Attention: Notice

Important Information*

IMPORTANT INFORMATION

*UPDATED* as of July 1, 2021

The CEBA application period has closed (the deadline to apply under the CEBA program was June 30, 2021). We are unable to accept any new CEBA enrolment requests.

If you need to provide additional information in connection with a previously submitted CEBA enrolment request, we will contact you by email. We will also contact you once the Government of Canada has reviewed your information.

For more details on CEBA, please visit our CEBA page. Click here to learn more.

Government of Canada’s Relief for Business

- Canada Emergency Business Account (CEBA)

- Canada Emergency Wage Subsidy (CEWS)

- The BDC Co-Lending Program

- BDC Mid-Market Financing Program

- The EDC Business Credit Availability Program (BCAP) Guarantee

- BDC Highly Affected Sectors Credit Availability Program (HASCAP)

Canada Emergency Business Account (CEBA)

The Government of Canada is providing the Canada Emergency Business Account (CEBA) to support Canadian businesses that have been adversely affected by COVID-19. Eligible businesses that are approved by the Government of Canada get access to a loan to help pay for non-deferrable operating expenses such as rent, payroll and insurance which are critical to sustain business continuity.

The CEBA application period has closed and we are unable to accept any new CEBA enrolment requests.

If you need to provide additional information in connection with a previously submitted CEBA enrolment request, we will contact you by email. We will also contact you once the Government of Canada has reviewed your information.

For more details on CEBA, please visit our CEBA page.

Canada Emergency Wage Subsidy (CEWS)

The Government of Canada’s Canada Emergency Wage Subsidy (CEWS) provides eligible employers a subsidy of 75% of employee wages for up to 24 weeks, retroactive from March 15, 2020, to August 29, 2020.

For detailed information about the program, eligibility, and how to apply, refer to the Government of Canada’s site.

You should also enroll for CRA Direct Deposit by logging into your RBC Online Banking for Business or RBC Express platform. CRA Direct Deposit is a quick, safe and secure way to receive eligible amounts to be paid to you by the Canada Revenue Agency (CRA) such as CEWS, should you be eligible for this program. Please see the FAQs below for more details. If you are eligible and expecting a CRA payment of more than $25 million, click here for details on how to receive your payment thought the Large Value Transfer System.

IMPORTANT: Please note that enrolling for CRA Direct Deposit through your RBC Online Banking for Business or RBC Express does not register you for the Government’s CEWS. You must apply for CEWS through the CRA directly. For instructions on how to apply, click here.

The BDC Co-Lending Program

The BDC Co-Lending program is designed to support Canadian businesses of all sizes that have been negatively impacted by COVID-19. Eligible applicants can access funding up to $6.25 million CAD (maximum loan amounts dependent on business size) to cover operating expenses (such as rent, payroll and other operating expenses) and working capital needs. For more program details, please read the FAQ below.

BDC Mid-Market Financing Program

The Business Development Bank of Canada (BDC) announced the availability of the BDC Mid-Market Financing Program to help medium sized Canadian businesses (revenues in the range of $100 million to $500 million) impacted by COVID-19. Eligible applicants can access $12.5 million to $60 million CAD (or USD equivalent) in short-term liquidity to maintain their staff, preserve supply chains and manage cash-flow. For more program details, please read the FAQ below.

The EDC Business Credit Availability Program (BCAP) Guarantee:

The Government of Canada announced the availability of the Export Development Canada (EDC) BCAP Guarantee help Canadian businesses with impacted by COVID-19. Eligible applicants can access up to $6.25 million CAD in short-term liquidity to cover expenses which are critical to business continuity such as rent, payroll and other operational costs. For more program details, please read the FAQ below.

BDC Highly Affected Sectors Credit Availability Program (HASCAP)

The Government of Canada has announced the availability of the Business Development Bank of Canada (BDC) Highly Affected Sectors Credit Availability Program to support Canadian businesses of all sizes that have been negatively impacted by COVID-19. Eligible applicants can access up to $1.0 million CAD (max. loan amounts dependent on business size) in loans to cover operating expenses such as rent and payroll, and working capital needs such as inventory. The loan will be funded by RBC.

