monthly basis for the unemployment rate to hold steady – is likely ~40K. This is in light of more stringent immigration policy and a massive wave of retirements, shrinking the available supply of labor, meaning the US now needs to create fewer jobs for fewer workers. From this new lens, a 51K print in September is not expected to drive the unemployment rate higher. In fact, we expect the unemployment rate will likely fall to 4.2% due to a surge in retirements in August (which makes room for unemployed jobseekers to take their positions) alongside noteworthy declines in continuing and initial claims data.

Still, context is important. Even though we are expecting a >40K NFP print and a tick lower in the unemployment rate, it has become very clear to us that the labor market has reached a cyclical turning point. We have written before that an aging population creates a need for a significant health care hiring (which is not a cyclically-exposed sector). At this point, health care is supporting the majority of US job growth. By separating cyclically-exposed sectors from the acyclical, we can see that cyclical services sector hiring has been exceptionally weak while goods hiring has outright declined. We expect this weakness to persist in the months ahead as uncertainty and tariffs weigh on hiring decisions. Structural growth masking cyclical challenges will be a continuing theme – limiting our ability to rely on monthly job gains as a standalone barometer for labor market health.

We expect to see growth in average hourly earnings moderate in September (to +0.1% m/m), reflective of lower-to-median wage job creation, primarily in the education space as the school year starts. We could also likely see the manufacturing sector create jobs for the first time in five months, as companies hire back those who were temporarily laid off during summer retooling season.

Other indicators to monitor next week:

-

Initial Jobless Claims will likely come in at 221k for the week of September 27th. Claims have moderated in recent weeks after a jump in early September from Texas distortions.

-

ISM Manufacturing and ISM Services are both expected to deteriorate in September. By and large, sentiment data has remained soft even as consumer momentum has held up as seen in the August PCE data this past week. It’s also worth noting, the ISM surveys are private and therefore will be released if we do have a government shutdown – in which case they would likely draw greater attention from the markets than is typical.

-

JOLTS Job Openings likely jumped to 7350k in August. JOLTS is a lagging indicator. This year, we have seen a similar pattern in the JOLTS data as in prior years, where we saw moderation in job openings in June and July. Last year, we saw a rebound in August, and we expect to see the same this year.

Government Shutdown FAQ

1) Why could we see a government shutdown on October 1st?

-

The US federal fiscal year runs from October 1st to September 30th and government funding is allocated on a fiscal year by fiscal year basis. In order for US federal agencies to allocate funds, these funds must first be appropriated through an approval from Congress. US Congress must pass 12 separate appropriation bills ahead of October 1st or US agencies will be unfunded, essentially ceasing operations until their respective appropriation bills have been passed in Congress.

-

If only some of the twelve appropriation bills are passed, agencies with appropriation bills are able to operate while those without will be forced to shut down.

2) Could Congress avert a shutdown by passing a continuing resolution?

-

Yes, Congress may avert a shutdown by passing a continuing resolution – in which case funding for agencies is extended at last year’s levels by a set deadline. A continuing resolution delays the shutdown (or may avert is entirely) and gives Congress more time to pass the appropriation bills.

3) What does a government shutdown mean for the economic data?

-

Historically, government shutdowns create data disruptions but not economic ones. During a government shutdown, only essential operations continue (and much to our dismay – statistical agencies are not considered essential!) with non-essential employees barred from working until the shutdown concludes.

-

This means that economic data that is released by statistical agencies (including the US Census Bureau, the Bureau of Economic Analysis, and the Bureau of Labor Statistics) cannot be prepared for release and will not be published as scheduled.

-

If we see an October 1st government shutdown, we will not get initial jobless claims data on Thursday nor employment data from Nonfarm Payrolls or the Household Survey on Friday. Depending on how long the shutdown lasts, the BLS CPI release may also be delayed alongside retail sales from the Census Bureau.

-

US Mandatory spending programs (Medicare, Medicaid and SNAP benefits) will continue as usual, so this will not derail low-income spending. Unemployment Insurance is not impacted, as it is a dispersed by state governments.

4) Could this be consequential for the October Fed meeting?

-

The timing of the looming potential government shutdown is not ideal for the Fed, which is set to meet again on October 29th. The FOMC was set to receive both employment data and inflation data ahead of the meeting. If a shutdown happens, there is still a chance that the NFP report is published ahead of the meeting. We have no visibility into the duration of a potential shutdown, but if the shutdown lasts until October 15th, it is highly likely that CPI data will not get released right away. There is a nonzero risk that the Fed does not get the CPI print ahead of the October meeting.

-

In our view, an increasingly data dependent Federal Reserve with limited visibility into the September data increases the probability of an October pause. We expect to see one more 25 basis-point cut from the Fed this year, and should the data releases be delayed, this adds to our conviction that the Fed will take a brief pause in October before returning with a cut in December.

About the Authors

Mike Reid is a Senior U.S. Economist at RBC. He is responsible for generating RBC’s U.S. economic outlook, providing commentary on macro indicators, and producing written analysis around the economic backdrop.

Carrie Freestone is an economist and a member of the macroeconomic analysis group. She is responsible for examining key economic trends including consumer spending, labour markets, GDP, and inflation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. The reader is solely liable for any use of the information contained in this document and Royal Bank of Canada (“RBC”) nor any of its affiliates nor any of their respective directors, officers, employees or agents shall be held responsible for any direct or indirect damages arising from the use of this document by the reader. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

This document may contain forward-looking statements within the meaning of certain securities laws, which are subject to RBC’s caution regarding forward-looking statements. ESG (including climate) metrics, data and other information contained on this website are or may be based on assumptions, estimates and judgements. For cautionary statements relating to the information on this website, refer to the “Caution regarding forward-looking statements” and the “Important notice regarding this document” sections in our latest climate report or sustainability report, available at: https://www.rbc.com/our-impact/sustainability-reporting/index.html. Except as required by law, none of RBC nor any of its affiliates undertake to update any information in this document.