Electricity

Index Score

Thematic Breakdown

Policy Score

Policy Score

The finalization of the Clean Electricity Regulations (CER) was the most notable policy change in 2024. In a concession to provinces, the final regulation extended the sector’s net-zero target by 15 years to 2050, with more flexibility for natural gas during peak load.

Detailed Scorecard

Indexed to 2019

baseline year

Weighted contribution to electricity sector score

Capital Score

Capital Score

Private sector capital expenditures were down slightlyEndnote 9, with capex from coal-to-gas conversions largely completed in 2022/2023. The proposed Clean Electricity Investment Tax Credit, budgeted at over $25 billion until 2034, should send the capital index higher over time.

Detailed Scorecard

Indexed to 2019

baseline year

Weighted contribution to electricity sector score

Action Score

Action Score

The action score rose as Alberta’s coal generation declined 70% in tandem with the province’s full phase-out of coalEndnote 10. The score, however, was partially weighed down by slower development of solar and wind projects, with capacity additions falling by 35% in 2024, compared to 2023Endnote 11.

Detailed Scorecard

Indexed to 2019

baseline year

Weighted contribution to electricity sector score

Emissions Score

Emissions Score

We estimate absolute electricity emissions declined by about 10% in 2024 compared to 2023Endnote 12. The decline was predominantly due to the removal of over six million tonnes of coal-based emissions year-on-year from AlbertaEndnote 13.

Detailed Scorecard

Indexed to 2019

baseline year

Weighted contribution to electricity sector score

Historical Trends

Policy:

Capital:

Consumer Action:

Emissions:

Business Action:

Technology:

Total:

Policy:

Capital:

Consumer Action:

Emissions:

Business Action:

Technology:

Total:

Policy:

Capital:

Consumer Action:

Emissions:

Business Action:

Technology:

Total:

Policy:

Capital:

Consumer Action:

Emissions:

Business Action:

Technology:

Total:

Policy:

Capital:

Consumer Action:

Emissions:

Business Action:

Technology:

Total:

Policy:

Capital:

Consumer Action:

Emissions:

Business Action:

Technology:

Total:

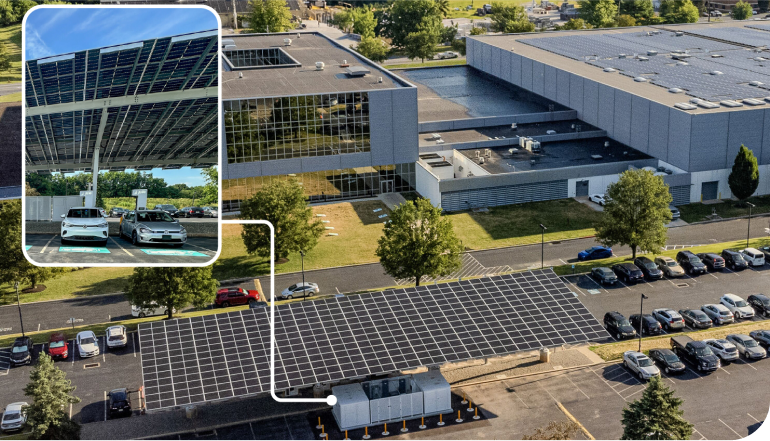

CASE STUDYEndnote 14

Jule: How micro grids are powering EVs

The Issue

Provincial utilities are grappling with twin long-term challenges: adding capacity and maintaining a low-carbon grid. They also have medium-term imperatives: managing outages brought on by extreme weather, unseasonal peaks in power demand, and the ability to respond to new energy demands such as electric vehicles and data centres.

The Company

Founded in Toronto in 2009, Jule was one of the first companies in North America to integrate lithium-ion batteries into the grid for backup power during outages, in collaboration with Toronto Hydro, and to deploy a battery-buffered fast charging system for electric vehicles across the Trans-Canada Highway in 2018. Jule's microgrid-based solutions not only expand EV charging infrastructure but also enable utilities to improve load management, load forecasting, minimize grid input, and reduce high demand charges.

Originally an energy management company offering battery storage and software for energy management solutions, Jule expanded in 2018 to offer EV charging and take advantage of the spate of EV-related infrastructure incentives being offered by all levels of governments across Canada and the U.S. Its energy-management solutions target industries such as utilities, retail, auto dealerships, hospitality, and fuel/rest stops.

The Opportunity

To handle increasing electrification, utilities levy demand charges on customers who use electricity above certain thresholds during peak consumption, often sourced from carbon-intensive natural gas. These charges, designed to recover infrastructure and operation costs for delivering higher load, have become a significant financial burden for high-demand users like fast EV charging facilities.

In British Columbia, for example, demand charges can make up as much as 80% of total electricity costs for operators of Level 3 DC fast chargers.

Jule addresses this challenge with a solution centered around battery storage. By dynamically charging batteries at an optimal grid capacity and during off-peak hours, operators can store energy when costs are most favourable. During peak periods, the stored energy is discharged at amplified power levels allowing operators to meet high-power demands without incurring excessive utility charges.

The company’s battery-buffered EV chargers can deliver up to 350 kW of power per port, enabling fast and efficient charging. Complementing this hardware is an internally developed energy management software that optimizes the performance of batteries and chargers, providing real-time analytics and actionable insights.

The Model

The company sources battery cells from abroad but manufactures the batteries and charging systems locally in Toronto, develops its own software solutions, and offers project management services for a complete solution.

It offers three models: host-owned and paid; energy-as-a-service where the site owner pays Jule a subscription fee but operates and earns revenue from the charging systems; and a fully Jule-owned and operated site at no cost to the property owner.

Jule is also expanding its reach into industries such as real estate development, business parks, multifamily housing, and fleet operations.

The Unlock

Jule became vertically integrated out of necessity. As it tried to source various parts of its supply chain, the company realized market offerings lacked what it needed—from charger hardware and software to installation services. That led to an end-to-end energy management solution that can maintain 97% charger uptime. The high uptime has an added benefit of qualifying Jule for various government funding programs, such as the Zero Emission Vehicle Infrastructure program administered by Natural Resources Canada, and the National Electric Vehicle Infrastructure program in the U.S.

The company has also benefited from technology improvements. Silicon carbide has emerged as a preferred material over traditional silicon, with significant advantages for high power EV charging, including a higher power density that means more energy can be delivered with smaller and lighter components in a more compact system—a game-changer in dense urban centres such as Toronto. Material costs are also starting to drop as it scales across EV supply chains.

The Lesson

Jule attributes its growth to its ability to pivot quickly, develop an expertise in system integration, and leverage government programs. It has also learned to work within the existing electrical infrastructure system and complement utilities. As the latter steadily works through system upgrades and infrastructure expansion, Jule provides them with access and visibility into its sites, which helps amplify existing infrastructure and reduce overhead.

It's an infrastructure game—strategic electrification will drive economic growth and support sustainable business development.

Monsoon Fu,

Director of product and innovation, Jule