RBC Term Loan - Maximum Loan Amount – Customer Criteria

Up to $100,000

- Confirmation of receipt of at least 3 months of CERS/CEWS benefits OR If not eligible for CERS/CEWS, accountant prepared financial statements that show 50 per cent revenue decline for at least 3 months

$100,001 to $250,000

- Confirmation of receipt of at least 3 months of CERS/CEWS benefits OR If not eligible for CERS/CEWS, accountant prepared financial statements that show 50 per cent revenue decline for at least 3 months

- Confirmation that annual revenues are at least $500,000 as per accountant prepared financials statements completed prior to March 1 2020.

$250,001 to $1,000,000

- Confirmation of receipt of at least 3 months of CERS/CEWS benefits OR If not eligible for CERS/CEWS, accountant prepared financial statements that show 50 per cent revenue decline for at least 3 months

- DSC Ratio of 1.1:1 tested on all existing debt and new HASCAP debt.

- Your business is an existing RBC Small Business Banking or RBC Commercial Financial Services client and RBC is your primary bank or primary lender.

- Your business is a Canadian business directly or indirectly negatively impacted by the COVID-19 pandemic and was financially viable prior to the impact of the COVID-19 pandemic.

- If your business is eligible for the Canada Emergency Rent Subsidy (CERS) or Canada Emergency Wage Subsidy (CEWS), you must apply for these relief programs before you can apply for HASCAP.

- Your business must have experienced a 50% revenue decrease in any three (3) of the past eight (8) months, which can be evidenced through your application and receipt of Government subsidies under either CERS or CEWS).

- The HASCAP program is intended to exclusively fund the operational cash flow needs of your business or any of its operating subsidiaries, and for no other purpose. Examples of permitted uses include: payroll, rent, utilities, taxes, scheduled debt repayments and other fixed costs. This includes any costs incurred in retrofitting business operations to ensure its continued viability.

- Your business must not have benefited (or is not in the process of benefiting) from the HASCAP program through any another financial institution.

- If your business has existing loans with RBC and you are in default of any of your loan obligations, such defaults must be resolved or cured prior to any advance under the program.

- Businesses that are economically dependent on non-commercial sources such as direct government funding or private donations.

- Government organizations or bodies (other than an indigenous entity or body), or entities which a government owns equity interest.

- Non-profit organizations, unions, registered charities, religious organizations or fraternal benefit societies or, except if such entity actively carries on a business in Canada that generates revenue primarily from the supply of goods or services and not from non-commercial sources such as direct government grant funding or private donations.

- Fundraising vehicles for charities.

- Non-Publicly traded entity owned by any single current member of Parliament or Senate of Canada.

- Entities that promote violence, incite hatred or discriminate on the basis of race, national or ethnic origin, color, religion, sex, age or mental or physical disability or operate a sexually exploitive business.

- Businesses (including affiliates) that have been determined to have committed tax evasion or, except as disclosed, been subject to any assertion or assessment to have engaged in tax evasion.

RBC business clients should speak with their RBC Account Manager to learn more about the application process and eligibility criteria. RBC business clients who do not have a dedicated RBC Account Manager can call our Advice Centre at 1-866-591-0757.

For more program details, please read the FAQ below.

RBC Business Client Support

For business owners in need of assistance, RBC offers customized advice to help relieve any financial pressures and disruption you may be experiencing.

Please contact your advisor, book an appointment or call our Advice Centre at 1-800-ROYAL-20 to discuss your options.

Online Banking

We remain committed to ensuring that your business needs are met. Our advisors and solutions remain available to you across a variety of channels. Given the current situation, we are experiencing extremely high call volumes.

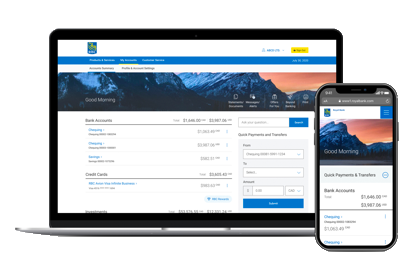

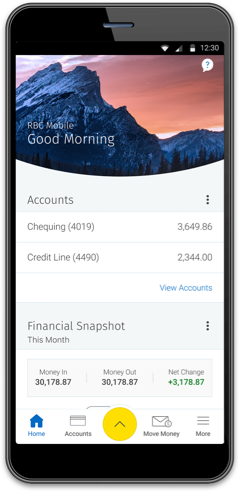

As always, the RBC Mobile app, Standard RBC Online Business Banking and Premium Online Business Banking solutions are safe, easy-to-use and available 24/7.

Online Banking for Business

Explore all you can do online from the convenience of home or work

- You can view and track expenses and payments

- Enjoy the convenience of setting up recurring payments to employees or vendors, or make a one-time Interac e-Transfer

- Instantly access and view current and past business transaction information, including up to 7 years of transaction history

Looking for a solution with more features?

Learn more about Premium Online Banking with RBC ExpressRBC Mobile App

Manage your business finances from anywhere.

- View account balances and transaction details for bank accounts, credit cards and loans

- Make spending decisions with clarity and confidence using NOMI, our innovative account dashboard that provides timely trends, alerts and overviews of your cash flow

- Deposit cheques through your smartphone from anywhere

- Improve cash flow with our Request Money feature to remind clients about outstanding invoices and receive real-time notifications on outstanding payments

Access our newest features with the latest update of the RBC Mobile app.

Or text “RBC” to 722722 and we’ll send you the link.

Standard message rates may apply.

Frequently Asked Questions

Government of Canada's Relief for Business*

Canadian Emergency Wage Subsidy (CEWS)

The Canada Emergency Wage Subsidy (CEWS) provides a 75% wage subsidy to eligible employers for up to 24 weeks, retroactive to March 15, 2020.

The CEWS aims to prevent further job losses, encourages employers to re-hire workers previously laid off as a result of COVID-19, and helps to enable businesses to resume and sustain normal operations following the crisis.

You can find more detailed information about the Government of Canada’s CEWS Program, eligibility criteria, and how to apply on the Government of Canada’s site.

You can find more detailed information about the Government of Canada’s CEWS funding calculations on the Government of Canada’s site.

For the complete CEWS eligibility details as set out by the Government of Canada, please visit the Government of Canada’s site.

RBC business clients now have the option to enroll for CRA Direct Deposit though RBC Online Banking for Business and RBC Express.

To sign up for CRA Direct Deposit:

- Ensure that you are enrolled in RBC Online Banking for Business or RBC Express.

- If you have not signed up for RBC Online Banking for Business and you are an existing RBC business client, click here to find out how to enroll.

- Log in to your RBC Online Banking for Business or RBC Express.

- RBC Online Banking for Business users can go to the Account Details page and click on the link on the right side of the screen to enroll for CRA Direct Deposit.

- RBC Express users will see an alert to register for CRA Direct Deposit as soon as you have signed in.

Important note: When enrolling for CRA Direct Deposit, please have your CRA Business Number (BN), including your CRA Program Account Identifier for payroll ready. You will need to enter this as part of the CRA Direct Deposit enrollment process. Click here for more information on the BN and CRA Program Account Identifier.

Please note that enrolling for CRA Direct Deposit through your RBC Online Banking for Business or RBC Express does not register you for the Government’s CEWS. You must apply for CEWS through the CRA directly. For instructions on how to apply, click here.

- Log into your CRA My Business Account portal to make sure that your direct deposit information has been updated. Please note that this update may take up to 24-48 hours, and processing times may vary.

No. You need to apply for CEWS through the directly. For instructions on how to apply, click here.

RBC is not acting as an administrator or facilitator of this program. The CRA Direct Deposit enrollment feature being offered by RBC is only for the purposes of helping business clients enroll to receive direct deposits from CRA for amounts (such as CEWS) to be paid to the client by CRA.

For instructions on how to apply, click here.

CEWS payments are administered by the Canada Revenue Agency (CRA). Please click here or contact the CRA for more details on the payment disbursement process.

CEWS payments are administered by the Canada Revenue Agency (CRA). Please click here or contact the CRA for more details on payment disbursement process.

EDC Business Credit Availability Program (BCAP) Guarantee

The EDC Business Credit Availability Program (BCAP) Guarantee is an EDC-guaranteed business loan to help Canadian businesses impacted by COVID-19. Eligible applicants can access up to $6.25 million CAD in short-term liquidity to cover expenses which are critical to business continuity such as rent, payroll and other operational costs.

The EDC Program features:

- Term loans up to CAD $6,250,000

- Terms of up to 5 years

- Fixed 80% EDC guarantee

- Loan is repayable in full on the 12-month anniversary

- EDC guarantee fee of 1.8% on the authorized loan amount

- 6-month EDC Guarantee fee payment deferral

For more details on the program, eligibility and application process, RBC business clients can contact their RBC Account Manager. RBC business clients who do not have a dedicated RBC Account Manager can call our Advice Centre at 1-866-591-0757.

No. The EDC BCAP Guarantee can be used to support new facilities to provide incremental emergency liquidity. It cannot be used to support an existing facility.

No. The EDC BCAP Guarantee will also be available to non-export, domestic businesses.

To qualify for an EDC BCAP, the client must:

- Apply for a new term loan up to $6.25million CAD to finance short-term operations in response to COVID-19

The client must NOT be:

- Government organizations or bodies or entities owned by a government organization or body.

- Unions, charitable, religious or fraternal organizations or entities owned by such organizations except registered T2 or T3010 corporations that generate a portion of their revenue from the sales of goods or services (so that business operations of those entities remain eligible.

- Entities owned by individuals any federal Member of Parliament or Senator.

- Entities that violence, incite hatred or discriminate on the basis of sex, gender identity or expression, sexual orientation, colour, race, ethnic or national origin, religion, age or mental or physical disability, contrary to applicable laws.

RBC business clients should speak with their RBC Account Manager to learn more about the application process and eligibility criteria. RBC business clients who do not have a dedicated RBC Account Manager can call our Advice Centre at 1-866-591-0757.

EDC Mid-Market Guarantee and Financing Program

The EDC Mid-Market Guarantee and Financing Program is an EDC-guaranteed business loan to help Canadian businesses impacted by COVID-19. Eligible applicants can access from $12.5 million to $80 million CAD (or USD equivalent) for terms up to 5 years to cover expenses which are critical to business continuity such as rent, payroll and other operational costs.

The EDC Program features:

- Term loans between $12.5 million and $80 million CAD (or USD equivalent)

- Terms of up to 5 years with a fixed 75% EDC guarantee

- Program ends June 30, 2021

For more details on the program, eligibility and application process, RBC business clients can contact their RBC Relationship Manager.

To qualify for the EDC Mid-Market Guarantee, the client must:

- Have been formed or incorporated and have operations at least partially located in Canada

- Have been financially stable and viable prior to the current economic turmoil

- Requests must meet RBC’s underwriting requirements for this program for businesses negatively impacted by Covid-19

- Met the necessary requirements that will form part of the application process

- Apply for a new term loan for $12.5 million to $80 million CAD (or USD equivalent) to finance short-term operations in response to COVID-19

The client must NOT be:

- Government organizations or bodies or entities owned by a government organization or body.

- Unions, charitable, religious or fraternal organizations or entities owned by such organizations except registered T2 or T3010 corporations that generate a portion of their revenue from the sales of goods or services (so that business operations of those entities remain eligible.)

- Entities owned by any federal Member of Parliament or Senator.

- Entities that promote violence, incite hatred or discriminate on the basis of sex, gender identity or expression, sexual orientation, colour, race, ethnic or national origin, religion, age or mental or physical disability, contrary to applicable laws.

No. The EDC Mid-Market Guarantee and Financing Program will also be available to non-export, domestic businesses.

RBC business clients should speak with their RBC Relationship Manager to learn more about the application process and eligibility criteria.

BDC Co-Lending Program

The Government of Canada announced the availability of the Business Development of Canada (BDC) Co-Lending program supporting Canadian businesses of all sizes that have been negatively impacted by COVID-19. Eligible applicants can access up to $6.25 million CAD (max. loan amounts dependent on business size) in loans to cover operating expenses such as rent and payroll, and working capital needs such as inventory. The loan will be jointly funded by RBC and BDC.

| RBC Term Loan - Maximum Loan Amount | ||

|---|---|---|

| Businesses with less than $1 million in annual revenue | Businesses with $1-$50 million in annual revenue | Businesses with over $50 million in annual revenue |

| Up to $312,500 | Up to $3.125 million | Up to $6.25 million |

RBC business clients of all sizes that have been impacted by COVID-19 and meet the eligibility criteria can apply for the BDC Co-Lending Program.

To qualify for a BDC Co-Lending Program, clients must have:

- Been a client of RBC as of March 1, 2020

- Been a viable business as of March 1, 2020 prior to COVID-19 impact

- Met the necessary requirements that will form part of the application process

Please contact your RBC Account Manager for further details on the eligibility criteria.

- Term loan

- Interest-only payments for the first 12 months

- Amortization and terms based on your business needs

Please contact your RBC Account Manager for further details on the terms and conditions.

RBC business clients should speak with their RBC Account Manager to learn more about the application process and eligibility criteria. RBC business clients who do not have a dedicated RBC Account Manager can call our Advice Centre at 1-866-591-0757.

Clients that have applied for the CEBA program and/or the EDC BCAP Program may also apply for the BDC Co-Lending Program. Your RBC Advisor can help you determine which solutions are suited for your financial needs.

Your RBC Advisor will work with you to complete the application process and will keep you apprised of your loan approval status.

BDC Mid-Market Financing Program

The BDC Mid-Market Financing Program will provide junior loans, done jointly with the business’ primary lender, to help Canadian businesses impacted by COVID-19. Eligible applicants can access from $12.5 million to $60 million CAD (or USD equivalent) in short-term liquidity to cover expenses which are critical to business continuity such as rent, payroll and other operational costs.

The BDC Program features:

- Mezzanine loans between $12.5 million and $60 million CAD (or USD equivalent) funded 90% by BDC and 10% by the company’s principal senior lender

- 4 year interest only term (interest paid in kind for the first year)

- Program ends September 30, 2020

For more details on the program, eligibility and application process, RBC business clients can contact their RBC Relationship Manager.

To qualify for the BDC Mid-Market Financing Program a client must:

- Apply for a new term loan for $12.5 million to $60 million CAD (or USD equivalent) to finance short-term operations in response to COVID-19

- Have been financially stable and viable prior to the current economic turmoil

- Requests must meet BDC’s underwriting requirements for this program for businesses negatively impacted by COVID-19

RBC business clients should speak with their RBC Relationship Manager to learn more about the application process and eligibility criteria.

BDC Highly Affected Sectors Credit Availability Program (HASCAP)

The terms of the program require that if you are eligible for CERS/CEWS you must avail yourself of those benefits prior to qualifying for HASCAP.

RBC business clients of all sizes that have been impacted by COVID-19 and meet the eligibility criteria can apply for the BDC HASCAP Guarantee.

To be eligible, your business must meet the following eligibility requirements:

- Your business is an existing RBC Small Business Banking or RBC Commercial Financial Services client and RBC is your primary bank or primary lender.

- Your business is a Canadian business directly or indirectly negatively impacted by the COVID-19 pandemic and was financially viable prior to the impact of the COVID-19 pandemic.

- If your business is eligible for the Canada Emergency Rent Subsidy (CERS) or Canada Emergency Wage Subsidy (CEWS), you must apply for these relief programs before you can apply for HASCAP.

- Your business must have experienced a 50% revenue decrease in any three (3) of the past eight (8) months, which can be evidenced through your application and receipt of Government subsidies under either CERS or CEWS).

- The HASCAP program is intended to exclusively fund the operational cash flow needs of your business or any of its operating subsidiaries, and for no other purpose. Examples of permitted uses include: payroll, rent, utilities, taxes, scheduled debt repayments and other fixed costs. This includes any costs incurred in retrofitting business operations to ensure its continued viability.

- Your business must not have benefited (or is not in the process of benefiting) from the HASCAP program through any another financial institution.

- If your business has existing loans with RBC and you are in default of any of your loan obligations, such defaults must be resolved or cured prior to any advance under the program

The following businesses are not eligible to apply:

- Businesses that are economically dependent on non-commercial sources such as direct government funding or private donations.

- Government organizations or bodies (other than an indigenous entity or body), or entities which a government owns equity interest.

- Non-profit organizations, unions, registered charities, religious organizations or fraternal benefit societies or, except if such entity actively carries on a business in Canada that generates revenue primarily from the supply of goods or services and not from non-commercial sources such as direct government grant funding or private donations.

- Fundraising vehicles for charities.

- Non-Publicly traded entity owned by any single current member of Parliament or Senate of Canada.

- Entities that promote violence, incite hatred or discriminate on the basis of race, national or ethnic origin, color, religion, sex, age or mental or physical disability or operate a sexually exploitive business.

- Businesses (including affiliates) that have been determined to have committed tax evasion or, except as disclosed, been subject to any assertion or assessment to have engaged in tax evasion.

Term loan

Interest-only payments for the first 12 months.

Amortization and terms based on your business needs, subject to an outside limit of 10 years.

Please contact your RBC Account Manager for further details on the terms and conditions

RBC business clients should speak with their RBC Account Manager to learn more about the application process and eligibility criteria. RBC business clients who do not have a dedicated RBC Account Manager can call our Advice Centre at 1-866-591-0757.

Clients that have applied for the CEBA program and/or the EDC BCAP Program may also apply for the BDC Co-Lending Program. Your RBC Advisor can help you determine which solutions are suited for your financial needs.

Your RBC Advisor will work with you to complete the application process and will keep you apprised of your loan approval status.

Branches

Branches are open with recommended safety precautions in place, such as physical distancing and capacity guidelines. For open locations and branch hours, please visit maps.rbcroyalbank.com.

Our priority is the safety and Well-being of our employees and our clients. We have increased frequency of cleaning, with daily disinfection of our retail branches and ATMs, and will continue to enhance our cleaning protocols as we need to.

In the event of a branch closure, a notice will be posted on the branch door. To find the next closest location, simply visit maps.rbcroyalbank.com. Our Branch locator will also have updated information on whether your branch is open or closed. For immediate financial needs or access to your safe deposit box, please use our online appointment booking tool to schedule a call with your advisor.

RBC remains committed to supporting you through all channels. As always, the RBC Mobile app and RBC Online Banking are safe, easy and available 24/7. You can:

- View account balances, transaction history, and your RBC credit card account information

- Sign up for e-Statements

- Send money with Interac e-Transfer

- Make Canadian bill payments

- Manage your other banking needs

Click here to sign into RBC Online Banking. For more information on how to sign up for online banking or to download the RBC Mobile app click here.

Use of the Government of Canada COVID Alert app is not mandated by Royal Bank of Canada (“RBC”) and is completely voluntary. RBC has no affiliation with the app and assumes no liability for its use by any person. RBC will not know if an app user has downloaded or used it, nor are we able to collect, view, or retain any personal information of an app user, including their health information.